Capitalising on RCEP and BRI Opportunities: Survey on GBA and YRD Enterprises

HKTDC Research conducted a questionnaire survey in the Greater Bay Area (GBA) and Yangtze River Delta (YRD) region in mid‑2023 to understand the overseas expansion plans of mainland enterprises, the challenges they face, and the services support they need. While cities in the GBA are adjacent to Hong Kong, the YRD is an important economic powerhouse in the mainland, and both regions are China's major sources of outward foreign direct investment (FDI). Guangdong, in which the nine mainland GBA cities are located, registered the highest non‑financial outward FDI flow within mainland China in 2021, accounting for 16.2% of the mainland’s total, followed by Zhejiang, Shanghai and Jiangsu at 15.2%, 15.1% and 10.3% respectively[1]; a similar picture on the outward investment of the mainland’s provinces and cities is painted by the figures for outward FDI stock at the end of 2021.

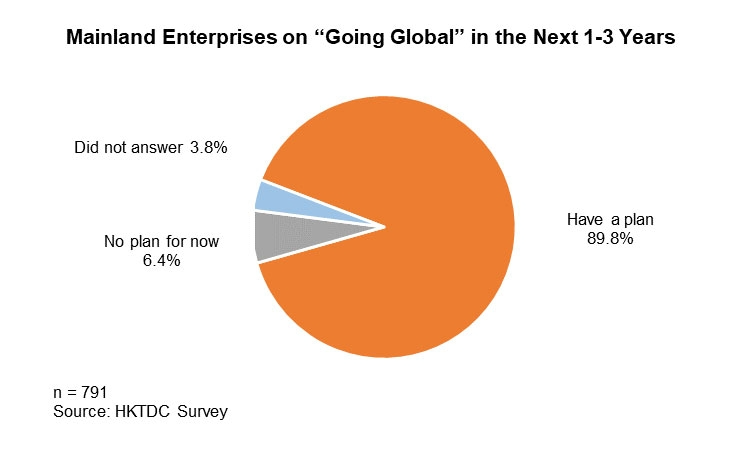

The survey, which covered a total of 791 mainland enterprises operating primarily in the GBA and YRD, found that 83.9% of respondents are facing challenges amid the global economic downturn. The majority of these reported that they are encountering difficulties associated with the pandemic or geopolitical tensions (93.4%), market demand and other economic factors (94.0%), or financing and risks (90.7%). Nevertheless, 89.8% of respondents indicated that they plan to “go global” in the next one to three years. These findings are consistent with the statistics illustrated in Part 2, which show that the mainland’s outward FDI has been on the rise in 2023.

