2023 Mid-Year Export Review: Recovery Set to Accelerate in the Second Half of 2023

Key findings

- ♦In terms of total exports, Hong Kong’s performance has been weaker than anticipated in 2023 to date with a 16.5% year‑on‑year decline recorded for the period January-April. This is the consequence of several factors, including weakened global demand, a slower-than-expected recovery in cross-border land transport capacity, a longer-than-expected downcycle in the electronics sector, and heightened trade friction.

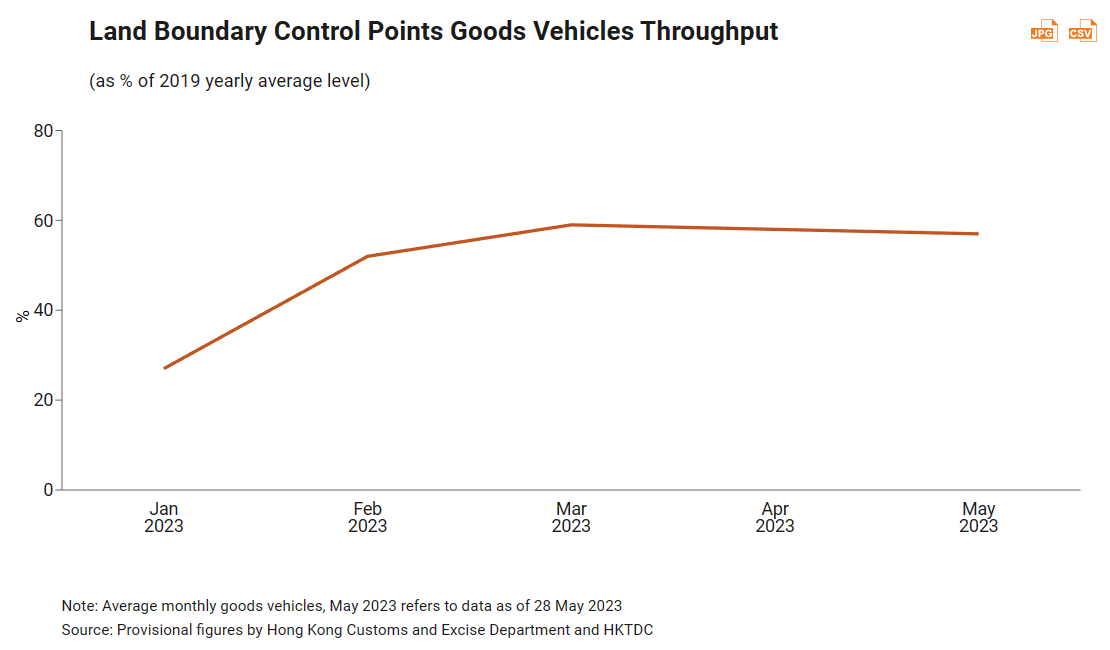

- ♦In more specific terms, the 2Q23 Hong Kong Export Index survey noted a slower-than-expected recovery in cargo routing through Hong Kong. There was also an increase in the number of respondents adopting a wait-and-see stance, as the level of Hong Kong’s cross-boundary land transportation capacity rose somewhat gradually, reaching only about 60% of its pre-Covid level by the end of May.

- ♦The survey also showed that exporters still have higher than normal inventory levels, a consequence of the longer-than-expected electronics downcycle and weakened global demand.

- ♦The overall level of economic recovery, however, is expected to gather pace in the second half of 2023. As a sign of this, exporter confidence rose to a two-year high in the second quarter of the year, while traders are also seeing an improving outlook in terms of profitability.

- ♦Nevertheless, business sentiment remains cautious, with many companies still concerned about the challenging external backdrop. Indeed, nearly two-thirds of exporters in the 2Q23 survey regard the risk of an economic recession or weakened demand in their overseas markets as their primary concern, a figure significantly higher than the 36.2% singling out the same issue in 4Q22.

- ♦In light of the above, HKTDC Research has revised its earlier forecast of Hong Kong’s 2023 export growth from 5% to 0-2%. More positively, however, there is a general expectation of a stronger rebound toward the later part of the year, with that momentum likely to carry on into next year.

Exports fall

Hong Kong's total exports fell by 16.5% year‑on‑year in the first four months of 2023. This decline was a result of weak global demand, a longer‑than‑expected downcycle in the electronics sector and a slower‑than‑expected recovery in the level of cross‑border land transport capacity.

