Enabling Foreign Direct Investment in the Renewable Energy Sector: Reducing Regulatory Risks and Preventing Investor-State Conflicts

Download Files in English

English PDFExecutive Summary

Increasing private investment is critical to meeting the growing energy needs in developing countries and, more broadly, achieving the Sustainable Development Goals (SDGs). Foreign direct investment (FDI) can contribute significantly—by bridging the financing gap but also by facilitating knowledge and technology transfer. A key factor impeding the ability of countries to attract and retain FDI is political risk, measured as a disruption in business operations caused by sudden political changes or actions (World Bank 2019). One kind of risk (more specifically, a subset of political risks)— regulatory risks caused by regulatory actions—can also lead to costly legal disputes between investors and states. This report explores these risks in the renewable energy (power generation) sector, the prevalence of investor-state disputes associated with such risks, the fiscal and reputational implications of disputes, and policy options for governments to prevent them. Indeed, reducing risk for the private sector to enable greater investment ultimately also contributes to private capital-enabling (PCE)1 targets.

According to estimates from the International Energy Agency (IEA), by the end of 2022, 774 million people around the world, mainly concentrated in Africa and Asia, still live without access to electricity (IEA 2022d).2 Moreover, the energy crisis we are currently facing has led, for the first time in decades, to an increase in the number of people without access (20 million increase against 2021). Over the next 10 years, the world’s population will grow from today’s 7.9 billion to around 8.5 billion (United Nations, 2022). Estimates indicate that under the current and announced policy scenario, by 2030, about 663 million people will still be without access (IEA 2022d). Ensuring everyone is connected to the grid will remain central to discussions on climate change and achieving the SDGs.

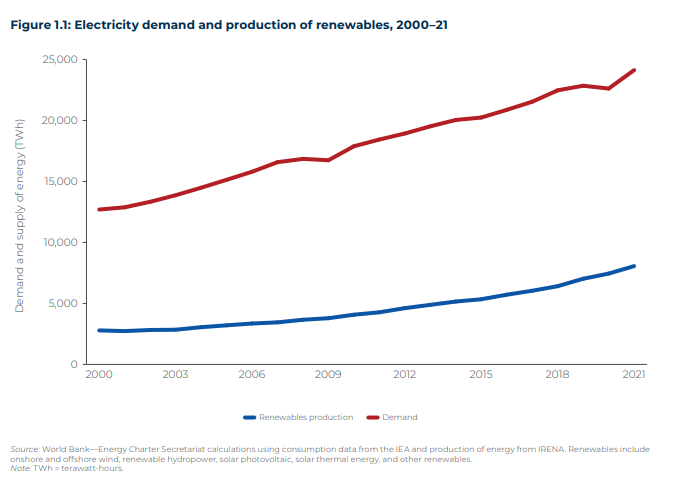

Electricity demand has been growing steadily, with an annual 3 percent increase during the past 20 years. By 2050, according to estimates from the IEA, demand is expected to double against the level exhibited in 2020.3 Currently, renewables can only cover 33 percent of this value. To achieve net zero greenhouse gas emissions4 and comply with the commitments under the Paris Agreement, an increasing share of renewables in electricity generation is required. Moreover, the increasing competitiveness of renewables, with the costs of electricity sharply decreasing over the past 10 years, generates further incentives to pursue this type of investment for electricity generation.

Recent events such as the war in Ukraine have caused disruptions in the demand and supply patterns of energy in the European and global energy markets, particularly in the case of fossil fuels, and, consequently, have affected energy prices for final consumers and businesses. The effects of these short-term shocks reinforce the need for ramping up investments in renewables and energy efficiency, in line with the net zero goals. Under the net zero scenario, the total share of renewables in total electricity generation is expected to increase globally, from 28 percent in 2021 to an estimated value of 61 percent in 2030 and 88 percent in 2050 (IEA 2022d).5 Developing countries must see significant investments in renewables to achieve these figures. Estimates indicate that building the required capacity to reach the net zero goals in 2050 would require an increase in average annual investments in renewables for electricity generation from around US$390 billion a year (between 2016 and 2022) to US$1,300 billion a year by 2030 (IEA 2022d). Both public and private capital, domestic and international, is expected to provide the funding required for these projects, with a significant amount coming by way of FDI.

First, please LoginComment After ~