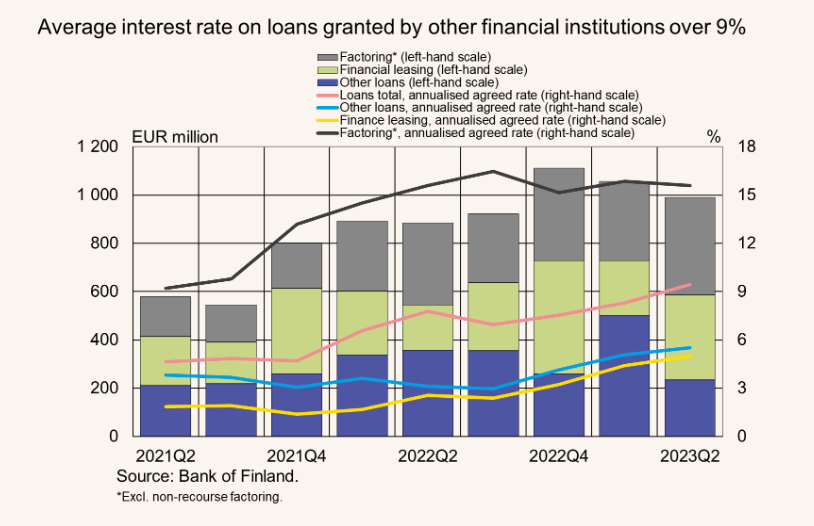

Average interest rate on corporate loans granted by other financial institutions over 9%

In the second quarter of 2023, among the non-financial corporations that drew down loans from OFIs, micro and small enterprises were the largest borrower group. At the end of June 2023, the stock of corporate loans granted by OFIs grew at an annual rate of 2.8%, compared with 12.4% in the corresponding period a year earlier.

In the second quarter of 2023, Finnish non-financial corporations drew down new corporate loans[1] from other financial institutions (OFIs) to a total of EUR 990 million. The average interest rate on new corporate loans was 9.4%[2]. There is, however, considerable variation in average interest rates on different forms of finance. For example, the average interest rate on conventional corporate loans was 5.5%, while that on factoring[3] was 15.6%.

In the second quarter of 2023, among the non-financial corporations that drew down loans from OFIs, micro and small enterprises were the largest borrower group. The most common type of newly drawn corporate loan was factoring (EUR 405 million), followed by financial leasing[4] (EUR 350 million) and conventional corporate loans (EUR 235 million).

At the end of June 2023, the stock of loans granted by OFIs to Finnish non-financial corporations stood at EUR 5.8 billion, with an average interest rate of 4.4%[5]. The interest rates on corporate loans vary significantly between lenders. For example, in the case of corporate finance companies, which provide corporate loans at higher rates, the average interest rate was almost 40%. These loans accounted for less than 1% of the loan stock. The largest share (57%) of the loan stock consisted of loans granted by banks’ finance companies. The average interest rate on the stock of these loans was 4.0%.

The most common loan type in the corporate loan stock was financial leasing (EUR 3.3 billion), before conventional corporate loans (EUR 2.2 billion). At the end of June 2023, the largest sectors by lending volume were energy and industry. The stock of loans to these sectors totalled over EUR 1 billion.

Growth of corporate loan stock has slowed

At the end of June 2023, the stock of corporate loans granted by OFIs grew at an annual rate of 2.8%, compared with 12.4% in the corresponding period a year earlier. The growth of corporate loans provided by credit institutions (banks) has slowed, too. In June 2023, the stock of these loans, EUR 62.5 billion, grew at an annual rate of 0.8%, compared with 6.5% in June a year earlier.

In June 2023, the average interest rate on banks' corporate loan stock (4.4%) was the same as that on OFIs'. Comparing the two, the average interest rate on the OFI loan stock has risen at a slightly slower pace. This partly reflects the larger share of fixed-rate corporate loans (34%) in the OFI corporate loan stock. In the case of banks, the share is 10%. Of corporate loans granted by OFIs, 64% were linked to Euribor rates. The corresponding figure for banks’ corporate loans was 88%.

The stock of loans granted by OFIs to Finnish non-financial corporations and households, 2023Q2:

| Non-financial corporation loans (EUR million) | Household loans (EUR million) |

Secured | 1,805 | 4,274 |

Unsecured and with collateral deficit | 3,972 | 638 |

Total | 5,777 | 4,912 |

For further information, please contact:

Markus Aaltonen, tel. +358 9 183 2395, email: markus.aaltonen(at)bof.fi,

Tommi Salenius, tel. +358 9 183 2156, email: tommi.salenius(at)bof.fi.

The next release on other financial institutions will be published in the early months of 2024.

Name & Shame process:

Financial corporations intentionally dropping out of the OFI statistics for the period 2023Q2:

Creditstar Finland Oy (2023Q1-2023Q2)

GF Money Consumer Finance Oy (2023Q2)

VFS Finland AB (2023Q2)

Laskukassa Oy (2023Q2)

[1] Excl. overdrafts, card credit and non-recourse factoring.

[2] Excl. overdrafts, card credit and non-recourse factoring.

[3] Factoring means financing of outstanding invoices and accounts receivable.

[4] Financial leasing as referred to in paragraphs 5.134–5.135 of Annex A of Regulation (EU) No 549/2013 of the European Parliament and of the Council.

[5] Excl. non-recourse factoring. Non-recourse factoring is a type of factoring where the financial institution assumes 100% of the risk of credit losses on trade receivables purchased from customers.

First, please LoginComment After ~