BRI and RCEP

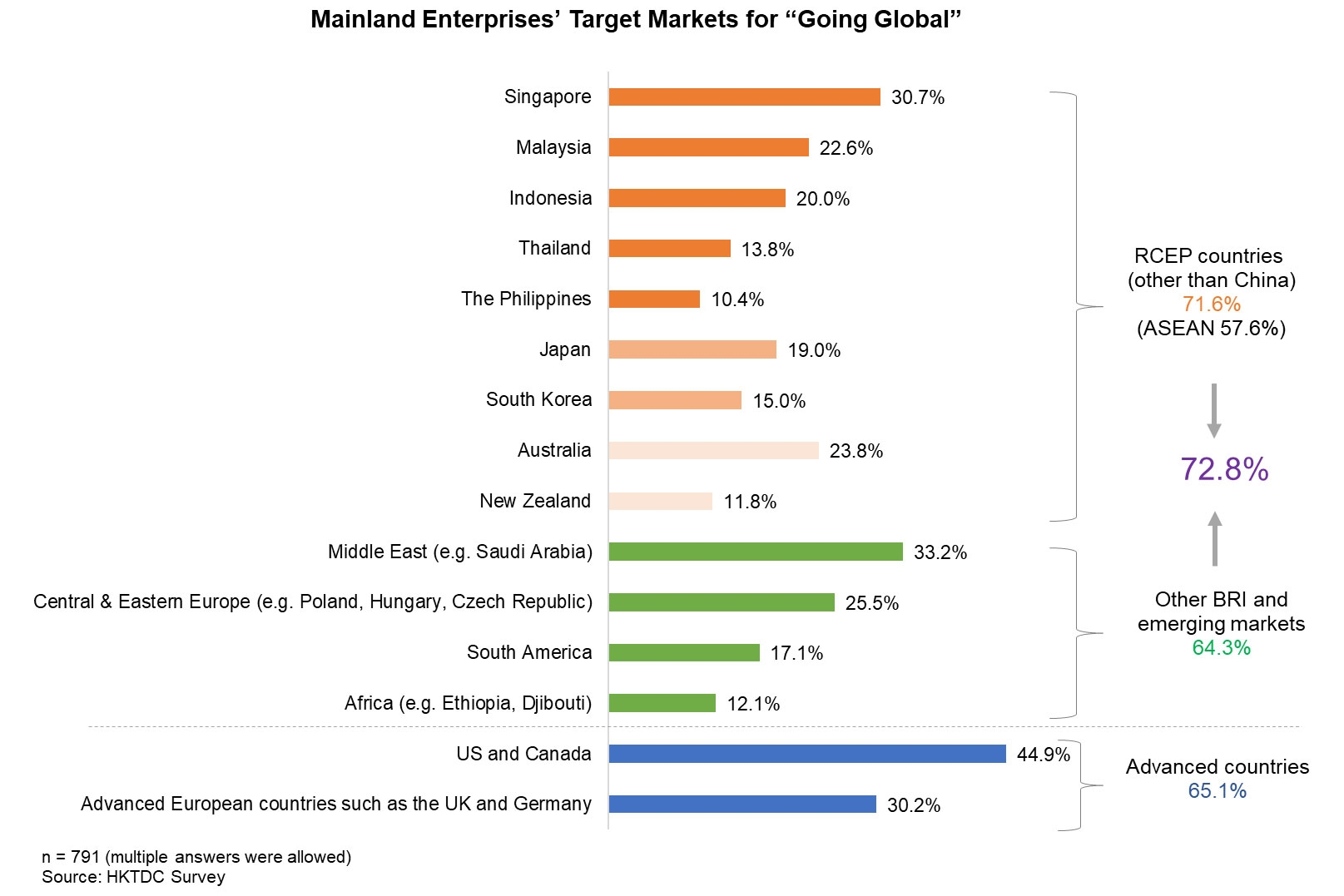

Mainland enterprises are most interested in tapping opportunities in RCEP, BRI and other emerging markets according to the survey. A significant 72.8% of those surveyed said they would like to expand into RCEP (other than China), BRI and other emerging markets. In more specific terms, 71.6% of enterprises are targeting the 14 RCEP signatories other than China, including ASEAN members like Singapore, Malaysia, Indonesia and Thailand (57.6%), as well as Japan (19.0%) and Australia (23.8%). Other BRI and associated emerging markets including the Middle East, Central and Eastern Europe, South America and Africa make up 64.3% of the responses. Meanwhile, 65.1% of respondents intend to explore opportunities in advanced economies in Europe and North America in the next one to three years, including the US and Canada (44.9%) and European countries like the UK and Germany (30.2%).

