Bank of England:Money and Credit - June 2023

Overview

These monthly statistics on the amount of, and interest rates on, borrowing and deposits by households and businesses are used by the Bank's policy committees to understand economic trends and developments in the UK banking system.

Key points:

- Net borrowing of mortgage debt by individuals increased to £0.1 billion in June, after net repayments of £0.1 billion in May and record high net repayments of £1.1 billion in April (if the period since the onset of the Covid-19 pandemic is excluded).

- Net mortgage approvals for house purchases saw an increase from 51,100 in May to 54,700 in June, while approvals for remortgaging rose from 34,100 to 39,100 during the same period.

- The ‘effective’ interest rate – the actual interest rate paid – on newly drawn mortgages continued to exhibit sustained increases, having risen by a further 7 basis points, to 4.63% in June.

- Net borrowing of consumer credit by individuals rose to £1.7 billion in June, the highest since April 2018.

- Households deposited an additional £3.4 billion with banks and building societies in June. This was largely driven by net flows of £6.6 billion into interest-bearing time deposits. Households’ deposits into non-interest bearing sight rose to £2.1 billion in June, after seven months of net withdrawals. These were largely offset by net outflows of £8.4 billion from interest-bearing sight deposit accounts, which were smaller when compared to net outflows of £11.4 billion observed in May.

- Households’ deposits into National Savings and Investment (NS&I) accounts fell for the third consecutive month to net zero in June, down from £0.8 billion in May.

- June marked the fifth consecutive month of net repayments in market finance by private non-financial companies (PNFCs), which repaid £2.9 billion in market finance in June, compared to £1.5 billion in May.

- Net repayments of bank and building society loans (including overdrafts) by UK non-financial businesses (PNFCs and public corporations) also increased, from £0.4 billion in May to £5.6 billion in June.

- The net flow of sterling money (known as M4ex) decreased to -£3.7 billion in June from -£3.4 billion in May, driven largely by net flows of -£6.9 billion by PNFCs. Similarly, the flow of sterling net lending to private sector companies and households (M4Lex) fell to -£0.4 billion in June, after increasing to £2.1 billion in May.

References in the text point to the summary tables below. For further statistics, please see our visual summaries, Effective Rates (ER) statistical release, Capital Issuance statistical release, and Bankstats tables.

Lending to individuals

Mortgage lending (M&C Tables D and E):

Net borrowing of mortgage debt by individuals increased to £0.1 billion of net flows in June after net repayments of £0.1 billion in May and record high £1.1 billion net repayments in April (if the period since the onset of the Covid-19 pandemic is excluded). Gross lending increased for the second consecutive month, from £19.0 billion in May to £20.0 billion in June. Similarly, gross repayments rose from £19.0 billion in May to £19.8 billion in June.

