Think Business, Think Hong Kong Thailand 2023: Reshaping E-commerce

The Covid-19 pandemic upended businesses, triggering a digital and e‑commerce turning point. As the world moves on from the pandemic, it is crucial for brands to adapt to the new normal, especially in the fast‑growing yet ever‑changing e‑commerce ecosystem in Asia. Hong Kong, thanks to its strategic location, well‑established logistics and technical expertise, is well‑positioned to provide international brands and e‑commerce players with the necessary agility and flexibility to thrive in the new supply chain era.

The HKTDC's signature promotional event Think Business, Think Hong Kong (TBTHK) Bangkok 2023 gathered experts to discuss key trends and opportunities in the booming Asian e‑commerce market, the latest marketing and logistics developments that have come in step with the digital evolution, as well as tips on e‑commerce strategies.

Cross-border e-commerce in Asia

Tina Lo, Chief Operating Officer at Asia’s leading cross‑border online marketplace for design brands Pinkoi, saw Asia as the key growth leader in the coming years, despite a recent global slowdown in e‑commerce growth. Data platform Statista projects Asia’s B2C e‑commerce market to reach US$1.8 trillion revenue in 2023, while continuing to post an average annual growth of 11.6% through 2027. Lo said: “Another sign of promise counts the rising e‑commerce penetration, along with a higher average order value (AOV), i.e., the average amount spent by customers per transaction, in our key Asian markets such as Japan, Hong Kong, Taiwan and Thailand.”

Positioned as a cross‑border online marketplace for original design goods, digital creations and workshop experiences, Lo highlighted cultural and creative elements as Pinkoi’s leverage to differentiate itself from its competitors and pitch to the growing market demand. Taking fashion, the platform's best‑seller, as an example, Lo said: “There has recently been a growing appetite for Thai fashion in Asia, particularly in Hong Kong, Taiwan and Japan, with some Thai swimwear brands, for example, fast gaining popularity thanks to their unique styles and aesthetic appeal. This gives hope and opportunities to small and medium brands to stand out from the crowd, as an everyday product in a market can become a hit when selling cross‑border.”

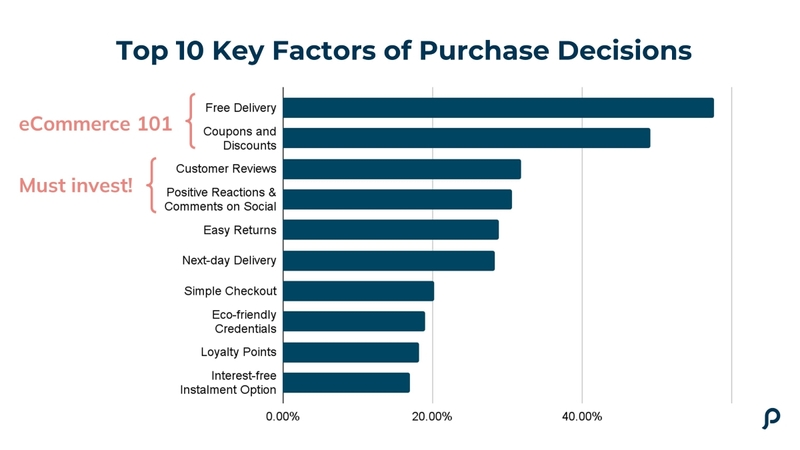

When it comes to e‑commerce strategies, Lo shared her insights from the company’s latest survey conducted in mainland China, Hong Kong, Macao, Taiwan, Thailand and Japan, saying: “To influence consumer purchase decisions for e‑commerce, the top three factors of success such as free delivery, free coupons and discounts are actually basics. However, you need to invest time and money to find a reliable marketing partner if you are really serious about going beyond the basics to toil away at customer reviews and positive social media interactions.”

Cross-border e-commerce in mainland China

The vast scale and rapid growth of the e‑commerce market in mainland China has made it a darling of global e‑commerce businesses. According to the Ministry of Commerce, the mainland’s online retail sales totalled RMB13.8 trillion (US$2.05 trillion) in 2022, solidifying its position as the world's largest online retail market by far for the tenth year in a row [1].

