Japanese Companies See Hong Kong as Premier Business Platform to Tap RCEP Opportunities

Key takeaways

♦About 90% of the Japanese companies in Hong Kong manage / handle RCEP business: In the HKTDC Research survey with Japan-affiliated enterprises based in Hong Kong, 89.4% of respondents were involved with business in at least one RCEP market other than Japan.

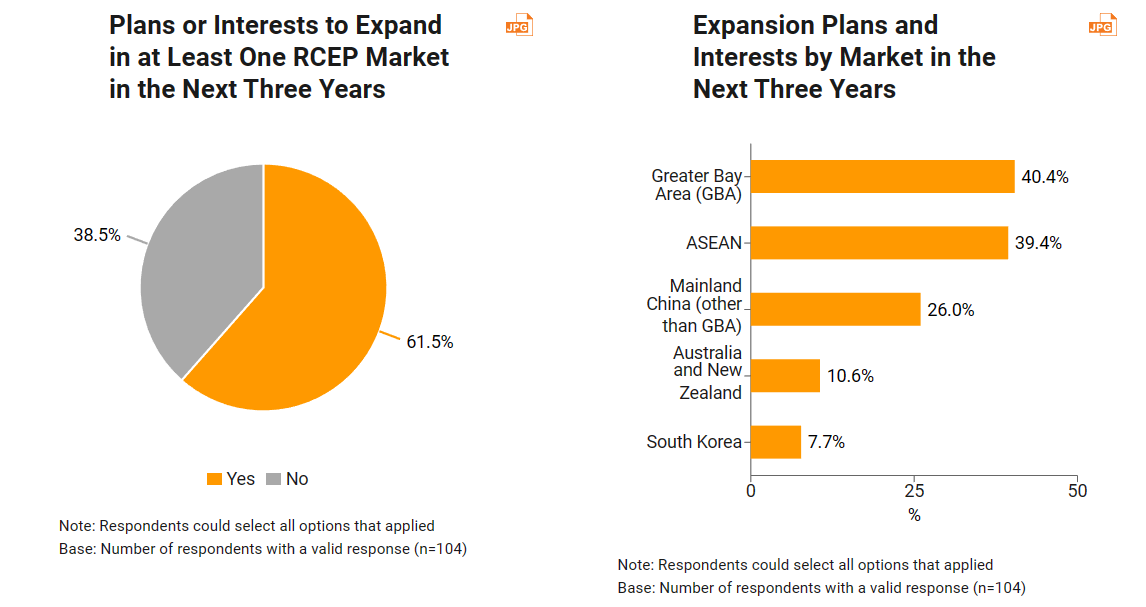

♦Majority of the respondents plan to expand RCEP business via Hong Kong: The majority of respondents (61.5%) had plans or interests to expand their RCEP business operations through their Hong Kong offices within the next three years, with the Greater Bay Area (40.4%) and ASEAN (39.4%) being the most popular destinations.