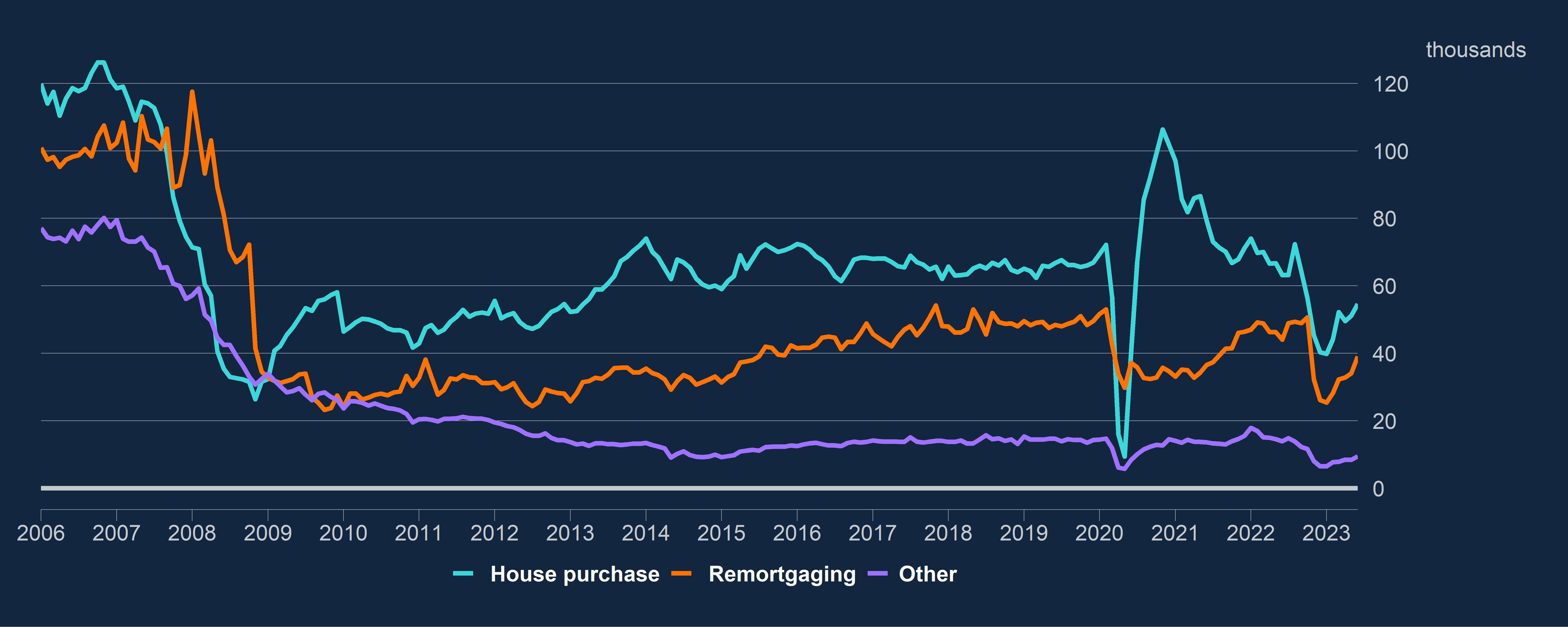

Net approvals (that is, approvals net of cancellations) for house purchases, which is an indicator of future borrowing, increased to 54,700 in June, the highest since October 2022. However, it remains below the monthly average for 2022 of 62,700 (Chart 1). Approvals for remortgaging (which only capture remortgaging with a different lender) saw a significant increase from 34,100 in May to 39,100 in June.

Chart 1: Mortgage approvals

Seasonally adjusted

The ‘effective’ interest rate – the actual interest rate paid – on newly drawn mortgages continued to increase, rising by a further 7 basis points, to 4.63% in June. Similarly, the rate on the outstanding stock of mortgages increased by 10 basis points, and now sits at 2.92%.

Consumer credit (M&C Tables B and C):

