Nomura Individual Investor Survey June 2023

1. Survey results

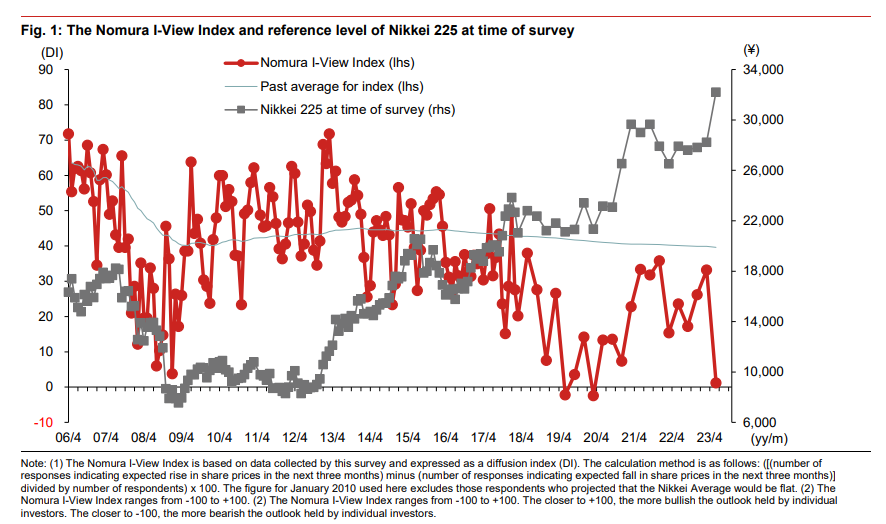

(1) Nomura I-View Index drops to 1.2 its lowest level since March 2020

The Nomura Individual Investor Market View Index (Nomura I-View Index), based on respondents' three-month outlook for share prices and calculated by subtracting the percentage of responses for "fall" from that for "rise," came in at 1.2 in June, down 32.0 pt versus the previous survey. The Nikkei 225 reference level (5 June 2023 close) was 32,217.43, up 3,979.65 versus the previous survey (6 March 2023 close of 28,237.78).

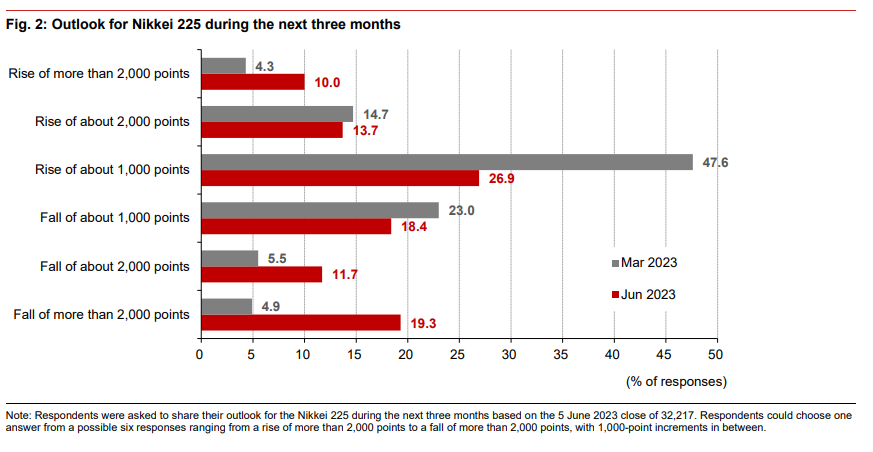

The combined percentage of respondents expecting the Nikkei 225 to rise over the next three months was 50.6%, down 16.0ppt from 66.6% in the previous survey. The percentage of respondents expecting a "rise of about 1,000 points" was down 20.7ppt versus the previous survey at 26.9%. The proportion of respondents expecting a "rise of about 2,000 points" was down 1.0ppt at 13.7%, while the proportion responding with a "rise of more than 2,000 points" rose 5.7ppt to 10.0%.

The proportion expecting a "fall of about 1,000 points" declined 4.6ppt to 18.4%. The proportion expecting a "fall of about 2,000 points" was up 6.2ppt at 11.7%, while the proportion expecting a "fall of more than 2,000 points" was up 14.4ppt at 19.3% (Figure 2).

