Evolution of credit institutions' balance sheet

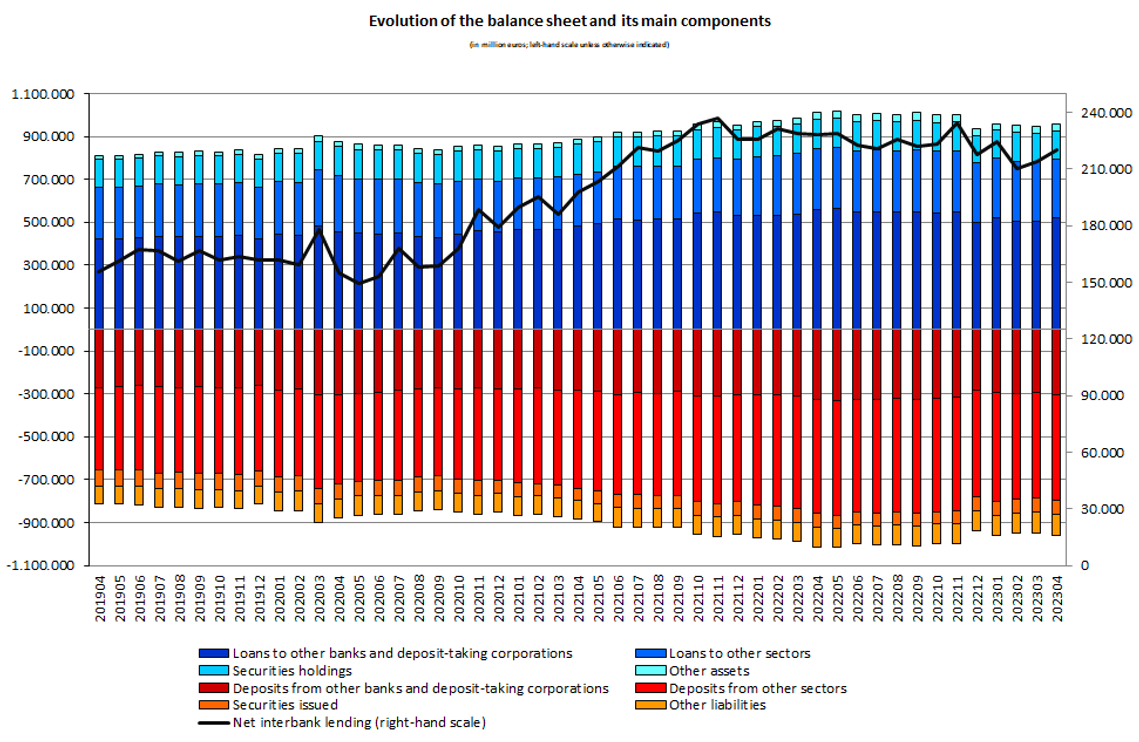

The Banque centrale du Luxembourg informs that, based on preliminary data, the aggregated balance sheet of credit institutions reached 958 007 million euros on 30 April 2023, compared to 946 434 million euros on 31 March 2023, an increase of 1.22%. This increase is due to the monthly progression of claims towards the banking sectors. On an annual basis, the aggregated balance sheet decreased by 5.54%.

Net interbank lending, i.e. the difference between interbank loans and deposits, increased by 6 175 million euros (2.89%) to reach 220 138 million euros at the end of April 2023.

