MONETARY POLICY COMMITTEE STATEMENT FOR THE FIRST QUARTER OF 2023

Download → MONETARY POLICY COMMITTEE STATEMENT FOR THE FIRST QUARTER OF 2023

OUTLINE OF PRESENTATION

Decision of the Monetary Policy Committee

Inflation Outturn and Outlook

Foreign Exchange Market

Current Account

Domestic Credit and Money Supply

Domestic Economic Activity and Outlook

Conclusion

At its Meeting held on May 15-16, 2023, the Monetary Policy Committee decided to increase the Monetary Policy Rate by 25 basis points to 9.50 percent. In arriving at this decision, the Committee took into account the following factors:

• Actual annual average inflation of 9.6% in Q1 2023 and the projection that, although declining, inflation would continue to be above the target band over the forecast horizon.

• The Committee also considered:

• Fragile growth; • Vulnerabilities and risks in the financial sector; and

• Potential benefits from the successful conclusion of external debt restructuring negotiations through the exchange rate channel.

INFLATION OUTTURN

• Inflation declined further in Q1 2023, albeit marginally. However, it remained elevated and is projected to remain above the 6-8% target band over the forecast horizon.

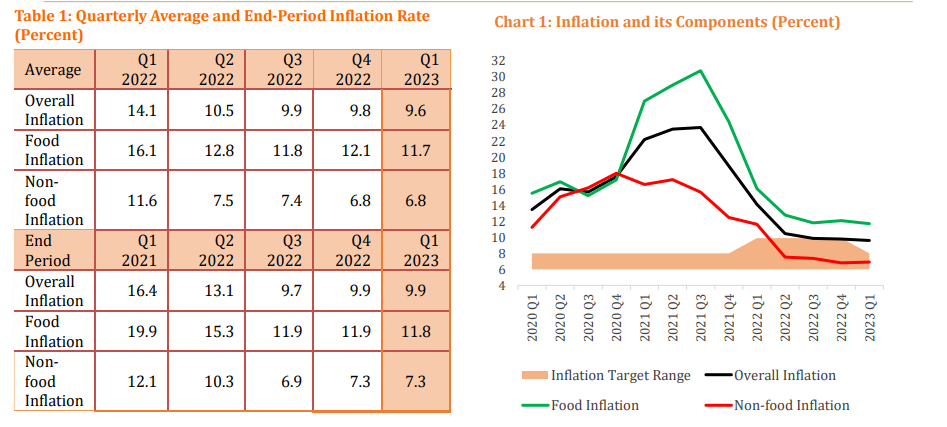

• In Q1 2023, inflation averaged 9.6% compared to 9.8% in Q4 2022 (Table 1, Chart 1).

• Dissipation of base effects in a broad range of items in the consumer basket and sustained reduction in the prices of oils and fats, due to lower costs of imported inputs, were the key drivers. Notable items in the consumer basket in which the base effect dissipated were road passenger transport, fish, fuel, bread and cereals as well as rent.

• In April 2023, inflation rose to 10.2% from 9.9% in March. Strong regional demand for maize grain and maize meal as well as the lagged pass-through from the depreciation of the Kwacha against the US dollar were the major drivers.

INFLATION OUTLOOK

INFLATION OUTLOOK

▪ The inflationary pressures observed in April are expected to persist over the forecast horizon and keep inflation above the target band of 6-8% despite declining slightly relative to the February 2023 forecast.

▪ Underpinning the current forecast are largely the impact of the recently approved electricity tariffs and elevated maize prices, particularly in 2023, as anticipated in the February 2023 Statement.

▪ Inflation is projected to average 10.5% and 8.4% in 2023 and 2024 compared to 11.1% and 10.1% in February 2023 forecast, respectively. In Q1 2025, inflation is forecast to remain at 8.4%.

▪ Further delays in external debt restructuring negotiations, tighter global financial conditions, higher maize prices, due to the anticipated lower production amid strong regional demand, and the impact of the prolonged war on food and energy prices remain key upside risks to the inflation outlook.

First, please LoginComment After ~