MAS Monetary Policy Statement - April 2023

INTRODUCTION

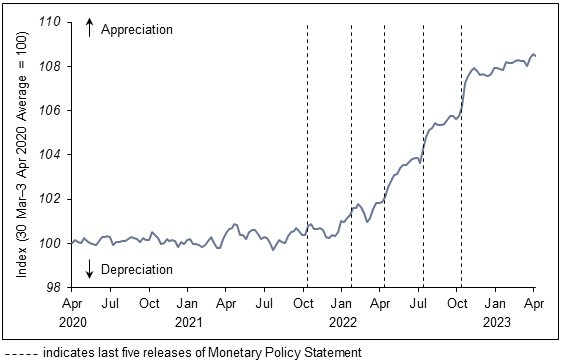

1. In October 2022, MAS tightened its monetary policy for the fifth consecutive time within 12 months. The mid-point of the Singapore dollar nominal effective exchange rate (S$NEER) policy band was re-centred up to the then-prevailing level of the S$NEER near the top of the band. There was no change to the slope and width of the band. Although Singapore's GDP growth was expected to slow, MAS had assessed that a further tightening of monetary policy was needed to help dampen still-elevated inflation and ensure medium-term price stability.

Chart 1

S$ Nominal Effective Exchange Rate (S$NEER)

2. Over the last six months, the S$NEER has appreciated within the upper half of the policy band, with short-lived bouts of depreciation pressures. These movements in the S$NEER largely reflected shifting market expectations of the path of monetary policy tightening in the advanced economies, as well as a brief episode of risk-off sentiment associated with recent international financial stresses. In line with the continuing rise in global interest rates, the three-month compounded Singapore Overnight Rate Average (SORA) increased to 3.6% in March 2023 from 2.5% in October 2022. The three-month S$ Singapore Interbank Offered Rate (SIBOR) rose to 4.2% from 3.9% during this period.

OUTLOOK

3. Singapore's GDP growth is projected to moderate significantly this year, in line with the global goods and investment cycle downturn. MAS Core Inflation [1] will remain elevated in the next few months but should progressively ease in H2 2023 and end the year significantly lower.

Growth Backdrop and Outlook

4. The Advance Estimates released by the Ministry of Trade and Industry today show that the Singapore economy contracted by 0.7% on a quarter-on-quarter seasonally-adjusted basis in Q1 2023, following the marginal 0.1% expansion in Q4. Both the trade-related cluster and the modern services sectors contracted. In contrast, activity in the domestic-oriented and travel-related sectors remained firm, supported by relatively strong consumption and investment spending as well as recovering visitor arrivals. On a year-ago basis, GDP growth came in at 0.1% in Q1, a sharp step down from 2.1% y-o-y in Q4 2022.

5. Global economic activity was somewhat more resilient than expected in Q1 2023. This reflected the fall in global energy prices, strong consumption demand in the advanced economies, and the lifting of pandemic restrictions in China. However, the global electronics industry, which has significant production and trade linkages across the region, is in a sharp downturn.

6. The drag on global investment and manufacturing from tighter financial conditions will intensify in the quarters ahead. The boost to demand in most of the regional economies from their reopening last year will also fade over 2023. China’s rebound will largely be consumption-driven and oriented towards domestic services. Overall, growth in Singapore’s major trading partners will be slower in 2023, below the pace recorded in the previous two years.

7 . Prospects for Singapore's GDP growth this year have therefore dimmed. The trade-related cluster is expected to contract further, while activity in the modern services sectors remains subdued. The pace of expansion in the domestic-oriented sectors should also moderate as higher consumer prices and interest rates restrain spending. All in, Singapore’s GDP growth is projected to step down to 0.5–2.5% in 2023, from 3.6% last year. This below-trend pace of growth will cause the positive output gap at end-2022 to turn slightly negative this year.

8. The global growth outlook remains uncertain. The impact of tighter monetary policy in the advanced economies could be amplified by fragilities in the financial system, further restraining credit growth and dampening confidence. The risks to growth in the global economy and in Singapore are tilted to the downside.

Inflation Trends and Outlook

9. MAS Core Inflation rose to 5.5% y-o-y in January–February 2023 from 5.1% in Q4 2022, in line with expectations. The step-up reflected in part the increase in the GST rate from January and in tobacco duties from February. Services inflation also remained firm amid the ongoing pass-through of elevated business costs. This was partially offset by lower electricity & gas price inflation following the decline in global oil prices. CPI-All Items inflation edged down to 6.5% y-o-y in January–February 2023, from 6.6% in Q4 2022, as lower private transport inflation offset higher core inflation.

10. MAS Core Inflation will stay elevated in the next few months, as accumulated business costs continue to feed through to consumer prices. However, it is expected to slow more discernibly in the second half of this year. Barring fresh shocks to global supply, Singapore’s imported inflation, which is already negative, should fall further alongside lower commodity prices and the stronger S$NEER. Domestic wage growth should also ease as labour demand moderates, especially in sectors more exposed to international trade and finance.

11. For 2023 as a whole, MAS Core Inflation is expected to average 3.5–4.5%. CPI-All Items inflation is forecast to come in higher at 5.5–6.5%, reflecting the tight supply of COEs and firm accommodation costs. Excluding the effects of the GST increase, core inflation is projected to average 2.5–3.5%, and headline inflation 4.5–5.5%. MAS Core Inflation is projected to reach around 2.5% y-o-y by the end of 2023. When the impact of the GST increase is excluded, core inflation would be even lower, and closer to the historical average.

12. There are both upside and downside risks to inflation. Fresh shocks to global commodity prices could impart additional inflationary pressures. However, a sharper-than-expected downturn in the advanced economies could induce a general easing of inflationary pressures.

MONETARY POLICY

13. Singapore's GDP growth is projected to be below trend this year. With intensifying risks to global growth, the domestic economic slowdown could be deeper than anticipated. While inflation is still elevated, MAS’ five successive monetary policy tightening moves since October 2021 have tempered the momentum of price increases. The effects of MAS’ monetary policy tightening are still working through the economy and should dampen inflation further.

14. With imported inflation turning more negative and core inflation expected to ease materially by end-2023, MAS has assessed that the current appreciating path of the S$NEER policy band is sufficiently tight and appropriate for securing medium-term price stability.

15. MAS will therefore maintain the prevailing rate of appreciation of the S$NEER policy band. There will be no change to its width and the level at which it is centred. This policy stance will continue to reduce imported inflation and help curb domestic cost pressures.

16. MAS will remain vigilant over developments in the economy and financial markets, amid heightened uncertainty on both inflation and growth.

***

- [1] MAS Core Inflation excludes the costs of accommodation and private transport from CPI-All Items inflation.

First, please LoginComment After ~