Swap Connect - A convenient Access Channel to Mainland China's Derivatives Market for Onshore Bond Investment

Download → Research Report

SUMMARY

The bond market in Mainland China started to open up to international investors through the Qualified Foreign Institutional Investor (QFII) scheme in 2002 and the Renminbi QFII (RQFII) scheme in 2011. Wider access to the China Interbank Bond Market (CIBM) has been enabled by the launch of CIBM Direct1 in 2016 and Bond Connect2 in 2017, giving foreign investors easier access to China’s onshore bond market. These access channels are able to well serve international investors’ growing demand for onshore bond investments, facilitating higher capital flows into the onshore bond market. This, in turn, has led to an increase in demand for interest rate-related risk management tools for onshore bond investments, which has not been fully met yet.

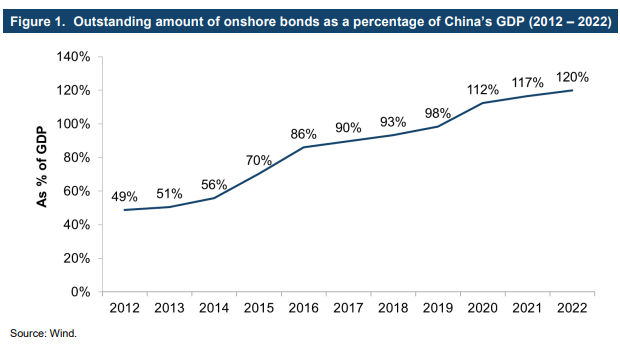

In parallel, foreign investors’ participation in the onshore bond market has also risen steadily over the years, thanks to the continuous opening-up of the Mainland capital markets. At the end of 2022, foreign institutions held RMB 3.39 trillion of outstanding onshore bonds in the China Interbank Bond Market, representing 2.7% of the total market. However, the proportion of foreign holdings is still low by international standards and far lower than China’s weight in the global economy.

Bonds are subject to interest rate risks, and so interest rate derivatives such as futures, options, swaps and forward rate agreements are often used as effective tools to help investors manage the risk profile of their bond holdings. This in turn facilitates the further development of the bond market. World experience shows that interest rate swaps (IRSs) are the most popular type of interest rate derivatives in the over-the-counter (OTC) market, having a world market share of 86% in April 2022.

In Mainland China, following the market-based interest rate liberalisation reform started in 1996, the onshore OTC interest rate derivatives market has grown rapidly as a result of risk management activities for hedging against the resultant increased interest rate volatility. In 2022, interest rate derivatives transactions on China’s interbank market amounted to RMB 21.3 trillion, showing a remarkable growth of over 6 times from RMB 2.8 trillion in 2011. RMB IRSs are the dominant product type in the Mainland OTC interest rate derivatives market, with a market share of 98.6% by trading value in 2022.

Onshore interest rate derivatives play an important role for investors in the management of their onshore bond portfolios. However, challenges exist for the market's further development and opening-up. These include inadequate diversity in market participants, and relatively low liquidity and market transparency.

The introduction of Swap Connect is a milestone step of the further opening-up of the Mainland derivatives market, which will help alleviate the challenges. Swap Connect is a new mutual access arrangement which will enable investors to participate in the financial derivatives markets in the Mainland and Hong Kong through a connection between financial infrastructure institutions in both places for trading, clearing and settlement. Northbound trading of IRSs under Swap Connect is implemented first at the initial stage, allowing international investors to trade and clear onshore RMB IRSs without changing their existing trading and settlement practices. This will give international investors a convenient channel to access the onshore IRS market to better manage their onshore bond investments, thereby encouraging more foreign participation in the onshore bond market. More foreign participation will lead to more participant diversity and higher liquidity, helping further develop both the financial derivatives and bond markets onshore.

With a well-developed financial regulatory framework, market infrastructure and strong global connectivity, Hong Kong is home to a vibrant OTC interest rate derivatives market that is on par with international standards and has active international participation. Founded on this, Swap Connect is believed to effectively support the functional role of Bond Connect to promote the further development and high-level opening-up of China’s onshore bond market and also to strengthen Hong Kong’s status as the premier offshore RMB hub.

First, please LoginComment After ~