Hong Kong's asset and wealth management business fared on par with global markets in 2022

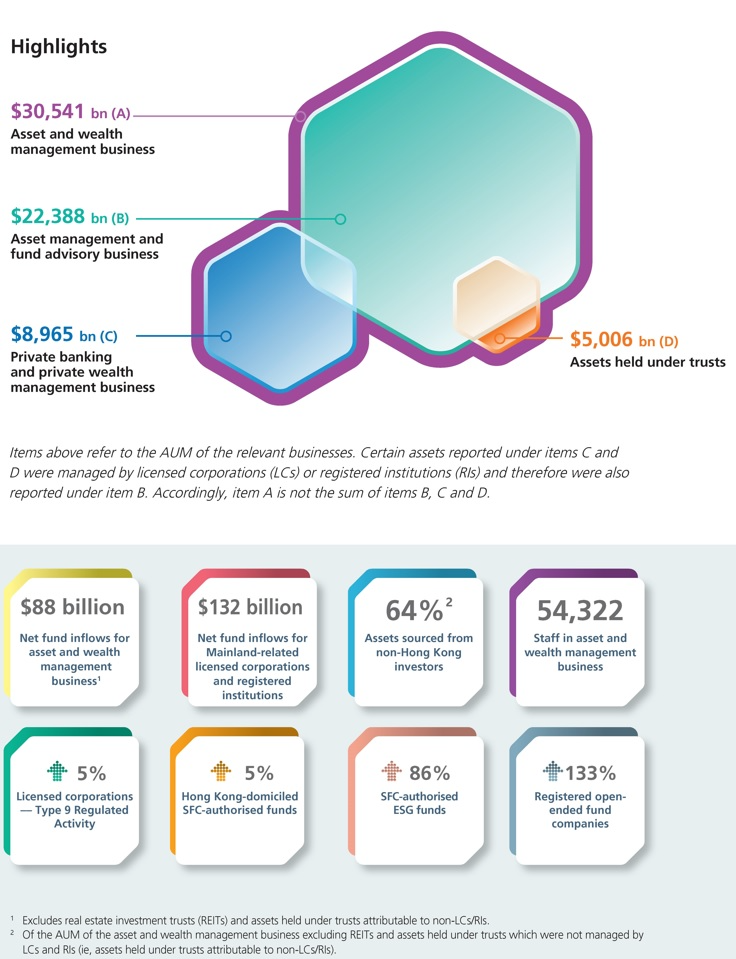

The Securities and Futures Commission (SFC) today published the report on its annual Asset and Wealth Management Activities Survey (Note 1), which recorded assets under management (AUM) of $30,541 billion (US$3,912 billion) (Note 2) and net fund inflows of $88 billion (US$11 billion) in 2022.

These findings reflect the challenges faced by the global asset and wealth management industry. The AUM decline of 14% year-on-year was similar to the 15% drop for the AUM of worldwide regulated funds and slightly outran major market indices (Note 3), while many other major fund markets saw net fund outflows.

Hong Kong has shown signs of turning a corner since late 2022. The AUM of Hong Kong-domiciled funds rebounded 15% from the third quarter of 2022 to $1,335 billion (US$171 billion) as at end-June 2023. Net fund inflows of $69 billion (US$8.9 billion) were recorded during the fourth quarter of 2022 and the first half of 2023, representing over 300% increase from the net fund inflows of $17 billion (US$2.2 billion) for the first three quarters of 2022.

Overall, the AUM of Hong Kong's asset and wealth management business recorded long-term healthy growth of 143% over the last 10 years.

“The latest survey shows the resilience of our asset and wealth management industry even though 2022 was a challenging year,” said Ms Christina Choi, the SFC's Executive Director of Investment Products. “The SFC stays committed to developing Hong Kong as a full-service international asset and wealth management centre and a preferred fund domicile.”

Other highlights include:

♦ The private banking and private wealth management business alone registered net fund inflows of $121 billion (US$15 billion) (Note 4).

♦ Mainland-related firms outperformed the industry average with net fund inflows of $132 billion (US$17 billion) and growth for their asset and wealth management business (Note 5).

♦ SFC-authorised environmental, social and governance (ESG) funds saw year-on-year growth of 8% in AUM and 86% in number.

♦ The number of firms licensed to carry out asset management in Hong Kong increased 5% year-on-year and the total number of staff in the asset and wealth management business remained steady at 54,322 (Note 6).

♦ Non-Hong Kong investors remained a major source of funding for the asset and wealth management business, accounting for 64% of the total AUM.

Notes:

1.Asset and wealth management business comprises asset management, fund advisory, private banking and private wealth management, SFC-authorised real estate investment trusts and assets held under trusts. Highlights of the survey are included in the Appendix.

2.Unless stated otherwise, values given are in Hong Kong dollars and all comparisons are made on a year-on-year basis (ie, 2022 over 2021). Amounts shown in US dollars were converted at the prevailing exchange rate.

3.Year-on-year changes in 2022: MSCI World Index (USD) -18%; MSCI AC Asia Index (USD) -19%; FTSE Developed Asia Pacific Total Return Index (USD) -14%; Hang Seng Index -15%; Shanghai Composite Index -15%; Shenzhen Composite Index -22%; Bloomberg Global Aggregate Bond Index -16%.

4.The AUM of the private banking and private wealth management business amounted to $8,965 billion.

5.The number of Mainland-related firms in the asset and wealth management business also increased 17%.

6.This year, 1,162 firms took part in the SFC's annual Asset and Wealth Management Activities Survey, including SFC-licensed corporations engaging in asset management and fund advisory business, banks engaging in asset management, private banking and private wealth management business, and non-SFC licensed insurance companies registered under the Insurance Ordinance and trustees.

First, please LoginComment After ~