Global situation of undertakings for collective investment at the end of August 2023

I. Overall situation

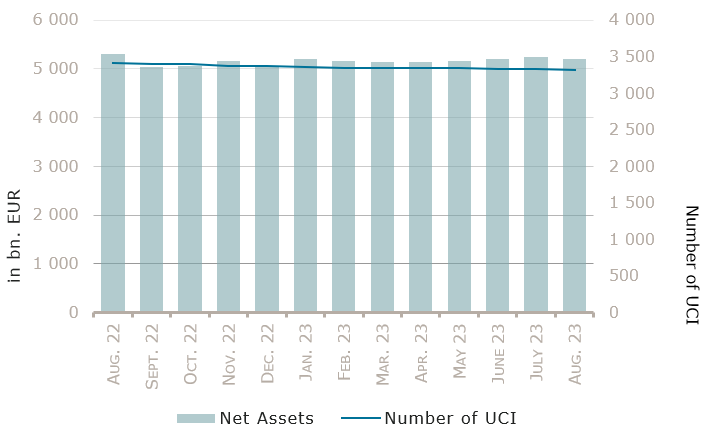

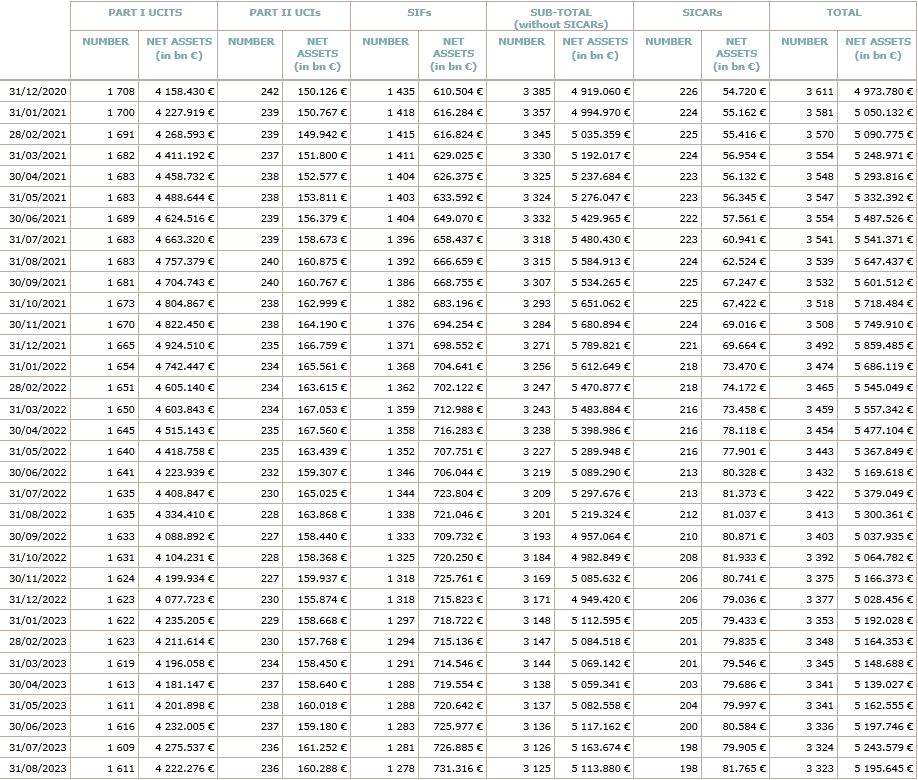

As at 31 August 2023, the total net assets of undertakings for collective investment, comprising UCIs subject to the 2010 Law, specialised investment funds and SICARs, amounted to EUR 5,195.645 billion compared to EUR 5,243.579 billion as at 31 July 2023, i.e. a decrease of 0.91% over one month. Over the last twelve months, the volume of net assets decreased by 1.98%.

The Luxembourg UCI industry thus registered a negative variation amounting to EUR 47.934 billion in August. This decrease represents the sum of negative net capital investments of EUR 4.410 billion (-0.08%) and of the negative development of financial markets amounting to EUR 43.524 billion (-0.83%).

The development of undertakings for collective investment is as follows:

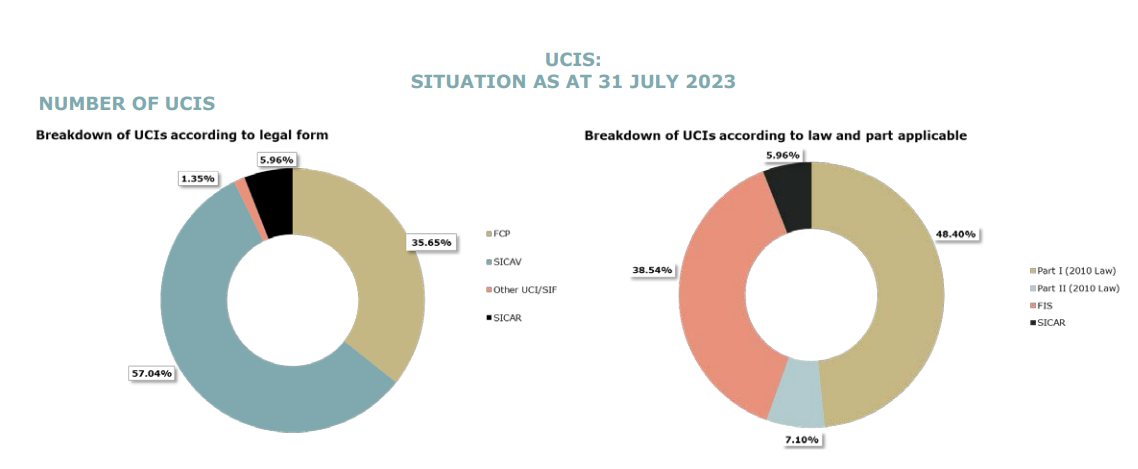

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,323, against 3,324 the previous month. A total of 2,176 entities adopted an umbrella structure representing 13,024 sub-funds. Adding the 1,147 entities with a traditional UCI structure to that figure, a total of 14,171 fund units were active in the financial centre.

