China's Going Out Programme: Optimised Outcomes

International business

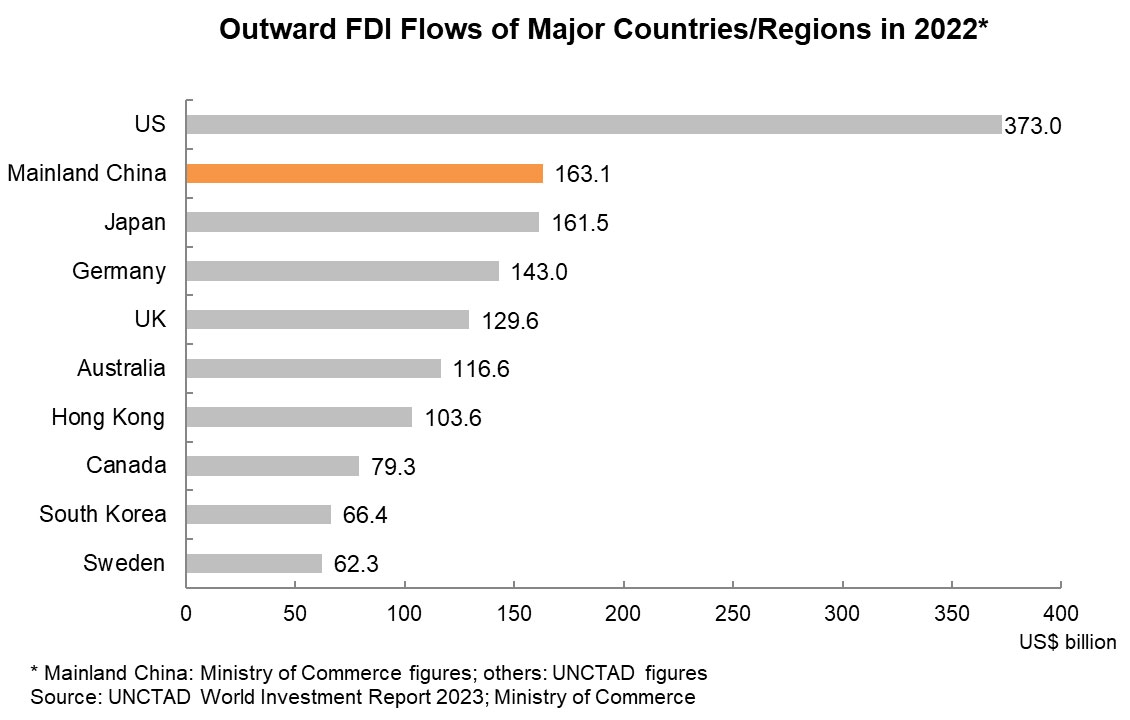

China is now a major exporter of capital in the world. According to a recent report released by the United Nations Conference on Trade and Development (UNCTAD)[1], as well as figures released by the Ministry of Commerce, China’s overall outward foreign direct investment (FDI) reached US$163.1 billion in 2022, making it the world’s second largest source of outward FDI after the United States with US$373.0 billion.

