SMBC Group and Jefferies Announce Growth of Strategic Alliance

Sumitomo Mitsui Financial Group, Inc., Sumitomo Mitsui Banking Corporation (“SMBC”), SMBC Nikko Securities Inc., and SMBC Nikko Securities America, Inc. (collectively, “SMBC Group”) today expanded their strategic alliance with Jefferies Financial Group Inc. (NYSE: JEF) (“Jefferies”) to enhance their collaboration in corporate and investment banking opportunities. In addition, SMBC plans to increase its investment in Jefferies in the form of non-voting stock to raise its economic ownership to up to 15% of Jefferies common shares on an as converted and fully diluted basis, subject to certain conditions.

The next phase of the alliance will enhance the collaboration that began in 2021, increasing the joint efforts across the firms’ M&A advisory services and equities and debt capital markets businesses, with a primary focus on investment grade clients in the U.S. Under the expanded agreement, Jefferies and SMBC Group will combine U.S. equities and M&A effort under Jefferies, and SMBC will be responsible for credit and SMBC Nikko Securities America will be responsible for debt capital markets, while Jefferies will be responsible for M&A and equity capital markets.

This enhanced alliance includes joint coverage efforts with Jefferies’ investment banking team, with a focus on designated U.S. investment grade clients. Under an information management and governance framework, both firms will jointly work to propose financial solutions to designated U.S. investment grade clients that have banking relationships with SMBC Group with dedicated Jefferies investment banking coverage. These efforts will take place under the co-branding of both firms. Both firms expect to grow the joint coverage initiative as the alliance relationship deepens going forward.

SMBC currently owns approximately 4.5% of the issued and outstanding common shares of Jefferies. SMBC intends, subject to any applicable regulatory approvals and the receipt of the approval of Jefferies’ shareholders for the authorization of a new class of non-voting common shares, to increase its investment in Jefferies through purchases of Jefferies’ common shares that will be exchanged for non-voting preferred shares that are mandatorily convertible into non-voting common shares. In doing so, SMBC plans to raise its economic ownership to up to 15% on an as converted and fully diluted basis. Upon SMBC Group’s investment reaching or passing 10% of the economic ownership of Jefferies on an as converted and fully diluted basis, then SMBC will be entitled to designate a new member to the Jefferies Board of Directors. This process will be subject to Jefferies’ customary onboarding procedures to determine the designee's eligibility and qualifications to serve as a director.

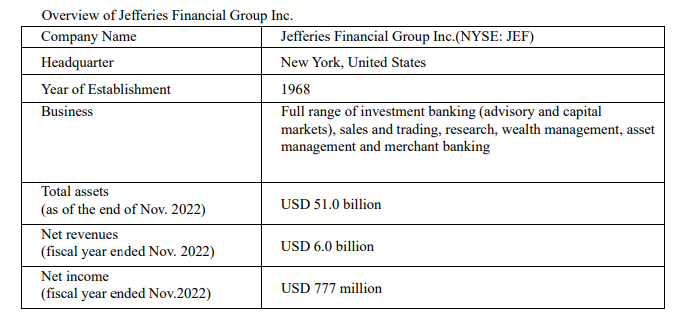

Jefferies is the largest independent, full-service, global, investment banking firm headquartered in the U.S. with a full range of financial service platforms, including investment banking, capital markets, research, and asset and wealth management services. In 2022, Jefferies ranked #6 in global M&A and ECM, and #7 for equity research in both the U.S. and Europe. In addition to strong positioning within investment banking, the company also has a leading global trading franchise and a diversified alternative asset management platform with more than $45 billion in assets under management.

Through the enhanced alliance, both firms will work to deliver best-in-class financial solutions by leveraging SMBC Group’s global client base, lending capacity, and debt capital markets capabilities and Jefferies’ extensive sector knowledge and investment banking capabilities, including its M&A advisory and equity franchises.

First, please LoginComment After ~