Bank of Singapore: Is China's inventory cycle turning to "passive de stocking"?

At the beginning of last week (the week of May 29th), as the Hong Kong stock market fell into a technical bear market, pessimism towards China deepened in the offshore market.

I can understand their dissatisfaction with the weak performance of the Chinese stock market this year, especially against the backdrop of improved fundamentals and profit prospects. The discounted valuation has disappointed foreign investors hoping to make money in the Chinese market.

Ironically, however, just after some foreign investors who had held out for several months raised their hands and surrendered, China's stock market ushered in a Big Bounce on June 2, because of rumors about further stimulus measures. Bloomberg reported on June 2nd that China is forming measures to support the real estate market, which was confirmed on the same day when Qingdao announced a new round of measures to relax the real estate market. This has sparked hopes for further relaxation of real estate policies and sparked a risk appetite.

However, the June 2nd National People's Congress did not mention the real estate market, with the main focus on new energy vehicles (NEVs). China will continue to use new energy vehicles to stimulate economic growth and achieve high-quality growth. The Ministry of Education has released the Forecast of Talent Demand in Ten Key Fields of Manufacturing Industry, and it estimates that by 2025, the talent gap in domestic energy-saving and new energy vehicles will reach 1.03 million people.

The sustainability of the market sentiment reversal remains to be observed this week. The sustained shortage of demand poses a challenge to short-term economic development, as the repair of household balance sheets and confidence in future income takes longer than previously anticipated.

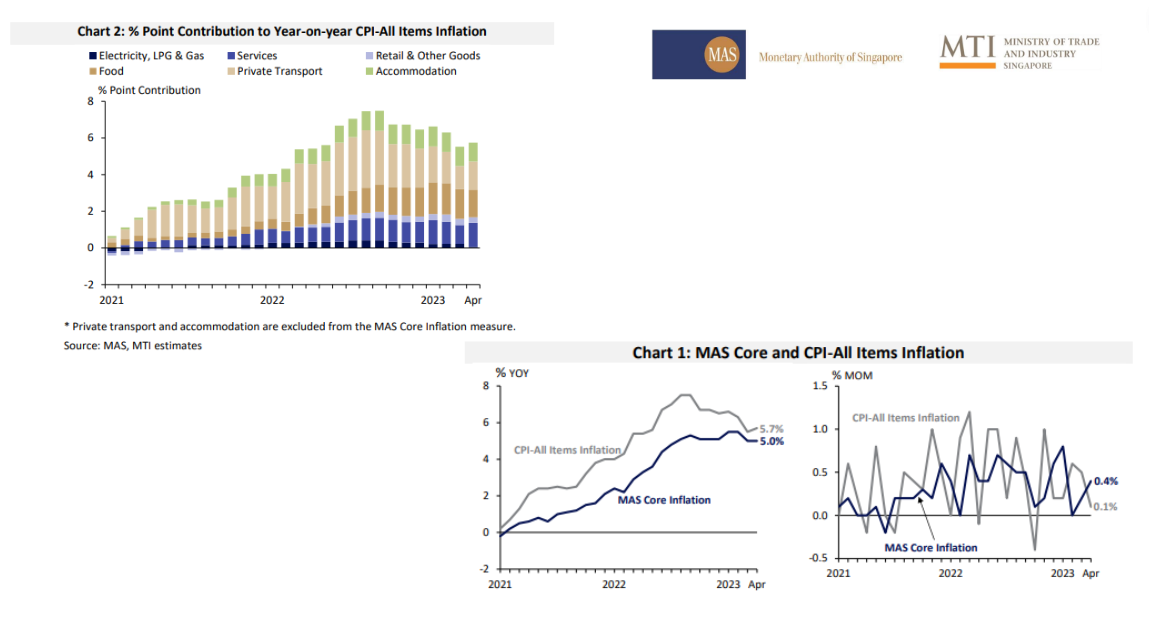

China's manufacturing purchasing managers'index(PMI) and non manufacturing PMI further declined in May. Although May is usually the off-season for the manufacturing industry, the observed 0.4% month on month decrease exceeds the usual seasonal impact, indicating that Chinese manufacturers are facing increasingly severe challenges. Both demand and production have further deteriorated.

In addition, a 0.5% month on month decrease in finished product inventory indicates that Chinese manufacturers are in the stage of destocking, which has been ongoing for a year since the inventory cycle reached its peak in April 2022. However, the author believes that this inventory cycle may be transitioning from "active destocking" to "passive destocking".

Considering that the duration of the average destocking stage is usually less than 20 months, this stage may be approaching its end. Insufficient demand may slow down the pace of recovery, but from the perspective of historical inventory cycles, I believe that the path of recovery is unlikely to deviate.

Hong Kong and Macau

Thanks to the distribution of vouchers and the recovery of passenger consumption, the performance of Hong Kong's retail industry continued to improve. The retail value and total quantity in April increased by 15.0% and 13.3% year-on-year, respectively. However, the slowdown in global economic growth continues to drag down Hong Kong's trade performance. The annual decline in the total value of Hong Kong's exports and imports has once again expanded, with a year-on-year decline of 13.0% and 11.9% in April, respectively.

Due to China's resumption of trading and exit, as well as major technology stock investors selling stocks, the local stock market briefly fell into a technical bear market last week and then rebounded on June 2nd. The Hang Seng Index once fell 20% from its peak in January this year. Due to the continued disappointment of China's economic data, market sentiment has been hit and earnings forecasts have been further lowered, leading to growing skepticism about the momentum of China's economic recovery. In addition, the continuous outflow of long-term funds has led to a decrease in trading volume and an increase in short selling ratios.

In May, the total gambling revenue in Macao rose 5.7% month on month and soared 365.9% year on year to 15.656 billion Macanese pataca, the highest level in three years. After the comprehensive opening of Macau, the number of tourists and gamblers will significantly increase, but the current speed and magnitude of recovery are still unexpected. Overall, the total gambling revenue in the first five months of this year increased by 172.9% year-on-year, reaching 51.7% of the pre -pandemic level (the same period in 2019). It is expected that the total gambling revenue will return to around 60-70% of the pre -pandemic level this year, paving the way for a strong economic recovery in Macau.

First, please LoginComment After ~