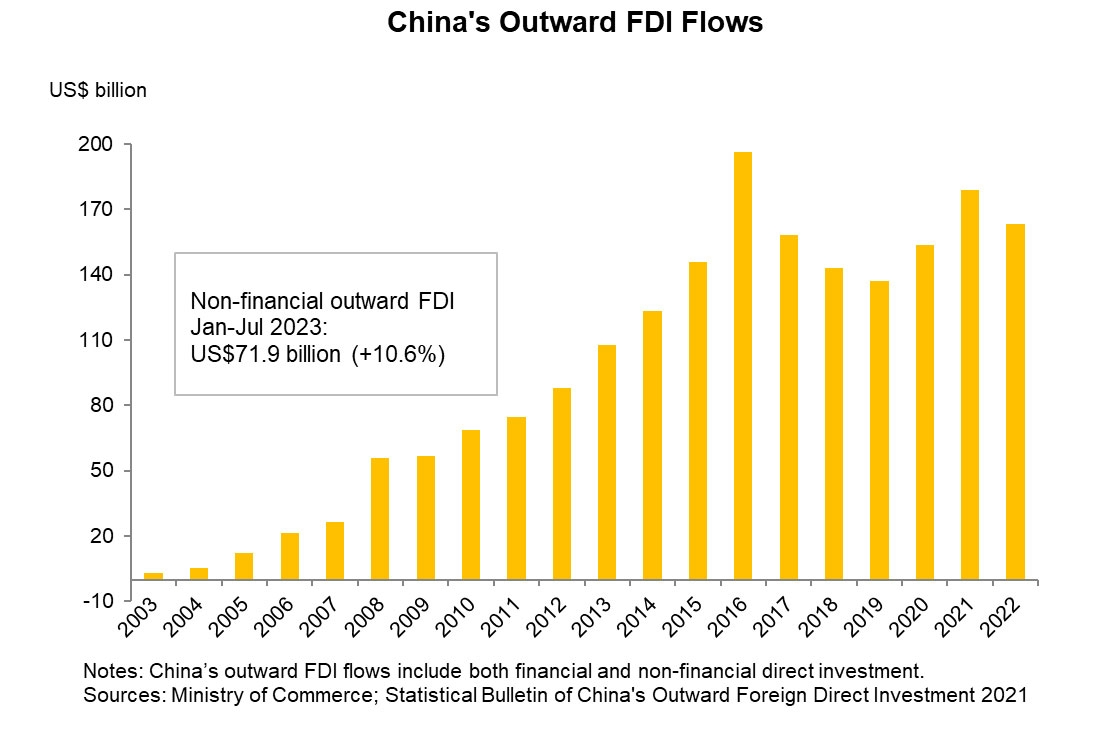

The Covid-19 pandemic affected cross‑border investment activities in 2022, with global outward FDI falling by 13.8%. Mainland enterprises also slowed down their “going out” pace. Ministry of Commerce figures showed China’s overall outward FDI falling by 8.8% in 2022. However, after China’s full relaxation of Covid restrictions in early 2023, these businesses quickly re‑adjusted their development and expansion strategies. They have sought to revitalise overseas projects delayed by the pandemic, and also to capture new opportunities as economic and trade development returns to normal.

Figures released by the Ministry of Commerce show China’s outward FDI continuing to grow from January to July 2023, with non‑financial investment reaching US$71.9 billion, up 10.6% year‑on‑year. Of this, direct investment in BRI countries amounted to US$13.7 billion, up 15.3% year‑on‑year and accounting for 19% of overall non‑financial direct investment during this period.

Despite the global economic downturn, emerging markets such as those in BRI countries in Asia and Africa still show decent growth potential. Thus, many mainland enterprises are turning their eyes to these BRI countries in their “going out” activities. Their plans for investment and marketing and sales projects in these countries have given new drive to international business.

