FAB Reports a Strong Start to 2023: Growth Strategy Delivers Superior Returns, with a Group Net Profit of AED 3.9 Billion in the First Quarter

Download → Report

FAB Reports a Strong Start to 2023: Growth Strategy Delivers Superior Returns, with a Group Net Profit of AED 3.9 Billion in the First Quarter

Key Highlights

• Strong start to 2023 with Group operating income of AED 6.7 billion, up 14% sequentially and 51% year-on-year, driven by sustained momentum across all business segments, and enhanced income generation across products and geographies

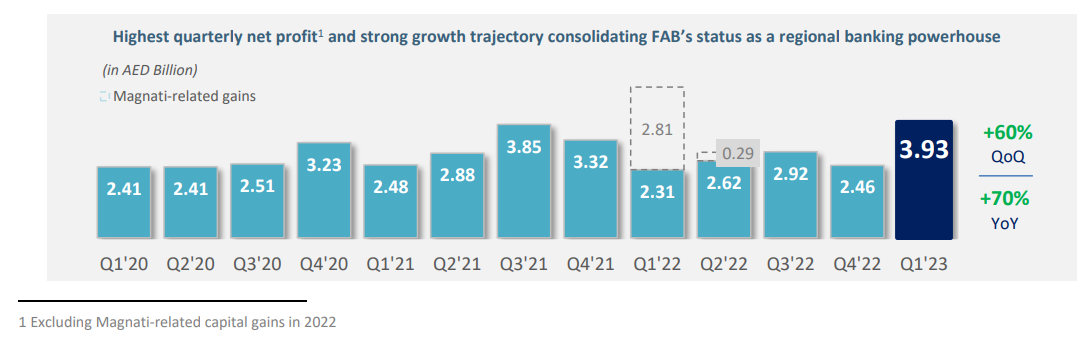

• Group Net Profit of AED 3.9 Billion, up 60% sequentially and 70% year-on-year excluding Magnati-related gains booked in the first quarter of 2022

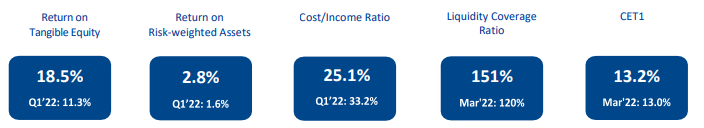

• Return on Tangible Equity (RoTE) improves to 18.5%, driving strong capital accretion with March-end 2023 Group CET1 at 13.2%

• Solid balance sheet fundamentals across all key metrics, with AED 80 Billion customer deposit inflows during the quarter, underlining franchise strength and our superior credit rating of AA- or equivalent as one of the safest banks in the world

• First quarter 2023 results underline solid progress against our growth strategy as the regional financial institution of choice, powering cross-border trade, economic growth and the transition to a low-carbon future, while emphasising our firm commitment to deliver superior and sustainable shareholder returns.

Q1'23 Key Performance Indicators

High double-digit earnings growth driven by sustained business activity, benefits from higher interest rates, and enhanced income generation across a diversified franchise

• Operating income at AED 6.7 Billion, up 51% yoy driven by strong growth in both net interest and non-interest income

• Net Profit at AED 3.9 Billion, up 60% sequentially, translating to an annualised Return on Tangible Equity (RoTE) of 18.5%

• Q1’23 Net Profit up 70% yoy excluding AED 2.8 Billion Magnati-related gains in Q1’22

• Cost-to-income ratio at 25.1%, compared to 33.2% in Q1’22

• Impairment charges (net) at AED 798 Million, implying an annualised cost of risk of 62 bps

First, please LoginComment After ~