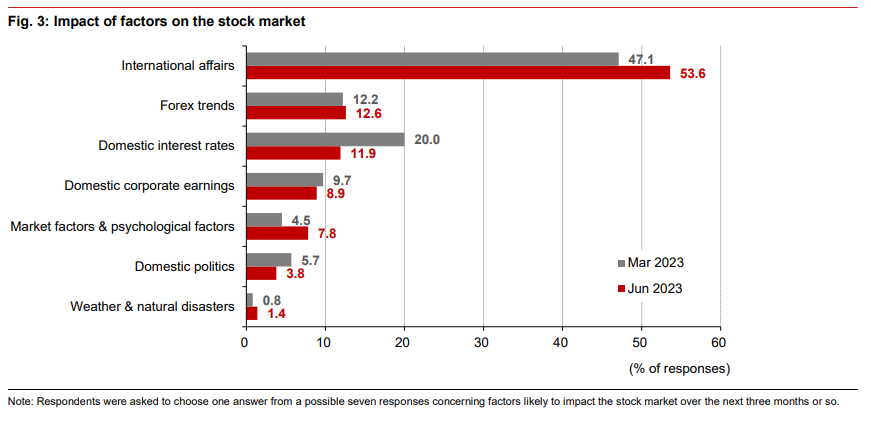

(2) Stronger investor focus on international affairs and market/psychological factors

Respondents were asked to select the factor most likely to affect the stock market over the next three months. The percentage selecting "international affairs" rose 6.5ppt versus the previous survey to 53.6%. The response rate for "market factors & psychological factors" increased 3.3ppt to 7.8%, while the response rate for "domestic interest rates" rose 8.1ppt to 11.9%.

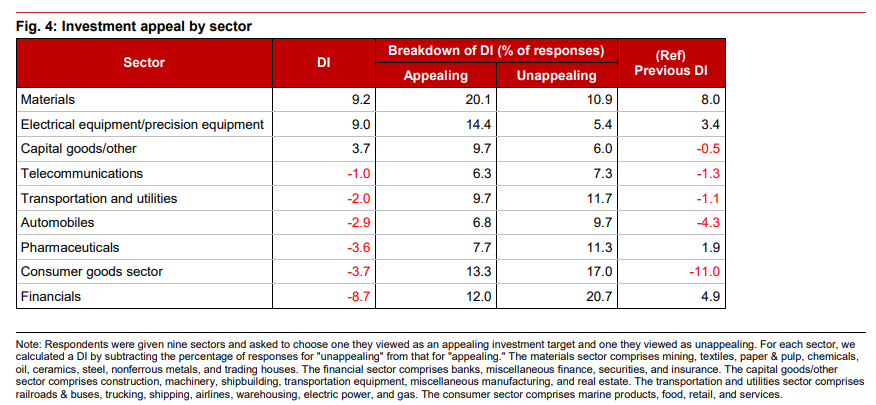

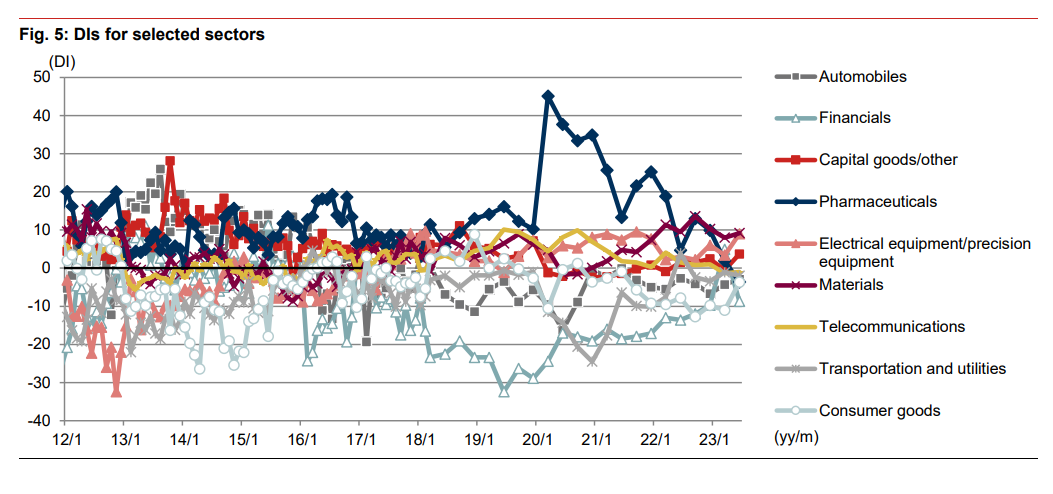

(3) Appeal of consumer goods, electrical/precision equipment up, appeal of financials, pharmaceuticals down

On the outlook for sectors over the next three months or so, we calculate a diffusion index (DI) for each sector by subtracting the percentage of respondents viewing it as "unappealing" from the percentage of respondents viewing it as "appealing." The DI for consumer goods increased 7.3pt to -3.7. The DI for the electrical equipment/precision equipment category also rose, by 5.6pt, to 9.0. In contrast, the DI for financials declined 13.6pt to -8.7, while the DI for pharmaceuticals declined 5.5pt to -3.6, marking its first time in negative territory since the January 2014 survey (Figures 4 and 5).

First, please LoginComment After ~