GBA – Survey Confirms Recovery Momentum Intact

- ♦Current sentiment index eased to the 50 neutral mark after strong Q1 jump, mirroring softer macro data

- ♦Expectations and credit indices point to further recovery in Q3 as city and industry performances diverge

- ♦Respondents see a broadening range of drivers for supply chain management and factory relocation

- Keep moving after a Q2 slowdown

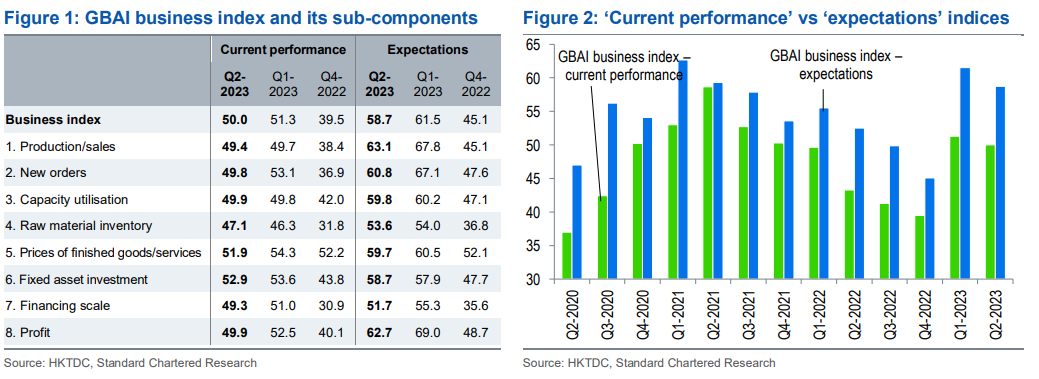

Our GBA Business Confidence Index (GBAI), based on quarterly surveys of over 1,000 companies operating in the Guangdong‑Hong Kong‑Macau Greater Bay Area (GBA) and conducted in collaboration with the Hong Kong Trade Development Council (HKTDC), shows that the current performance of ‘business confidence’ eased to 50.0 in Q2‑2023 after a strong jump to 51.3 in Q1. We had expected a notable q/q drop in our Q2 sentiment gauge, given (1) normalisation of base effects; (2) softening of nationwide macro data QTD; and (3) that the novelty of reopening was bound to wear off. That said, the current headline print managed to avoid slipping into contractionary territory, which together with our GBAI expectations staying elevated at 58.7 suggests a mere setback rather than an end to the post‑COVID recovery. Furthermore, respondents expect their cash‑flow positions to continue improving in Q3, another indication of no entrenched pessimism setting in; that said, other credit subindices do confirm that keeping monetary conditions loose and borrowing costs low to ‘defend the bottom line’ would not hurt either.

A further breakdown showed more differentiated Q2 performance across industries and cities after a quarter of uniform increase. Most notably, Shenzhen weathered weaker responses from its tech respondents by posting the highest score for ‘manufacturing and trading’ among all city sub‑indices. Guangzhou and Hong Kong outperformed Shenzhen across the other four industry sub‑indices, despite weaker headline prints. For thematic questions, we took a closer look at how GBA companies are responding to global supply chain migration, and more specifically what their plans are for overseas factory relocation and tapping RCEP opportunities.

Download full report

First, please LoginComment After ~