INTEREST RATES(July)

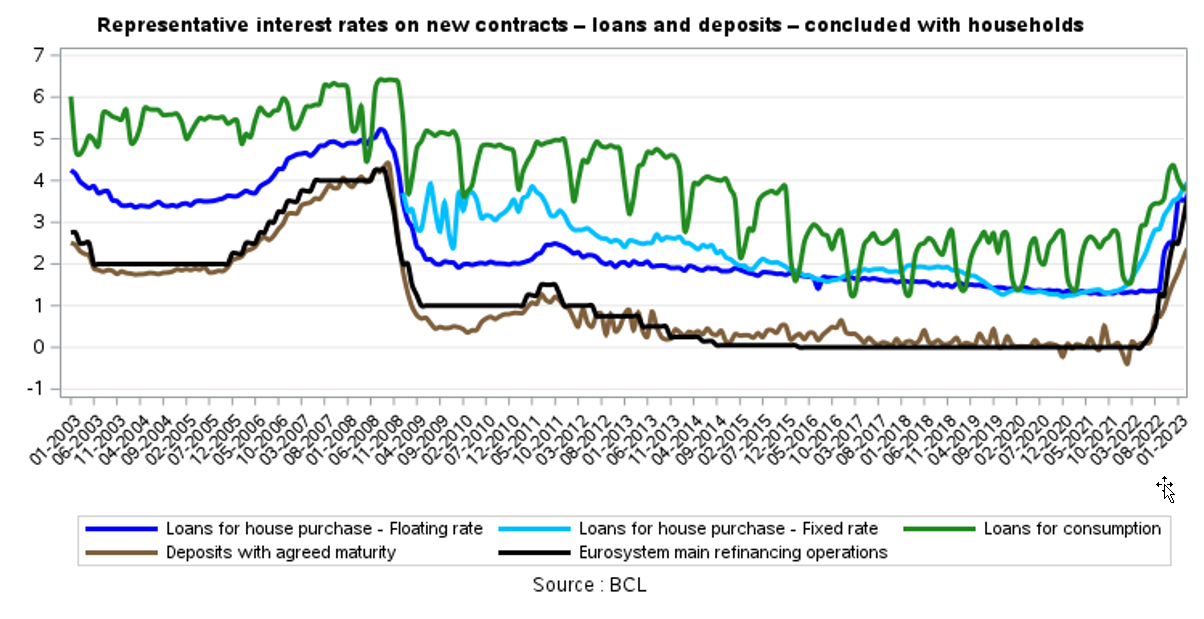

Representative interest rates on new contracts[1] – loans and deposits – concluded with households