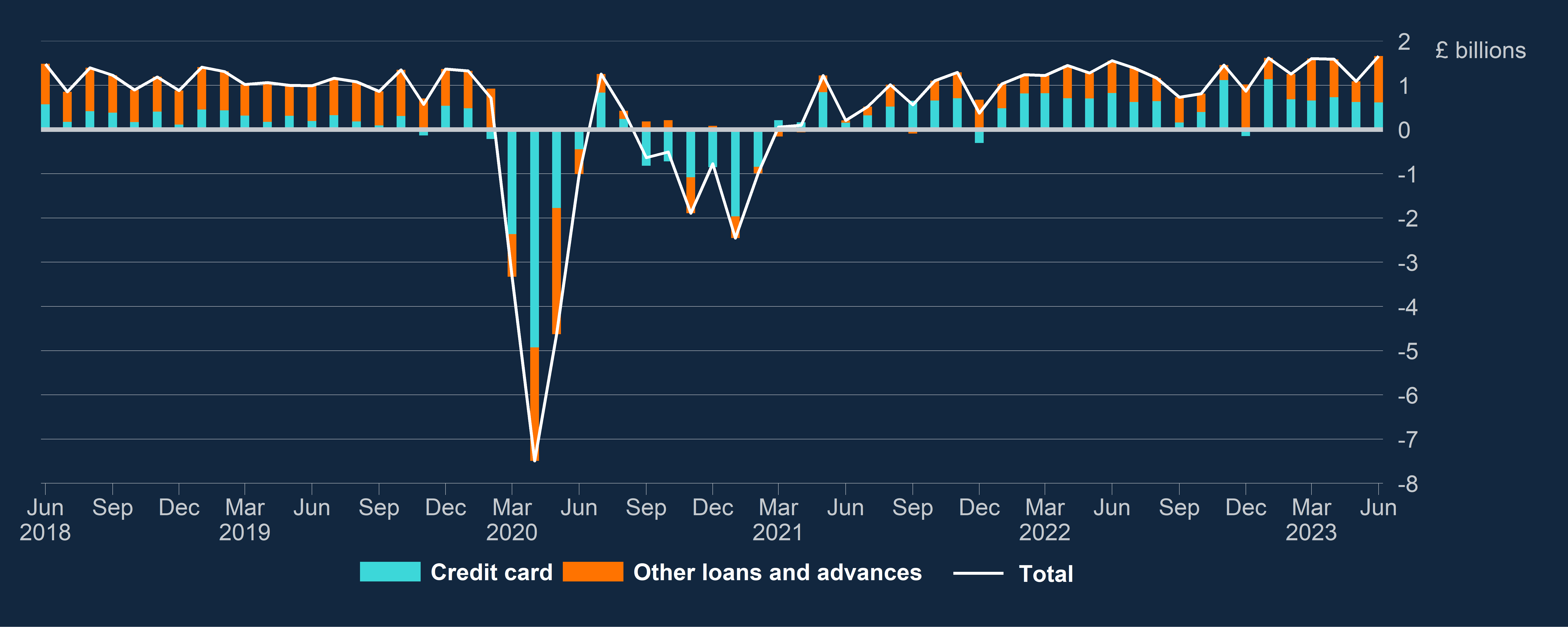

Net borrowing of consumer credit by individuals rose to £1.7 billion in June, following a £0.5 billion decrease in May (Chart 2). This is the highest net consumer credit borrowing since April 2018 (£1.9 billion). Borrowing on credit cards remained stable at £0.6 billion, while borrowing through other forms of consumer credit (such as car dealership finance and personal loans) increased significantly from £0.5 billion in May to £1.0 billion in June.

The annual growth rate in June for all consumer credit remained unchanged when compared to May, at 7.6%, while the growth rate for credit card borrowing decreased from 12.5% in May to 12.0% in June. By contrast, the annual growth rate for other forms of consumer credit increased slightly to 5.7% in June, compared to 5.5% in May.

Chart 2: Consumer credit

Seasonally adjusted

The effective interest rate on interest-charging overdrafts in June remained largely unchanged when compared to May, at 21.77%. The effective rate on interest bearing credit cards ticked down to 20.42%, after peaking in May at 20.44%, while the effective rate on new personal loans to individuals saw a 14 basis point increase, from 8.27% in May to 8.41% in June.

