Highlights of the Outlook for Economic Activity and Prices (April 2023)

Outlook for Economic Activity and Prices

For further details, please see "The Bank's View" and the full text of the Outlook for Economic Activity and Prices (Outlook Report) on the following pages:

- Outlook Report (April 2023, The Bank's View) [PDF 382KB]

- Outlook Report (April 2023, full text) [PDF 1,801KB]

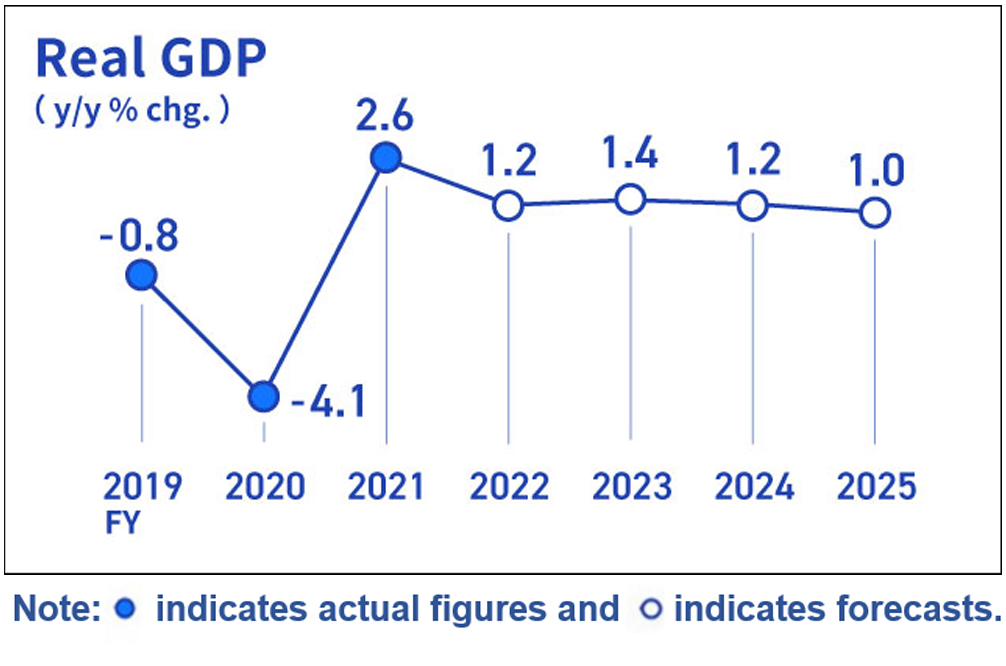

Japan's economy is likely to recover moderately

Japan's economy is likely to recover moderately, supported by factors such as an increase in consumption, although it is expected to be pushed down by past high commodity prices and a slowdown in the pace of recovery in overseas economies.

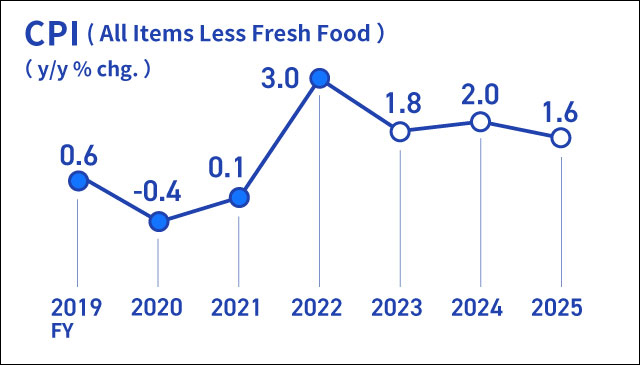

Inflation is likely to decelerate and then accelerate again moderately

The year-on-year rate of increase in the CPI is likely to decelerate toward the middle of fiscal 2023, with a waning of the effects of a pass-through to consumer prices of cost increases led by a rise in import prices. Thereafter, the rate of increase is projected to accelerate again moderately on the back of economic improvement and a rise in wage growth.

There are high uncertainties, including developments in overseas economic activity and prices, and market developments warrant attention

Extremely high uncertainties surround Japan's economy, including developments in overseas economic activity and prices as well as developments in the situation surrounding Ukraine and in commodity prices. In addition, due attention is warranted on developments in financial and foreign exchange markets and their impact on Japan's economic activity and prices.

The Bank will continue with powerful monetary easing

With extremely high uncertainties surrounding economies and financial markets at home and abroad, the Bank will patiently continue with monetary easing while nimbly responding to developments in economic activity and prices as well as financial conditions. By doing so, it will aim to achieve the price stability target of 2 percent in a sustainable and stable manner, accompanied by wage increases.

Policy Board Members' Forecasts

First, please LoginComment After ~