As regards the impact of financial markets on the main categories of undertakings for collective investment and the net capital investment in these UCIs, the following can be said for the month of August.

During the month, markets were again focused on inflation, which remained relatively stable at high levels, raising concerns that interest rates would stay higher for longer, regardless of already deteriorating economic conditions. Weakness in the Chinese real estate sector also weighed on market sentiment resulting in an overall increase in volatility and an appreciation of the US dollar against all major currencies.

Against this backdrop, equity markets fell significantly, with China and Emerging markets experiencing the largest declines.

In August, the equity UCI categories registered an overall negative capital investment, mostly driven by the European, Asian and Other equities UCI categories.

Development of equity UCIs during the month of August 2023*

Market variation in % | Net issues in % | |

| Global market equities | -1,62% | 0,12% |

| European equities | -2,37% | -0,55% |

| US equities | -0,72% | 0,11% |

| Japanese equities | -0,71% | 1,00% |

| Eastern European equities | -0,97% | -0,44% |

| Asian equities | -4,99% | -1,54% |

| Latin American equities | -5,00% | 3,28% |

| Other equities | -2,81% | -0,85% |

* Variation in % of Net Assets in EUR as compared to the previous month

Among the few Central Bank monetary policy meetings held in August, the Bank of England increased its policy rate by 25bps, a decision that was widely expected. On the opposite, the Central Bank of China lowered interest rates twice during the month, in a fight against deflation as well as poor economic perspectives notably in the real estate sector.

Furthermore, regarding the US, Jerome Powell said during the annual economic symposium in Jackson Hole that the Federal Reserve will “proceed carefully as we decide whether to tighten further or, instead, to hold the policy rate constant and await further data”.

The above events did however not result in significant changes in yields and in credit spreads during the month.

In that context, most fixed income UCIs reported moderate performance, slightly positive, with the exception of the USD money market and the Emerging market bonds categories, which respectively reported significant positive and negative returns, both mostly explained by conversion effects.

In August, fixed income UCI categories registered an overall positive net capital investment, mostly due to the USD money market UCI category.

Development of fixed income UCIs during the month of August 2023*

Market variation in % | Net issues in % | |

| EUR money market | 0,28% | 0,55% |

| USD money market | 1,51% | 2,09% |

| Global money market | 0,23% | 0,74% |

| EUR-denominated bonds | 0,13% | 0,53% |

| USD-denominated bonds | 0,13% | -3,48% |

| Global market bonds | -0,21% | 0,14% |

| Emerging market bonds | -1,29% | -1,43% |

| High Yield bonds | 0,13% | -0,86% |

| Others | -0,21% | -0,76% |

* Variation in % of Net Assets in EUR as compared to the previous month

The development of net assets of diversified Luxembourg UCIs and funds of funds is illustrated in the table below:

Development of diversified UCIs and funds of funds during the month of August 2023*

Market variation in % | Net issues in % | |

| Diversified UCIs | -0,81% | -0,20% |

| Funds of funds | -0,52% | 0,10% |

* Variation in % of Net Assets in EUR as compared to the previous month

II. Breakdown of the number and net assets of UCIs

During the month under review, the following seven undertakings for collective investment have been registered on the official list:

UCITS Part I 2010 Law:

- CITI FUNDS, 4, rue Albert Borschette, L-1246 Luxembourg

- A.M. UCITS SICAV, 28, Avenue Monterey, L-2163 Luxembourg

- MORRISON & CO SICAV, 3, rue Gabriel Lippmann, L-5365 Munsbach

- UNIEURORENTA UNTERNEHMENSANLEIHEN 2027, 3, Heienhaff, L-1736 Senningerberg

- UNIEURORENTA UNTERNEHMENSANLEIHEN 2029 II, 3, Heienhaff, L-1736 Senningerberg

SIFs:

- ALPHA Z INFRASTRUCTURE EVERGREEN, SCSP SICAV-SIF, 19, rue de Bitbourg, L-1273 Luxembourg

- GIM SPECIALIST INVESTMENT FUNDS II FCP-SIF, 6, route de Trèves, L-2633 Senningerberg

The following eight undertakings for collective investment have been deregistered from the official list during the month under review:

UCITS Part I 2010 Law:

- DEKA: 6, rue Lou Hemmer, L-1748 Luxembourg-Findel

- STURGEON CAPITAL FUNDS, 23, Val Fleuri, L-1526 Luxembourg

- TWELVE CAPITAL FUND, 5, rue Jean Monnet, L-2180 Luxembourg

SIFs:

- EUROPEAN SPECIAL OPPORTUNITIES FUND V FCP SIF, 5, Heienhaff, L-1736 Senningerberg

- GLOBAL REAL ESTATE DEBT PARTNERS – FUND I (UK) SCSP-SIF, 7, rue Lou Hemmer, L-1748 Findel-Golf

- PENNANT REEF SICAV-FIS, 4, rue Thomas Edison, L-1445 Strassen

- WISS LIFE REAL ESTATE MANAGEMENT FUNDS I S.C.S. SICAV-SIF, 4A, rue Albert Borschette, L-1246 Luxembourg

- TOLOMEO SQUAREPOINT FUND S.C.A. SICAV-SIF, 10, rue du Château d’eau, L-3364 Leudelange

First, please LoginComment After ~