AMCM:Payment card and mobile payment statistics – 1st Quarter 2023

Download → Payment card and mobile payment statistics – 1st Quarter 2023

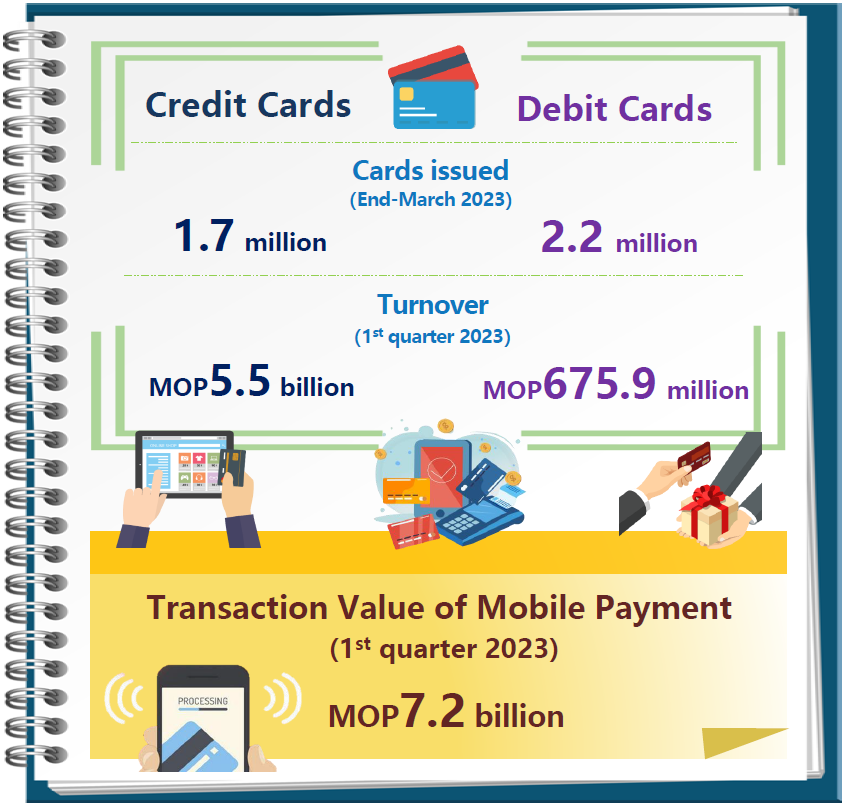

According to statistics released today by the Monetary Authority of Macao, the total numbers of personal credit cards and debit cards issued by banks in Macao increased in the first quarter of 2023. The credit card and debit card turnover both witnessed quarter-to-quarter growth. On the other hand, the number and the value of transactions of local mobile payment tools both retreated on a quarterly basis.

Payment cards issued

The total number of personal credit cards issued by banks in Macao reached 1,724,841 at end-March 2023, up 1.3% when compared with end-2022. The total number of debit cards issued by banks in Macao rose quarter-to-quarter by 2.2% to 2,156,407.

Credit limit granted and delinquency

At end-March 2023, credit card credit limit granted by banks in Macao reached MOP49.5 billion, up 1.7% from end-2022. Credit card receivables amounted to MOP2.5 billion, of which the rollover amount totalled MOP746.9 million, representing 30.0% of credit card receivables. On the other hand, the delinquency ratio, i.e. the ratio of delinquent amount overdue for more than three months to credit card receivables, edged down 0.1 percentage point to 3.0% when compared with end-2022.

Turnover and repayment

For the first quarter of 2023, the credit card turnover totalled MOP5.5 billion, a growth of 10.9% from the previous quarter. The cash advance turnover was MOP169.6 million, occupying 3.1% of total credit card turnover. The number of credit card transactions marked 7.7 million, down 2.1% on a quarterly basis. Credit card repayments, in which payments for interest and fees are included, rose quarter-to-quarter by 3.5% to MOP5.5 billion. Meanwhile, the number of debit card transactions other than cash withdrawals grew 1.1% to 330.0 thousand. The debit card turnover increased 5.4% from the previous quarter to MOP675.9 million.

Mobile payment

In the first quarter of 2023, the number of transactions carried out by local mobile payment tools retreated by 4.3% from the relatively high base in the previous quarter to 69.6 million. Meanwhile, the transaction value dropped by 1.4% to MOP7.2 billion. The average amount per transaction was MOP103.2. At end-March 2023, the number of mobile payment terminals and QR code signs totalled 98.1 thousand, an increase of 3.0% from end-2022.

First, please LoginComment After ~