The E-Commerce Route into Central & Eastern Europe

At a webinar hosted by HKTDC Research, entitled The E-Commerce Route into Central & Eastern Europe, a number of experts were invited to analyse the structure and growth potential of the e‑commerce market in Poland, and to discuss the attributes needed to enter the market there. Louis Chan, Deputy Director of Research at HKTDC, noted that during the Covid-19 pandemic, e‑commerce became a major sales channel for many industries around the world. However, since the demands and spending habits of consumers in Central and Eastern Europe (CEE) differ from those of their counterparts in Asia, Hong Kong companies wanting to enter the CEE market via e‑commerce must first obtain a good understanding of the structure of the e‑commerce market in the region, and the latest developments in that market, if they are to succeed.

Market growth

Simeon Woo, Economist (Global Research) at HKTDC Research, gave an overview of key CEE markets at the webinar. He explained that CEE generally refers to the 16 countries around the Baltic Sea, Balkan Peninsula and Central Europe. The combined population of the region exceeds 100 million and its total GDP reached US$2 trillion (HK$15.6 trillion) in 2022. Poland, Romania, the Czech Republic and Hungary are the region's largest economies. Outlining CEE's links with Hong Kong, Woo said: “According to the trade figures, in 2022 the value of Hong Kong‑CEE trade surpassed US$8 trillion, up some 20% from 2017, with Hungary, Poland and the Czech Republic being Hong Kong's major trading partners. Key import‑export products included telecommunications equipment, computers and semi‑conductors.”

CEE: the most significant B2C e‑commerce market in Europe.

Woo warned that the Russia‑Ukraine conflict has somewhat dampened the economic outlook for CEE, but added: “While geopolitical risk has weakened consumer demand and slowed down economic growth in CEE, the economy in the region remains resilient amidst this difficult environment. As the market in general remains optimistic about the long‑term prospects for economic development in CEE and inflation eases markedly, it is expected that the region will register considerable economic growth this year and the next.”

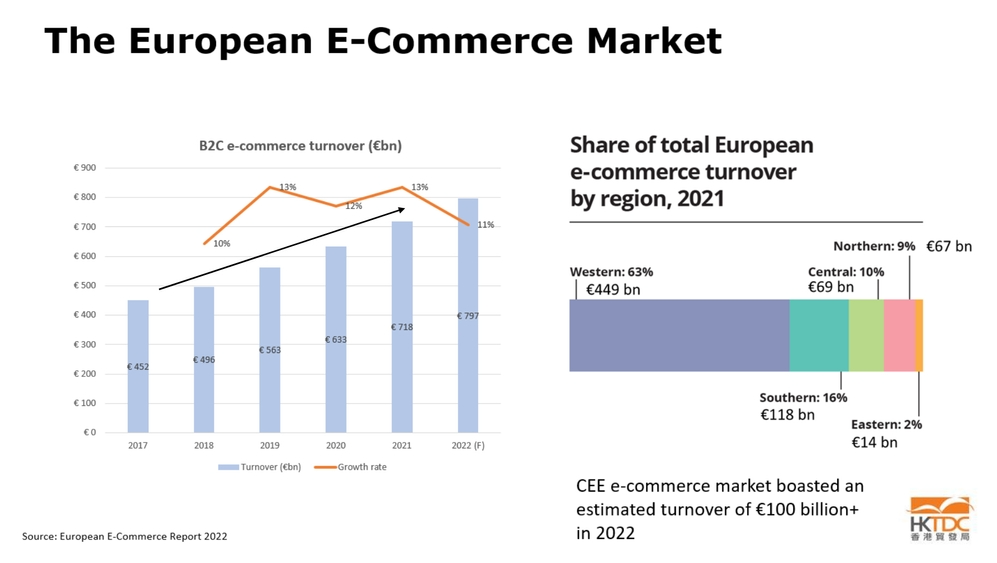

Turning to the e‑commerce market in Europe, Woo cited the European E-Commerce Report 2022 and said the B2C e‑commerce market in Europe had stayed vibrant from 2017 to 2021, with turnover increasing from €452 billion (HK$3.88 trillion) to €718 billion. Of this growth, the contribution from the CEE market was the most remarkable, accounting for 12% of total European e‑commerce turnover.

Mobile‑first and personalisation are key.

Springboard to Europe

Noting that overall internet penetration rate in Europe is over 90%, while that in Eastern Europe is 75% and in Southern Europe 86%, Woo said: “The internet penetration rate and the performance of e‑commerce operators are closely related. The greater the number of internet users, the greater also is the number of e‑shoppers. Although at present the number of online shoppers in Europe is still largest in Western Europe and Northern Europe where the e‑commerce market is more developed, the number of internet and e‑commerce users in CEE has been rising in recent years. Therefore, this region can serve as an ideal springboard for Hong Kong companies wishing to develop the European market by way of e‑commerce.”