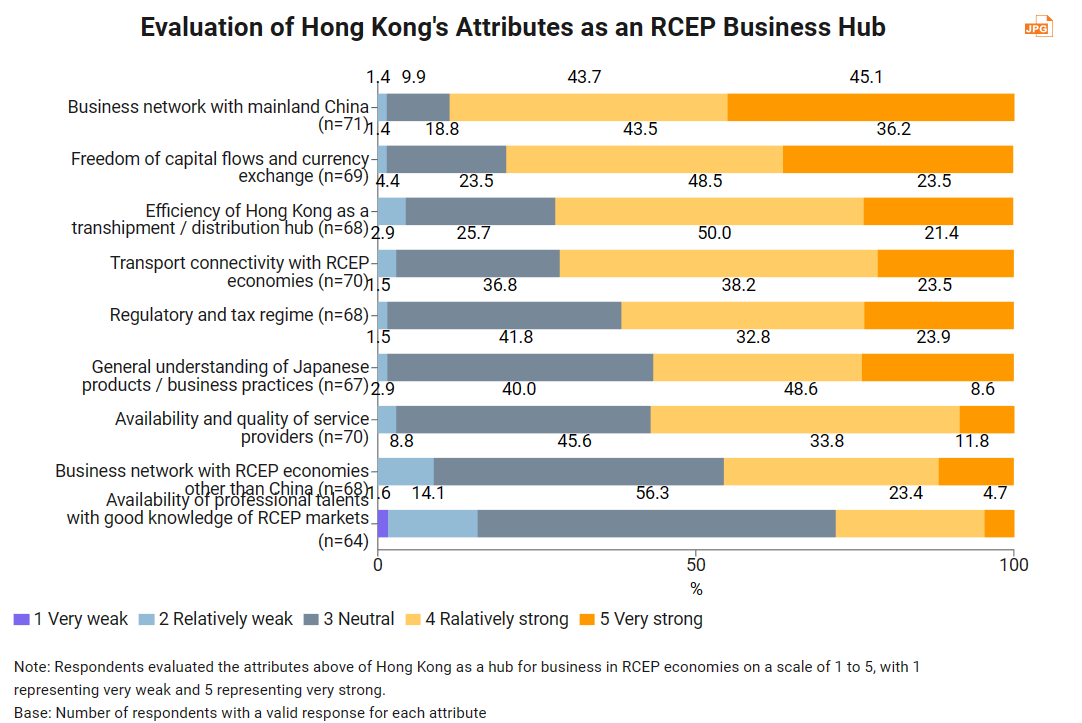

♦Strong regional connectivity makes Hong Kong the premier platform for RCEP: Business networks with mainland China (88.8%), freedom of capital flows and currency exchange (79.7%), efficiency as a transhipment and distribution hub (72.0%) and transport connectivity with RCEP economies (71.4%) were most frequently cited as Hong Kong’s core strengths as an RCEP business hub.

