Post-Covid Prospects: Finland

Finland, which has been ranked the happiest country in the world for six years in a row by the United Nations' World Happiness Report, has survived the Covid-19 pandemic reasonably well. On 1 July 2022, nearly two and a half years after the first confirmed coronavirus case in Lapland was reported in January 2020, the Nordic country lifted all its Covid-19 entry restrictions. This was possible in part due to its high vaccination rates: 87% of people 18 years of age or over had received at least two vaccine doses, and over 66% (27%) had received three (four) jabs by the end of March 2023.

After a 2.3% fall in GDP in 2020, Finland saw its economy and most of its industries returning to pre‑crisis levels in 2021 with an economic rebound of 3%. The Finnish economy had a strong start to 2022, and although the overall performance was overshadowed by the energy crisis, and by the instability, inflation and high interest rates brought on by the Russo‑Ukrainian conflict, the year saw a GDP growth of 2.1%. According to the latest forecasts from the Bank of Finland, the Finnish economy is likely to remain weak in 2023, although any recession is expected to be short‑lived and shallow.

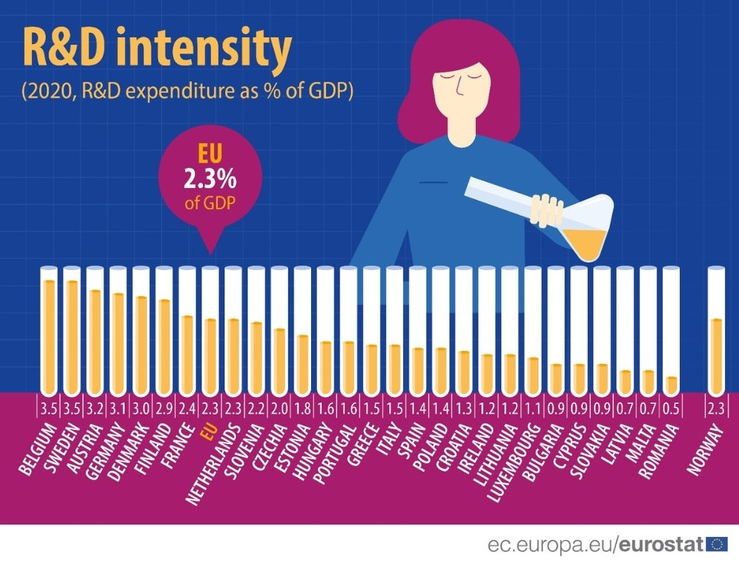

In addition to introducing various fiscal support measures designed to safeguard industry and people’s livelihoods from the economic setbacks triggered by Covid-19, the Finnish government has set in motion a plan to boost research and development (R&D) by pumping an extra €280 mn into the sector each year between 2024 and 2030. This will make the country one of the EU’s biggest R&D investors, spending as much as 4% of its GDP annually by the end of the decade.

A technology pioneer: Finland ranks top in R&D intensity.

To find out how businesses in the happiest country on earth are coping with the post‑pandemic new normal, while preparing for a broad‑based recovery amid turbulence from the tense geopolitical situation, in partnership with their Hong Kong counterparts, Louis Chan, Principal Economist (Global Research) at HKTDC, interviewed Timo Kantola, Finland’s Consul General in Hong Kong.

Chan: How has Finland coped with the Covid-19 pandemic?

Kantola: Finland, with a total of less than 1.5 mn confirmed Covid-19 infections and 9,000 related deaths as of end‑March 2023, boasted one of the lowest excess mortality rates [1] across the EU in the three years ending 2022.

While there were times when hospital capacity was under heavy pressure, timely pandemic restrictions helped to prevent sudden spikes of severe cases that would require immediate hospitalisation or intensive care.

When it comes to economic activities, Finland survived the most difficult times of the pandemic relatively well, registering GDP growth far higher than many other countries in Europe. After a GDP decline of 2.3% in the first year of coronavirus, economic growth resumed in most sectors of the Finnish economy in both 2021 and 2022. Overall, the Covid‑19 has not dealt a major blow to the Finnish economy.

