MAS Monetary Policy Statement - October 2023

INTRODUCTION

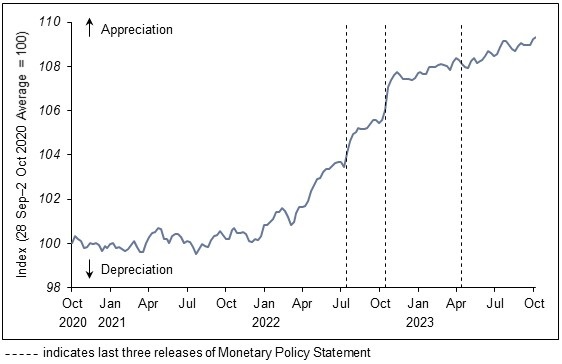

In the April 2023 Monetary Policy Statement, MAS maintained the rate of appreciation of the Singapore dollar nominal effective exchange rate (S$NEER) policy band, with no change to the width of the band or level at which it was centred. Since then, the S$NEER has broadly strengthened in line with the appreciating policy band.

Chart 1

S$ Nominal Effective Exchange Rate (S$NEER)

GROWTH BACKDROP

Global economic activity has moderated reflecting weaker growth in the Eurozone and China, even as the US economy has thus far been resilient. In the near term, global final demand is expected to soften amid elevated interest rates. Nevertheless, the risk of a sharp global downturn, precipitated by financial vulnerabilities, has receded compared to earlier in the year. Growth in Singapore's major trading partners should gradually pick up later in 2024 as inflation continues to ease and the electronics cycle turns up modestly, although the timing and extent of the recovery is subject to significant uncertainty.

MTI's Advance Estimates show that the Singapore economy expanded by 1.0% on a quarter-on-quarter seasonally-adjusted basis in Q3 2023, up from 0.1% in Q2. Growth picked up on the back of an improvement in the manufacturing sector, while activity in some of the domestic-oriented sectors eased. Against the external outlook, prospects for the Singapore economy are muted in the near term but should improve gradually in H2 2024. MAS expects Singapore’s GDP growth in 2023 to come in at the lower half of the 0.5–1.5% forecast range. For 2024, growth is projected to come in closer to its potential rate, with the output gap remaining slightly negative.

INFLATION OUTLOOK

MAS Core Inflation [1] eased to 3.4% y-o-y in August 2023, considerably lower than its peak of 5.5% in January. Inflation has slowed across a broad range of goods and services, including for non-cooked food, food services, travel-related and point-to-point transport services. Core inflation is projected to step down further to between 2.5–3.0% y-o-y by December. For 2023 as a whole, MAS Core Inflation is projected to come in at around 4%, unchanged from last year. Excluding the impact of the GST increase in January this year, however, core inflation will be lower compared to 2022.

CPI-All Items inflation declined to 4.0% y-o-y in August. It is forecast to pick up slightly in the remaining months of 2023 amid higher COE premiums and petrol pump prices. But for the year as a whole, CPI-All Items inflation should average around 5%, down from 6.1% the year before.

In 2024, MAS Core Inflation should be on a broad moderating trend. Although prices of crude oil have risen in recent months, global prices for most food commodities, as well as for intermediate and final goods, should be tempered by favourable supply conditions. Meanwhile, unit labour costs are expected to rise at a slower pace next year alongside the gradually cooling labour market. MAS Core Inflation is projected to slow to an average of 2.5–3.5% for the year as a whole. Excluding the impact of the increase in the GST rate in January, core inflation is forecast at 1.5–2.5%.

CPI-All Items inflation is projected to average between 3.0–4.0% in 2024. Private transport inflation should moderate for the year as a whole, alongside the expected increase in COE quotas. Accommodation inflation should also ease as the supply of completed housing units expands. Excluding the impact of the increase in the GST rate in January, headline inflation is forecast at 2.5–3.5%.

There are both upside and downside risks to inflation. Shocks to global food and energy prices or domestic labour costs could bring about additional inflationary pressures. However, a sharper-than-expected downturn in the global economy could induce a general easing of cost and price pressures.

MONETARY POLICY

Singapore's GDP growth is expected to improve gradually over 2024. However, the global economic outlook remains uncertain and the domestic recovery could be weaker than expected. MAS Core Inflation has slowed and is projected to broadly decline over the course of 2024.

Against this backdrop, the current appreciating path of the S$NEER policy band is assessed to be sufficiently tight. A sustained appreciation of the policy band is necessary to dampen imported inflation and curb domestic cost pressures, thus ensuring medium-term price stability.

MAS will therefore maintain the prevailing rate of appreciation of the S$NEER policy band. There will be no change to its width and the level at which it is centred. MAS will closely monitor global and domestic economic developments, amid uncertainty on both inflation and growth.

MONETARY POLICY STATEMENT SCHEDULE

MAS will be shifting to a quarterly monetary policy statement schedule from 2024. Statements will be released in January, April, July, and October. This is part of MAS’ continuing efforts to enhance monetary policy communications. MAS continues to uphold a medium-term orientation in its policy formulation to secure low and stable inflation. The next monetary policy statement will be released in late January 2024. [2]

***

- [1] MAS Core Inflation excludes the costs of accommodation and private transport from CPI-All Items inflation.

- [2] The January Monetary Policy Statement date will be announced in the Advance Release Calendar of the MAS website on 2 January 2024. A similar process will precede the July Statement, while the timings of the April and October editions remain unchanged, coinciding with the Ministry of Trade & Industry's release of the Advance Estimates.

First, please LoginComment After ~