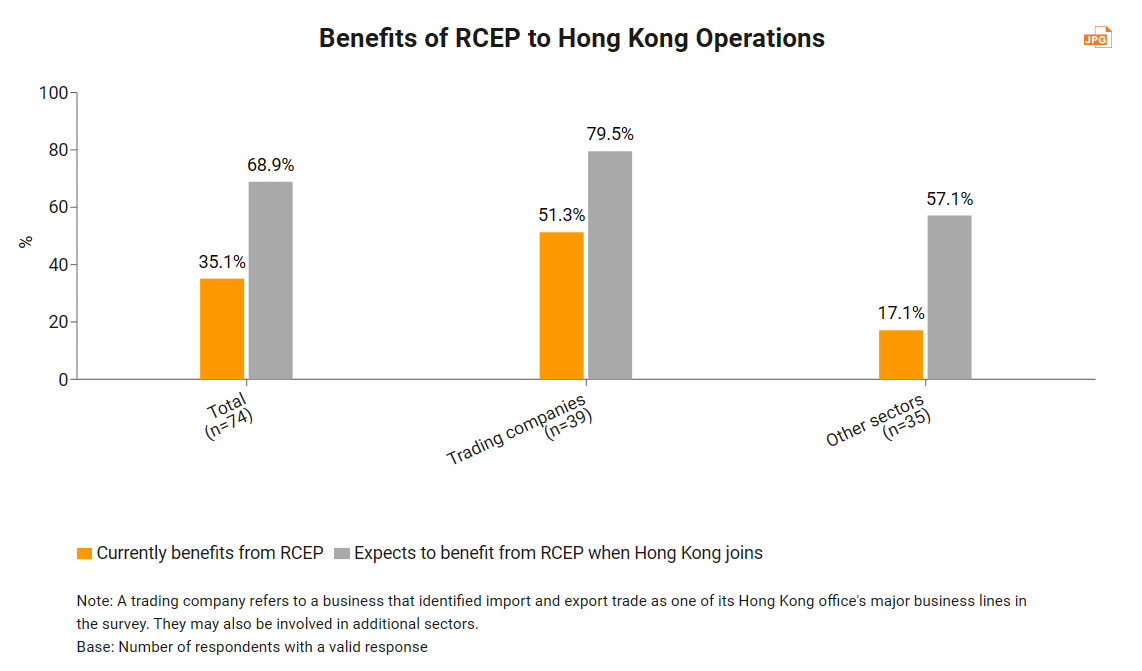

♦Even though Hong Kong had yet to become an RCEP member when the survey was conducted, the majority (51.3%) of the Hong Kong-based Japanese traders have already enjoyed RCEP benefits (rules of origins, lower tariffs, streamlined customs procedures, e-commerce, etc.), and 79.5% of them anticipated more benefits to come upon Hong Kong’s accession. This reflects Hong Kong’s role as a major logistics hub in the region and its deep trade ties with RCEP economies.

Acknowledgements

HKTDC Research would like to thank the Hong Kong Japanese Chamber of Commerce & Industry (HKJCCI) for its support in disseminating the questionnaire to its members for this survey.

Introduction

Hong Kong has long been an important business hub for Japanese companies. As of 2022, there were 1,388 Japanese regional headquarters and offices in Hong Kong[1], making use of the city’s well‑developed logistics and commercial networks, as well as its world‑class business services, to manage and expand their global businesses, particularly in the Asia‑Pacific region.

With the Regional Comprehensive Economic Partnership (RCEP), the world’s largest free trade agreement (FTA)[2], coming into effect in January 2022, trade and investment activities in the region are expected to increase significantly. It is also the first FTA between China and Japan. RCEP economies accounted for 71% of Hong Kong’s total merchandise trade in 2022[3]. While Hong Kong has yet to become an RCEP member, Hong Kong had already concluded FTAs with 13 of the 15 RCEP members and officially submitted an application to join the partnership in early 2022.

HKTDC Research conducted an online questionnaire survey in early 2023 with Japan‑affiliated enterprises based in Hong Kong to better understand their current operations in relation to RCEP markets, their future business plans and their views on Hong Kong’s position as a business platform to facilitate their RCEP business. The questionnaire was sent to 499 companies, and 104 valid responses were received.