Hong Kong management

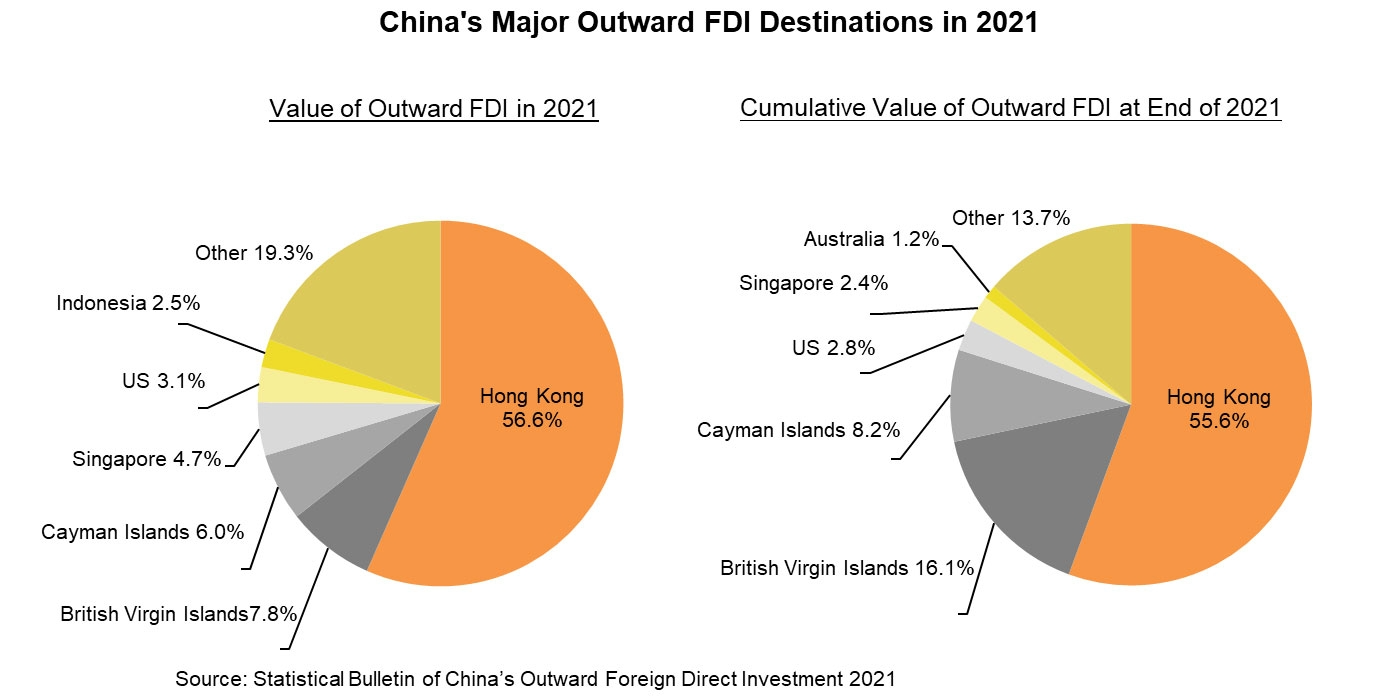

As China’s essential springboard for economic co‑operation with foreign countries, Hong Kong plays a crucial role in the country’s FDI inflows and outflows. Mainland enterprises have always chosen Hong Kong as their service platform for investing overseas and so Hong Kong has become a major destination for the mainland’s outward FDI. In 2021, FDI outflow from the mainland to Hong Kong reached around US$101.2 billion, up 13.5% year‑on‑year and accounting for 56.6% of mainland China’s overall FDI outflow. At the end of 2021, mainland China’s accumulated stock of FDI going to Hong Kong had reached US$1,549.7 billion, up 7.7% year‑on‑year, accounting for 55.6% of the country’s total accumulated stock of FDI.

Although Hong Kong is China’s largest destination of outward FDI, most of the enterprises concerned are mainly using the city as a “going out” platform for investing overseas. The free flow of capital there facilitates foreign exchange and cross‑border fund scheduling, and encourages some mainland enterprises to establish a presence in Hong Kong to handle their business within the territory and in overseas countries.

