Online distribution: homework for insurers

A recent market survey conducted by BaFin provides answers to these questions, and also shows where insurers are failing to comply with the statutory requirements when distributing insurance products online.

The majority of insurers now allow customers to take out policies online. In most cases, insurance products are offered on the insurers’ websites. This is one of the findings of a market survey conducted by the Federal Financial Supervisory Authority (BaFin). According to the survey, the use of apps in this context is still relatively rare. The survey also revealed that insurers do not always comply with the statutory requirements when it comes to policies taken out online.

For its market survey on online distribution (see the info box “Online distribution at insurers”), BaFin surveyed 308 primary insurers domiciled in Germany. The survey covered the years 2019 to 2021, alongside the companies’ planning for 2022. Around 70% of the insurers surveyed responded that they either use online distribution in combination with other distribution channels, or that they use online distribution exclusively. The share of insurers that do not use online distribution was highest among life insurers. According to the answers given by some of the insurers, this is due to the considerable need for advice in this area.

Apps offered by a small number of insurers

At 180 insurers, policies were offered on the companies’ own website. 170 insurers made use of untied intermediaries. At 133 insurance companies, tied intermediaries also played a role in online distribution. Only 35 insurers had their own app. Some companies added a chat function (41 via their website; 5 via an app) or video calls (25 via their website; 1 via an app) to the digital application process.

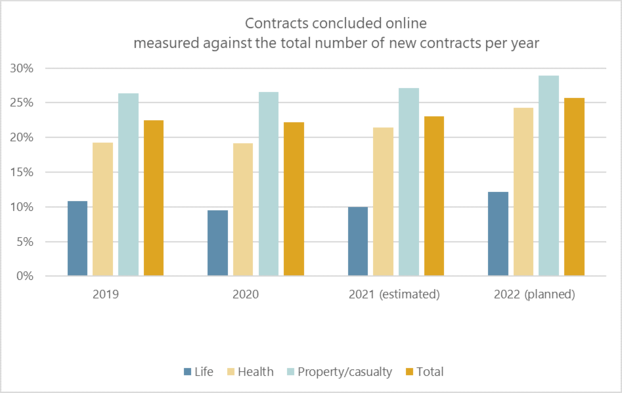

In the period examined, the coronavirus pandemic only had a minor impact on online distribution. As shown in Figure 1, there was no significant increase in new online contracts during this period.

Figure 1: Contracts concluded online

Source: BaFin/own survey

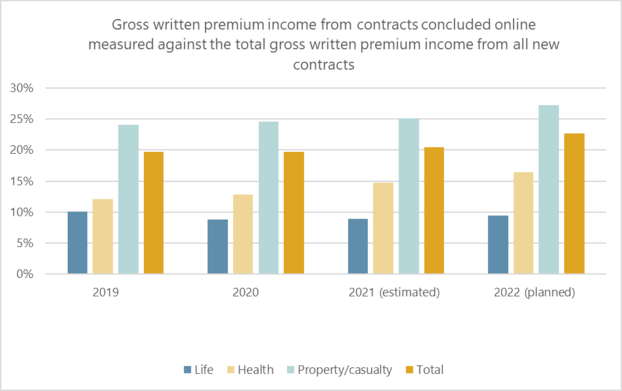

Analysis of the economic significance of contracts concluded online showed a similar pattern, with the financial impact of these contracts largely corresponding to their percentage share in relation to the total number contracts. Health insurance, however, is an exception since the majority of contracts concluded online were supplementary policies with low premiums (see Figure 2).

Figure 2: Contracts concluded online (gross written premium income)

Source: BaFin/own survey

At a glance

Online distribution at insurance companies

In its market survey, BaFin defined online distribution in particular as distribution via a website and/or an app for internet-enabled mobile devices.

The survey also looked at whether providers make use of an online form only, or whether they also use chat functions and/or video chats, and whether they involve tied or untied intermediaries that also offer online distribution forms.

Untied intermediaries are independent insurance brokers or insurance agents who act as intermediaries in the sale of insurance contracts on a commercial basis. Independent insurance agents are also known as multiple agents.

