How wildfire risk and extreme heat is changing the insurance industry

Climate change poses a conundrum for the insurance industry. Extreme weather events have been occurring with heightened frequency, severity and unpredictability in recent years, upending the climate models and risk management strategies used by insurers throughout the globe.

Climate perils have been increasingly threatening economies and societies globally, causing record shattering heatwaves in Europe, unprecedented flooding in South Asia, and, most recently, unseasonably early Canadian wildfires which cast a dystopian hue over much of the north-eastern United States.

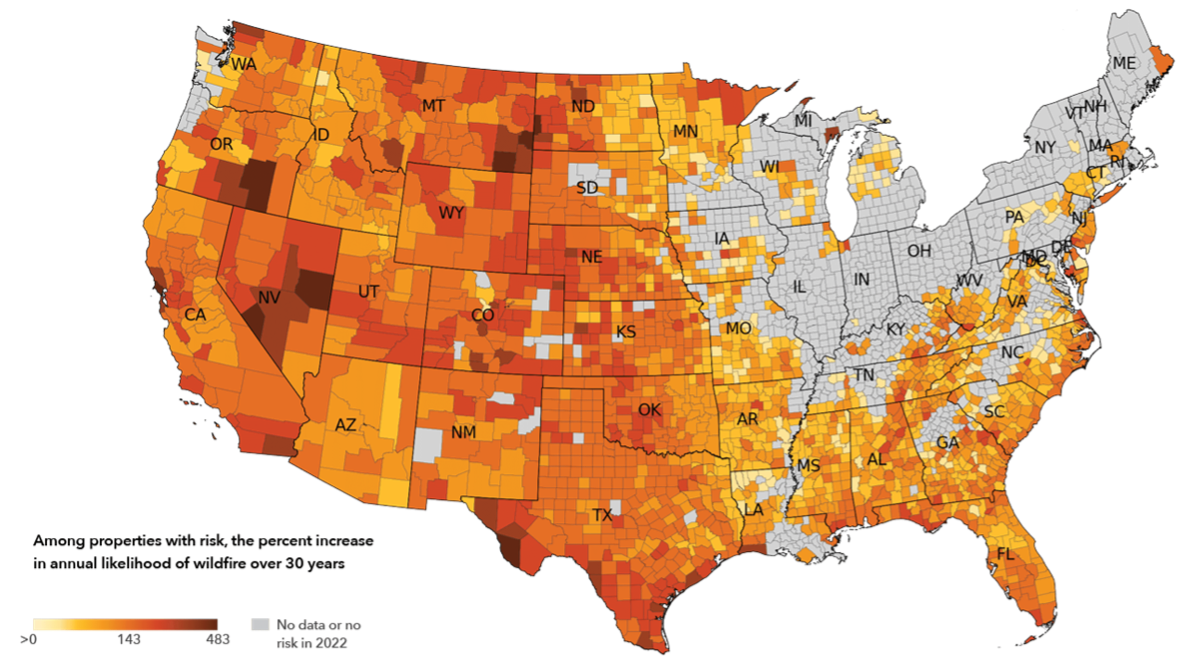

Extended bouts of severe drought and low humidity are increasing the length of the wildfire season at a significantly faster rate than initially predicted by climate models.

Since the 1980s, wildfire season has extended by 27% globally, with particularly pronounced increases in the Amazon, Mediterranean, and the Western Forests of North America. With new research showing the world could reach 2.7ºC of warming by the end of this century, climate change is leading to larger and more frequent wildfires in much of the world.

Wildfires becoming an insurance crisis

The wildfire crisis is becoming an insurance crisis. In recent weeks, two of the largest insurers in the US state of California decided to stop offering new homeowners insurance policies.

State Farm and All State, which represent more than 20% of the market share in the US’s most populous state, will no longer offer coverage for both residential and commercial real estate. According to these companies, growing catastrophe exposure, historic increases in construction costs outpacing inflation, and a challenging reinsurance market has made offering policies financially untenable.

The company’s recent losses in the wildfire insurance market speaks volumes: during the 2017-2018 fire season, the insurance industry in the state lost the equivalent of two decades worth of profit.

Much of the state is at risk of becoming an “insurance desert”, exacerbating California’s already dire housing crisis, preventing homeowners from accessing a monthly mortgage, halting new construction, and threatening the long-term economic health of communities in risk-prone areas.

This trend mirrors the flood insurance market in hurricane-prone states such as Florida and Louisiana. Florida has struggled to keep a stable insurance market since 1992 when Hurricane Andrew began a decades-long trend of insurers pulling out of coastal cities such as Miami and Napes.

Insuring these coastal areas amid longer and more intense hurricane seasons have strained carriers balance sheets – insurers have now seen two straight years of net underwriting losses exceeding $1 billion dollars.

