Advantages, risks and outlook for tokenisation of cashless money: Bank of Russia report

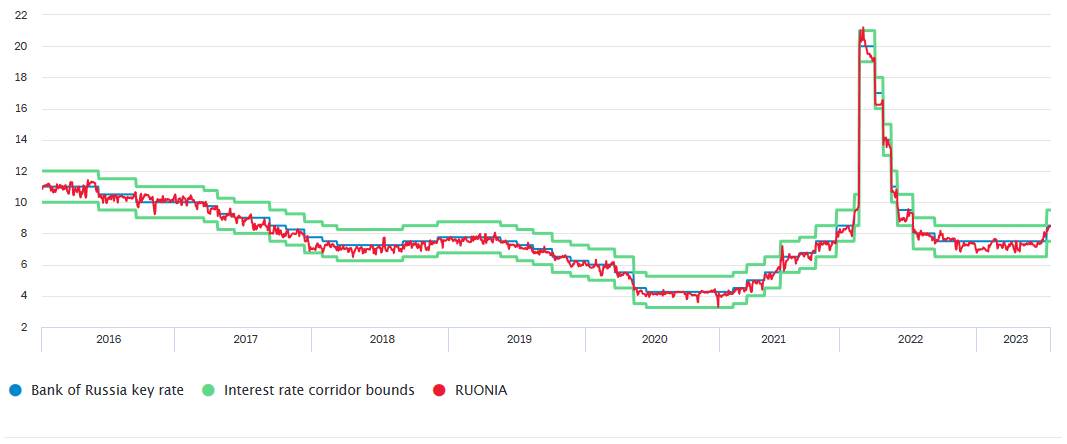

The technology of tokenisation of money in bank accounts will open up additional opportunities for making settlements. This will depend on the extent to which the payment system is developed in a particular country, the plans for introducing a central bank digital currency there, and the functional effectiveness of the proposed solutions, according to the Bank of Russia's information and analytical report.

Despite the fact that tokenised cashless money is usually referred to as cashless money in international practice, its accounting and circulation call for the use of new technologies. Banks can record money in the form of a standard entry in the customer account or in the form of an entry using tokenisation technology.

The prospects of the development of tokenised cashless money are generally determined by the needs and business strategies of market participants. In doing so, regulators can create additional conditions by fine-tuning regulation and limiting possible risks.

There is currently an ongoing active worldwide discussion of optimal regulatory approaches and scenarios ensuring that the advantages of digital payment development are implemented and risks are duly controlled.

The Bank of Russia's report continues the series of publications devoted to the study of financial innovations. Given the rapid development of technology, it is important to be informed of current trends, assessing their potential for the advancement of the financial market and the economy as a whole.

First, please LoginComment After ~