Financial Stability Report May 2023

Download → Financial Stability Report for May 2023

Overview

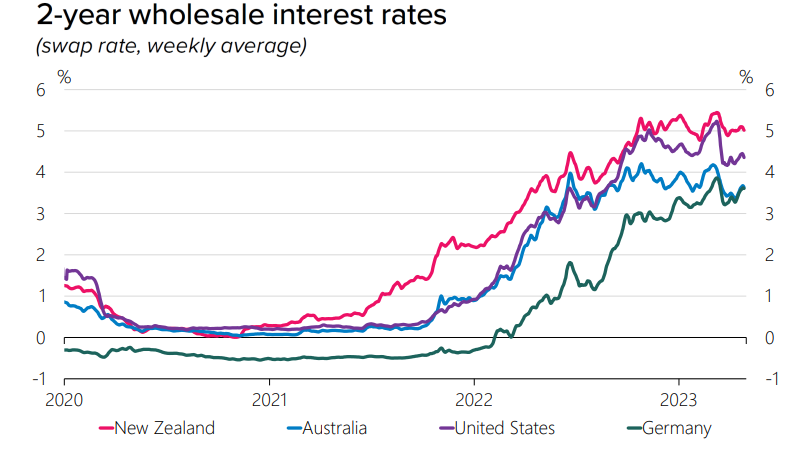

• Global inflation pressures remain high. Central banks have continued tightening monetary policy, albeit at a slowing pace.

• Higher interest rates have exposed some fragilities in the global financial system, shown by the failure of a few US banks and Credit Suisse in March. New Zealand banks take on relatively little interest rate risk, and have well developed methods to manage this risk.

• House prices have continued to decline, reflecting reduced borrowing capacity from higher interest rates. We intend to ease LVR settings, given current lending activity presents less risk to financial stability and household resilience compared to that of the past couple of years.

• The financial system has been resilient to the recent severe weather events in the North Island. These events are impacting insurers’ profitability and may accelerate long-term changes to insurance, but are not a threat to financial stability.

• New Zealand households and businesses are facing higher debt servicing costs. While this is creating financial strain, most borrowers have been able to adapt so far. Household’s financial buffers will continue to be tested, particularly as the labour market softens.

• New Zealand’s financial institutions are well positioned to handle these domestic and international pressures. The banking system’s capital and liquidity positions are strong, with profitability and asset quality remaining high.

Monetary policy tightening is slowing, but there is ongoing uncertainty about the speed at which inflation will reduce.

The higher interest rate environment is exposing fragilities in the global financial system.

• The rapid adjustment of monetary policy in response to high inflation is creating difficulties for institutions that have taken on excessive risks during the preceding period of very low interest rates.

• Several medium-sized banks in the US and Credit Suisse in Europe experienced a loss of depositor and investor confidence, leading to the failure of these banks and intervention by regulators to mitigate contagion to other institutions.

• While each of these bank failures had idiosyncratic factors behind them, these developments have seen a tightening in global financial conditions more broadly, including in bank wholesale funding markets and in credit conditions for households and businesses

First, please LoginComment After ~