Deep Dive of Hong Kong-Active Mainland Companies (1): “Going Out” to Explore Post-Covid Business Opportunities

Although the pandemic is ebbing, the global economy remains under the spell of Covid. Increasing geopolitical tensions since the outbreak of the Russia‑Ukraine war last year have also slowed down growth in the major economies. However, mainland enterprises are still actively “going out” and investing overseas. Apart from tapping the opportunities created by the Belt and Road Initiative (BRI), they also hope to capture new opportunities generated by the Regional Comprehensive Economic Partnership (RCEP), which entered into force in 2022. After years of globalisation, production and supply chains in Asia have become further integrated and developed, providing new growth drivers for economic and trade exchanges between China and other Asian countries and helping the Covid‑battered global economy regain its growth momentum.

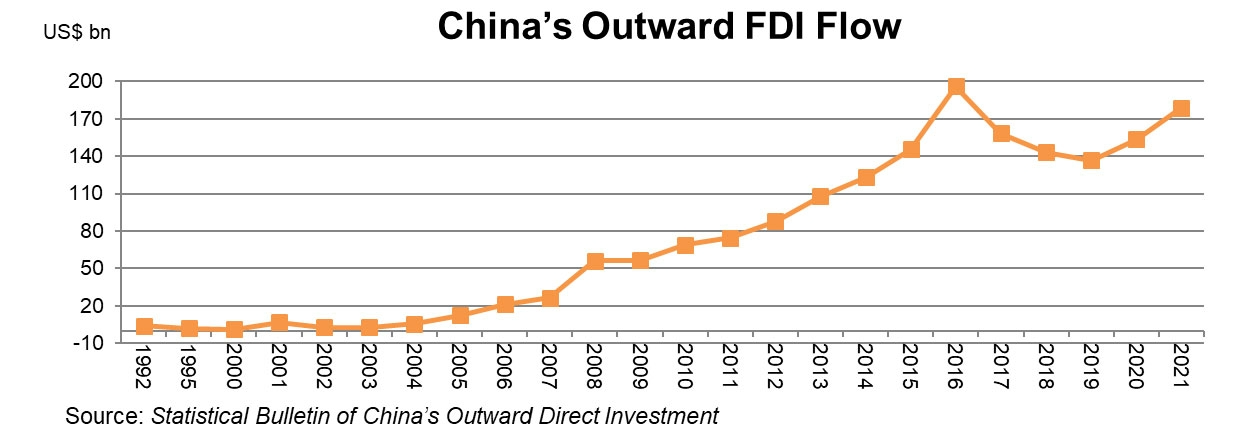

China has maintained steady growth of outward investment in the past two years and continues to be a major source of global investment. The latest statistics show China’s outward foreign direct investment (FDI) increasing 16.3% year‑on‑year to reach US$178.8 billion in 2021, ranking second globally only to the US and exceeding that year’s foreign investment inflow (actual use of foreign investment) of $173.5 billion to become a net capital exporter. China’s overall FDI (excluding financial investment) also returned to the fast track of growth in January and February 2023, rising 26.5% to $20 billion after only managing a sluggish 0.9% growth to reach $146.5 billion in 2022.

The Chinese government has substantially eased its control over outward investment in recent years. Except for foreign investment projects involving sensitive countries/regions or sensitive sectors, mainland enterprises only need to report their general investment projects overseas to the government for the record without going through examination and approval procedures. This greatly facilitates their overseas ventures, as they can go to their chosen destinations for direct investment according to their business‑development strategy.

Apart from stressing the need to expand domestic demand and expedite the establishment of a domestic circulation system, the 14th Five‑Year Plan (2021‑2025) also specifically mentions the need to establish the “dual circulation” development paradigm, upgrade the business environment and encourage enterprises to further develop international business. Against this backdrop, many mainland enterprises are continuing to make use of international resources in their “going out” efforts as well as China’s huge market development potential to create a new growth model and ultimately achieve more robust and sustainable business development. However, in view of the global economic downturn, many enterprises are turning their eyes from the traditional advanced economies of the west to the constantly developing Asian region. In particular, considering the positive effect of RCEP, they are focusing their attention on RCEP investment destinations and overseas markets such as ASEAN and Northeast Asia (Japan and South Korea).

Accessing How Mainland Enterprises Respond to External Challenges by Leveraging Hong Kong’s Platform

Hong Kong has for years been the main destination for mainland outward FDI because many mainland enterprises are choosing the city as their main channel for investing overseas. China’s FDI outflow to Hong Kong reached $101.2 billion in 2021, up 13.5% year‑on‑year and accounting for 56.6% of China’s total FDI outflow. Calculated up to the end of 2021, China’s outward FDI stock reached $1,549.7 billion, a 7.7% year‑on‑year rise and accounting for 55.6% of China’s total outward FDI stock.

