New Zealand's Surplus Target Implies More Fiscal Consolidation

New Zealand's fiscal space has narrowed following significantly higher debt and slippage of fiscal consolidation targets in recent years amid wider external deficits and weaker growth, says Fitch Ratings. Fitch expects the next government to remain committed to consolidation, but we believe achieving the stated target of fiscal surplus in the fiscal year ending June 2027 (FY27) could be challenging.

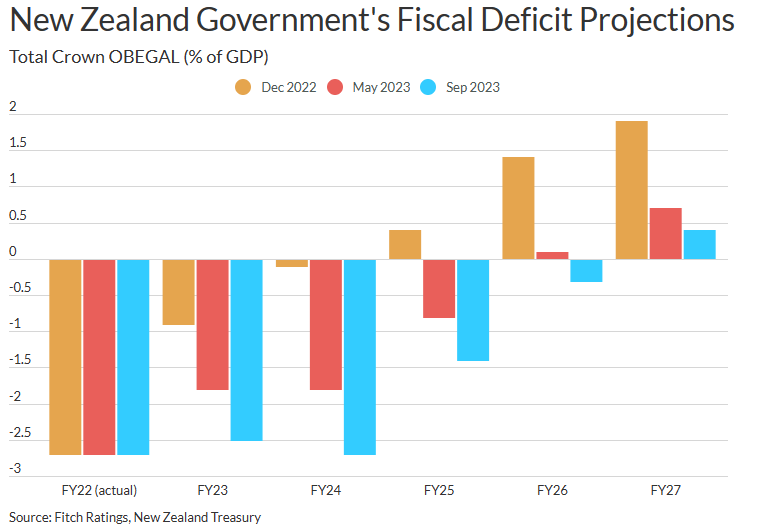

In September’s Pre-election Economic and Fiscal Update, the government forecast a 2023 fiscal deficit of 2.5% of GDP under its preferred fiscal balance metric, the operating balance before gains and losses (OBEGAL). This is significantly wider than its previous 1.8% deficit forecast published in May, as tax revenues have underperformed expectations as the economy slows. The Pre-election Update shows the OBEGAL returning to surplus in FY27, one year later than in May's forecasts.

The latest projections incorporate policy measures identified by the Labour government in August to achieve expenditure efficiencies and boost revenues. However, the Pre-election Update does not entirely set out specific measures to achieve its envisaged deficit reduction, which entails a 1.3% of GDP increase in annual revenue and 1.6% of GDP in spending cuts, and we think reaching a fiscal surplus by FY27 will require further policy actions.

The task of formulating and implementing such measures is likely to fall to a new government after the incumbent Labour Party lost nearly half its parliamentary seats in the 14 October general election. The centre-right National Party was set to win about 50 of 121 seats, making it almost certain to lead an incoming coalition with the free-market ACT party - with potential support from the populist New Zealand First, depending on the final results due on 3 November.

A commitment to return to fiscal surplus and putting the ratio of government debt/GDP on a downward trajectory was an important factor in our affirmation of the sovereign rating at ‘AA+’/Stable on 29 August. There is a long-standing commitment to prudent fiscal policies across the political spectrum, and the National and Labour parties outlined similar fiscal plans in their election campaigns, both pledging to return to surplus by FY27. The National Party has portrayed itself as the party of fiscal responsibility; and while its programme includes some tax cuts (via interest tax deductibility and income tax band adjustment), these are modest and would be funded through expenditure reductions and efficiencies. ACT and New Zealand First appear to be broadly in alignment with National on fiscal policy.

Nevertheless, persistent fiscal slippage (the May target of returning to fiscal surplus in FY26 was itself one year later than previously forecast) and a more challenging macroeconomic backdrop have raised risks to Fitch’s deficit and debt projections at our August sovereign review. Then, we forecast the general government deficit (using the government finance statistics measure rather than the OBEGAL) to narrow to 2.5% of GDP in FY23 and 0.6% by FY26, from 4.6% in FY22. We also expected gross general government debt to peak at about 47% of GDP in FY24. Fitch’s next quarterly forecast update towards end-2023 could incorporate more detailed policy announcements by the next government, for example in December’s mid-year fiscal update or a potential ‘mini-budget’, if available.

We forecast real GDP growth to slow to 0.8% this year and 0.6% in 2024 from 2.7% last year. High-frequency economic data since our August review have been slightly stronger than expected, with New Zealand avoiding a technical recession - due partly to higher-than-predicted immigration. However, adverse terms of trade and tight monetary policy will keep growth subdued until 2025, when we forecast a bounceback to 2.2%.

First, please LoginComment After ~