Background: Scope of business

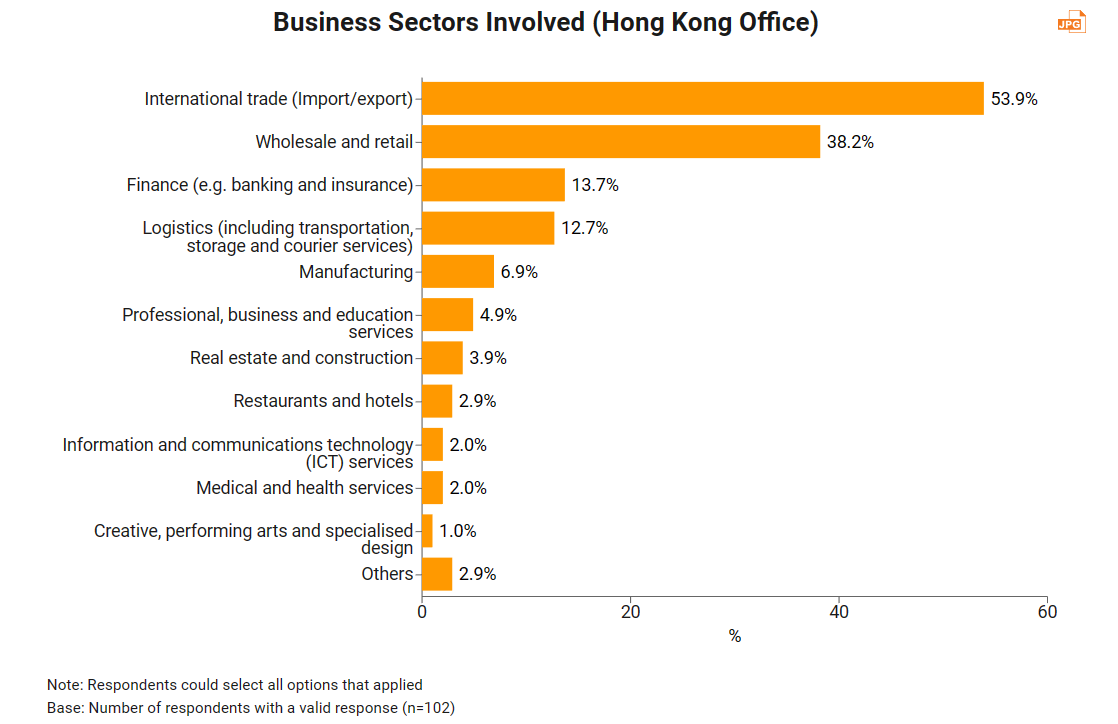

More than half of the survey respondents operate in the import and export trade sector (53.9%), followed by wholesale and retail (38.2%), finance (13.7%) and logistics (12.7%).

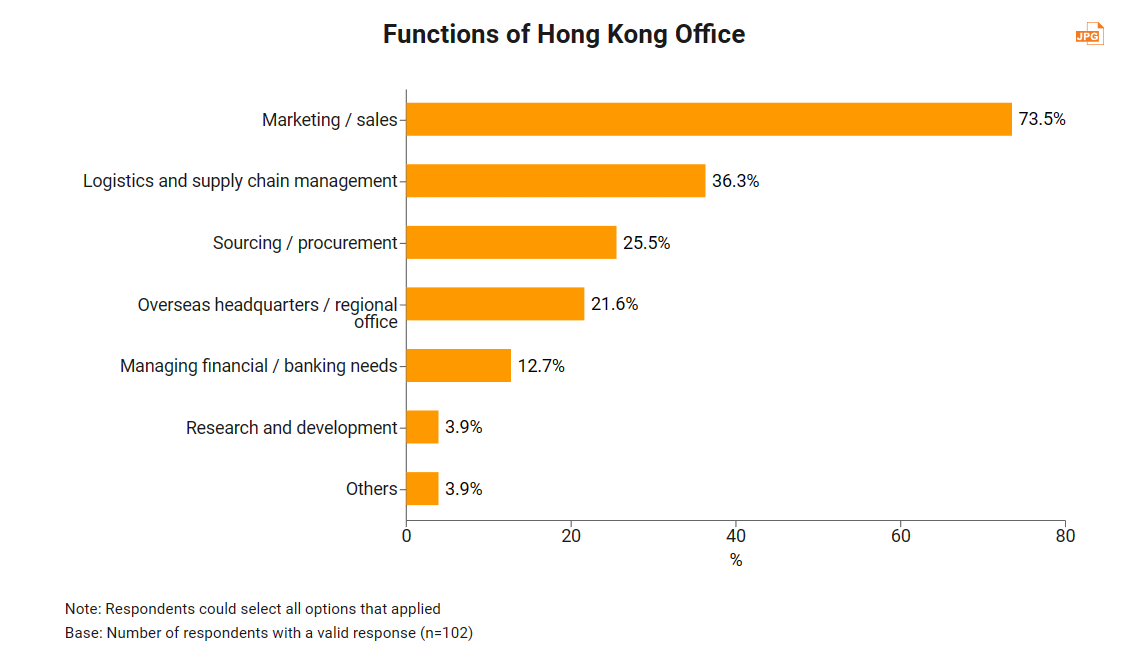

Most respondents use their Hong Kong office as a marketing and sales base (73.5%), while on the supply side, common functions include logistics and supply chain management (36.3%), and sourcing and procurement (25.5%).

