NPF returns exceed inflation: 2023 Q1 outcomes

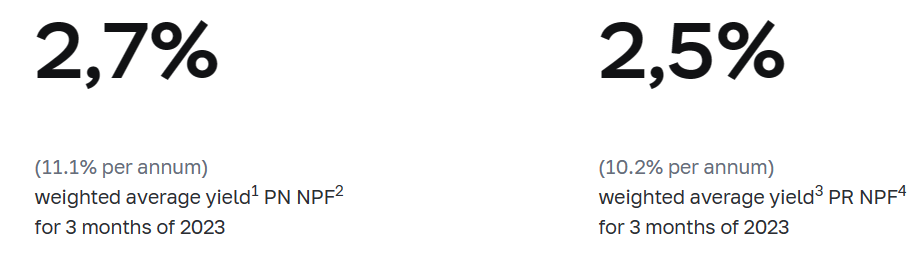

All non-governmental pension funds (NPFs) posted positive returns in the first quarter, with most of them demonstrating returns above inflation. The weighted average returns on pension savings were 2.7% (11.1% per annum), on pension reserves — 2.5% (10.2% per annum), whereas inflation was 1.7% (6.9% per annum).

The income of NPFs was mainly derived from the positive revaluation of shares and from coupons on debt securities.

The median return of funds in the first quarter of 2023 was 9.1% for PIT and 8.2% for PR in annual terms.

For all NPFs, the yield for 3 months of 2023, both for PR and PIT, turned out to be positive. 23 out of 27 funds operating under CPI5, and 26 of the 36 foundations operating on NGOs6, showed a yield above inflation.

NPF's income was mainly due to positive revaluation of shares and coupons on debt securities.