“Tied” or “exclusive” intermediaries work exclusively for one insurance company. If there is no competition between the insurance products they offer, tied intermediaries can also work for several insurance companies. It is key that the insurance company assumes unlimited liability for the work of the intermediary, provided they have not already been granted authorisation under section 34d (1) of the German Industrial Code (Gewerbeordnung).

Regulatory requirements

BaFin also examined the extent to which insurers comply with the regulatory requirements when distributing insurance products online. Here, BaFin focused on the pre-contractual information requirements and the duty to provide advice under the Insurance Contract Act (Versicherungsvertragsgesetz – VVG) (see info box “Regulatory requirements for distribution”). To this end, BaFin selected ten insurers each from the areas life insurance, health insurance, and property/casualty insurance for a more in-depth survey.

The survey showed that all of the companies made the pre-contractual information available within the prescribed period, i.e. before consumers submitted their policy declaration, and that they made use of the text form as required. In addition, the majority of insurers surveyed offered consumers insurance advice as necessary. If customers decided not to make use of the advice offered, they were instructed within the prescribed period that this could have an unfavourable effect on any compensation claims they may later try to assert.

There were no reports of significant technical problems due to the electronic transmission of information and advice documentation.

Lapse rates and justified complaints

With regard to lapse rates and the number of justified complaints, there were no significant differences between contracts concluded online and those concluded offline. Only three life insurers had developed products specifically for online distribution. More than half of the companies surveyed (63%) stated that, of their existing products, they only offer the less complex products online.

Insurers do not always comply with the statutory requirements

The survey also revealed breaches of insurance law in online distribution. The insurers surveyed were not always in compliance with the statutory requirements. Some insurers stated that it was only possible to take out policies online if customers waived their right to insurance advice. However, where advice was necessary in individual cases, this contravened section 6 (1) sentence 1 of the VVG (“Advising the policyholder”). Advice may be necessary due to the consumer’s personal situation or needs, or due to the complexity of the insurance product. In such cases, consumers were denied the advice required by law. If insurers directed consumers to the possibility of telephone or in-person advice (hybrid distribution) and the consumers nevertheless concluded a contract online, then the insurers may be deemed to have encouraged consumers to waive the right to insurance advice. This is because consumers who take out policies online are likely to want to conclude a contract as quickly as possible. They must have the option to receive advice online if advice is necessary.

Termination in text form not always possible

Some of the insurers surveyed do not allow their customers to terminate contracts using the required consumer-friendly text form.

Some insurers also stated that they do not ask consumers as part of the digital application process whether the risk they are seeking to insure may already be covered by another insurance product. BaFin takes a critical view of this: it makes little sense for consumers to take out travel insurance, for example, if their existing policies already provide sufficient cover.

BaFin does not tolerate breaches of the rules

BaFin expects insurance companies to comply with the statutory requirements when distributing products online. For the most part, digital distribution is subject to the same rules as other forms of distribution. BaFin does not tolerate breaches of the rules in any form of distribution. The supervisor is in contact with 20 insurers at which it noted irregularities or even violations of the rules in online distribution. BaFin has requested these companies to remedy the issues identified, and it will follow up on this.

At a glance

Regulatory requirements for distribution

The EU Insurance Distribution Directive (IDD) was transposed into German law by various legislative texts, including the Regulation on Insurance Mediation and Advice (Versicherungsvermittlungsverordnung – VersVermV), which entered into force in December 2018. The IDD includes the stipulation that the same level of consumer protection must be guaranteed regardless of the distribution channel used by consumers to purchase an insurance product.

♦Section 6 of the Insurance Contract Act (VVG) sets out requirements for “Advising the policyholder”. This section sets out requirements regarding the advice to be provided where necessary, which must be appropriate (including with regard to costs) and suited to the needs of the consumer; this section also covers the documentation of this advice, the option to waive the right to advice, and possible claims for compensation the policyholder may assert should the insurer breach its obligation to provide advice

♦Section 6a of the VVG covers “Details concerning the provision of information”, i.e. transmission to the consumer of the advice given and the reasons for this.

♦Section 7 of the VVG details the “Information provided to the policyholder”. This section covers the requirements for the pre-contractual information to be provided by the insurer.

♦Section 7c of the VVG governs the assessment of insurance-based investment products and the reporting requirement. This section specifies requirements regarding advice on insurance-based investment products.

First, please LoginComment After ~