However, several sectors such as airlines, restaurants, events organisations and tourism‑related businesses were particularly hard hit by the Covid-19 and related travel restrictions. Thanks to the deep pockets of Finns with a per‑capita GDP exceeding US$50,000 in 2022, the country’s relatively strong domestic consumption became a key growth driver through the pandemic years. Domestic traveling and tourism, for example, to destinations such as Lapland in Northern Finland, have been doing especially well, throwing a lifeline to the struggling Finnish tourism industry.

Like many countries in the world, the Finnish Government has provided a wealth of fiscal support to keep pandemic‑battered individuals and businesses afloat. While necessary, the stimulus measures have deteriorated the country’s public finances, resulting in a prospective fiscal deficit for the fifteenth consecutive year in 2023.

Social inequality matters have always been important in Finland, and were of particular concern during the pandemic. The signs of rising social inequality due to Covid‑19 are alarming, especially when it remains unclear whether these imbalances will gradually ease after the pandemic.

Immediately before serving as Head of Mission at Finland's Consulate General in Hong Kong, I was Finland’s Ambassador to Estonia in Tallinn, witnessing how Covid-19-related travel and border restrictions posed challenges to international logistics and traffic across the Gulf of Finland.

There was no uniform approach in applying Covid-19 restrictions within the region as the pandemic situation varied country‑to‑country and day‑to‑day, depending on the strain on public health services and the success of vaccination rollouts. The overall situation at times was quite out of control, as changes happened too fast to allow reviews and planning. Understandably there was a lot of confusion, and many people were unhappy with the restrictions applied. Many lessons can be drawn from the global fight against Covid-19, especially the response to the emergence of variant strains and timely reporting of findings on variants, and these highlight the importance and value of cooperation within the European Union (EU) and across the globe.

Chan: How has Finland’s foreign trade developed over the pandemic?

Kantola: The first year of coronavirus (2020) saw Finland's exports decrease by 12% year‑on‑year, but sales strongly rebounded by 20% and 19% in 2021 and 2022, respectively, with total exports of goods reaching an all‑time high of €82 bn last year. The country's imports followed a similar pattern, shooting to a fresh high of €92 bn in 2022, after shrinking by 1% and 9% in the two previous years.

The EU as a bloc remains by far the biggest trading partner for Finland, accounting for more than 56% of its total exports and nearly 55% of its total imports in 2022, while the leading individual nations were Germany, Sweden, Mainland China, the US, the Netherlands and Norway. During the pandemic, Finland’s exports (imports) to (from) the EU fell by 13% (7%) to €31 bn (€36 bn) in 2020, then significantly rebounded by 19% to €39 bn (24% to €42 bn) in 2021 and rose further to a new high of €46 bn (€51 bn) last year.