Pimkwan Aditapsatit, China Market Consultant at BB Birdnest Trading Co., Ltd., a Thai bird's nest product manufacturer and distributor, shared her experience of using the cross‑border e‑commerce (CBEC) channel as an effective means to make inroads into the gigantic mainland consumer market without setting up a domestic entity. Aditapsatit highlighted the advantages of the CBEC channel, such as simplified licensing and customs clearance procedures, fewer product requirements and reduced import taxes. As a flexible and cost‑effective avenue for foreign products and brands to gain access to the mainland market, it has enabled BB Birdnest to ride the growing popularity of Thai cosmetics and personal care products in mainland China to expand its product range beyond traditional bird’s nest items to masks, soaps, and hand creams, for example.

Aditapsatit identified branding as the key to success in mainland China's highly competitive e‑commerce market, saying: “Pricing alone is not a reliable means of competition, as consumers are spoiled for choice in mainland China. To stand out from the crowd, one has to have a strong identity. So at BB Birdnest we have proactively promoted our brand on social media, while making full use of social commerce platforms, such as WeChat and Douyin, to drive awareness and make sales directly.”

E-commerce marketing

The growth of e‑commerce has catalysed the development of corresponding marketing technologies and strategies, prompting businesses to redefine their approaches to customer engagement and digital marketing.

Yoyo Ng, General Manager at the enterprise and marketing cloud platform iClick Interactive Asia Group Limited, demonstrated how data‑driven solutions can inform and optimise advertising strategies. She said: “Marketing return on investment (MROI) is often used as a key performance indictor (KPI) to justify marketing spending and budget allocation for ongoing and future campaigns and initiatives. We therefore aim to help our clients to precisely identify their target audience by taking into consideration factors like intentions, behaviours, interests and locations to allow effective engagement through tailored messages, direct marketing and different programmatic solutions. Real‑time dashboards are also offered to assist them in monitoring sales conversion rates and other performance indicators, in order to measure the success of a marketing campaign.”

As a case in point, Ng elaborated on how she and her team have been working with McDonald’s Thailand in a marketing campaign in mainland China to promote new food items to Chinese tourists visiting Thailand. In addition to the use of multi‑dimensional data analytics, they partnered with top Chinese key opinion leaders (KOLs) to create video content on popular mobile platforms such as Xiaohongshu, Douyin and Bilibili, amassing over 1.2 million views and 50,000 likes on the first day of the programme's launch. Ng pointed out that KOL marketing can be a success‑defining strategy, as the KOL's genuine narrative and personal experience can create a sense of authenticity. It goes without saying that consumers are getting more used to using social media to research and discover new products and trends.

With decentralised Web3 technologies such as blockchain emerged as instruments for creating more personalised user experiences and feature‑rich online community development, Ng expects the sky is hardly the limit for cross‑border e‑commerce businesses in future.

Hong Kong: An e-commerce logistics hub

At the heart of the evolving global e‑commerce supply chains, the logistics industry has reinvented how it operates over the years by pivoting into new, faster and more efficient services and solutions. Eddie Lee, Co‑Founder of the Hong Kong E-Commerce Logistics Association (HKELA), confirmed transformative changes in Asia's CBEC logistics landscape over the past decade, saying: “E‑tailers are becoming much smarter in terms of shipping.”

According to Lee, rapid CBEC growth over the past decade has engendered a broad range of novel logistics solutions over the conventional international courier and postal services. For instance, most large e‑commerce marketplaces nowadays have their own logistics subsidiaries offering one‑stop door‑to‑door delivery solutions. Others may work with tech‑savvy parcel delivery service providers to improve the speed and cost‑effectiveness of cross‑border delivery, or fourth‑party logistics providers (4PLs) to offer integrated warehousing, fulfilment and inventory management services.

Despite the promising prospects of Asia's e‑commerce market, Lee highlighted some of the growth challenges, like the increasing difficulty of managing diverse logistics arrangements while maintaining cost efficiency and service quality across different markets as the businesses scale. This becomes particularly acute when one has to handle direct‑to‑consumer (D2C), small package shipments.

Lee believes that Hong Kong, which ranked seventh overall in the World Bank’s Logistics Performance Index 2023, as well as second for international shipments, would be the natural choice for international e‑commerce businesses to set up their regional logistics hub, when cross‑border logistics efficiency is a growing concern. Explaining this, he said: “As Asia's centrally located business hub for sourcing, storage, management and distribution, Hong Kong stands out an ideal location for overseas companies managing cross‑border deliveries and returns to use it as a platform to serve and expand into Asia, including mainland China and ASEAN. The city's streamlined customs procedures, excellent multimodal transportation networks and status as an international financial centre also make it an unrivalled springboard to explore the dynamic and diverse Asian e‑commerce universe.”

First, please LoginComment After ~