HKTDC Export Index 2Q23: Confidence at Two-Year High

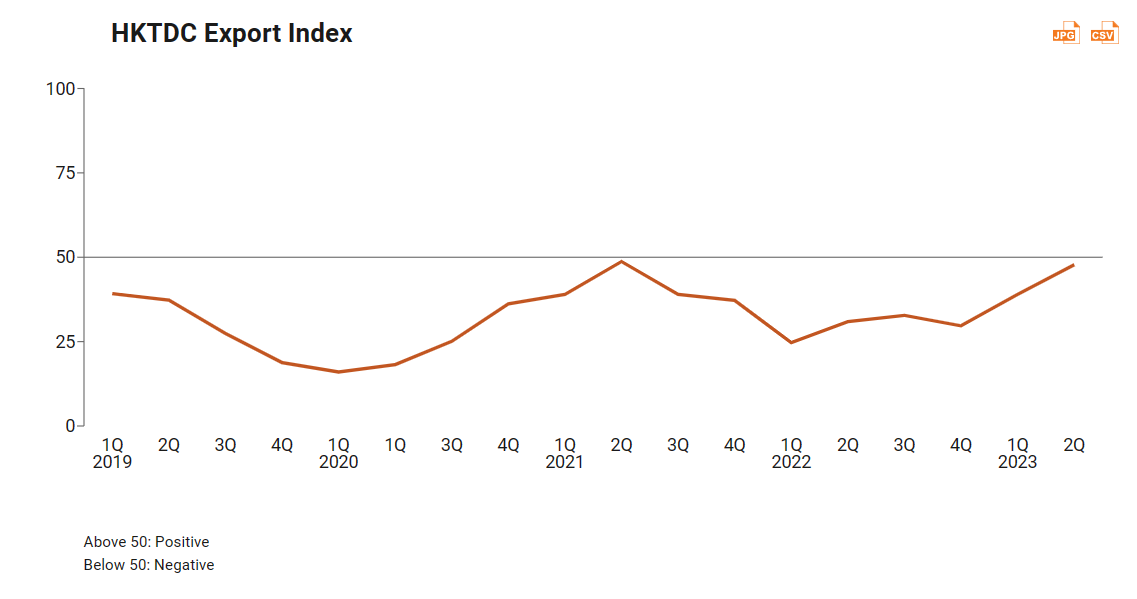

♦The HKTDC Export Index rose to a two-year high of 47.8 in the second quarter of 2023 (2Q23). The 8.8-point quarter-on-quarter rise also marks the second consecutive quarter of improving business sentiment among Hong Kong exporters.

- ♦Five of the six sector sub-indices recorded improvements in 2Q23, with toys (55.4) and machinery (50.3) returning to expansionary territory.

- ♦Sub-indices for all major export markets rallied with the EU, ASEAN and US markets bouncing back to the expansionary zone.

- ♦The Trade Value Index edged up by 0.8 points to 48.8, while the Procurement Index increased substantially by 15.9 points to 44.3.

- ♦The 2Q23 survey introduced three new sub-indices – the Current New Orders Index, the Expected New Orders Index and the Inventory Index – in order to deliver a more comprehensive understanding of the business prospects of Hong Kong exporters. For their first outing, the outcomes were as follows:

The Current New Orders Index showed a below-50 reading (45.1) for the overall volume of new export orders.

Exporters are more upbeat about the outlook for 3Q23, with the overall Expected New Orders Index at 53.6; toys, timepieces and machinery in particular were expected to have sizable increases in new export orders.

The overall Inventory Index was 48.5, suggesting exporters are holding slightly higher than normal inventory.

- ♦Concerns over economic risks are rising. The majority of respondents (66.1%) identified the risk of an economic slowdown or recession in their overseas markets as the biggest challenge to their export performance over the next three months, significantly higher than the 36.2% citing the same issue in 4Q22.

- ♦The survey results also revealed a slower-than-expected recovery of cargo routing through Hong Kong. More respondents took a wait-and-see stance, as the normalisation of Hong Kong’s cross-boundary land transportation for cargo progressed only gradually.