More importantly, Hong Kong is a popular destination among Japanese enterprises as a primary or major base to manage operations outside of Japan. Some 21.6% of the survey’s respondents reported that their Hong Kong office serves as the company’s overseas headquarters or main regional office.

Hong Kong as the base to manage and handle business in RCEP

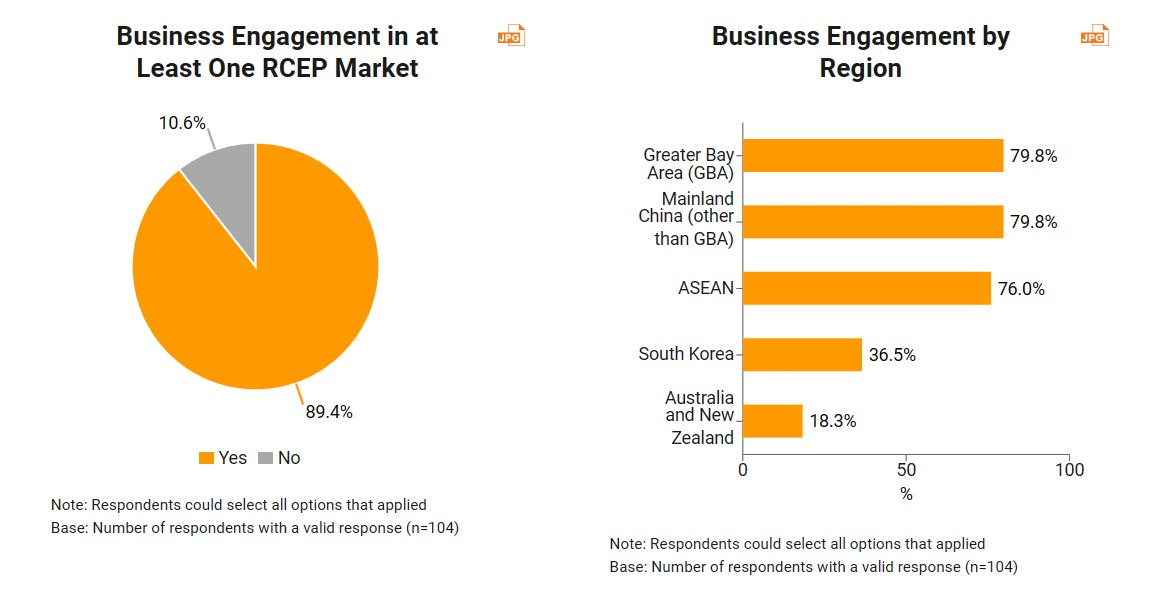

Hong Kong is a popular destination among Japanese enterprises as a base to manage or handle business in RCEP markets outside of Japan. In aggregate, 89.4% of the survey respondents are currently involved in at least one RCEP market other than Japan. By geographical focus, most respondents’ Hong Kong offices are engaged in business with mainland Greater Bay Area (GBA) cities and the rest of mainland China, both with a 79.8% share, followed by ASEAN at 76.0%, South Korea at 36.5%, and Australia and New Zealand at 18.3%.