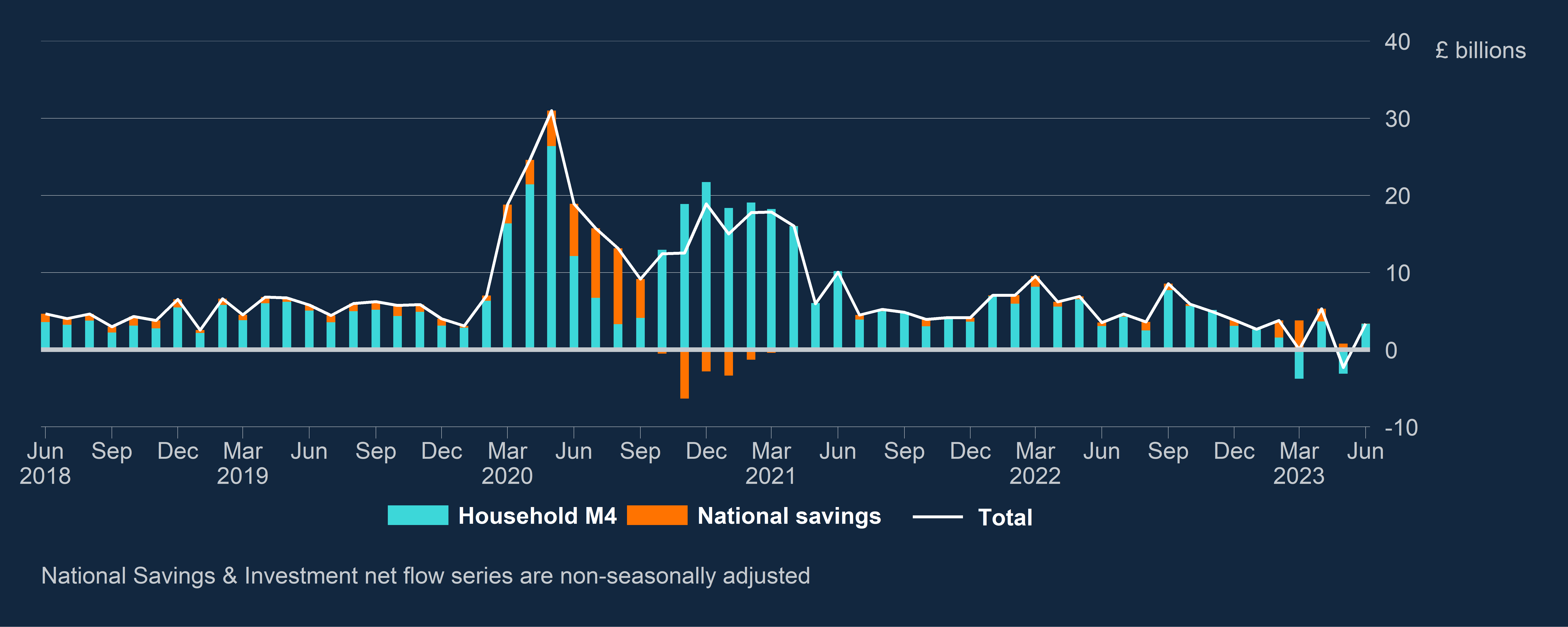

Households' deposits (M&C Table J):

During June, households deposited an additional £3.4 billion with banks and building societies, following net withdrawals of £3.1 billion in May. This was mainly driven by net inflows of £6.6 billion into interest-bearing time deposits, up from £5.1 billion in May. Similarly, households’ deposits into non-interest bearing sight accounts rose to £2.1 billion in June after seven months of net withdrawals. Net inflows into ISAs fell to £3.0 billion in June, continuing a decline from £3.7 billion in May and its recent peak of £9.0 billion in April. These net inflows were all largely offset by net outflows in June of £8.4 billion from interest-bearing sight deposit accounts, compared to net outflows of £11.4 billion in May. (Chart 3).

Chart 3: Breakdown of households' deposits (Household M4)

Seasonally adjusted net flow

Households' deposits into National Savings and Investment (NS&I) accounts, which are not captured within households' deposits with banks and building societies but can act as a substitute for them, fell for the third consecutive month to net zero in June, down from £0.8 billion in May. However, the combined net flow of both household deposits with banks and building societies and NS&I accounts was still higher compared to May, at £3.4 billion, up from -£2.3 billion (Chart 4).

Chart 4: Household deposits

Seasonally adjusted net flow

The effective interest rate paid on households' new time deposits with banks and building societies showed a sustained increase, having risen from 3.95% in May to 4.29% in June. Likewise, the effective rate on the outstanding stock of time deposits and the effective rate on stock sight deposits rose by 15 and 13 basis points respectively, and now sits at 2.71% and 1.46%.

Lending to and deposits from businesses

Businesses' borrowing from banks (M&C Tables F-I):