China’s Major Outward FDI Destinations in 2021

Country /Region | Value (US$ billion) | Share | Country/Region | Stock (US$ billion) | Share | |

Hong Kong | 1,01.2 | 56.6% | Hong Kong | 1,549.7 | 55.6% | |

British Virgin Islands | 14.0 | 7.8% | British Virgin Islands | 447.5 | 16.1% | |

Cayman Islands | 10.8 | 6.0% | Cayman Islands | 229.5 | 8.2% | |

Singapore | 8.4 | 4.7% | US | 77.2 | 2.8% | |

US | 5.6 | 3.1% | Singapore | 67.2 | 2.4% | |

Source:Statistical Bulletin of China’s Outward Foreign Direct Investment 2021 | ||||||

Shanghai, Zhejiang and Jiangsu in the Yangtze River Delta (YRD) region ranked second, fourth and fifth, respectively, in China’s outward FDI stock at the end of 2021 (with Guangdong and Beijing holding first and third place). This shows that the YRD is a major source of outward investment. Enterprises mainly invest overseas through Hong Kong.

According to figures published by the Division of Foreign Economic Co-operation of the Shanghai Municipal Commission of Commerce, up to October 2022 there were as many as 2,519 mainland enterprises in Hong Kong from Shanghai alone, with recorded Chinese‑side investment reaching $47.27 billion. Hong Kong is also the biggest destination country/territory of Shanghai enterprises for global investment.

However, mainland enterprises, including those from the YRD, are facing all kinds of challenges while “going out”. Apart from increasing geopolitical tension in recent months and factors such as energy, inflation, central bank interest rate hikes and insufficient orders from overseas buyers, recent financial issues such as the closure/restructuring of the Silicon Valley Bank (SVB) and Credit Suisse have all increased business risks and affected the pace of mainland enterprises in “going out” to develop their international business.

HKTDC and the Shanghai Municipal Commission of Commerce signed a memorandum of understanding on economic and trade co‑operation in August 2021 to tap “dual circulation” development opportunities during the 14th Five‑Year Plan period. Representatives from HKTDC Research and the Shanghai Municipal Commission of Commerce interviewed online some senior executives of companies in the YRD in the third quarter of 2022 and obtained a preliminary understanding of the intention of Chinese enterprises on the mainland to “go out” and tap RCEP and BRI opportunities as well as the difficulties they encounter in developing international business. Many companies also expressed their need to find professional services in areas such as finance, law and marketing strategy to help them cope with different external challenges while further exploring RCEP and ASEAN market opportunities. They also hoped to come to Hong Kong to set up companies or footholds to make better use of the city’s economic and trading platforms to obtain the services they need.

In order to grasp a clearer picture of the situation, the China business advisor seconded from the Shanghai Municipal Commission of Commerce to Hong Kong and HKTDC Research interviewed in the fourth quarter of 2022 and the first quarter of 2023 mainland enterprises that have invested and set up footholds in Hong Kong to find out how they operate in the city under the impact of the domestic and international situation, including:

- ♦ The operation of enterprises from Shanghai and other YRD cities (and relevant foreign investors) in Hong Kong under factors of uncertainty, including the Covid pandemic, which ravaged the whole world, the intensification of US-China trade friction, worsening problems of global inflation and interest-rate fluctuations and the Russia-Ukraine conflict, including their views on the international situation and how they are affected.

- ♦ Specifically how they use Hong Kong services to respond to challenges.

- ♦ How they “go out” to tap RCEP and BRI opportunities in the global economic downturn.

The following are the main opinions collected during interviews with mainland enterprises in Hong Kong.

Mainland Enterprises in Hong Kong: Highlights of Views

- Compared with growing US-China trade friction and global geopolitical developments, mainland enterprises in Hong Kong are more concerned about the global economic downturn and problems such as rising US dollar interest rates, insufficient funds and recruiting Hong Kong talent.

- The pandemic and international developments have slowed down the global economic recovery, resulting in the deferral or shelving of projects planned by mainland enterprises that have gone global in the past two years.

- China’s implementation of the “carbon peaking and carbon neutrality” strategy and the global practice of ESG responsibilities have also prompted mainland enterprises to readjust their overseas investments. This will have a particular impact on energy-related investment portfolios and the profits of such projects.

- Since Hong Kong’s business platforms can provide a wide range of financial and professional services and its business habits and standards are in line with international practices, and given that Hong Kong has the benefit of extensive international commercial networks, mainland enterprises “going out” are hoping to invest overseas through the city. Many foreign enterprises are also continuing to use Hong Kong as a platform to tap mainland opportunities.

- Enterprises “going out” continue to keep an eye on business opportunities in mature western markets, but emerging markets can actually provide their overseas business with additional growth drivers. When exploring BRI and RCEP opportunities, they generally focus on the ASEAN markets first.

- Many mainland enterprises consider Hong Kong to be the top service platform for investing in overseas markets as it can help them deal with trade and investment issues. They also regard Hong Kong as an important offshore base for finding professional services to develop new BRI and RCEP In particular, Hong Kong’s accounting, legal and other professional services are of great help to their compliance operation overseas. Its financial services can help them in matters such as capital movement and remittance. On the other hand, mainland enterprises can obtain international market information, find foreign partners and carry out due diligence investigation to control risks through Hong Kong.

- Hong Kong is also the bridgehead for foreign enterprises venturing into the mainland. Apart from helping them to understand mainland business practices and abide by mainland laws and regulations, Hong Kong can also promote better connection between foreign and mainland enterprises. Therefore, even after three years of Covid, Hong Kong remains an effective service platform for China's “going out” and “bringing in” strategies.

First, please LoginComment After ~