HKEX 2023 interim results

Download → HKEX 2023 interim results

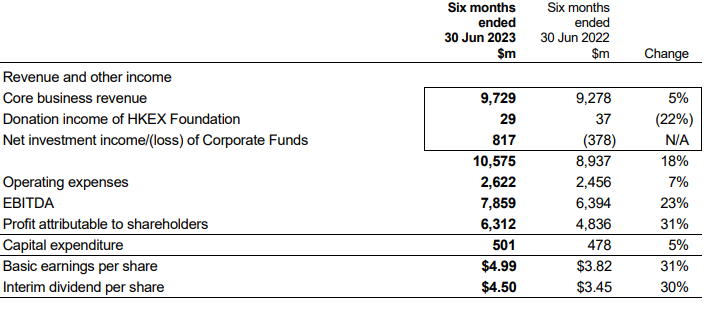

Comparison of 1H 2023 with 1H 2022 Results

Financial Highlights

▪ Second best ever half-yearly revenue and other income and profit in 1H 2023, after exceptional 1H 2021

▪ 1H 2023 revenue and other income of $10,575 million, 18 per cent higher than 1H 2022

- Core business revenue up 5 per cent against 1H 2022, due to higher net investment income from Margin Funds and Clearing House Funds; and record half-yearly derivatives contract ADV in 1H 2023. Increase partly offset by lower trading and clearing fees from lower Headline ADT and lower listing fees

- Net investment income from Corporate Funds of $817 million (1H 2022: loss of $378 million), driven by net fair value gains on the External Portfolio of $215 million (1H 2022: losses of $511 million) and higher investment income from internally-managed Corporate Funds

▪ Operating expenses up 7 per cent against 1H 2022, attributable to higher staff costs and professional fees

▪ EBITDA margin1 of 75 per cent, 3 percentage points higher than 1H 2022

▪ Profit attributable to shareholders of $6,312 million, 31 per cent higher than 1H 2022

Key Financials

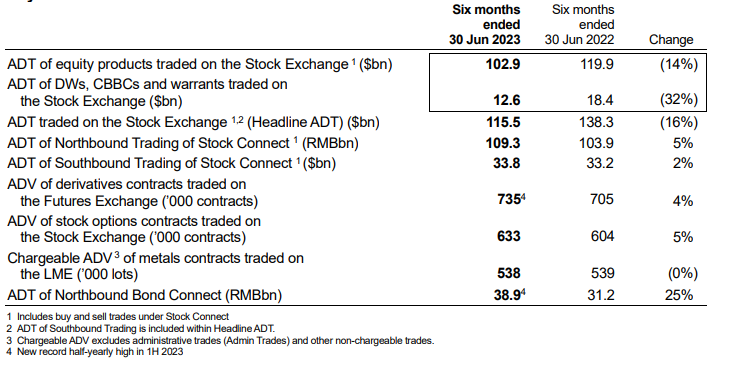

Key Market Statistics

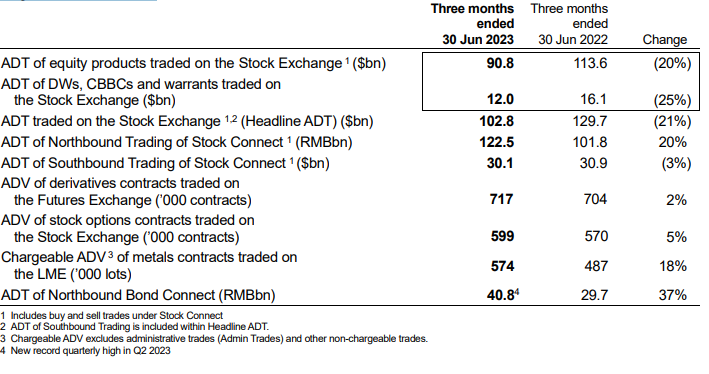

Comparison of Q2 2023 with Q2 2022 Results

Financial Highlights

▪ Record Q2 revenue and other income of $5,017 million for Q2 2023, 18 per cent higher than Q2 2022

- Core business revenue up 5 per cent against Q2 2022, attributable to increase in net investment income from Margin Funds and Clearing House Funds, partly offset by lower trading and clearing fees and lower listing fees

- Net investment income from Corporate Funds of $268 million (Q2 2022: loss of $274 million), driven by net fair value gains on the External Portfolio of $20 million (Q2 2022: losses of $322 million) and higher investment income from internally-managed Corporate Funds

▪ Operating expenses up 3 per cent, attributable to higher professional fees and charitable donations, partly offset by lower staff costs

▪ EBITDA margin of 73 per cent, 3 percentage points higher than Q2 2022

▪ Profit attributable to shareholders of $2,904 million, 34 per cent higher than Q2 2022

Key Financials

Key Market Statistics

......

First, please LoginComment After ~