Global demand slowed in the first quarter of the year, as high inflation took a toll on consumer spending in many parts of the world. Demand for consumer electronics products, such as mobile phones and computers, was subdued, with the problem exacerbated by the surplus inventory that has accrued over the past two years. Other key electronic exporters in the regional supply chain were also hit hard by the electronics downcycle and falling chip prices. Exports from South Korea, for example, fell for eight consecutive months, decreased by 15.2% year‑on‑year in May this year. Taiwan’s exports also fell for eight straight months and were down 13.3% in April 2023, largely on account of the volume of electronic component shipments, including such essentials as semiconductors, continuing to decline.

The 2Q23 HKTDC Export Index survey also noted that electronics exporters still have higher than normal inventory levels, another sign of depressed demand.

This subdued level of demand has, inevitably, also impacted the export performance of a number of other countries in the Asia‑Pacific region. In the case of Viet Nam, for instance, its export level declined continuously throughout the first four months of 2023, while Singapore saw its exports decline by 18.1% in April. This has led to the latter negatively adjusting its 2023 forecast for its non‑oil domestic exports (NODX), downgrading them from a range of ‑2% to 0% to ‑10% to ‑8.0%.

Table 1: Summary of Hong Kong’s External Trade

| 2021 | 2022 | Jan - Apr 2023 | |||

HK$m | Growth % | HK$m | Growth % | HK$m | Growth % | |

Total Exports | 4,960,656 | +26.3 | 4,531,650 | -8.6 | 1,281,356 | -16.5 |

Domestic Exports | 74,531 | +57.1 | 62,645 | -15.9 | 21,690 | 14.8 |

Re-exports | 4,886,125 | +25.9 | 4,469,004 | -8.5 | 1,259,665 | -16.9 |

Imports | 5,307,792 | +24.3 | 4,927,467 | -7.2 | 1,429,777 | -12.5 |

Total Trade | 10,268,448 | +25.3 | 9,459,117 | -7.9 | 2,711,133 | -14.4 |

Trade Balance | -347,136 | -395,818 | -148,422 | |||

Source: Hong Kong Trade Statistics, HKSAR Census and Statistics Department | ||||||

Table 2: Hong Kong’s Total Exports by Primary Destination

| 2021 | 2022 | Jan - Apr 2023 | |||

HK$m | Growth % | HK$m | Growth % | HK$m | Growth % | |

US | 309,619 | +19.6 | 292,705 | -5.5 | 87,642 | -12.5 |

EU(27) | 339,510 | +21.2 | 312,617 | -7.9 | 96,883 | -9.0 |

Japan | 118,849 | +8.7 | 102,488 | -13.8 | 28,756 | -25.0 |

Developing Asia | 3,732,954 | +27.8 | 3,422,168 | -8.3 | 998,774 | -19.1 |

Mainland China | 2,951,973 | +27.0 | 2,570,757 | -12.9 | 682,427 | -21.2 |

ASEAN | 338,015 | +19.5 | 360,017 | 6.5 | 102,965 | -16.0 |

Latin America | 92,411 | +39.5 | 84,667 | -8.4 | 23,507 | -20.6 |

Middle East | 101,693 | +21.7 | 125,538 | 23.4 | 41,593 | 11.5 |

Emerging Europe | 110,887 | +20.1 | 82,057 | -26.0 | 26,440 | -10.9 |

Africa | 46,603 | +3.2 | 28,261 | -39.4 | 7,536 | -32.2 |

Source: Hong Kong Trade Statistics, HKSAR Census and Statistics Department | ||||||

The slower‑than‑expected recovery in cross‑border land transport capacity has also capped the cargo flow of trade between mainland China and Hong Kong. The rebuild in capacity slowed in April and May after a sharp rebound in the first quarter, with the number of cross‑boundary vehicles at all crossings for goods vehicles and containers reaching a plateau of around 60% of the pre‑Covid level in April and May. In the first four months of 2023, Hong Kong’s exports to the mainland (its largest export destination, accounting for 56.7% of the total in 2022) declined by 21.2% year‑on‑year, while imports from the mainland decreased by 8.4% over the same period.