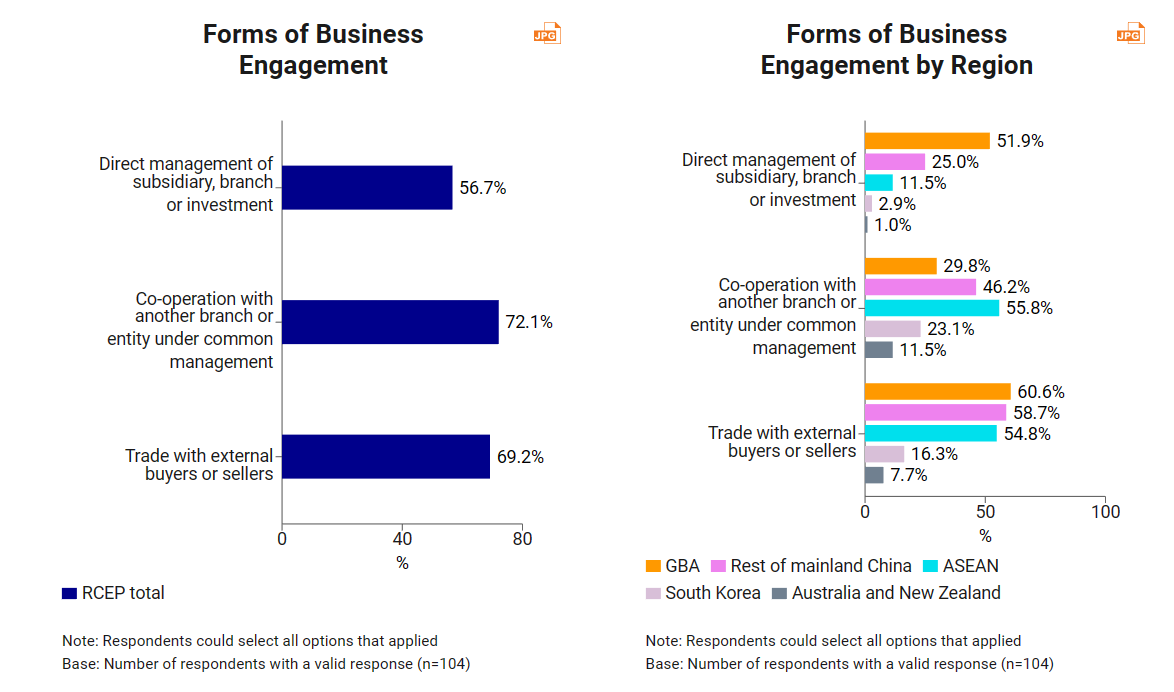

Forms of business engagement vary across different markets. Survey results showed that the GBA is the most common location for subsidiaries, branches or investments under the Hong Kong office’s direct management (51.9%). Hong Kong is also seen as a key connector for regional business, with most frequent co‑operations with branches in ASEAN (55.8%) and non‑GBA areas of mainland China (46.2%). In terms of trade activities, the mainland and ASEAN are the key focus areas. More than half of the survey respondents are also directly engaged in the goods or services trade with external parties in the GBA (60.6%), the rest of mainland China (58.7%) and ASEAN (54.8%).

Majority of the respondents plan to expand RCEP business via Hong Kong

Geared towards the emerging business opportunities in the RCEP region, 61.5% of respondents had existing plans or expressed interest in expanding their business operations in at least one RCEP market other than Japan within the next three years. The GBA (40.4%) and ASEAN (39.4%) are top on the agenda.

Majority of Hong Kong-based Japanese trading companies enjoy RCEP benefits

Even though Hong Kong had yet to become an RCEP member at the time this survey was conducted, more than half (51.3%) of all Hong Kong‑based Japanese trading companies[4] indicated they had already enjoyed RCEP benefits, while 79.5% anticipated these benefits would increase should the city join the bloc. This reflects Hong Kong’s role as a major logistics hub in the region, as well as its deep trade ties with many RCEP economies. In 2022, 69.8% of Hong Kong’s exports originated from RCEP economies, and RCEP accounted for 69.5% of Hong Kong’s total exports. RCEP benefits related to trade in goods, such as lower tariffs, streamlined customs procedures and unified rules of origin, were by far the most frequently cited current benefits (48.7%) and expected benefits should Hong Kong join RCEP (76.9%) for trading companies.