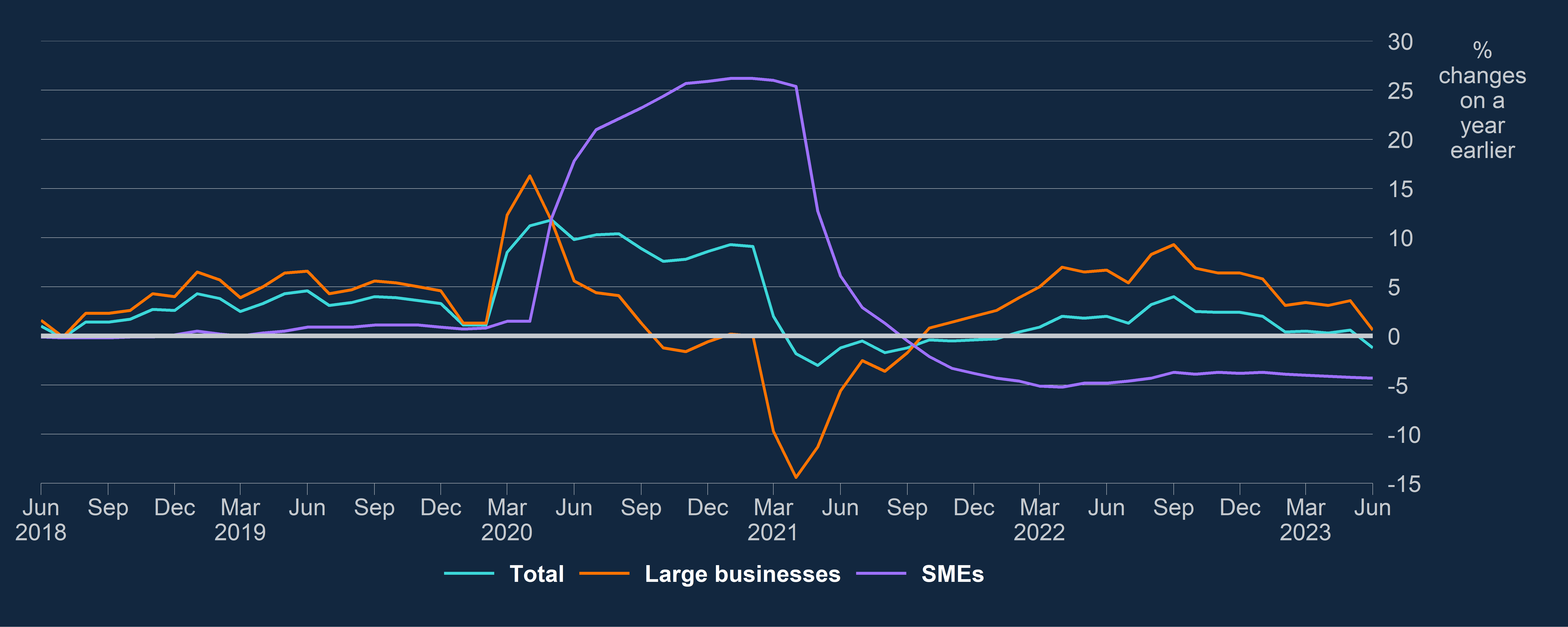

During June, UK non-financial businesses (PNFCs and public corporations) repaid, on net, £5.6 billion of bank and building society loans (including overdrafts), compared to £0.4 billion of net repayments in May. Within this measure, net repayments by large non-financial businesses amounted to £4.3 billion in June, following net borrowing of £0.4 billion in May. Net repayments by small and medium sized non-financial businesses (SMEs) increased to £1.3 billion in June, up from £0.8 billion of net repayments in the previous month.

The annual growth rate of borrowing by large businesses dropped to 0.6% in June, from 3.6% in May, while for SMEs the rate decreased slightly for the fifth consecutive month, from -4.2% to -4.3% during the same period.

The average cost of new borrowing from banks by UK PNFCs rose by 19 basis points in June, to an effective interest rate of 6.36%, and now sits 433 basis points above the December 2021 rate of 2.03% (when Bank Rate increases began). Similarly, the effective interest rate on new loans to SMEs saw a 27 basis point increase, from 6.86% in May to a record high 7.13% in June (compared to 2.51% in December 2021).

