HY23 Result: BNZ demonstrates its commitment to customers in a turbulent 2023

Bank of New Zealand (BNZ) released its half year results to 31 March 2023 and says a strong banking sector is important for New Zealand’s economy. BNZ is stable, well-capitalised, with strong liquidity, and the past six months has highlighted its commitment to serve its customers well and stand by them when they need support.

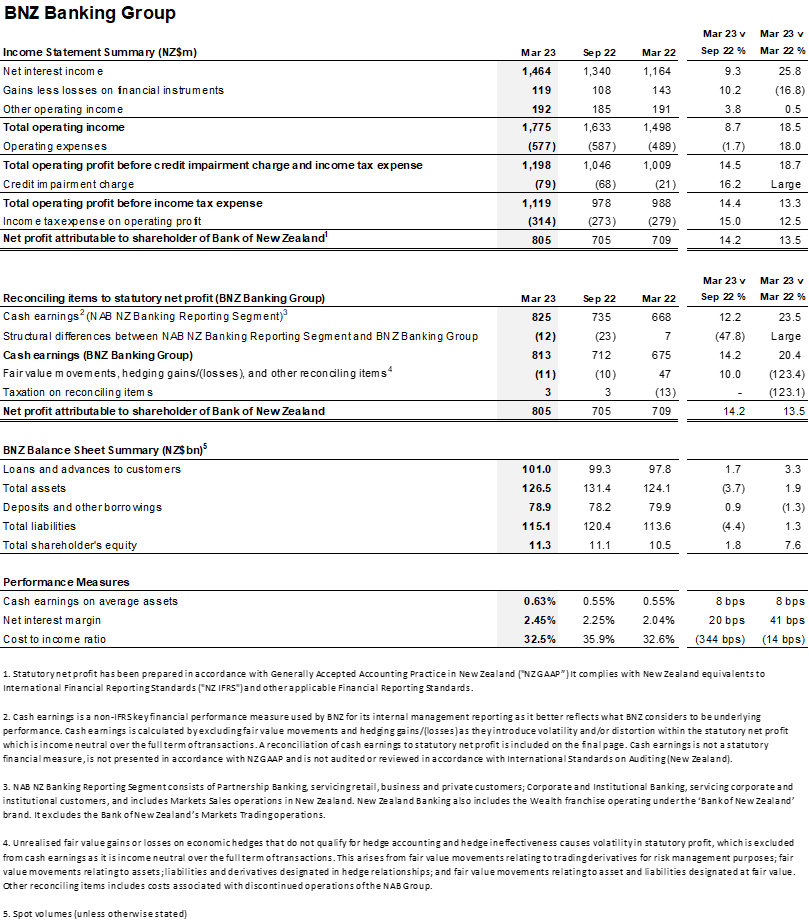

BNZ announced its statutory net profit increased by $96 million, or 13.5%, to $805 million. This was driven by higher revenue, partially offset by higher operating expenses and higher credit impairment charges.

Standing by our customers

BNZ CEO Dan Huggins says BNZ is committed to supporting its customers. “During the recent severe weather events, and as New Zealanders face increasing financial pressure on household budgets, we have shown that we will be there for our customers when it matters, just like we were during the pandemic and the Global Financial Crisis.

“Following the upper North Island floods and Cyclone Gabrielle, we acted swiftly to support our customers and communities in urgent need.

“So far, we have committed to waiving $22 million in interest costs for customers across our range of support options. We also provided nearly $500,000 in cash grants to customers, and donated over $360,000 to help KidsCan, The Foodbank Project and TaskForce Kiwi to deliver direct support to communities.

“For businesses, we have made $1 billion in low-cost funding available to help New Zealanders recover and invest in a more resilient future.”

Addressing the rising cost of living, Mr Huggins says BNZ is well positioned to support customers who are finding it tough in the current economic climate.

“We know our customers well and understand that many New Zealand households are feeling the pressure of cost of living increases, particularly those with home loans. While we’re confident that our home loan customers are able to manage the current higher interest rate environment, for some, it will be challenging.

“As always, our message to customers is get in touch – we’re here to help.”

Making banking simpler, easier and more accessible

Mr Huggins says BNZ has continued to deliver innovative solutions to help make it simpler and easier for customers to make the best financial decisions for them and their families.

“Tools like BNZ’s recently launched MyProperty empower customers with more information so they can better plan ahead for future interest rate changes and the impact this could have on their repayments. While BNZ’s easy to use online repayment feature has enabled 18,000 customers in the past six months alone to manage their mortgage repayments online.”

BNZ’s focus on delivering market-leading products saw it recently win two Canstar Innovation Excellence Awards for MyProperty and its tap-on-phone app, BNZPay, which turns any android phone or tablet into a contactless payment terminal.

Mr Huggins says by continuing to focus on simplification, over the past six months BNZ has been able to remove or reduce fees across a range of products, saving customers close to $15 million per year. This includes removing international payment fees and monthly account fees on BNZ’s popular TotalMoney account.

“We also recognise that access to mobile data can be a barrier to customers doing banking online, which is why we’re proud to be the only bank offering mobile banking free of data costs across New Zealand’s three largest telcos.”

Supporting businesses

“Alongside BNZ’s $1 billion Business Recovery and Resilience Fund, BNZ has backed over 7,800 small and medium sized businesses with new or increased lending in the first half of this financial year,” says Mr Huggins.

“We also launched a new funding model to provide innovative Kiwi tech businesses in sectors such as high-tech manufacturing, biotech and aerospace with access to capital to help fund growth and expansion.

“As with all economic cycles, challenges come with opportunities and BNZ will continue to partner with its customers to support their ambitions to innovate and grow.”

Key Financial Items

Note: compared to the six months ended 31 March 2022, unless otherwise stated.

- Statutory net profit of $805 million increased by $96 million, or 13.5%

- Loans and advances to customers (total lending) increased by $3.2 billion to $101 billion supported by home loan and business lending growth

- Customer deposits increased $1 billion to $75 billion

- KiwiSaver funds under management increased by $351 million, up 8%

- BNZ’s parent bank reinvested a further $5 billion in ordinary shares in BNZ through a dividend reinvestment.

- Total Capital Ratio 15.7% – more than $11 billion invested in New Zealand

An unaudited summary of financial information for the six months ended 31 March 2023 follows:

First, please LoginComment After ~