Electronics, clothing and footwear are the most popular goods purchased online by CEE consumers. Woo indicated that online shopping is set to grow still further in CEE, saying: “In 2021, e‑commerce accounted for about 15% of the region’s retail sales, up nine percentage points from 2016, and is expected to reach 20% by 2026. This shows that online shopping is becoming a normality. Hong Kong companies should take note that among the CEE countries, Poland and the Czech Republic are leaders in terms of online shopping and e‑commerce growth in the region.”

Woo’s advice for Hong Kong companies wishing to make a foray into the CEE e‑commerce market is that they should first try to understand well the consumer habits and preferences of the locals in order to stand out from the crowd of their competitors. Underlining this point, Woo said: “In order to draw the attention of CEE consumers to your products, you must start off with knowledge about their internet browsing habits and spending patterns. Rather than buying from online shops, nearly 80% of the consumers in the region prefer to shop via mobile apps on their phone, and the brand loyalty of these users is generally higher. Local consumers also like personalised services. Therefore, market players looking to tap the CEE market must give priority to meeting the demands of the local consumers by offering user‑friendly mobile apps as well as value‑added services such as personalisation and sustainable consumption, laying a sound foundation for marketing their brand.”

Allegro positions itself as gateway to multiple markets.

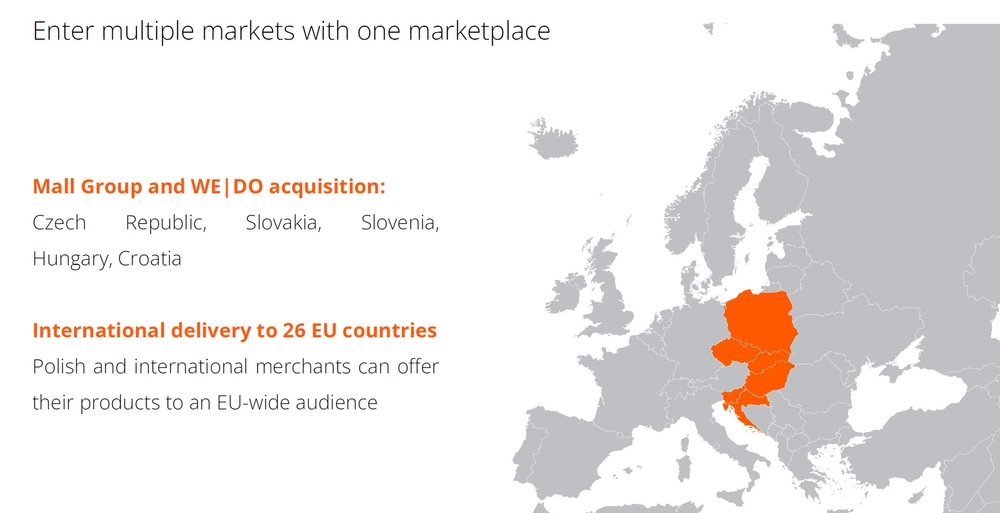

Closer ties with Asia-Pacific

For Hong Kong companies and other cross‑border e‑commerce operators in Asia, CEE is an emerging market that should not be overlooked. In order to tap into the consumer market in the region more effectively, they could consider co‑operating with the local e‑commerce giants. One of these is Allegro, a leading cross‑border e‑commerce operator in CEE. Established in 1999 and headquartered in Poland, the company has a market penetration rate of almost 90% in the region. With the e‑commerce ecosystem in CEE gradually coming of age, Allegro officially opened its international marketplace last year to help sellers on the platform sell their products to 24 EU countries. The company has also successfully acquired Mall Group, the second largest e‑commerce platform in the Czech Republic, in a move to extend its sales networks to Poland, the Czech Republic, Slovakia, Slovenia, Croatia and Hungary, opening up a potential consumer market of over 70 million shoppers for the sellers on its platform.

Jakub Kolodynski, Senior Business Development Partner at Allegro, told the webinar that the company had set up a department dedicated to expanding co‑operation networks. Great efforts are being devoted to strengthening co‑operation ties with business partners in the Asia Pacific region, providing training and guidance for Chinese‑speaking merchants, and helping them to sell their products to CEE consumers. Explaining how CEE has become more enthusiastic about e‑commerce in recent years, Kolodynski said: “Like their counterparts in other economies, an increasing number of CEE consumers are keen on shopping online. The Covid-19 pandemic has also driven the rapid growth of e‑commerce in the region. Because our company had already tapped into the CEE markets years ago, this has enabled us to compete with other international online shopping platforms. Take Poland for example. Nearly one‑third of the consumers there start their product search on the Allegro platform before they shop online, and almost all of them end up buying products on Allegro.”