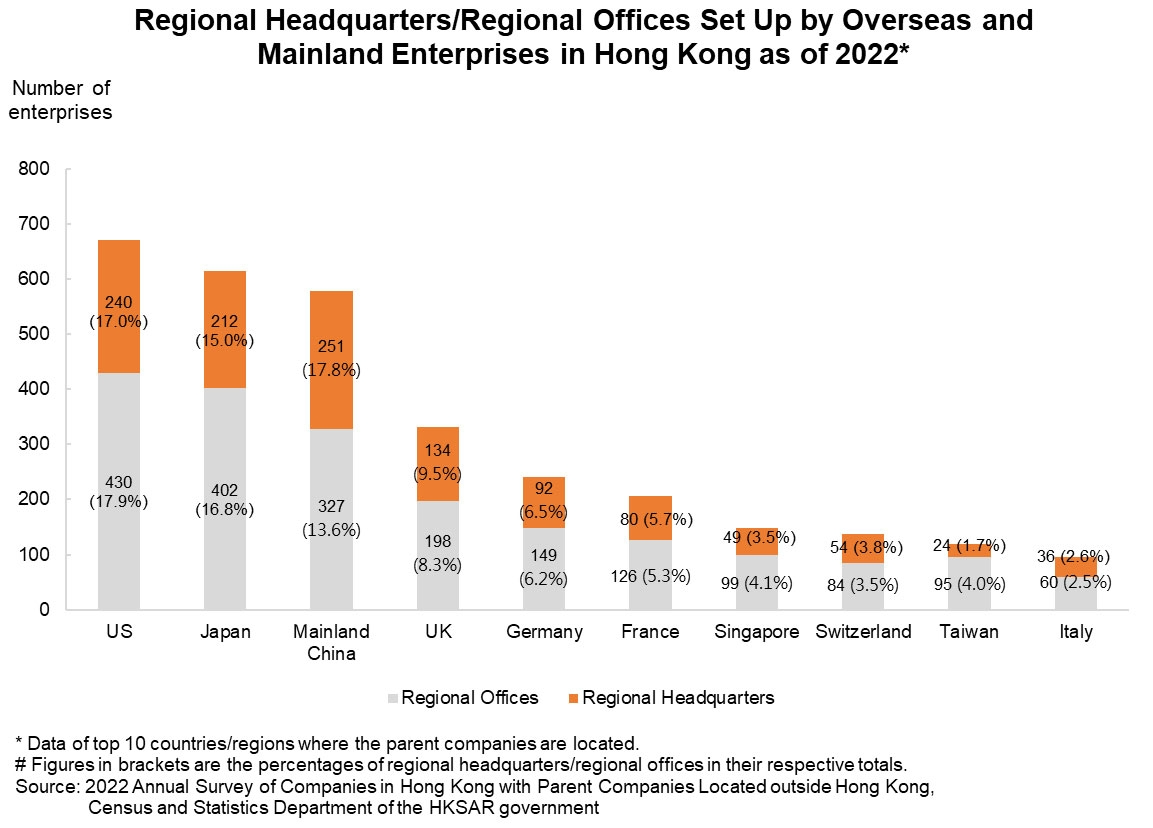

According to figures released by Hong Kong’s Census and Statistics Department, 3,808 overseas companies had regional headquarters and regional offices registered in Hong Kong as of 2022. EU companies accounted for the largest number, followed by those from the US, Japan and the mainland. Mainland enterprises had the highest number of regional headquarters in Hong Kong, with 251 of the total number of 1,411 regional headquarters in the territory in 2022 (17.8%), followed by the US with 240 (17%) and Japan with 212 (15%). Meanwhile, overseas companies had set up 2,397 regional offices in Hong Kong. Mainland enterprises had 327 regional offices in the territory (13.6%), trailing behind the US with 430 (17.9%) and Japan with 402 (16.8%).

The regional headquarters set up by these mainland enterprises in Hong Kong are mainly responsible for managing the operations of their offices in the Asia‑Pacific region, while the regional offices are responsible for co‑ordinating the operations of offices within the region. In addition to the mainland, their business mainly covers the Asian region, including Singapore, Taiwan, Japan, South Korea, Viet Nam and Thailand. They handle a wide range of business activities, including import‑export trade, manufacturing, finance, professional and commercial services, transportation, and storage.

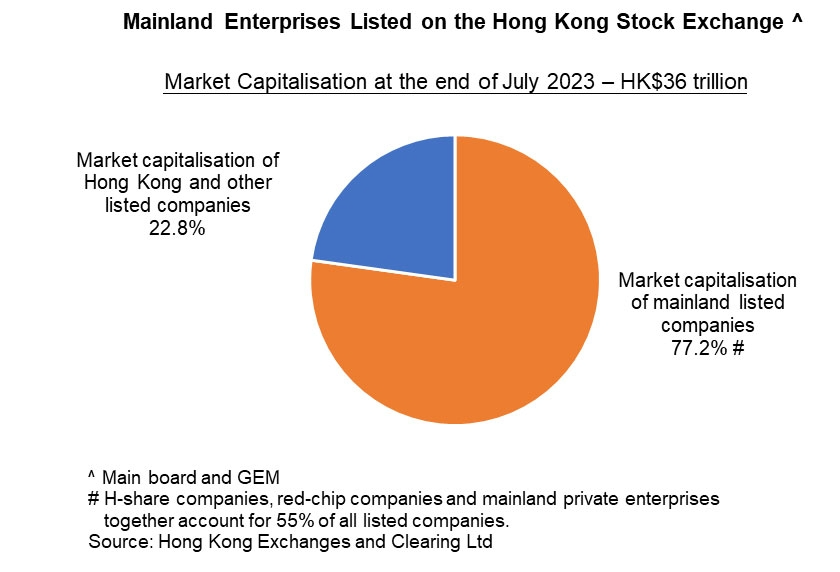

Hong Kong is one of the world’s most important international financial centres. Besides raising funds, Hong Kong’s financial market has international marketisation as one of its characteristics. Without capital control, the high liquidity and lack of capital controls attract many mainland enterprises to the city for fund raising and listing on the Hong Kong stock market. Up to the end of July 2023 1,665 mainland enterprises, including “H‑share companies”, “red‑chip companies” and “mainland private enterprises”[2], were listed on the Main Board and GEM of the Hong Kong Stock Exchange. Their market capitalisation stood at around HK$28 trillion, accounting for a remarkable 77.2%.

In addition to having a sound legal environment and a rigorous regulatory system, Hong Kong has strict requirements for listed companies in areas such as financial statements, auditing, corporate governance, and information disclosure. In order to meet listing standards in Hong Kong a company must be up to international standards in its operation and governance. Hong Kong listing assures a good corporate image, increasing the company’s long‑term value, and attracting the attention of international investors. Thus, when a mainland enterprise goes to Hong Kong for an IPO, it is not just using the city’s capital market resources but is also improving its international reputation and helping it to better negotiate deals with international companies and “go out” for international business deployment.