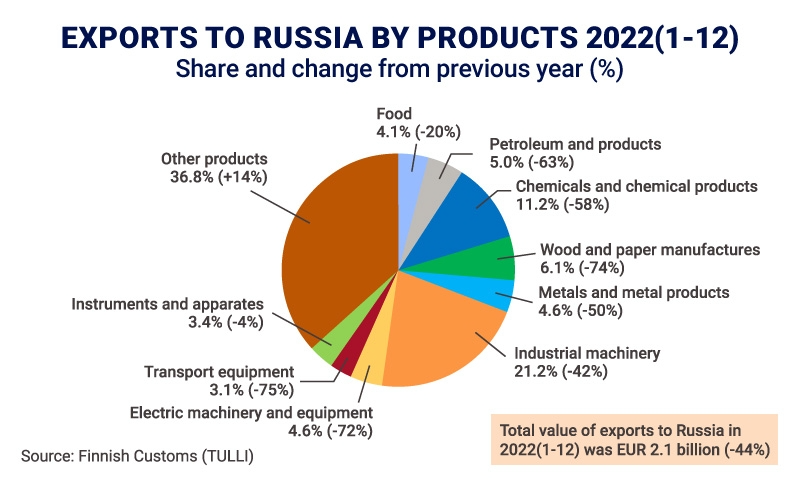

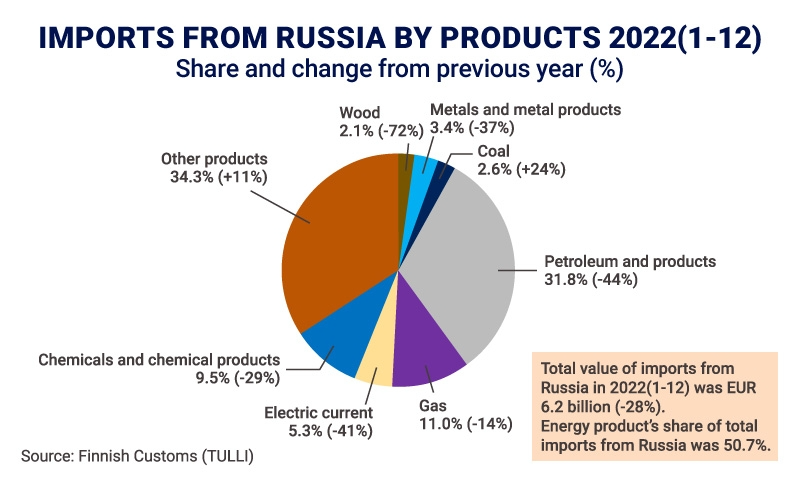

In addition to the pandemic, there was a drastic deterioration of the country’s trade relations with Russia. The EU sanctions in response to Russia's illegal and unprovoked military aggression against Ukraine have heavily and effectively curbed the bloc's as well as Finland's trade with Russia. Trade was also affected by the EU bans on Russian crude oil from December 2022 and refined petroleum products from February 2023, not to mention many other items on the sanctions list such as coal, other solid fossil fuels, steel and iron.

While Russia has long been one of our key trading partners, Finland widely supports the EU sanctions and their continuing strengthening. In 2022, Finnish exports to and imports from Russia slid by 44% to €2 bn and 28% to €6 bn, respectively, accounting for 2.6% (from 5.4% in 2021) and 6.8% (from 11.8%) of the country's total.

'

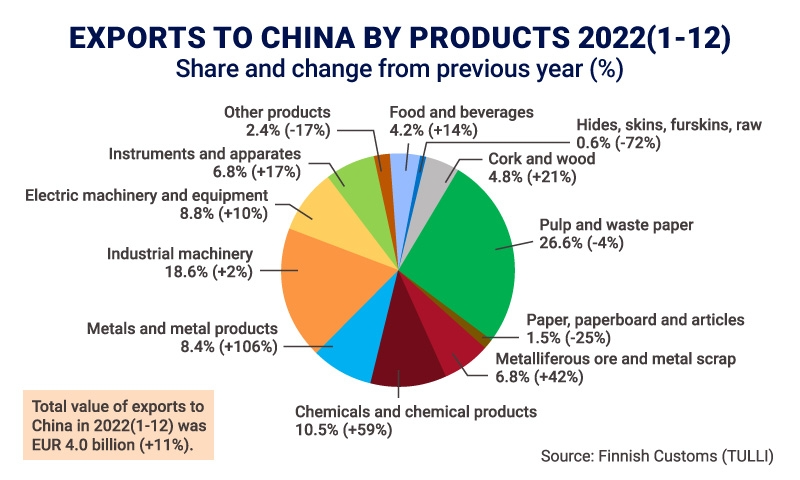

Over the years, China has been one of our biggest trading partners. In 2022, China was Finland’s fifth‑largest export market (€4 bn, up 11% year‑on‑year) and third‑largest import source (€9 bn, up 28% year‑on‑year), accounting for 5% of the country’s total exports and more than 9% of its imports.

Chan: What is the near- to medium-term outlook of Finland’s economy? How are the perspectives of economic recovery affected by the prolonged Russo-Ukrainian conflict?

