Mystery shopping: BaFin tests investment advice

The Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht – BaFin) again sent out test buyers to investment services institutions – an undercover campaign aimed at inspecting these institutions’ practices in providing investment advice.

This was BaFin's second mystery shopping exercise – following up the pilot in June 2021 – and the focus was again on investment advice. The main issue was whether the investment services institutions were providing their clients with the information documents prescribed by law, such as the suitability report and the ex-ante cost information. “This time, we tested 16 institutions throughout Germany and had a total of 100 mystery shops carried out,” says Christian Bock, BaFin’s Director-General for Consumer Protection as well as its Consumer Protection Officer.

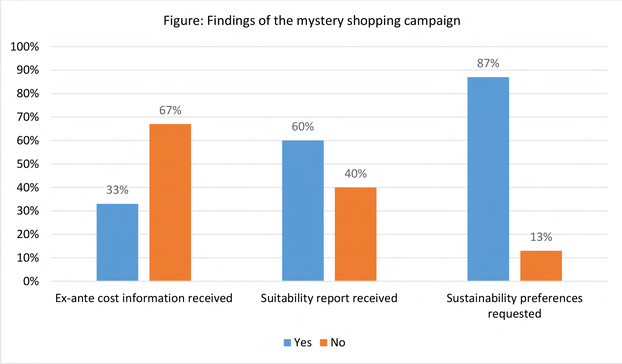

Bock reports that the data provided by the current exercise are somewhat mixed. There were some good results, for example regarding the identification of sustainability preferences, which has been mandatory since August 2022. In other aspects, however, Bock observes that the institutions' performance in providing investment advice is significantly worse than two years ago.

The pilot was not representative, Bock explains, due to its limited scope. The follow-up was therefore designed to be much broader. Furthermore, BaFin has linked its mystery shops to an EU-wide mystery shopping exercise on costs and fees that has been coordinated by the European Securities and Markets Authority (ESMA). “We have again identified significant irregularities in how mandatory information required by law is being provided during the investment consultation. But these are not necessarily evidence that there are serious irregularities in this respect throughout the industry”, Bock points out.

At a glanceMystery shopping...

...is used by BaFin to observe banks, insurers and other financial services providers – unnoticed and from the customers’ point of view. It sends out specially trained mystery shoppers for this purpose.

In the second mystery shopping exercise, launched in the third quarter of 2022, these shoppers took up their role in most cases posing as new clients. The campaign made use of two age groups: those aged 35 to 50 and those older than 60.

Provision of mandatory information: noticeably high error rates

The results of the campaign, Bock emphasises, must be viewed from a nuanced perspective. In 40 percent of the consultations providing investment advice, shoppers did not receive a suitability report; in 67 percent, they did not receive any ex-ante cost information. Both documents are required by law (see info box “Mandatory information for investors”). For the sake of comparison: in the pilot campaign conducted in the summer of 2021, there had been no suitability report provided in 22 percent of the consultations, and in 19 percent no ex-ante information on costs and charges had been provided.

To make sense of these results, however, it should be noted that this mystery shopping campaign did not involve placing any orders in any of the investment consultations. As Bock explains, “This means we cannot completely rule out the possibility that the mandatory information would have been provided if the investment consultation had been concluded with the shopper placing an order”.

At a glanceMandatory information for investors

Suitability report

As of the beginning of 2018, retail clients must receive a suitability report once they have received investment advice. Banks and financial services institutions are required to provide the suitability report under the Second European Markets in Financial Instruments Directive (MiFID II) and the German Securities Trading Act (Wertpapierhandelsgesetz – WpHG) (see expert article on the BaFin website dated 17 October 2018).

In this report, institutions must set out in writing why the advice they give to a particular client – for example, to buy or sell a particular financial instrument – is appropriate for that client.

Cost information

The ex-ante cost information is likewise a requirement under MiFID II and the WpHG. As of the beginning of 2018, it too must be provided in good time before an order is placed. Institutions are obliged to provide this information to clients, detailing all the costs and charges relating to investment services (and ancillary services) and the respective financial instrument (see expert article on the BaFin website dated 1 October 2018).

Identification of sustainability preferences

As of August 2022, institutions providing investment advice are required by law to ask (potential) clients about their personal sustainability preferences (ESG preferences) in the course of the investment consultation. ESG stands for environmental, social and governance. If, during the investment consultation, investment advisers give a recommendation to buy, sell or hold a financial instrument or an investment service, they must ensure for example that the recommendation matches the client's personal investment objectives – also with regard to any sustainability preferences the client may have.

Good results in terms of sustainability preferences and no signs of age discrimination

On the positive side, 87 percent of the shoppers were asked about their sustainability preferences in the course of the consultation. This has been mandatory since August 2022 (see info box “Mandatory information for investors”). The vast majority of the recommendations aligned with the sustainability preferences expressed in the investment consultation.

Unlike the (non-representative) mystery shopping pilot in 2021, there were no signs of age discrimination this time. Both test profiles – for the age group 60+ and the age group 35 to 50 – show a similar pattern of shortcomings. Concerning the provision of ex-ante cost information, the rate of error for the age group 35 to 50 was around 71 percent – an even higher rate than that for the age group 60+, which was just under 59 percent.

Figure 1: Findings of the mystery shopping campaign

BaFin still sees room for improvement

For consumer protection expert Bock, the mystery shopping campaign shows that there is “still room for improvement when it comes to how investment services institutions operating in Germany provide investment advice”. There are still particular shortcomings with regard to mandatory information, he says. At the same time, institutions are doing rather well in asking clients about their personal sustainability preferences. “But the results are not yet perfect in this respect, either”, he summarises.

BaFin is content with the responses of the institutions concerned: “My colleagues from institution supervision have reached out to the relevant investment service providers, and the institutions have proven to be cooperative and constructive”, Bock reports. The service providers have undertaken to critically examine and adapt their processes. Another aim, he says, is to increase all investment advisers' awareness of the fact that the statutory information documents must always be provided in the course of the investment consultation.

BaFin will be monitoring the implementation of the measures. It will also continue to conduct mystery shopping at the institutions and companies it supervises. “Mystery shopping has proven to be an effective supervisory tool for us”, Bock affirms.

First, please LoginComment After ~