Key areas

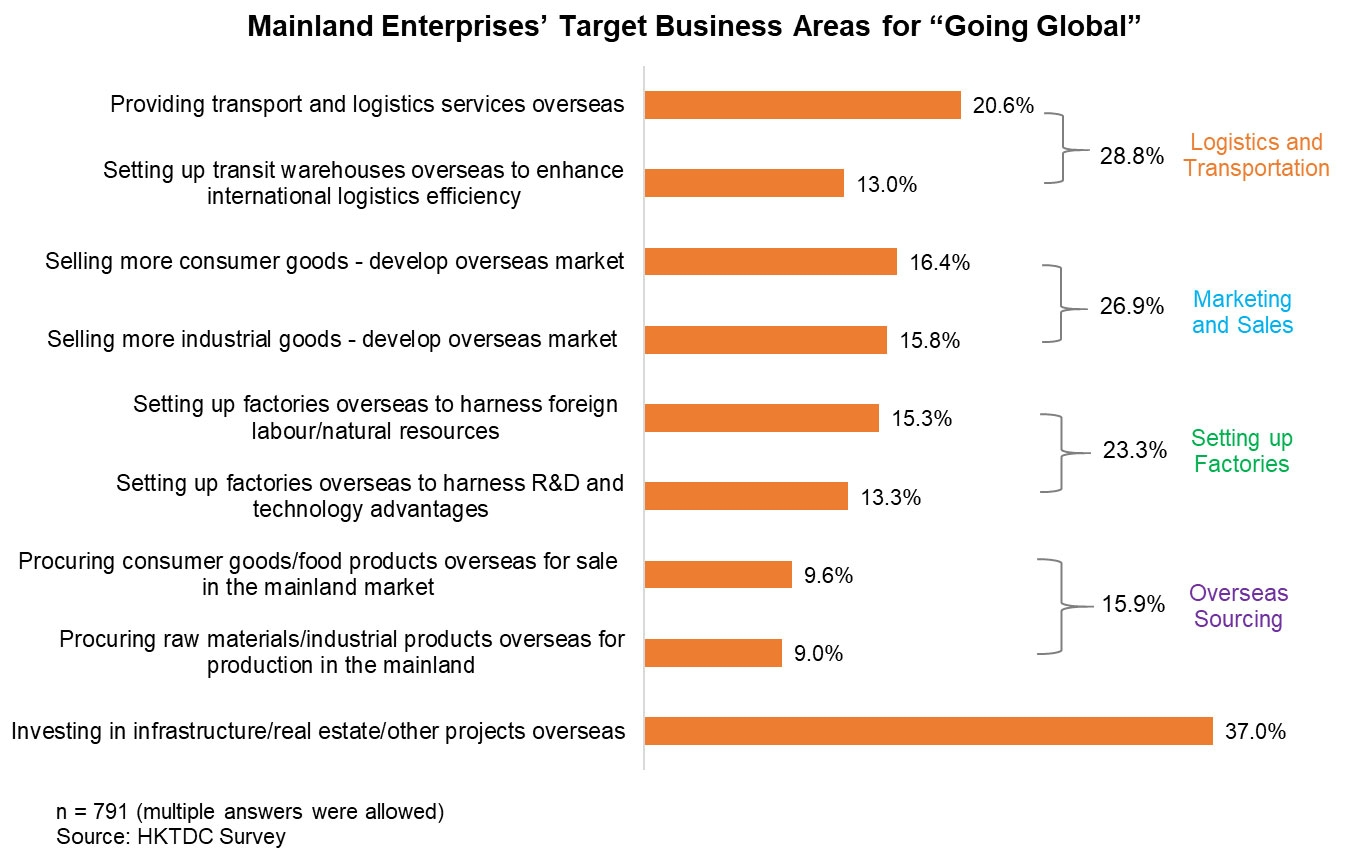

The survey reveals four areas respondents are focusing on in their global expansion plans for the next one to three years: logistics and transportation (28.8%), marketing and sales (26.9%), setting up factories (23.3%) and overseas sourcing (15.9%). While mainland enterprises may have different preferences regarding their “going out” destinations, with some targeting emerging markets like RCEP and BRI countries and others favouring advanced economies, they all show a desire to complement their domestic industrial advantages by accessing overseas resources and supply chains.

In addition, some respondents plan to provide transport and logistics services overseas, set up transit warehouses to enhance international logistics efficiency, or sell more consumer and industrial goods to expand globally. Some hope to set up factories overseas to harness foreign labour or natural resources, as well as R&D and technology advantages. Others plan to procure raw materials or industrial products for production in the mainland, or secure consumer goods and food products for sale in the mainland market. In addition, 37% of respondents plan to engage in other businesses overseas, with a good number of enterprises keen on investing in infrastructure and real estate projects.