Chart 5: Annual growth of lending to SMEs and large businesses

Seasonally adjusted

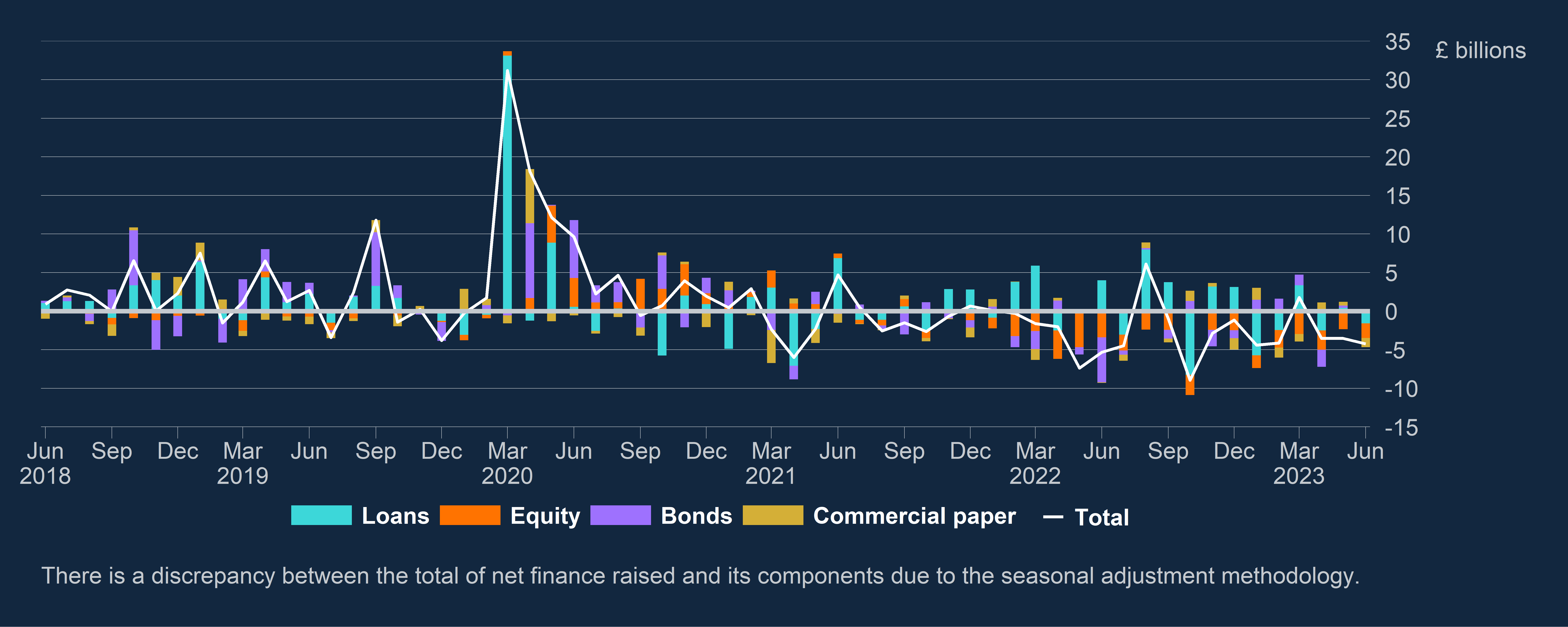

Market Finance (M&C Table F):

June marked the fifth consecutive month of net repayments in market finance by private non-financial companies (PNFC). Net repayments by private non-financial companies (PNFC) increased from £1.5 billion in May to £2.9 billion in June. Within this measure, companies bought back £1.9 billion of equity in June, down from £2.3 billion of equity buybacks in May. In addition, companies redeemed £1.2 billion of commercial paper. These were partly offset by £0.2 billion of bond issuances (Chart 6).

Chart 6: Net finance raised by PNFCs

Seasonally adjusted net flow

Businesses' deposits:

UK non-financial businesses deposited £5.1 billion with banks and building societies in all currencies in June, down from £10.0 billion in May. The effective rate on new time deposits rose by 30 basis points, to 4.24% in June, while the effective rate on stock sight deposits increased by 25 basis points and now sits at 2.17%.

Aggregate money (M4ex) and lending (M4Lex) (M&C Table J)

The net flow of sterling money (known as M4ex) decreased to -£3.7 billion in June, compared to -£3.4 billion in May. This was largely driven by a decline in the net flows of PNFCs’ holding of money, which amounted to -£6.9 billion in June. Net flows of non-intermediate other financial corporations’ (NIOFCs’) holdings of money was down from £0.7 billion in May to -£0.3 billion in June. These were partly offset by net flows of households’ holdings of money, which increased to £3.4 billion in June, compared to -£3.1 billion in May.

Similarly, the flow of sterling net lending to private sector companies and households (M4Lex) fell to -£0.4 billion in June, after rising to £2.1 billion in May. This was mainly driven by a significant fall in the flow of net lending to PNFCs to -£1.9 billion in June, down from £0.3 billion in May. The flow of net lending to households also decreased, from £0.6 billion to £0.1 billion during the same period.

First, please LoginComment After ~