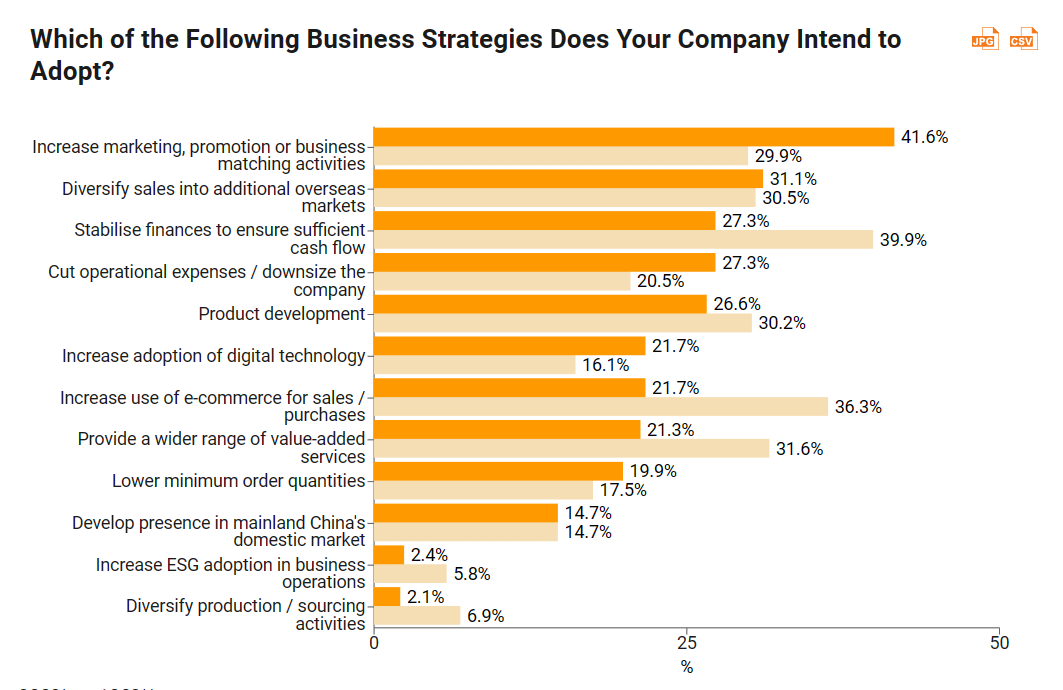

- ♦Exporters have deployed additional resources into marketing and promotional activities in 2Q23 (41.6%, up 11.7 percentage points from 1Q23), while fewer respondents were concerned about cash-flow management (27.3%, down 12.6 percentage points).

The HKTDC Export Index rose to a two‑year high of 47.8 in 2Q23, marking an 8.8‑point rise from 1Q23 and the second consecutive quarter of improving business sentiment among Hong Kong exporters. This was, at least partly, down to the re‑opening of mainland China’s borders and the normalising of business activities.

Five of the six sector sub‑indices improved in 2Q23. Toys (up 7.5 points to 55.4) and machinery (up 7.4 points to 50.3) returned to expansionary territory. Timepieces came third at 48.8, up 1.3 points. Electronics saw the largest gain (up 9.5 points to 47.7). Jewellery also improved, rising by 3.8 points to 47.1, while clothing was down by 7.6 points to 43.9.

Period | HKTDC | Electronics | Clothing | Toys | Jewellery | Timepieces | Machinery |

2Q23 | 47.8 | 47.7 | 43.9 | 55.4 | 47.1 | 48.8 | 50.3 |

1Q23 | 39.0 | 38.2 | 51.5 | 47.9 | 43.3 | 47.5 | 42.9 |

4Q22 | 29.7 | 29.5 | 23.8 | 28.9 | 30.8 | 36.8 | 38.3 |

3Q22 | 32.8 | 32.7 | 31.2 | 37.0 | 44.2 | 33.8 | 34.9 |

Sub‑indices for all major export markets rallied in 2Q23 with the EU (51.4) and US (51.1) markets bouncing back to expansionary territory for the first time in five years. Sentiment towards ASEAN (51.3), Japan (48.4) and mainland China (48.3) markets also improved.