Kantola: Finland's economy slipped into a mild recession towards the end of 2022 and the perspectives for this year remain gloomy. The Russian war in Ukraine has been disrupting the global supply of commodities and sharply increasing energy and food prices, threatening the post‑pandemic recovery with high inflation and interest rates.

In Finland, increases in average interest rates on housing loans and higher prices of district heating brought the year‑on‑year change in consumer prices to 8.8% in February 2023, which was close to the Eurozone average of 8.5%.

Another measure of the health of the Finnish economy includes the current account deficit, which was at a record high of more than €10 bn last year, shifting from a surplus of €1.3 bn in 2020 and €1.2 bn in 2021.

When it comes to public finance, various fiscal supports put into place to ease the consequences of tough pandemic‑control measures for businesses and individuals, though necessary and effective, have led Finland's public debt level to rise from 65% of its GDP in Q4 2019 to 73% in Q4 2022, after peaking at 75.5% in Q1 2021.

Despite the unusually foggy global economic scene and persisting uncertainties over most if not all of our major export markets, energy prices have come down to levels way lower than originally expected over the winter months. At this point, according to the latest forecasts, any recession is expected to be short‑lived and shallow, while the overall economy is expected to resume growth again next year, as will real incomes and private consumption.

At the same time and above all we have a huge task of combating climate change and accelerating the evolution to a green, net‑zero future. Like all the other EU Member States among the close to 190 Parties across the globe, Finland is strongly committed to the Paris Agreement – the first‑ever universal, legally binding global climate change agreement, adopted at the Paris climate conference (COP21) in December 2015. The EU formally ratified the agreement on 5 October 2016, thus enabling its entry into force on 4 November 2016.

Chan: What is Finland doing in more concrete terms regarding efforts to combat climate change and promote a more sustainable future?

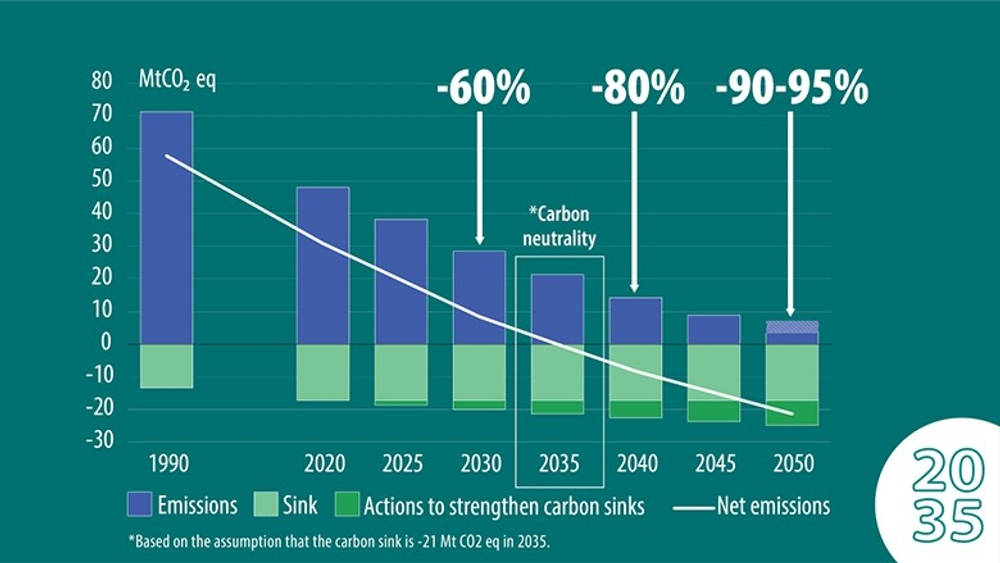

Kantola: As a contributor to the global response to the threat of climate change by keeping a global temperature rise this century well below 2°C above pre‑industrial levels and in pursuing efforts to limit the increase even further to 1.5°C, the Finnish government has established a goal of becoming the world’s first fossil‑free welfare society and passed new laws committing itself to achieving carbon neutrality by 2035 – well ahead of the EU’s 2050 goal – and carbon negativity by 2040.