Reduced capacity has led to cross‑border logistics costs being 20% to 30% higher than in the immediately pre‑pandemic period, according to several industry players. In addition, the 2Q23 Hong Kong Export Index survey noted a slower‑than‑expected recovery in cargo routing through Hong Kong. This has led many respondents to take a wait‑and‑see stance given how gradually Hong Kong’s cross‑boundary land transportation capacity is rising.

In addition to the mainland, there was also a decline in the level of Hong Kong’s total exports to most of its other primary markets. In the first four months of 2023, its exports to the US fell by 12.5%, for instance, while exports to the EU were down by 9.0%, Japan decreased by 25.0% and the ASEAN bloc contracted by 16.0%. As with 2022, however, exports to the Middle East continued to rise, with a two‑digit increase recorded for the first four months of the year. This has largely been seen as stemming from the closer economic and trade ties now in place between the two territories.

Looking at exports by industry, precious jewellery was the sector that performed the best overall, largely on account of strong demand from mainland China (with exports up 31.7%) and Macao (up 42%). This has been seen as a consequence of both a post‑pandemic spike in jewellery demand and the influx of high‑spending tourists that followed the lifting of the strict border controls. All in all, jewellery exports rose by 14.4% in the first four months of 2023, even as exports from other key industry sectors declined.

Table 3: Hong Kong’s Total Exports by Industry Sector

| 2021 | 2022 | Jan – Apr 2023 | |||

HK$m | Growth % | HK$m | Growth % | HK$m | Growth % | |

Electronics | 3,601,394 | +27.7 | 3,285,001 | -8.8 | 888,748 | -20.5 |

Precious Jewellery | 74,016 | +47.0 | 71,348 | -3.6 | 24,842 | 14.4 |

Watches & Clocks | 59,807 | +28.9 | 54,781 | -8.4 | 17,903 | -0.6 |

Clothing | 66,688 | +4.6 | 53,520 | -19.7 | 15,647 | -8.7 |

Toys | 33,780 | +14.0 | 21,380 | -36.7 | 5,687 | -35.0 |

Household Electrical Appliances | 16,562 | +19.2 | 8,693 | -47.5 | 2,487 | -32.1 |

Source: Hong Kong Trade Statistics, HKSAR Census and Statistics Department | ||||||

Improving export outlook

Looking ahead to the second half of 2023, it would appear that, post‑Covid, the rate of economic recovery will continue to accelerate. As a sign of this, exporter confidence rose to a two‑year high of 47.8 in the second quarter of 2023, while exporters are increasingly optimistic that 3Q23 will see a substantial uptick in export orders. Furthermore, an on‑site survey conducted during the 2023 Hong Kong Electronics Fair (Spring Edition) in April found that nearly 60% of exhibitors and buyers expect their businesses to grow in the year ahead.

Traders also see an improving profitability outlook, with 27.1% of participants in the 2Q23 survey expecting a year‑on‑year rise in their net profit margins, (up 10.3 percentage points from 4Q22) while a further 39.2% expected their net profit margins to be about the same as last year (up five percentage points from 4Q22). In another sign of returning confidence, the percentage of exporters investing in marketing and promotional activities has increased from 29.9% in 1Q23 to 41.6% in 2Q23, an 11.7 percentage point rise.

Nevertheless, the below‑50 exporter confidence headline figure indicates that trader sentiment remains cautious, with concern stemming principally from the challenging external backdrop. This explains why the majority of exporters (66.1% in 2Q23) see the risk of economic recession (or weak demand) in their overseas markets as their primary concern, with the figure significantly higher than the 36.2% singling out the same issue back in 4Q22.

Hong Kong Export Growth Forecast for 2023

This year’s recovery is expected to be more moderate, given the weaker‑than‑expected trade performance. The latest indicators point to a stronger rebound later in the year, with that momentum expected to be sustained in 2024.

HKTDC Research has, therefore, revised its forecast for Hong Kong’s 2023 export growth, with the figure falling from its earlier estimate of 5% to 0‑2%. This is on account of several prevailing global factors, as well as uncertainty as to just how quickly Hong Kong‑mainland China cross‑boundary land transportation facilities will resume their pre‑Covid level of throughput. As an additional challenge, there is also the very real possibility that escalating geopolitical tensions, may also create uncertainty surrounding electronics trade flows throughout the region, especially those relating to the semiconductor industry.

Table 4: Hong Kong Export Growth Forecasts

Value | |

2023 (forecast) | 0-2% |

Source: Hong Kong Trade Development Council | |

First, please LoginComment After ~