HKTDC Export Index | US | EU | Japan | Mainland China | ASEAN |

2Q23 | 51.1 | 51.4 | 48.4 | 48.3 | 51.3 |

1Q23 | 44.4 | 42.0 | 46.9 | 47.9 | 44.8 |

4Q22 | 40.2 | 40.4 | 47.2 | 44.4 | 43.5 |

3Q22 | 41.1 | 40.5 | 48.4 | 45.8 | 46.9 |

The Current New Orders Index showed a below‑50 reading for the overall volume of new export orders at 45.1 for 2Q23. Exporters are more upbeat for new export orders for 3Q23, with an overall Expected New Orders Index reading of 53.6. In particular, respondents from the toys, timepieces and machinery sectors expect a substantial increase in their number of new export orders.

Index | 2Q23 |

Current New Orders Index | 45.1 |

Expected New Orders Index | 53.6 |

Note: The New Orders Index, first introduced in the HKTDC Export Index survey 2Q23, tracks the level of new export orders received by respondents in volume terms for the present quarter (“current”) and upcoming quarter (“expected”). The index takes values between 0 and 100. An index reading above 50 indicates an upward trend and an optimistic outlook, while a reading below 50 indicates a downward trend and a pessimistic outlook. | |

The Trade Value Index, which tracks the movement of unit export prices, edged up by 0.8 points but remained slightly below the neutral 50‑point mark at 48.8 in 2Q23. The electronics sector (48.3) is seeing less downward price pressure. Toys (54.4), timepieces (54.2), machinery (53.8) and jewellery (52.5) all showed above‑50 readings – a sign of a potential upswing in export prices, though clothing edged down by 1.9 points to 48.8.

Period | Trade Value Index | Electronics | Clothing | Toys | Jewellery | Timepieces | Machinery |

2Q23 | 48.8 | 48.3 | 48.8 | 54.4 | 52.5 | 54.2 | 53.8 |

1Q23 | 48.0 | 47.8 | 50.7 | 51.8 | 46.6 | 51.0 | 48.8 |

4Q22 | 39.2 | 39.1 | 34.9 | 37.3 | 39.4 | 44.6 | 44.8 |

3Q22 | 40.2 | 40.2 | 37.4 | 46.1 | 48.6 | 36.8 | 39.2 |

The overall Inventory Index reading was 48.5 in 2Q23, suggesting exporters are holding slightly more inventory than normal. By sector, clothing (42.4) and electronics (48.1) recorded sub‑50 readings, suggesting a higher‑than‑normal inventory level for the season. On the other hand, machinery (56.3), jewellery (54.5) and timepiece (52.2) exporters reported lower‑than‑normal inventory levels, while exporters of toys (50.0) considered theirs to be normal for the season.

Sector (2Q23) | Inventory Index |

Electronics | 48.1 |

Clothing | 42.4 |

Toys | 50.0 |

Jewellery | 54.5 |

Timepieces | 52.2 |

Machinery | 56.3 |

Overall | 48.5 |

Note: The Inventory Index, first introduced in the HKTDC Export Index survey 2Q23, tracks the inventory levels of respondents as of when the survey was conducted. The index is rated from 0 to 100. An index reading above 50 indicates a lower-than-normal inventory level, while a reading below 50 indicates a higher-than-normal inventory level. | |

The Procurement Index increased substantially in 2Q23 by 15.9 points to 44.3, in line with the overall recovery in exporter sentiment, with sector sub‑indices ranging from 44.2 (electronics) to 47.1 (toys). Input‑buying activity remained subdued as many exporters still have higher‑than‑desired inventory levels.

Period | Procurement Index | Electronics | Clothing | Toys | Jewellery | Timepieces | Machinery |

2Q23 | 44.3 | 44.2 | 45.1 | 47.1 | 44.3 | 45.0 | 46.3 |

1Q23 | 28.4 | 27.8 | 36.1 | 30.3 | 34.6 | 33.3 | 35.2 |

4Q22 | 28.9 | 28.6 | 29.2 | 26.8 | 28.8 | 37.3 | 35.2 |

3Q22 | 24.3 | 24.0 | 25.7 | 29.6 | 32.7 | 25.5 | 27.8 |

The Employment Index edged up by 0.5 points to 48.1 in 2Q23, driven mainly by improvements in the machinery (up 6.8 to 51.9), jewellery and electronics sectors. Nevertheless, timepieces, clothing and toys recorded sub‑indices below 50, after strong recruitment activities in 1Q.

