HKEX 2023 First Quarter Results

Download → QUARTERLY RESULTS FOR THE THREE MONTHS ENDED 31 MARCH 2023

HIGHLIGHTS

Nicolas Aguzin, Chief Executive Officer said:

“The year has got off to a very good start, with HKEX reporting one of its best quarters ever. Our clear strategy, commitment to offering our customers around the world more choice and opportunity and our resolute focus on our unique strength of connecting China and the World, is producing results. Despite economic fragility impacting market volumes around the world, this quarter our derivatives market has gone from strength-to-strength, we announced a range of important new strategic initiatives such as our new Specialist Technology Company listing regime and Stock Connect eligible stocks and trading calendar enhancements, and we welcomed a host of new issuers and products to our markets. As we look forward to the rest of the year, we will continue to execute on our strategy, ensuring that we are active proponents of global dialogue and connectivity, working with all our regional and international stakeholders to deliver shared sustainable success. We remain fully committed to prudently investing in our people, our operations and our markets, reinforcing our relevance and role at the heart of one of the world’s leading international financial centres.”

Strategic Highlights

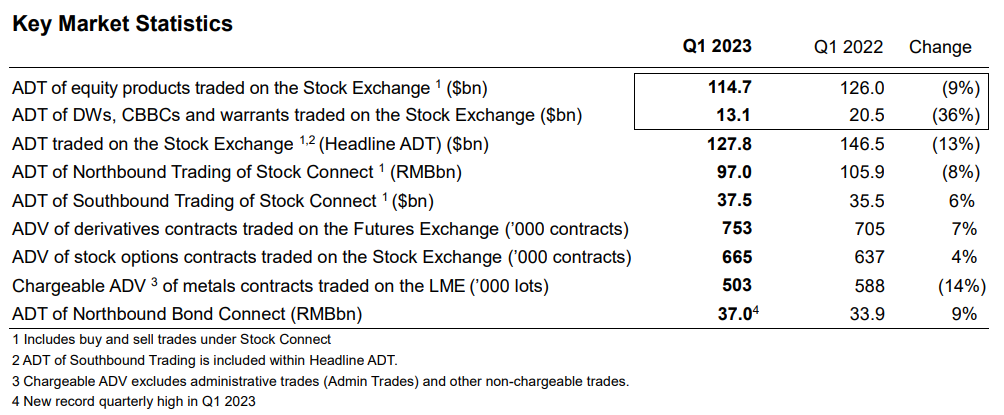

Stock Connect trading calendar enhancements announced, adding around 10 trading days to Northbound and Southbound Connect each year

Expansion of eligible stocks through Stock Connect took effect in March, with four primary-listed international companies in Hong Kong becoming eligible for Southbound Trading and an additional 1,034 stocks becoming eligible for Northbound Trading

Hong Kong Investor Identification Regime launched in March

New Specialist Technology Company listing regime took effect on 31 March 2023

IPO pipeline remained strong with over 90 active applications as at 31 March 2023

Q1 products launched included two ESG ETFs and a bitcoin futures ETF

The LME Group announced a two-year strategic and operational programme to strengthen and enhance its markets

HKEX Foundation launched its 2023 Impact Funding Scheme

Financial Highlights

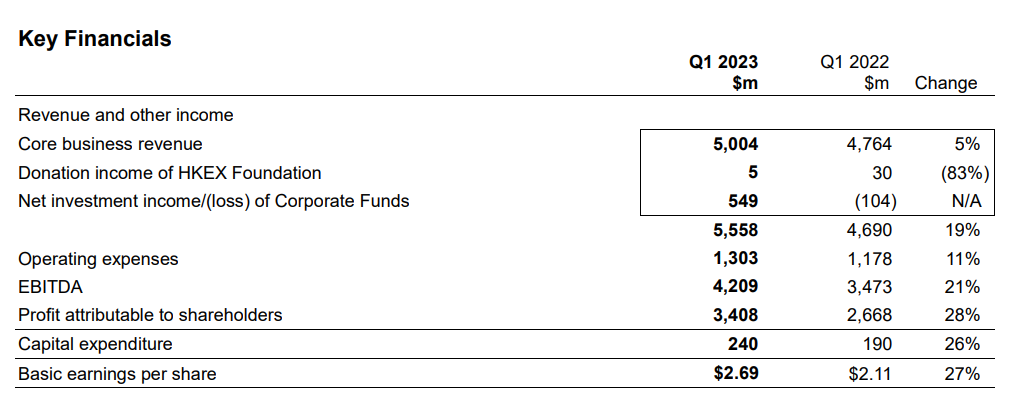

HKEX reported the Group’s second best ever quarterly revenue and other income and profit in Q1 2023, after the exceptional Q1 2021

Q1 2023 revenue and other income was up 19 per cent on prior year to $5,558 million (7 per cent higher than Q4 2022) - Core business revenue was up 5 per cent against Q1 2022, reflecting higher net investment income from Margin Funds and Clearing House Funds, partly offset by lower trading and clearing fees and lower listing fees - Net investment income from Corporate Funds was $549 million (Q1 2022: losses of $104 million), reflecting net fair value gains on the externally-managed investment funds (External Portfolio) of $195 million (Q1 2022: losses of $189 million) and higher investment income from internally-managed Corporate Funds

Operating expenses were 11 per cent higher than Q1 2022 (3 per cent lower than Q4 2022), attributable to higher staff costs and professional fees

EBITDA1 margin was 1 per cent higher at 76 per cent compared with prior year and 2 per cent higher than Q4 2022

Profit attributable to shareholders was $3,408 million, 28 per cent higher than Q1 2022 (14 per cent higher than Q4 2022)

First, please LoginComment After ~