Data Centre migration: performance and market quality improvements

During February 2023, we completed a landmark data centre migration and hardware upgrade of the London Stock Exchange, Turquoise and TRADEcho services to a new dedicated facility in London.

The successful migration was thanks to the tireless efforts of teams across LSEG and those of our member firms and clients.

Our data centre is now both more innovative and robust in its architecture and tooling but also highly energy efficient - powered entirely by green energy.

More crucially, we are already seeing evidence of an increase in trading efficiency to the benefit of our clients, such as:

A 50% reduction in the London Stock Exchange Order Book equities average round-trip latency (or order processing time), and 'outlier’ observations (fat tails) in the distribution have reduced by 75%

A 66% reduction in the London Stock Exchange Order Book ETFs average round-trip latency, and outliers are down by 80%

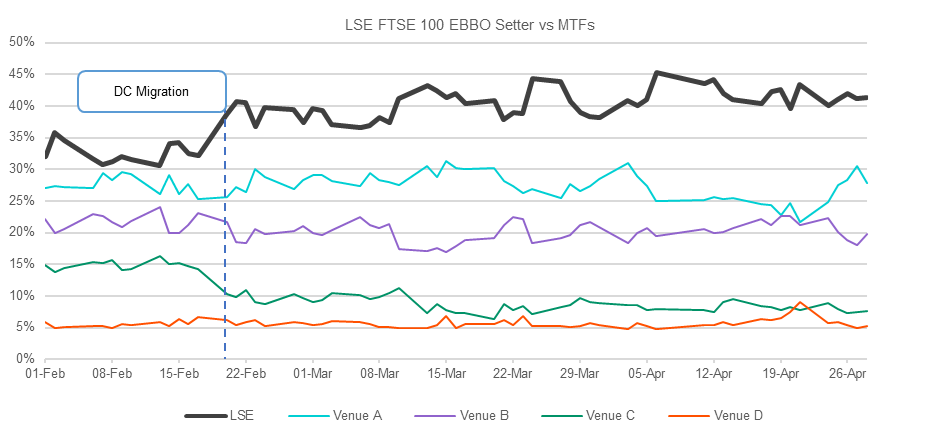

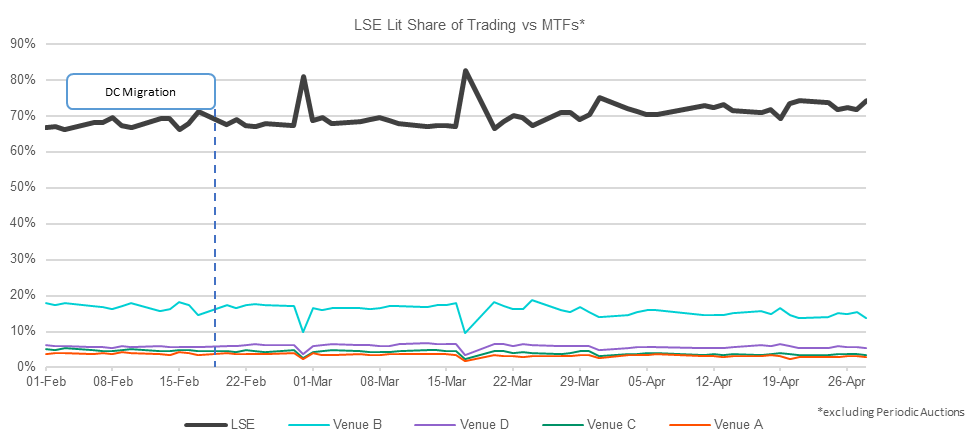

Alongside this improved latency, our data indicates that the London Stock Exchange Order Book has considerably increased its role as a price-former in UK Equities, increasing its FTSE 100 EBBO setting by 9% points compared to pre-data centre move, now accounting for just over 40% of all EBBO Setting events (see fig 1), and resulting in an increase to total LSE Lit liquidity (continuous/auction) with a share of trading consistently above 70% throughout April (see fig 3).

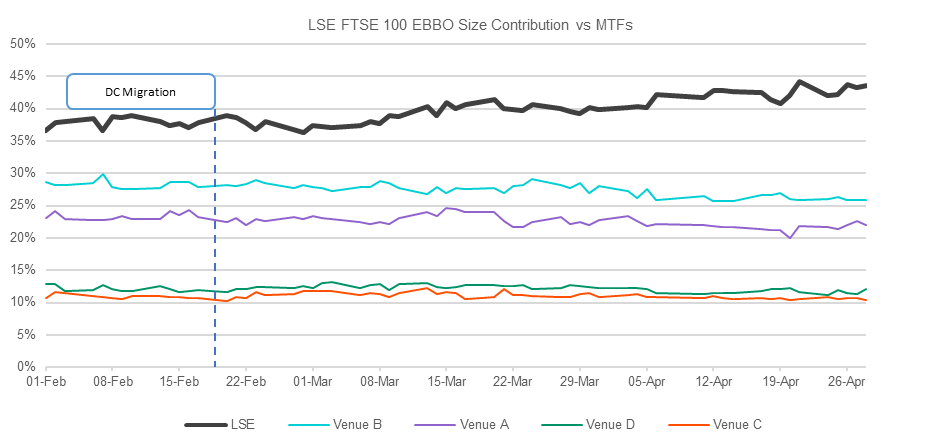

The FTSE 100 EBBO Size Contribution (see fig 2) has also increased by 5%, meaning the London Stock Exchange now accounts for a larger proportion of the volume available at the best price.

All of this means that our clients now receive confirmation of their orders more quickly and more predictably than ever before – translating into an ability to trade on the London Stock Exchange with more confidence and to enable greater access to liquidity.

Fig 1. Source - BMLL

EBBO Setter:

Percentage of instances where venue improves the European Best Bid/Offer (EBBO) price

Fig 2. Source - Big XYT

EBBO Size Contribution:

Percentage of total European Best Bid/Offer (EBBO) volume contributed by an individual venue

Fig 3. Source - Big XYT

Share of Trading:

Percentage share of total value traded by an individual venue

First, please LoginComment After ~