HKEX:Development Potential of Offshore Mainland China REITs in Hong Kong

Download → Development potential of offshore Mainland China REITs in Hong Kong

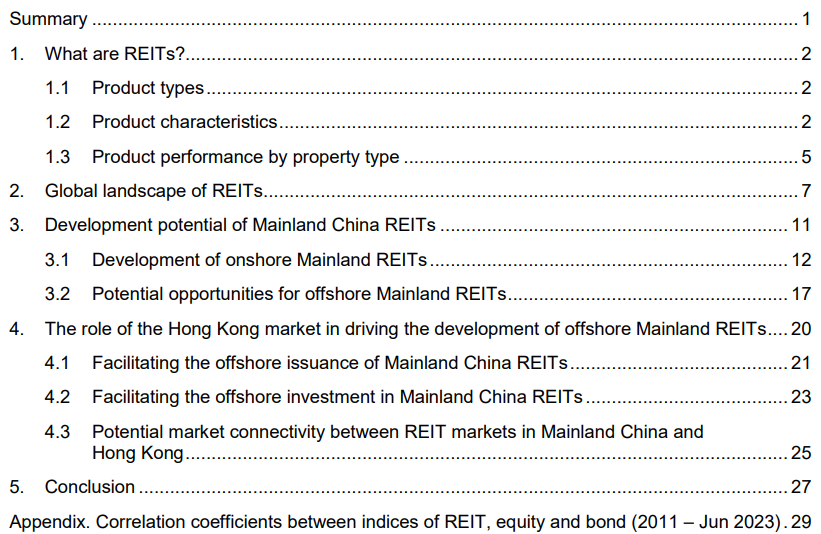

SUMMARY

A real estate investment trust (REIT) is a collective investment scheme that aims to deliver recurrent income to investors through focused investments in a portfolio of income-generating properties.

REITs are usually listed and traded on exchanges. They are an alternative to equities and bonds for investment diversification, offering investors exposure to a wide range of underlying properties of different types that could have different valuations and investment returns. They can be attractive to passive income investors because of their potential for dividend yield. Compared to direct investment in physical properties, the advantages of REIT investments include ease of portfolio diversification, liquidity, flexible scale of investment and cost effectiveness.

The market size and development pace of REITs vary across the world's major listed markets. However, listed REIT markets are still relatively small compared to the respective sizes of the physical property and stock markets. Regulatory regimes may explain why some REIT markets are at different development stages. REIT-specific regulations can include caps on leverage, investment restrictions, dividend payout ratios and tax treatments.

The growth of the global REIT market has promoted the active development of a product ecosystem, including REIT indices and exchange traded funds (ETFs), and this in turn supports the further development of the REIT market.

n Mainland China, the REIT market is at an early development stage, but growing rapidly. The first batch of onshore REITs were listed on the Mainland exchanges in June 2021 under a pilot scheme for public infrastructure REITs. By the end of June 2023, the number of listed REITs had risen to 28. As there are, as yet, no governing laws in the Mainland for REITs, the 2021 pilot scheme serves as a formal REIT regime for the regularised development of the sector. Further ahead, it is expected that the Mainland regulatory regime for REITs will continue to develop to address issuers' concerns, including asset restructuring and acquisitions, constraints on refinancing and tax treatment.

Strong demand from issuers and investors indicates potential upside for the development of Mainland REITs in both onshore and offshore markets. On the issuer side, REITs can provide an alternative funding source for Mainland real estate developers. On the investor side, REITs are attractive investment tools for both global and Mainland investors seeking portfolio diversification and passive income.

The first offshore Mainland REIT was issued in Hong Kong in 2005. Compared to onshore Mainland REITs, offshore Mainland REITs offer greater flexibility of property types and financial leverage for asset owners and diversified exposure to Mainland properties for global investors.

In addition, Hong Kong's well-developed regulatory regime for REITs provides clarity in market regulation and operation for issuers and investors. Recent government initiatives to support the listing of REITs in Hong Kong include subsidies to cover up to 70% of eligible professional services expenses for listing REITs in Hong Kong.

In 2023, Mainland and Hong Kong regulators disclosed that they have started to explore the expansion of market connectivity to include REITs. Referencing the success of the inclusion of ETFs in Stock Connect, mutual market connectivity in REITs is expected to boost product liquidity in both markets as a result of the widened investor base and increased supply as more issuers are attracted to offer REITs in the two markets. This would increase Hong Kong's attractiveness as a global REIT hub and promote the further internationalisation of the Mainland capital market.

First, please LoginComment After ~