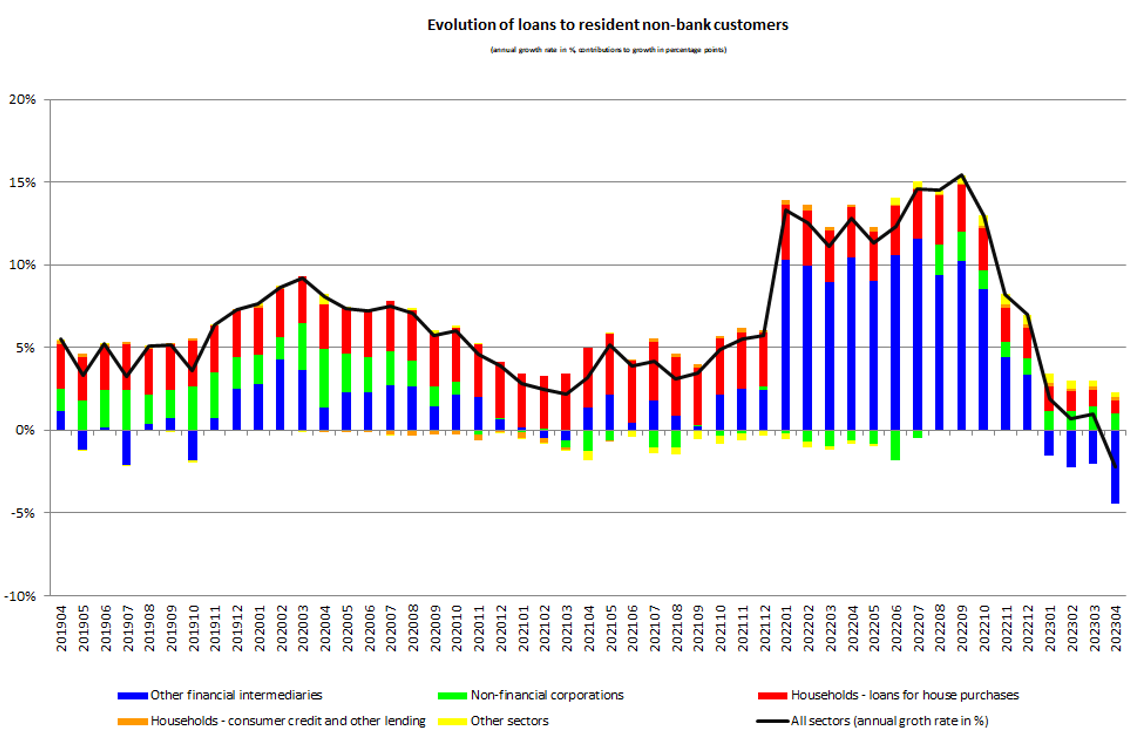

Loans to resident non-bank customers decreased by 2 196 million euros, or 1.87%, between March 2023 and April 2023. Over twelve months, these loans decreased by 2 621 million euros (2.2%).

On a yearly basis, loans to non-financial corporations (NFCs) increased by 1 212 million euros (4.36%), loans for house purchases increased by 869 million euros (2.14%) and loans to other financial intermediaries (OFIs) decreased by 5 288 million euros (12.39%).

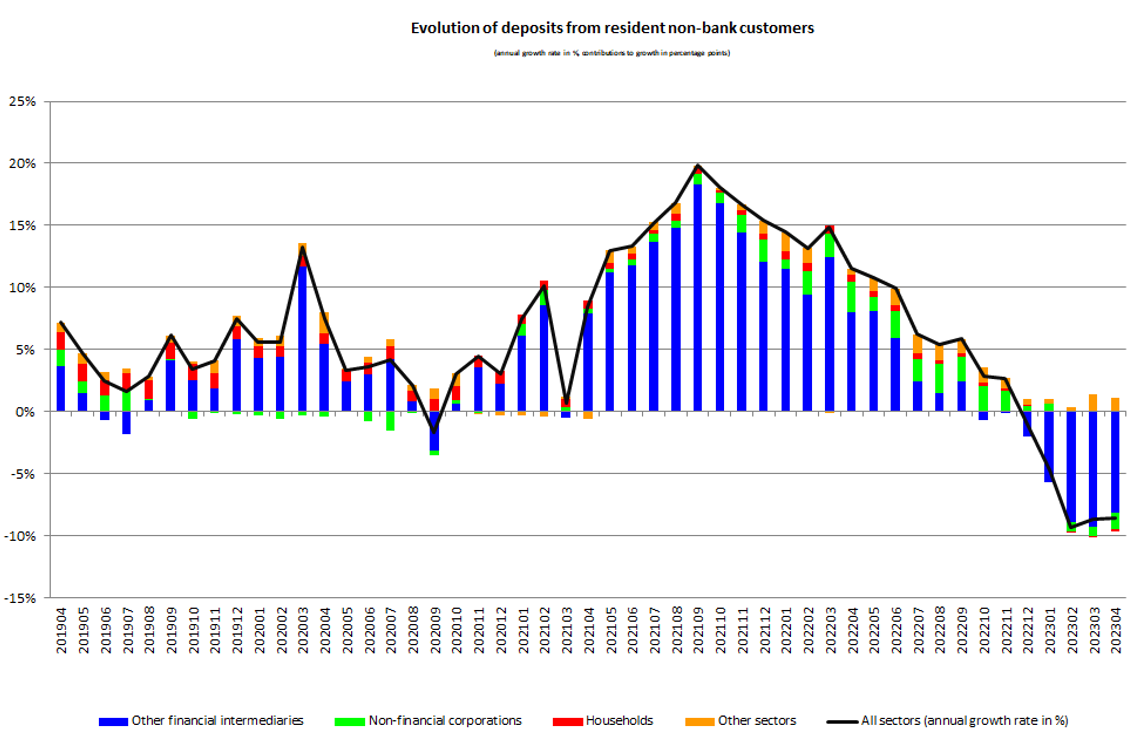

With regard to the liability side, deposits from the resident non-bank sector increased by 1 475 million euros or 0.5% between March 2023 and April 2023. Over twelve months, these deposits decreased by 27 737 million euros, or 8.6%.

Between April 2022 and April 2023, Other financial intermediaries (OFI) deposits (which had a share of 68.3% as at 30 April 2023 and comprised deposits made up by monetary and non-monetary investment funds) decreased by 26 544 million euros (11.6%) and household deposits by 650 million euros (1.4%). NFC deposits decreased by 4 235 million euros (16.6%) and deposits from the other sectors[1] also increased by 3 693 million euros (15.49%).

The tables pertaining to the balance sheet of credit institutions can be consulted on the BCL’s website on the following page:

http://www.bcl.lu/en/statistics/series_statistiques_luxembourg/11_credit_institutions/index.html

Evolution of reserve requirement

The Banque centrale du Luxembourg (BCL) informs that the reserve requirement, for the maintenance period from 10 May 2023 to 20 June 2023, amounts to 6 217 million euros.

The minimum reserves for credit institutions to hold with the BCL have increased by 12 million euros compared to the previous maintenance period.

Statistical series relating to the minimum reserve requirements of credit institutions are accessible on the BCL's website using the following link:

http://www.bcl.lu/en/statistics/series_statistiques_luxembourg/01_Mon_Pol_Stat/index.html

[1] General government, insurance corporations and pension funds.

First, please LoginComment After ~