Period | Employment Index | Electronics | Clothing | Toys | Jewellery | Timepieces | Machinery |

2Q23 | 48.1 | 47.9 | 45.1 | 48.0 | 47.9 | 49.2 | 51.9 |

1Q23 | 47.6 | 47.0 | 59.9 | 52.8 | 45.2 | 62.7 | 45.1 |

4Q22 | 40.3 | 40.3 | 38.6 | 37.3 | 38.5 | 43.1 | 44.4 |

3Q22 | 41.8 | 41.7 | 42.1 | 46.5 | 47.1 | 37.3 | 42.0 |

Concerns over economic risks are rising. The majority of respondents (66.1%) recognised the risk of an economic slowdown or a recession in their overseas markets as the biggest challenge to their export performance over the next three months, significantly higher than the 36.2% citing the same issues in 4Q22. A lower‑than‑expected boost from mainland economic recovery (10.9%) and US‑China trade friction (10.7%) were also among the major concerns.

Biggest Challenge to Export Performance Over the Following Three Months

2Q23 | 4Q22 | ||

Challenge | Share (n=504) | Challenge | Share (n=508) |

Economic slowdown / recession risk in overseas markets | 66.1% | Risk of economic slowdown / recession in major markets | 36.2% |

Smaller-than-expected boost from mainland economic recovery | 10.9% | Difficulties in cross-border travel | 21.1% |