The Climate Change Act entered into force on 1 July 2022, setting out new emission reduction targets. Source: Ministry of the Environment

Based on our firm commitment to biodiversity and the circular economy, key policy measures to achieve the legally‑binding net‑zero targets include:

- ♦Transition to nearly emissions-free electricity and heat production by the end of 2030s

- ♦Use of resource-wise and low-emission transport systems

- ♦Reduction of the carbon footprint in construction

- ♦Improvement of the energy efficiency of the existing building stock and support to the transition to zero-emission heating

- ♦Shift of taxation focus towards reducing environmental harm

It is clear that this green undertaking will require everyone's involvement to succeed. If you look at private households, the rising energy prices caused by the war in Ukraine have amplified calls for an accelerated energy transition, prompting many to install solar panels, air‑source heat pumps and underground thermal heating systems. Several steps have been taken to improve the energy efficiency of homes. In a similar vein, the transition to electric vehicles (EVs) has accelerated over the past couple of years, with more than 14,500 new ones registered in 2022 – an increase of 43% from 2021.

Similar green transitions can also be seen in the business sector. It is a rule in the industrial sector today that companies try to reduce waste and to make profitable use of side streams along their production chains. Take the forest industry as an example, Finland is in the forefront of turning waste into value when it comes to side streams such as woodchips, sawdust and bark in sawmills and plywood mills and fibre sludge in paper, board and mechanical pulp mills.

The green transition also means that the use of fossil fuels in energy consumption will disappear in the coming years. Despite the energy crisis brought forward by the prolonged war in Ukraine, the share of electricity production that is fossil‑free rose to 89% in 2022. In addition, the country’s first new nuclear plant in over four decades and Europe’s first in almost 15 years, Olkiluoto 3 (OL3), is going to produce 15% of Finland’s electricity upon full operation.

In Finland, renewable energy sources make up about 40% of all energy‑end consumption, with an aim to increase their share to more than 50% during the 2020s. The most important forms of renewable energy used in Finland are bioenergy generated from biodegradable waste, side streams of agriculture and industrial production and from municipal waste, fuels from forest industry side streams and other wood‑based fuels in particular, hydropower, wind power and ground heat. Also growing is the role of solar electricity as a green substitute and solar heating as a supplement to the main heating system.

On the other hand, the use of wind power has gradually picked up in Finland after a slow start in comparison to several other European countries. Vibrant development underway includes the building of many wind power turbines and more than 500 wind power plants. In recent years, wind power has significantly increased Finland’s renewable energy capacity.

In 2022, 2,430 megawatts (up 75% from 2021) of new wind power capacity was built and 437 new wind turbines were put into operation in Finland. Having clocked a 75% increase in wind power capacity, Finland had 1,393 wind turbines in operation with a total capacity of 5,677 megawatts by the end of last year. Thanks to the continued influx of foreign investment to the sector – the wind power projects completed last year alone brought a total of more than €2.9 billion to Finland – wind power is expected to cover at least 28% of Finland’s electricity consumption by 2025.

Chan: International logistics have been upended during the pandemic, hampering both air and sea transportation. How has it affected the Finnish logistics sector? How are smart city and smart port technologies being used to reshape and strengthen Finland's?

Kantola: Finland is often described as an island from the perspective of foreign trade, given its heavy reliance on the sea link across the Baltic Sea. This has been even more evident in the current circumstances as trade across the border to Russia has dramatically decreased.

In 2022, more than 92% of Finland’s foreign trade (in volume terms) – 90% of imports and 93% of exports – was done through ocean shipping. The Russian war in Ukraine has broadly affected the security situation in Europe – including the Baltic Region. However, maritime shipping has so far continued as normal.