Among the non‑trading respondents, just 17.1% currently enjoy RCEP benefits. This may be because the main markets of Hong Kong‑based Japanese companies tend to be mainland China and the ASEAN bloc, both of which are already extensively covered by the Mainland and Hong Kong Closer Economic Partnership Arrangement (CEPA) and the ASEAN‑Hong Kong FTA. Mainland China, for example has already fully / partially opened up 95.6% of its services sector under CEPA compared with 65% under the RCEP framework. Nevertheless, the majority of such respondents expect to benefit from Hong Kong joining RCEP (57.1%), largely on account of the anticipated increase in economic activities and investment flows between mainland China, Hong Kong and Japan likely to be facilitated by the agreement – the first FTA between China and Japan. Goods trade‑related benefits (31.4%) were the most frequently expected benefits among non‑trading respondents, while some also anticipated an enhanced trade in services and investment (25.7%) should Hong Kong join the bloc.

In aggregate, 35.1% of respondents reported that their Hong Kong business had already benefitted from RCEP, while the majority of respondents (68.9%) anticipated yet more benefits for their Hong Kong operations should Hong Kong join the partnership.

RCEP Benefits | Trading companies (n=39) | Other companies (n=35) | ||

Current benefit | Expected benefit upon Hong Kong joining RCEP | Current benefit | Expected benefit upon Hong Kong joining RCEP | |

Trade in goods (e.g. Lower tariffs, streamlined customs procedures, unified rules of origin) | 48.7% | 76.9% | 8.6% | 31.4% |

Trade in services and investments | 2.6% | 12.8% | 8.6% | 25.7% |

Others (e.g. enhanced e-commerce, intellectual property rights protection) | 7.7% | 7.7% | 2.9% | 8.6% |

Note: Respondents could select all options that applied. | ||||

Strong regional connectivity makes Hong Kong the premier platform for RCEP

When evaluating the attributes contributing to Hong Kong’s position as a premier business platform for RCEP, business networks with mainland China was the most widely recognised strength (88.8% of respondents considering it to be “relatively strong” or “very strong”). Hong Kong’s financial infrastructure was also well‑regarded by 79.7% of respondents in terms of freedom of capital flows and currency exchange. At the same time, 72.0% of respondents set high stock by Hong Kong’s efficiency as a transhipment and distribution hub, while 71.4% saw its transportation connectivity with RCEP economies as underscoring Hong Kong’s efficacy as a regional trade and logistics hub.

