Integrating Climate Scenario Analysis into Investment Management: A 2023 Update

Download → Integrating Climate Scenario

Analysis into Investment

Management:

A 2023 Update

Executive Summary

- ♦For long-term investors such as GIC, climate change is a key concern given its imminent and considerable impact on the value of physical assets and companies over time. Hence, factoring climate risks into both our top-down and bottom-up processes is vital to ensuring a resilient portfolio.

- ♦At the top-down level, GIC partnered with Ortec Finance and Cambridge Econometrics to quantify how climate change drivers affect long-term capital market assumptions We stress tested the portfolio against different climate scenarios, and identified areas with heightened risks. This exercise enabled us to focus our efforts on deeper analysis and mitigating strategies to make our portfolio more climate-resilient.

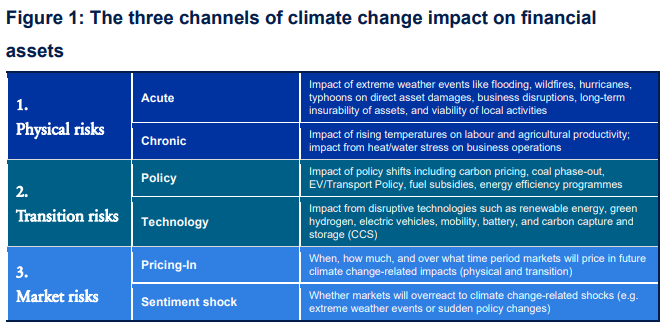

- ♦In our analysis, the main climate-related risks outlined are: (i) the timing and sufficiency of climate policies (timely, delayed, late, or none, and whether they are sufficient to meet the Paris climate goals or not), (ii) extent of physical risks (both acute and chronic) and (iii) whether markets price in future climate-related drivers smoothly or disruptively, and whether these result in sentiment shocks. The exploration of the pricing-in effects of markets and sentiment shocks in relation to climate-related transition and physical risks is a key innovative feature of Ortec Finance's work on climate scenarios.

- ♦Investors need to continually assess the evolution of long-term drivers of climate change and their impact on the portfolio. It is also crucial to incorporate potential new ways the long-term investment environment could play out and update modelling methodologies. Hence, this report provides an update to the paper ‘The Role of Climate Change Scenarios in Investment Portfolios’ that GIC and Ortec published in July 2021. There are two new major features to highlight:

First, we included a new fourth scenario, titled ‘Too Little Too Late’, which is aligned with a 2-3⁰C outcome. This scenario assumes both high transition and physical risks, given the delayed introduction of climate policies which fail to limit the physical impact of climate change. It offers a more extensive and nuanced narrative that reflects GIC’s concerns as an investor and is not included in any climate scenario sets currently in the market.

Second, we updated the supply side effects of physical climate risks on inflation. These are inflationary and counteract the deflationary impact of lower growth resulting from physical risks.

- ♦The four climate scenarios we analysed are:

Net Zero (NZ)

Delayed Disorderly Transition (DDT),

Too Little Too Late (TLTL), and

Failed Transition (FT).

- ♦Not all investors can develop custom scenarios tailored to their own needs. GIC believes that a range of high-quality climate scenarios, developed for investors and preferably by investors, should be made available for asset owners and managers to consider. If other investors are keen to use the parameters of the bespoke scenarios we have developed, they may approach Ortec Finance.

- ♦Compared to our 2021 research, our current set of scenarios illustrate the increased volatility in macro variables more clearly. This is especially the case in the DDT and TLTL scenarios due to responses to extreme weather and policy shocks as well as the effects of more disruptive market pricing-in mechanisms and sentiment shocks.

- ♦The impact of climate change on broad market beta is expected to be negative, although there might be a potential upside for certain markets, sectors, companies, and business models. Opportunities span emerging markets with currently low exposure to low-carbon utilities, or decarbonisation and adaptation technologies that are currently nascent but could scale with more policy support and capital flows. Risk assets such as equities and real estate are more sensitive to climate change compared to bonds and cash.

- ♦Based on a hypothetical global 60% equities and 40% bonds portfolio, returns may still be positive in the long run with climate change, but projected returns are meaningfully lower across all four scenarios versus a climate-uninformed baseline. Hence, long-term investors may be surprised by the underperformance of the portfolio relative to their expectations.

- ♦In addition to transition risks, investors should account for the effects of climate-related physical risks on the portfolio and be prepared to navigate the potential increase in market volatility from climate-related shocks.

- ♦As with the case of the impact on global GDP growth, the investment portfolio fared worst in the Failed Transition scenario where no new climate policies are introduced so transition risks are low but physical risks are the highest.

- ♦Given GIC’s long-term mandate, it is essential to prepare for managing climate-related transition, physical, and market risks in our portfolio. Climate scenario analysis plays a central role and can be integrated into the investment process via top-down strategic asset allocation, stress-testing, and risk management, and through the bottom-up integration of scenario assumptions and implications into active investment processes.

First, please LoginComment After ~