HKMA Quarterly Bulletin (June 2023 Issue)

The Quarterly Bulletin can be viewed on and downloaded from the HKMA website.

The Hong Kong Monetary Authority (HKMA) today (29 June) published the June 2023 issue of its Quarterly Bulletin. This issue of Quarterly Bulletin carries a regular article on the developments in the banking sector.

HIGHLIGHTS OF KEY TRENDS

Banking sector performance

Overview

• The Hong Kong banking sector remained strong and resilient. Banks in Hong Kong continued to maintain adequate capital and liquidity buffers. Despite an increase in the classified loan ratio, the asset quality of the banking sector stayed healthy.

Profitability

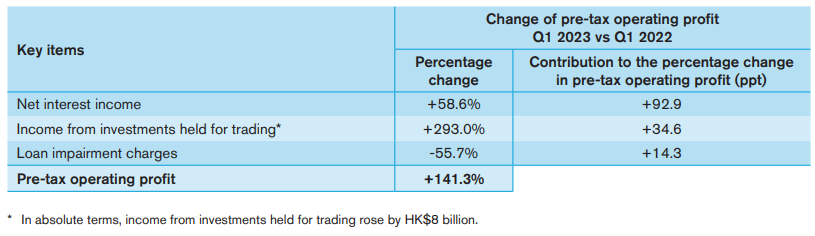

• The aggregate pre-tax operating profit of retail banks increased by 141.3% year on year in the first quarter of 2023 (Exhibit 1). The improvement in profit was mainly due to increases in net interest income and income from investments held for trading, coupled with a decrease in loan impairment charges. Against the backdrop of rising interest rates, the net interest margin of retail banks widened to 1.56% in the first quarter of 2023, compared with 0.98% during the same period last year (Exhibit 2).

Balance sheet trends

• Total loans of the banking sector rose by 0.9% in the first quarter of 2023 (Exhibit 5). Among the total, loans for use in Hong Kong increased by 1.5% while trade finance and loans for use outside Hong Kong declined by 0.9% and 0.4% respectively. Mainland-related lending also increased by 0.6% during the same period (Exhibit 6).

• Banking deposits remained stable. Total deposits increased by 0.5% in the first quarter of 2023, with Hong Kong dollar deposits growing by 2.6%. The overall loan-to-deposit ratio edged up to 68.7% at the end of March 2023 from 68.5% a quarter earlier (Exhibit 7).

Loan quality, liquidity conditions and capital adequacy

• The classified loan ratio of the banking sector increased to 1.45% at the end of March 2023 from 1.38% a quarter earlier. The classified loan ratio for Mainland-related lending also increased to 2.25% from 2.21% (Exhibit 10). During the same period, the delinquency ratio of credit card lending edged up to 0.25% from 0.23%, while that of residential mortgage loans remained stable at 0.06% (Exhibit 12).

• The banking sector continued to be liquid and well capitalised. The average Liquidity Coverage Ratio of category 1 institutions was 166.0% in the first quarter of 2023, well above the statutory minimum requirement of 100% (Exhibit 14). The total capital ratio of locally incorporated authorized institutions (AIs) stood at 20.8% at the end of March 2023 (Exhibit 16), well above the international minimum requirement of 8%.

Profitability

Exhibit 1 Pre-tax operating profit of retail banks’ Hong Kong offices

......

First, please LoginComment After ~