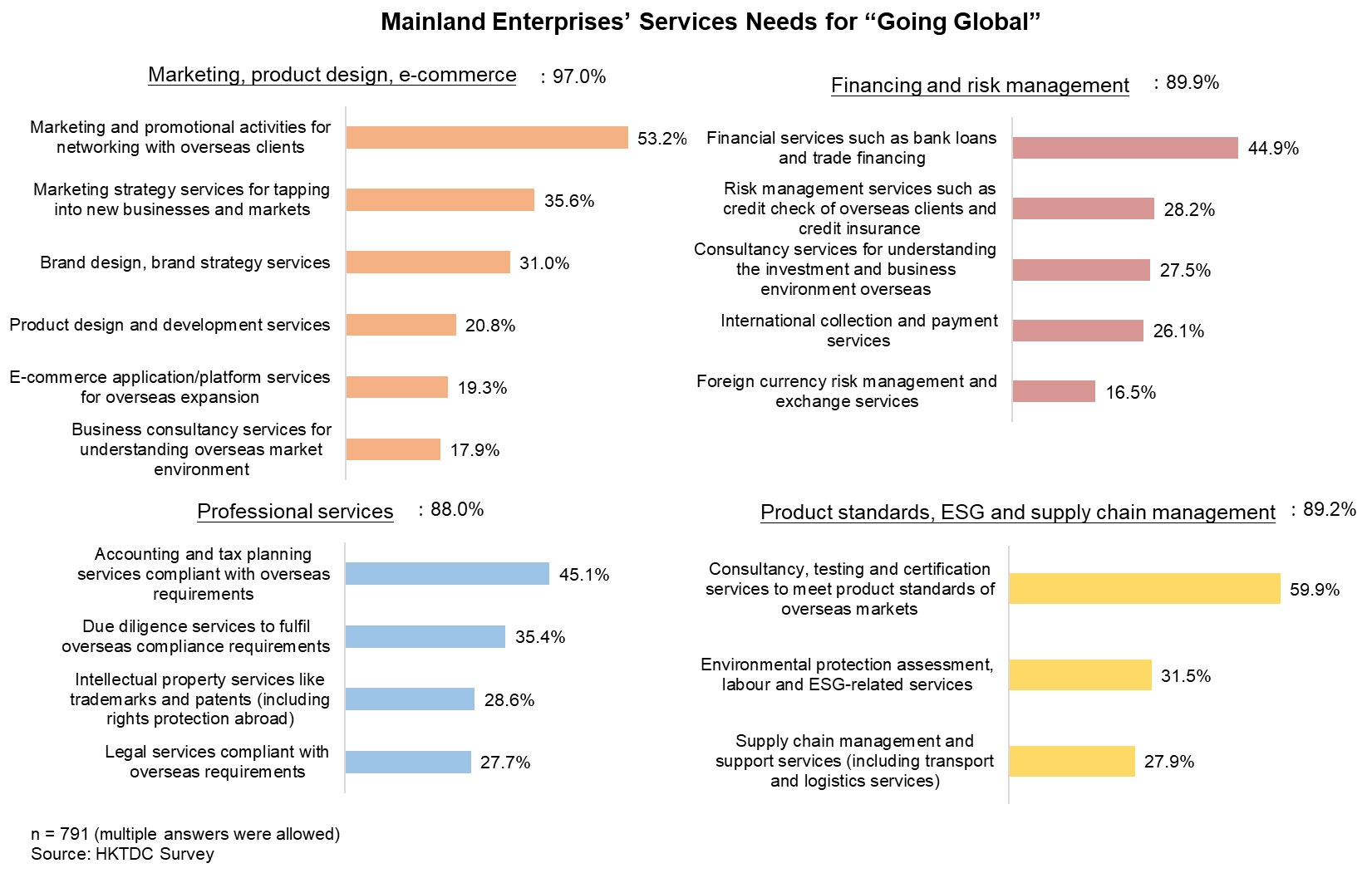

Many respondents who plan to “go global” said they need professional services support to help develop their businesses overseas. Of those, 97% are looking for services on marketing, product design and e‑commerce, particularly marketing and promotional activities targeted at overseas clients. Meanwhile, 89.9% require financing and risk management services, especially financial services such as bank loans and trade financing, whilst 88% seek accounting and tax planning services to ensure they are compliant with overseas requirements. Another 89.2% need services relating to product standards, ESG and supply chain management, with the majority wanting to secure consultancy, testing and certification services to meet overseas product standards.

Hong Kong platform

Hong Kong is the preferred platform for mainland enterprises to “go global”. Of those planning to expand overseas, 62.1% said they would look for professional services support in Hong Kong, while 47.7% said they would opt to find such services in mainland provinces and cities, including Guangzhou, Shenzhen and Shanghai (more than one option could be chosen). Some respondents choose to secure services directly in overseas markets, including Singapore (23.4%), Japan (17.3%) and European and North American countries like the US (23.8%) and Germany (14.2%).

Overall, most GBA‑based respondents see Hong Kong as their preferred service platform, whereas those operating in the YRD tend to use the professional services of both Hong Kong and Shanghai. Of those primarily operating in the GBA, 67.6% said they prefer Hong Kong's services, followed by Guangzhou (33.1%) and Shenzhen (21.3%). Hong Kong is also the top choice for YRD enterprises despite the geographical distance, with 40.1% of YRD respondents choosing Hong Kong’s services, compared to Shanghai and Shenzhen at 36.6% and 31.7% respectively.

In summary, many mainland enterprises are gradually adjusting their “going out” strategies by exploring RCEP and other BRI markets overseas more vigorously. With international standards and a business‑friendly environment, coupled with local service providers that have well‑established global connections and top‑notch professional services, Hong Kong serves as the premier services platform for mainland enterprises looking to capture business opportunities in new and emerging markets. This in turn generates enormous opportunities for Hong Kong service providers.

[1] Source: Statistical Bulletin of China's Outward Foreign Direct Investment 2021

First, please LoginComment After ~