Hong Kong is key to capture potential RCEP opportunities

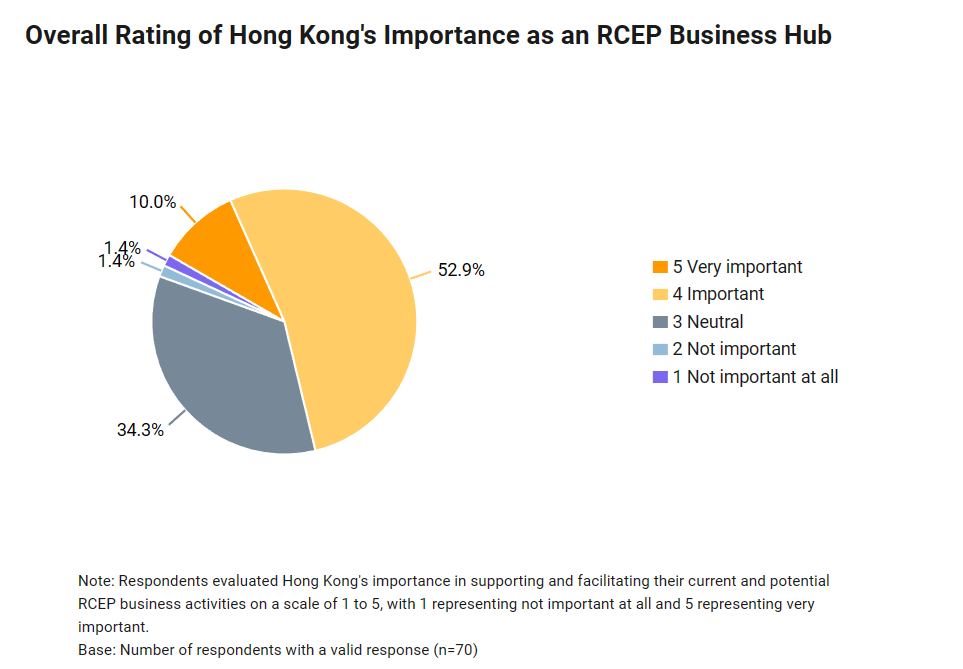

While Hong Kong is currently playing an important role in facilitating RCEP related business (close to 90% of the respondents manage or handle RCEP business via Hong Kong), the majority of the respondents (62.9%) see Hong Kong “important” or “very important” in helping them to capture potential business opportunities in the RCEP region.

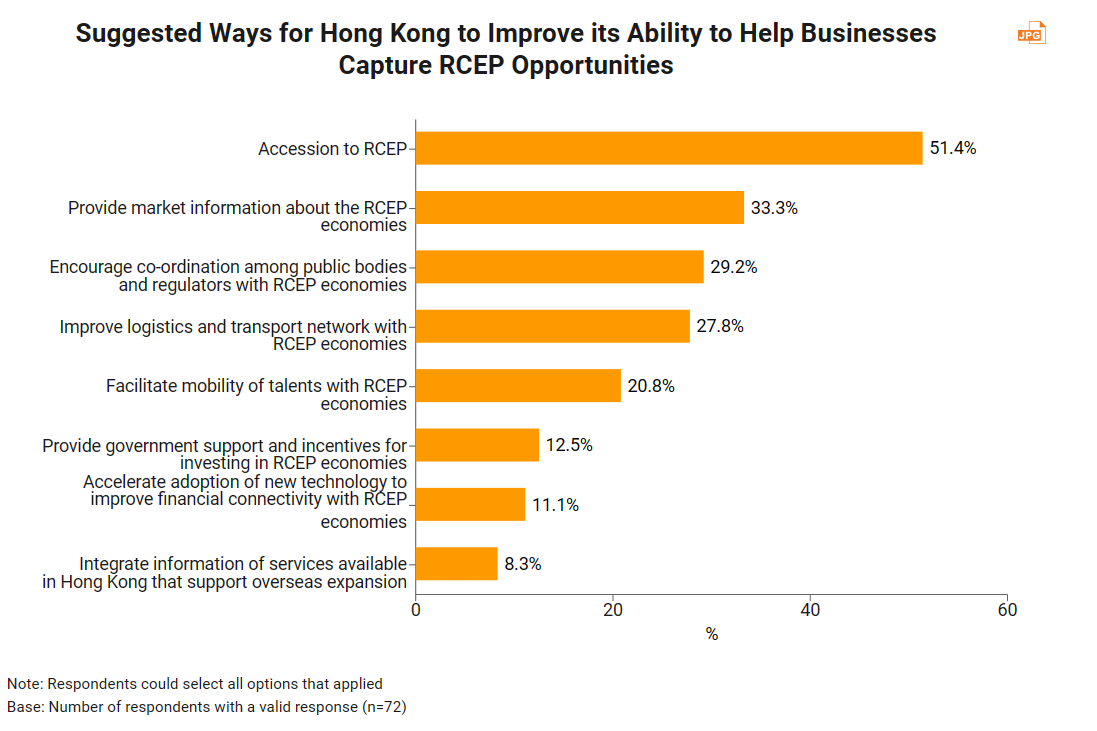

Hong Kong’s accession to RCEP is deemed to be the most effective way to bring more benefits to Japanese companies

More than half of the respondents (51.4%) suggested that Hong Kong’s accession to RCEP would improve their companies’ ability to capture RCEP business opportunities. One‑third of the respondents looked for market information about RCEP economies. Some 29.2% would like to see increased co‑ordination among RCEP public and regulatory bodies, as well as further enhancement in regional logistics and transport networks (27.8%) to help Japanese business capture RCEP opportunities.

First, please LoginComment After ~