Air traffic, especially passenger flights, on the other hand, has been picking up fast after the lifting of travel restrictions. Although air freight did not witness as dramatic a reduction as passenger travel over the pandemic, it is obvious that the war in Ukraine with all its consequences has changed the operating environment of the entire aviation logistics industry, affecting all the airlines including the Finnish company, Finnair. Against this backdrop, many flights departing from Finland to Asian destinations have been rerouted and that increases not only flying distance and time, but unavoidably the fuel and other costs for the airlines. But despite the challenges, we are glad to see that Finnair has been able to resume daily flights to and from Hong Kong.

Chan: Global trade and investment were weakened by the pandemic when travelling and business plans were shelved or postponed. Looking forward in 2023, what would you see as the most promising areas for Finland-Hong Kong collaboration?

Kantola: Partly due to the fact that many Finnish companies have already been trading directly with business partners in mainland China or have even set up companies or representative offices there, Finland’s trade with Hong Kong has not been growing on such a scale as its trade with other countries in the rest of Asia over the past decades. However, I believe there is huge potential to do more in our trade relations in future, including trade in services, which totalled around €120 mn in 2021.

In 2022, Finland’s export of goods to Hong Kong decreased by 30% year‑on‑year to €95 mn, with wood pulp, machinery and parts, electrical machinery and equipment, aircraft and parts as well as instruments being the major items. Meanwhile, Finland’s imports of goods from Hong Kong surged by 63% to €101 mn, with electrical machinery and equipment, instruments, machines and parts, clothing and vehicles being the key products.

Looking ahead, green transition and the work that relates to combating climate change will offer a wealth of opportunities for Finland‑Hong Kong business cooperation. Finland has a lot to offer in this field. For instance, Finland has ample experience and extensive expertise in bioeconomy [2] and waste utilisation.

Anyone visiting the world’s largest start‑up event “Slush” in Helsinki would appreciate how the vibrant Finnish start‑up community is working on innovations related to green transition. The Slush 2022, itself a carbon‑negative event, welcomed 4,600 start‑up founders and operators and 2,600 investors. Hong Kong companies are welcome to visit the next Slush, which will take place at the Helsinki Expo and Convention Centre from 30 November to 1 December 2023.

Finland is ranked top of most global rankings in education, innovation and digital technologies. All that will not only help us in moving green transition forward, but also offer plenty of room for Finland‑Hong Kong business cooperation.

Digital solutions and innovations will also be important in developing health services – an area of growing importance due to the ageing population in Finland. That is clearly another area where our start‑ups are energetic in seeking investment and making inroads into foreign markets. This aligns with what the HKSAR Government is actively promoting – the development of healthcare innovations – in Hong Kong, and, in turn, becomes an area of increasing focus for Finnish and Hong Kong companies.

On the other hand, many Finnish business representatives have asked me if and to what extent Hong Kong could serve as a gateway to the Greater Bay Area (GBA). In addition to sharing with them the benefits that Hong Kong can offer in terms of business and environment, international and mainland connections, language and culture, I believe each company has to draw its own conclusions on how to make best use of Hong Kong as their gateway to the much bigger GBA markets.

The geographical distance between Finland and Hong Kong is big and unfavourable to small companies which may find it safer to concentrate on markets closer to home. This is natural and needs to be addressed when discussing business cooperation between Finland and Hong Kong.

One productive answer is to have more face‑to‑face meetings and direct interaction between business representatives from the two sides to know each other better. Many Finnish companies are already well established in Hong Kong. Their success tells a story to those in Finland who consider doing business in Hong Kong.

Finally but importantly, the work done by the Finnish Chamber of Commerce in Hong Kong and Finland-Hong Kong Business Association in Helsinki is of great importance to the continued success of Finland‑Hong Kong business relations. We need more business‑to‑business interaction which is particularly timely now as the post‑Covid‑19 period presents a golden opportunity for us to bring our trade and commercial ties to the next but more sustainable level.

[1] Excess mortality is the rate of additional deaths compared to the average number of deaths over a baseline period (2016‑2019). The higher the value, the more additional deaths have occurred compared to the baseline.

[2] The use of renewable biological resources from land and sea, like crops, forests, fish, animals and micro‑organisms to produce food, materials and energy.

First, please LoginComment After ~