Recovery opportunities

Since the full relaxation of Covid restrictions, people are once again able to move freely between the mainland and Hong Kong. Economic co‑operation and exchanges have quickly recovered and companies are able to meet with Hong Kong professionals and discuss how they can use Hong Kong’s financial, legal and other services in their international business. Many mainland enterprises are already “going out” to explore overseas markets with their Hong Kong partners.

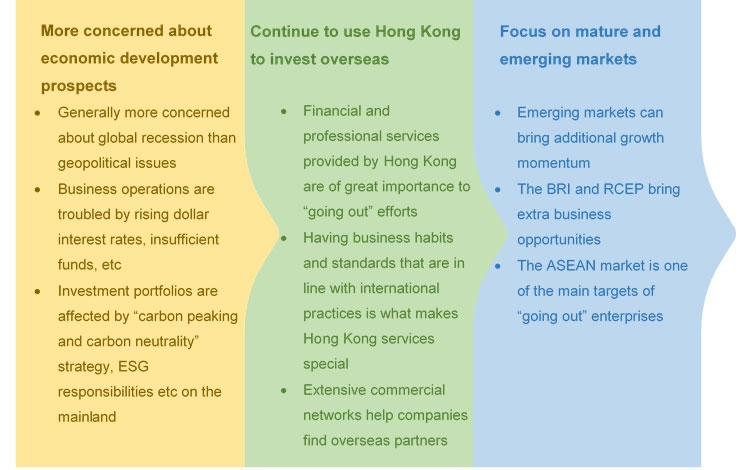

According to a recent joint survey by HKTDC Research and the Shanghai Municipal Commission of Commerce on some of the mainland enterprises with operations in Hong Kong [3], many respondents say they are using Hong Kong’s services in fund raising, financial planning and overseas compliance to meet challenges in their “going out” efforts. They hope that as the economic recovery gathers momentum they will be in pole position to capture market opportunities. The opinions expressed by these respondents are summarised as follows:

Business strategies

Sustainability has become an important issue that mainland enterprises cannot afford to overlook in their efforts to develop international business. The international community attaches increasing importance to the impact of commercial activities on society and the environment and many countries are mapping out sustainability policies and relevant legal requirements. Overseas customers and consumers often take sustainability as an important consideration when buying a product or service. Thus, when mainland enterprises seek to expand overseas they must make sure that their investment and commercial activities comply with the relevant laws and regulations and be able to prove that their products and business comply with the principles of sustainability in order to attract more customers.

Mainland enterprises intending to venture out are increasingly concerned about environmental, social and governance (ESG) requirements and the impact of ESG on their overseas business. A survey shows that close to 90% of enterprises in the Greater Bay Area are planning to invest in ESG‑related projects in the next five years.[4] Moreover, these companies have become issuers of some of the largest sustainability‑linked bonds in Asia. Against this backdrop, mainland enterprises not only need financial, legal and other professional services but also need the support of ESG‑related services. Hong Kong as the largest green finance hub of Asia[5] and a place of best ESG practices[6] can provide them with suitable professional services to ensure the sustainable development of their overseas business through the formulation of comprehensive development strategies.

[1] Source: UNCTAD World Investment Report 2023

[2] “H‑share companies” are mainland‑incorporated companies that are controlled by mainland government entities or individuals. “Red chip companies” are companies that are incorporated outside of the mainland and controlled by mainland government entities. “Mainland private enterprises” are enterprises that are incorporated outside of the mainland and controlled by mainland individuals.

[3] HKTDC Research and the Shanghai Municipal Commission of Commerce interviewed some mainland enterprises in Hong Kong between the end of 2022 and early 2023. For more details, see: Deep Dive of Hong Kong-Active Mainland Companies: Service Sector Opportunities – Joint Research by HKTDC and the Shanghai Municipal Commission of Commerce

[4] Source: “AFF 2022 HKTDC PwC Joint Pulse Survey ‑ ESG Investing: Challenges and Opportunities for Hong Kong”, January 2022

[5] According to the International Capital Market Association, 35% of green and sustainability‑linked bonds issued in Asia in 2022, worth about US$28 billion, were arranged through Hong Kong.

[6] Source: Morningstar Sustainability Atlas, April 2023

First, please LoginComment After ~