Today, with innovation and technology spreading far and wide across the globe, CEE countries are sparing no efforts in trying to develop new‑ and high‑tech industries as well as knowledge‑based services. Actions taken include actively promoting online payment, improving logistics and transport, as well as building a more stable network system, all of which help to boost the development of e‑commerce. Kolodynski suggested that it makes sense for foreign companies to ally themselves with CEE‑based partners to take advantage of these developments, saying: “In Poland, for instance, the largest e‑commerce market in CEE, 75% of consumers buy from domestic e‑shops and only about 30% of them opt for foreign e‑shops. This shows that Polish online buyers trust and are loyal to domestic brands and that they prefer to use their mother tongue when e‑shopping. In light of this, foreign brands should consider co‑operating with CEE e‑commerce platforms when selling their products as this will make it easier for them to win the trust of local people.”

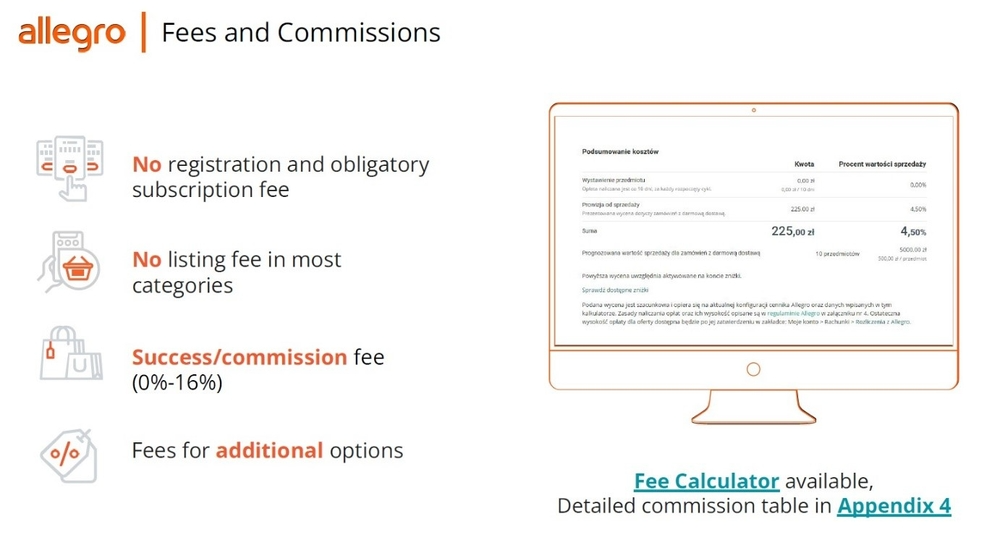

Targeting Chinese-speaking merchants

For small and medium‑sized enterprises with limited capital, developing a new market like this usually involves huge costs. To try to allay SMEs’ fears, Kolodynski said: “To sell on Allegro, there are no hidden charges, no registration fee, no obligatory subscription fee, and no listing fee, and commission fee is capped at 16%. Also, we offer a Fee Calculator for merchants to calculate sales cost so that they can devise a better marketing plan.”

Allegro's charging system.

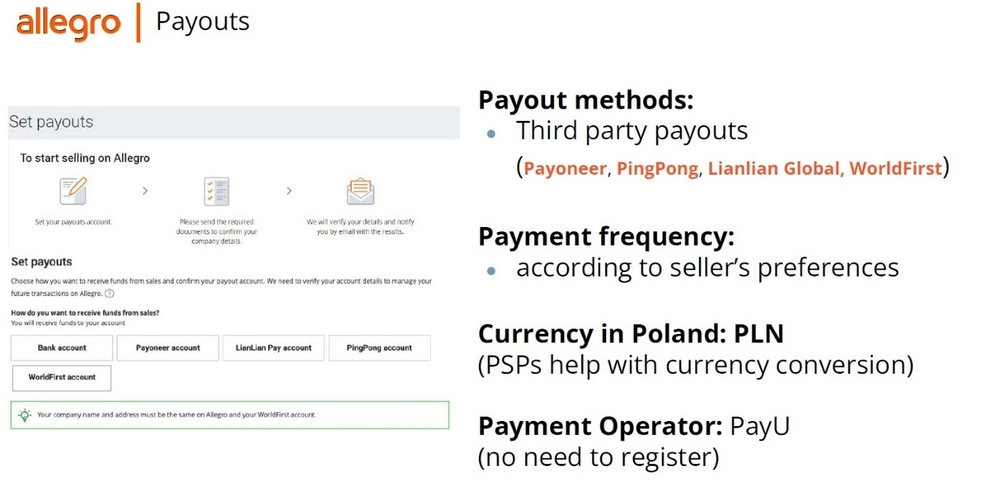

Allegro set up a website in the Czech Republic in May this year to expand its cross‑border e‑commerce business territory. In addition to building a China team, Allegro also provides e‑commerce related training and guidance to Chinese‑speaking merchants in mainland China and Hong Kong. The company is also co‑operating with a number of cross‑border payment platforms, such as Payoneer, PingPong, Lianlian Global and WorldFirst, to provide cross‑border settlement services in multiple currencies and multiple payment methods. Such services aim to build an open cross‑border payment ecosystem to help merchants develop the CEE market.

Allegro's open cross‑border e‑commerce ecosystem.

First, please LoginComment After ~