US-China trade friction | 10.7% | Covid-19 persistence | 18.3% |

Note: Respondents could select one option only. | |||

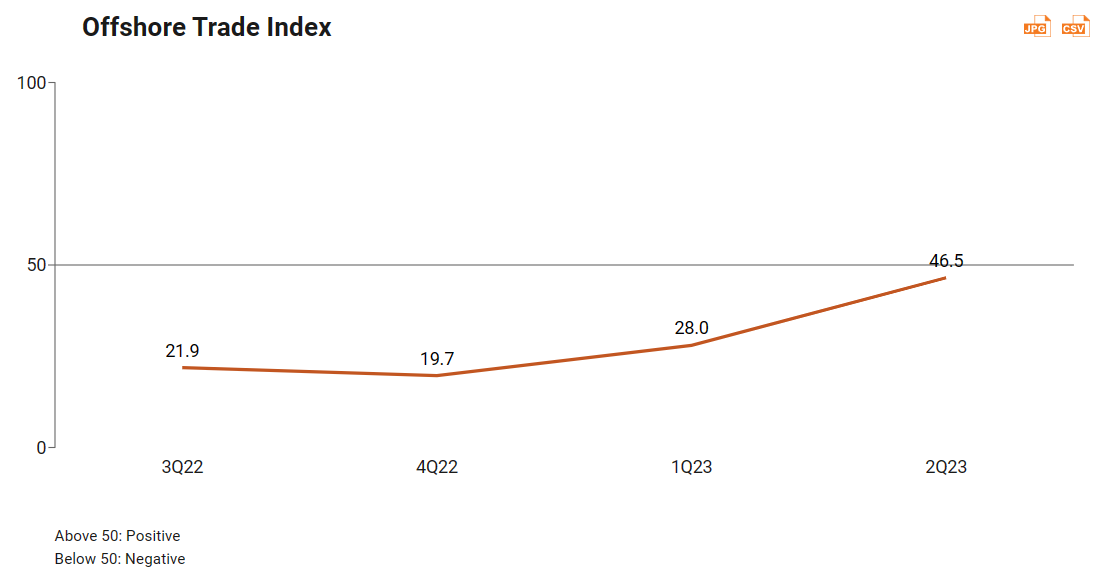

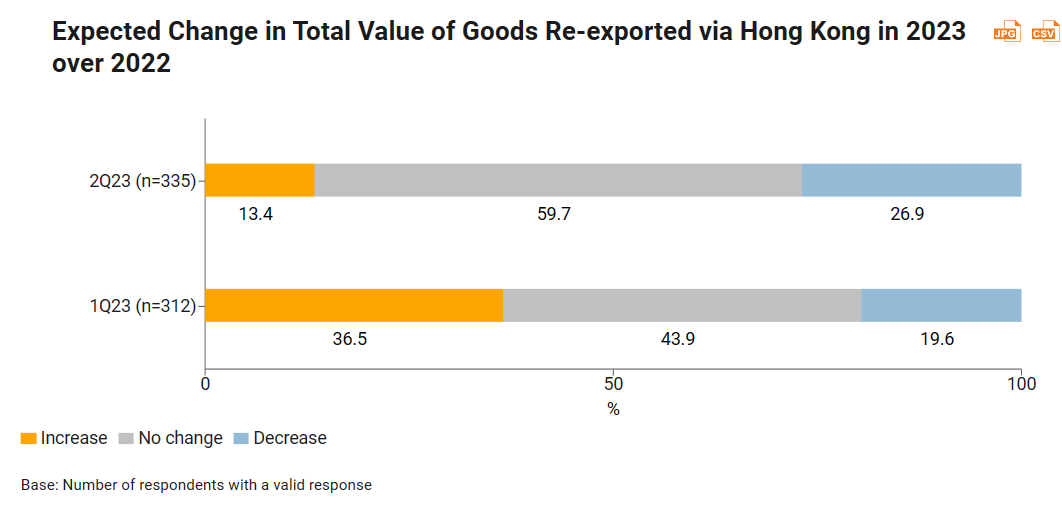

The survey results also revealed a slower‑than‑expected recovery for re‑exports routed through Hong Kong between the mainland and overseas locations. Among the 2Q23 respondents who re‑export goods through Hong Kong, just 13.4% expected an increase in these shipments this year, 23.1 percentage points lower than the 36.5% in the 1Q23 survey. More respondents now foresee no change (59.7%) or a decrease (26.9%) in this respect, as the post‑pandemic normalisation of Hong Kong’s cross‑boundary land transportation process for cargoes has progressed only gradually.

By contrast, the profitability outlook improved throughout the first six months of 2023. More respondents expected to see higher (27.1% in 2Q23, up 10.3 percentage points from 4Q22) or stable (39.2%, up 5 percentage points) net profit margin for 2023 year‑over‑year, while far fewer expected a decrease (33.7%, down 15.3 percentage points).

- 2Q23*

- 1Q23**

Note: Respondents could select all options that applied.

* Strategies for the 2nd half of 2023, based on 2Q23 survey (Base: Number of respondents with a valid response, n=286)

** Strategies for 2023, based on 1Q23 survey (Base: Number of respondents with a valid response, n=361)

Note: Introducing the New Sub-Indices (2Q23)

The 2Q23 survey introduced three new sub‑indices – the Current New Orders Index, the Expected New Orders Index and the Inventory Index – in order to deliver a more comprehensive understanding of the business prospects of Hong Kong exporters. All three new sub‑indices are rated from 0 to 100, with 50 being the neutral mark.

- The Current New Orders Index measures the level of new export orders received by respondents in volume terms for the present quarter, relative to the previous quarter. An index reading of above 50 indicates that, in general, exporters received a higher volume of new orders than the previous quarter, while a reading of below 50 indicates that exporters received a lower volume of new orders than the previous quarter.

- The Expected New Orders Index measures the level of new export orders respondents expect in volume terms for the following quarter, relative to the present quarter. An index reading of above 50 indicates that, in general, exporters expect a higher volume of new orders in the following quarter, while a reading of below 50 indicates that exporters expect a lower volume of new orders in the following quarter.

- The Inventory Index tracks the inventory levels of respondents, relative to the normal level for the season, as of when the survey was conducted. An index reading of above 50 indicates a lower-than-normal inventory level (typically, but not necessarily, associated with high demand or an optimistic outlook), while a reading of below 50 indicates a higher-than-normal inventory level (typically reflecting low demand or a pessimistic outlook). However, since the desired inventory level for each firm depends on its nature of business, preferences and exact business situation, this index should be interpreted alongside other indicators, such as the HKTDC Export Index, New Orders Index and Procurement Index, in order to ascertain a more accurate understanding of overall export prospects.

First, please LoginComment After ~