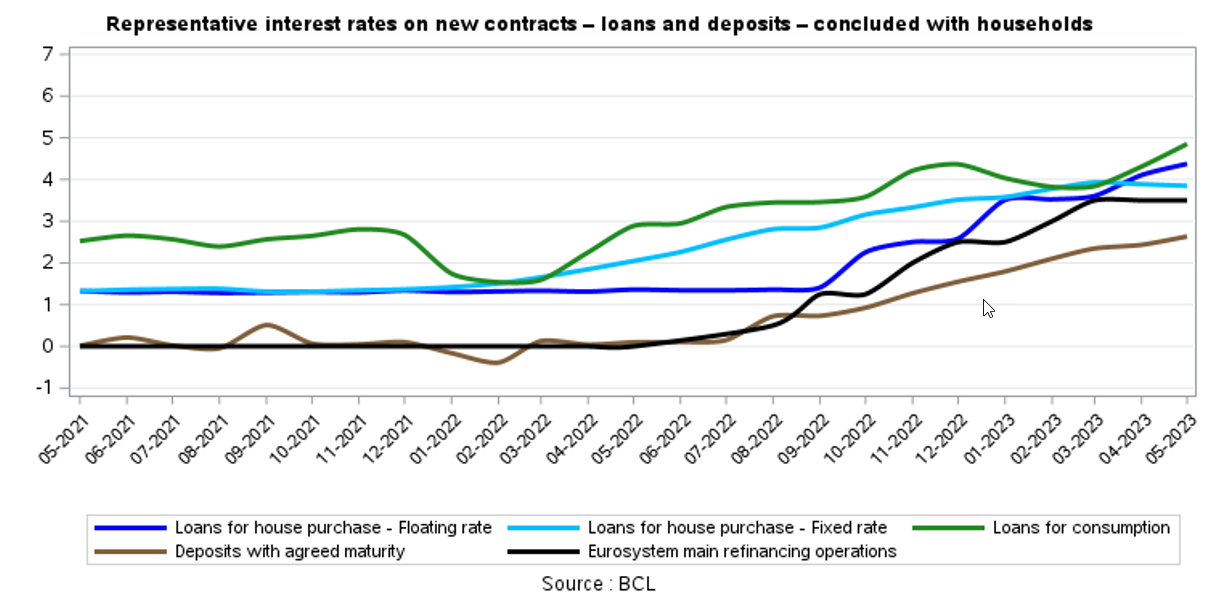

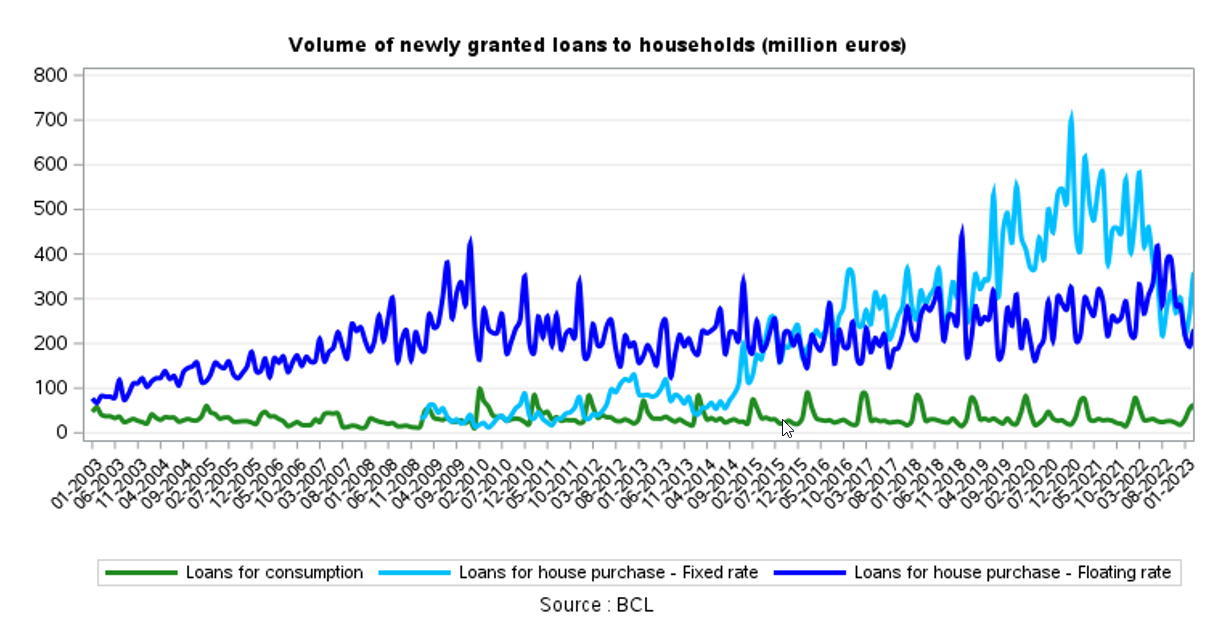

The variable[2] interest rate on mortgage loans granted to households has increased by 27 basis points on a monthly basis to reach 4.38% in May 2023 compared to 4.11% in April 2023 and the volume of these newly granted loans has increased by 53 million euros to reach 216 million euros in May compared to 163 million in April. On a yearly basis, the interest rate has increased by 302 basis points whereas the volume of newly granted loans has decreased by 91 million euros.

The fixed[3] interest rate on mortgage loans granted to households decreased by 4 basis points on a monthly basis between April and May to reach 3.85% in May 2023 while the volume of these newly granted loans has increased by 52 million euros between the two months to reach 276 million euros. On a yearly basis, this interest rate increased by 180 basis points whereas the volume of newly granted loans has decreased by 184 million euros.

On longer maturities, real estate loans with an initial rate fixation period over 10 years decreased by 10 basis points to reach 3.80% in May 2023. The monthly volume of these newly granted loans increased by 45 million on a monthly basis to reach 227 million euros in May 2023. On a yearly basis, this rate increased by 169 basis points while the amount of newly granted loans decreased by 131 million euros. It is important to mention that this fixed rate includes all initial fixation periods above 10 years and is computed based on a sample of banks. The indicated rate is an average rate weighted on the volumes of granted loans.

Furthermore, fixed rates with initial fixation periods on loans with very long maturities, like e.g. 30 years, can be significantly higher than this average rate mentioned above.

The interest rate on consumer loans that have an initial fixation period above 1 year and below or equal to 5 years has increased by 54 basis points on a monthly basis between April and May to reach 4.85% in May 2023. The volume of newly granted loans has increased by 8 million euros to reach 29 million euros in May compared to 21 million in April. On a yearly basis, the interest rate has increased by 196 basis points whereas the volume of new lending has remained stable at 29 million euros.