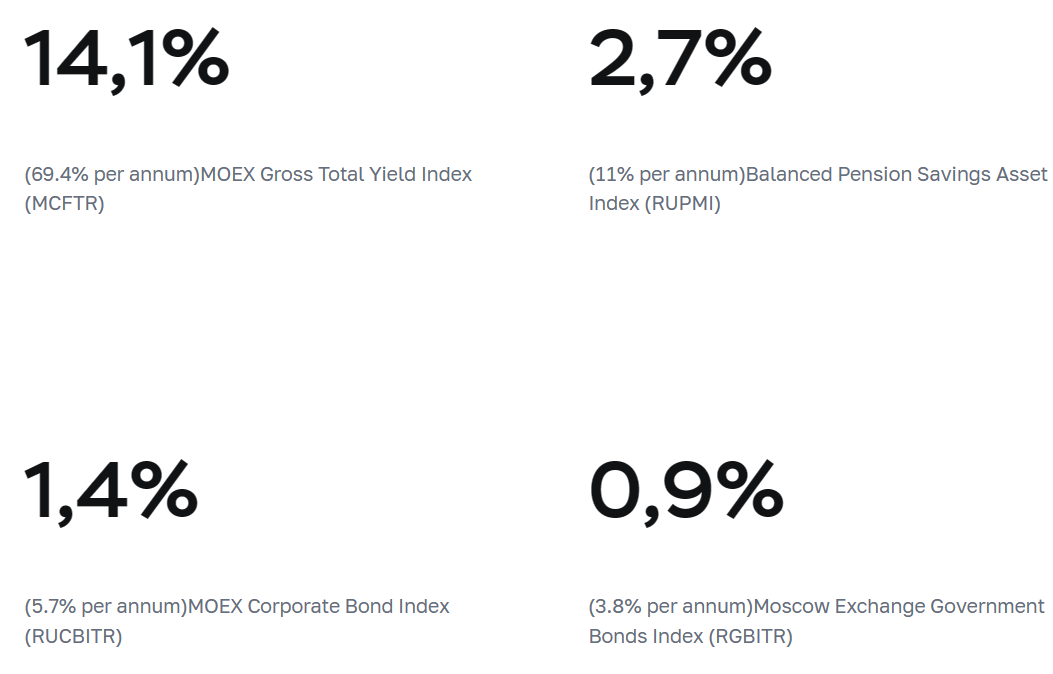

Change in market indicators in the first quarter of 2023

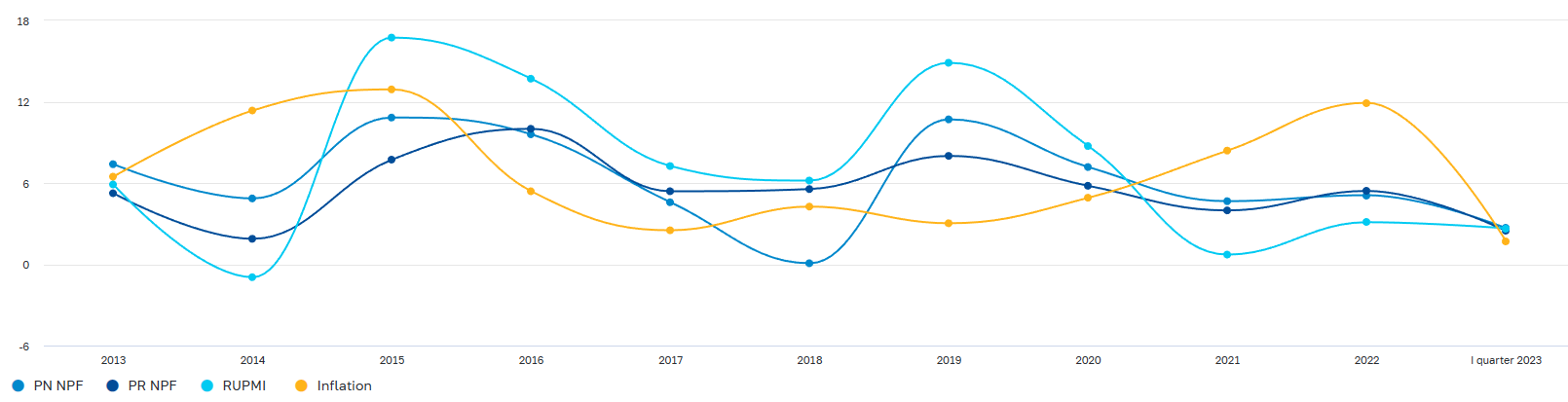

Weighted average yield of PNF in comparison with inflation and a balanced index of pension savings, % since the beginning of the year

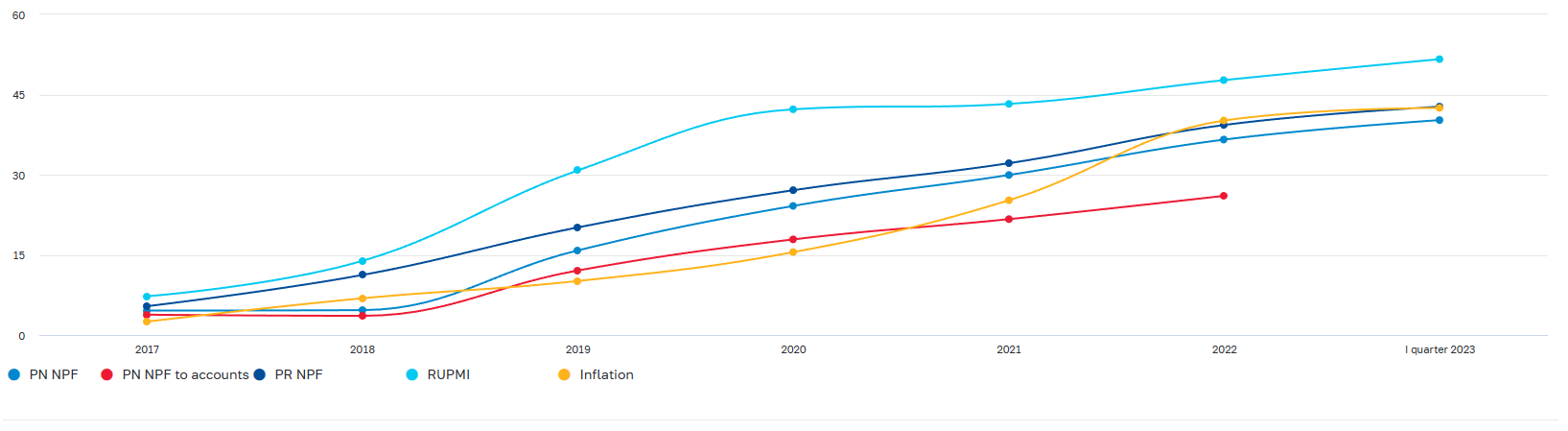

Accumulated profitability of NPFs since the beginning of 2017 in comparison with inflation and the balanced index of pension savings, %

1 The yield is indicated before the payment of remuneration to the fund.

2 PN NPF — funds of pension savings of non-state pension funds.

3 The yield is indicated before the payment of remuneration to management companies, a specialized depository and a fund.

4 PR NPF - funds of pension reserves of non-state pension funds.

5 OPS - compulsory pension insurance.

6 NGO - non-state pension provision.

First, please LoginComment After ~