PBOC:Banker Survey Report (Q2 2023)

Download → Banker Survey Report (Q2 2023).pdf

The results of nationwide banker survey conducted by the People's Bank of China (PBOC) in Q2 2023 are as follows.

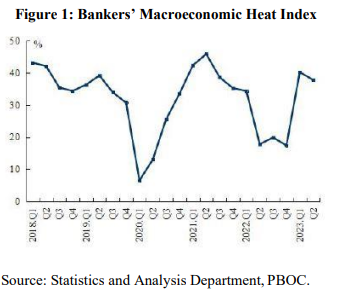

I. Bankers'Macroeconomic Heat Index (BMHI)

Bankers’ Macroeconomic Heat Index was 37.8 percent, down 2.4 percentage points from the previous quarter. Among the surveyed, 62.4 percent bankers considered the current macroeconomic climate "normal", down 0.4 percentage points from the previous quarter; 31.0 percent considered it "relatively cool", up 2.6 percentage points from the previous quarter. For the next quarter, bankers’ macroeconomic heat expectation index is 44.7 percent, 6.9 percentage points higher than that of the current quarter.

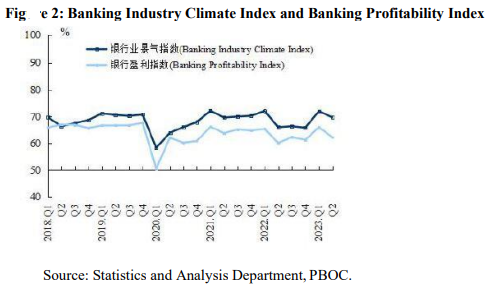

II. Banking Industry Climate Index andBanking Profitability Index

The Banking Industry Climate Index registered 69.6 percent, down 2.3 percentage points from the previous quarter, and up 3.6 percentage points from the same period last year. The banking profitability index was 62.2 percent, down 3.7 percentage points from the previous quarter, and up 2.1 percentage points from the same period last year.

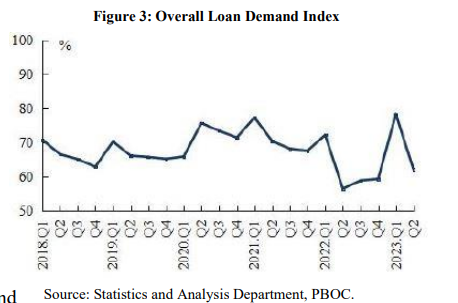

III. Overall Loan Demand Index

The Overall Loan Demand Index was 62.2 percent, down 16.2 percentage points from the previous quarter, and up 5.6 percentage points from the same period last year. By sectors, the loan demand index of the manufacturing sector stood at 64.1 percent, down 9.8 percentage points from the previous quarter; the loan demand index of infrastructure was 61.0 percent, down 10.0 percentage points from the previous quarter; the loan demand index of wholesale and retail industry posted 60.0 percent, down 8.0 percentage points from the previous quarter; the loan demand index of real estate enterprises was 47.0 percent, down 8.4 percentage points from the previous quarter. By scale, the loan demand index of large-sized enterprises, medium-sized enterprises, and micro and small businesses posted 55.1 percent, 58.1 percent, and 64.5 percent, down 9.8 percentage points, 10.2 percentage points, and 12.1 percentage points from the previous quarter, respectively.

IV. Monetary Policy Sentiment Index (MPSI)

The Monetary Policy Sentiment Index posted 64.2 percent, down 3.5 percentage points from the previous quarter, and down 5.1 percentage points from the same period last year. Among the surveyed, 29.9 percent bankers considered the monetary policy stance "eased", down 7.3 percentage points from the previous quarter; 68.5 percent considered the monetary policy stance "moderate", up 7.5 percentage point from the previous quarter. For the next quarter, the monetary policy sentiment expectation index is 64.5 percent, 0.3 percentage points higher than that of the current quarter.

First, please LoginComment After ~