The interest rate on households’ fixed-term deposits that have an initial maturity below or equal to 1 year has reached 263 basis points in May 2023 from 243 basis points in April 2023. On a yearly basis, this rate has increased by 253 basis points.

The following graph provides a detailed overview of the evolution of interest rates over the past two years.

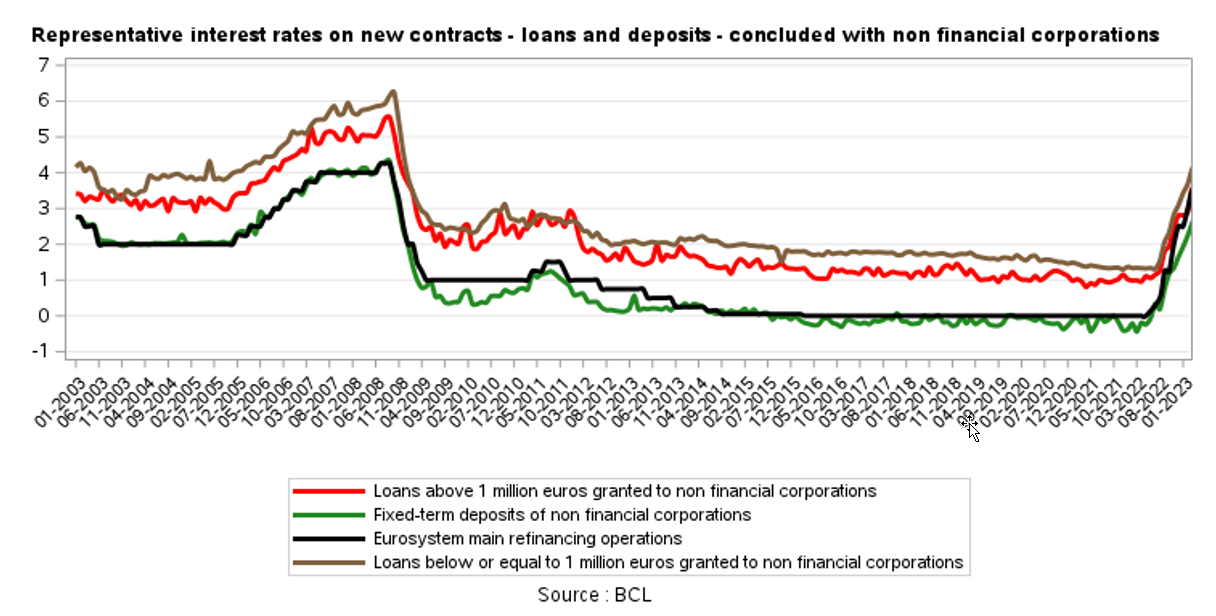

Representative interest rates on new contracts1 – loans and deposits – concluded with non-financial corporations (NFCs)

The variable interest rate on loans below or equal to 1 million euros granted to NFCs decreased by 54 basis points in May 2023 to 3.73%, compared to 4.27% in April, and the volume has decreased by 397 million euros to reach 121 million in May from 518 million euros in April. On a yearly basis, this interest rate has increased by 241 basis points and the volume of newly granted loans has decreased by 762 million euros.

The variable interest rate on loans above 1 million euros granted to NFCs has decreased by 46 basis points on a monthly basis to 2.55% during the last reference period, compared to 3.01% in April. The volume of newly granted loans has decreased by 790 million euros to reach 1 567 million euros in May compared to 2 357 in April. On a yearly basis, this interest rate has increased by 144 basis points and the volume of newly granted loans has decreased by 2 463 million euros.

The interest rate on fixed-term deposits of NFCs with an initial maturity below or equal to 1 year has increased by 6 basis points on a monthly basis between April and May to reach 2.92% in May 2023. On a yearly basis, this interest rate has increased by 316 basis points.

The tables pertaining to interest rates applied to credit institutions can be consulted and/or downloaded on the BCL’s website on the following pages:

http://www.bcl.lu/en/statistics/series_statistiques_luxembourg/03_Capital_markets/index.html

Weighting method

The interest rates applied to new contracts are weighted within the categories of instruments concerned by the amounts of individual contracts. This results from the compilation of national aggregates carried out by reporting credit institutions and by the BCL.

[1] New contracts refer to any new agreement concluded between the household or the non-financial corporation and the reporting agent. New contracts include all financial contracts which mention for the first time the interest rate pertaining to the deposit or credit and all renegotiations of existing deposits or credits.

[2] Variable interest rate or rate with an initial fixation period inferior or equal to 1 year.

[3] Fixed interest rate weighted by the amounts of contracts for all mortgage loans granted, whatever the initial rate fixation period (above 1 year). This series has been published by the BCL since February 2009 only for methodological reasons linked to the identification of reporting agents.

First, please LoginComment After ~