Global Wealth Report 2023:Resetting the Course

The past few years have been difficult for many industries, and wealth management is no exception. What had been a steamroller of global financial wealth expansion began to develop engine trouble in 2022, with booking centers undergoing major power shifts. The prospect of consistent business growth became increasingly difficult to envision on the horizon. Such daunting conditions have made it that much more important for both incumbent and rising players to have a clear roadmap for the rest of the decade. How can these players achieve ongoing, profitable growth in this volatile era—a time further characterized by intensifying customer demands for higher and more efficient service levels?

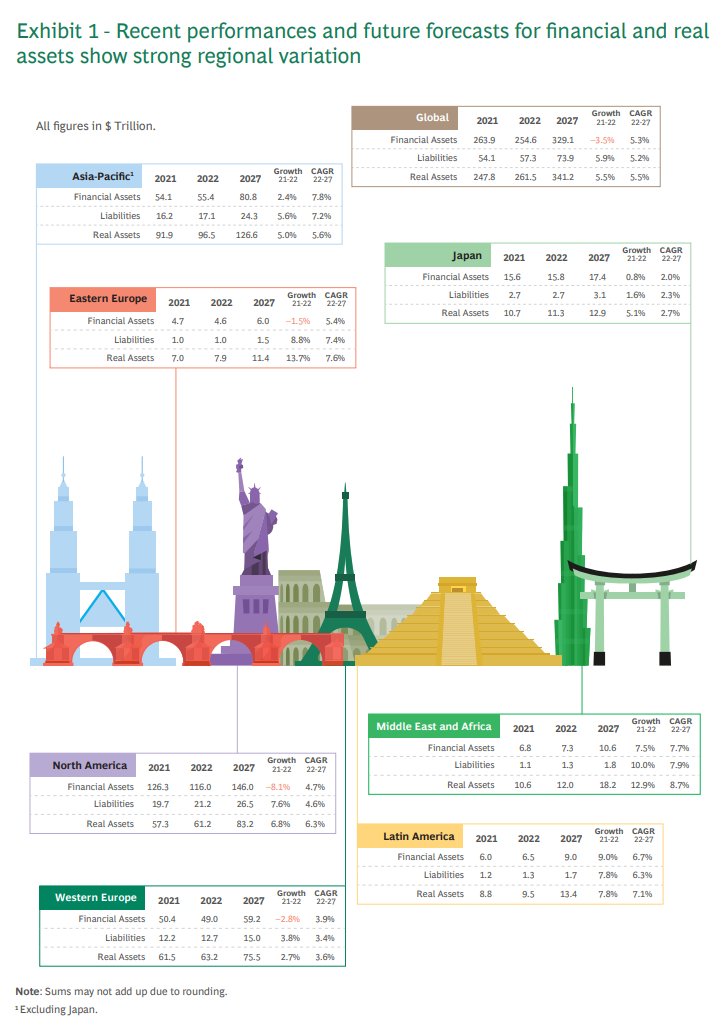

In this report, BCG's 23rd annual study of the global wealth management industry, we address how wealth managers are reacting to the present turbulence, call out developments that may surprise industry observers—such as interest income from deposits overcompensating for declining investment-fee revenues in many regions—and take a detailed look at how wealth managers have performed in different areas of their businesses. We also offer comprehensive market-sizing, analyze the ongoing quest for long-term profitability the industry is facing, and outline eight initiatives—encompassing both the revenue and cost sides—that can help firms position themselves optimally for the future. Our goal is to provide both actionable information and food for thought for wealth managers vying for competitive advantage in a highly challenging marketplace and tough overall economic climate.

First, please LoginComment After ~