Louisiana is in the midst of an insurance crisis exacerbates by record-setting hurricane seasons in 2020 and 2021. The state is now offering millions in subsidies to try to draw insurers back into the state.

While a volatile climate risk landscape brings significant challenges to the insurance market, there are solutions that can be leveraged to manage these cascading risks.

Improved early warning systems and new technology such as artificial intelligence (AI) are improving predication and mitigation, while investments in adaptation infrastructure are also critical to protect communities and economies from climate perils.

Adaptation investment is already under way in California, where new regulations discourage construction in fire-prone areas and incentivize fire resistant roofs and non-combustible space at the bottom of home’s walls.

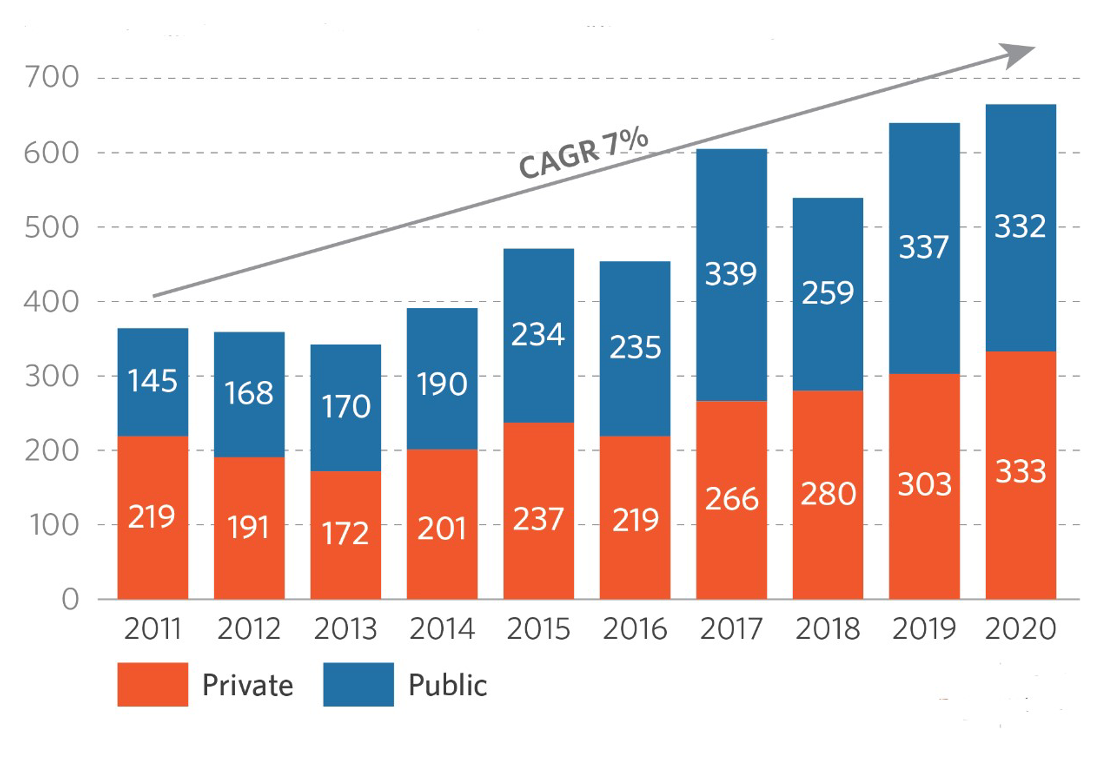

The business case for scaling adaption investment has never been clearer: heat-fuelled climate perils are already causing 202 million in losses per day and could threaten 80 million full-time jobs by 2050.

Seven disasters in the US in 2023 have already caused more than $1 billion in damages, and these numbers are only likely in increase with more intense and long-lasting wildfire seasons.

Strengthening collaboration between policy-makers, regulators and the insurance industry is also key for keeping coverage in disaster-prone areas. Two of the biggest challenges for insurers in California – high cost of reinsurance and strict limits for pricing wildfire risk – can be solved through policy solutions.

Insurers and policy-makers can come together to adjust regulations and limits for pricing catastrophe risk that accurately reflects this volatile climate peril environment. This requires striking a fine balance between adopting regulations to ensure affordable and available insurance policies for homeowners, renters and businesses.

At the same time, policies which prevent risk-sensitive pricing can end up stifling the insurance industry as insurers exit key markets. Furthermore, unlike in any other US state, California insurers bear the entire cost of reinsurance.

Given reinsurers diminishing appetite to cover climate risk in the state, policies that bolster that access of reinsurance while passing on a portion of these costs to policyholders seems to be a pragmatic path forward for keeping California from becoming uninsurable.

California should be seen as a case study for many other parts of the world at risk for becoming insurance deserts. As the fundamental nature of catastrophe risk changes, policy-makers and insurers must advance new strategies and strengthen their partnerships to protect vulnerable economies and communities worldwide.

First, please LoginComment After ~