HKTDC ESG Survey: Hong Kong as a Sustainable Business Hub

Key Takeaways

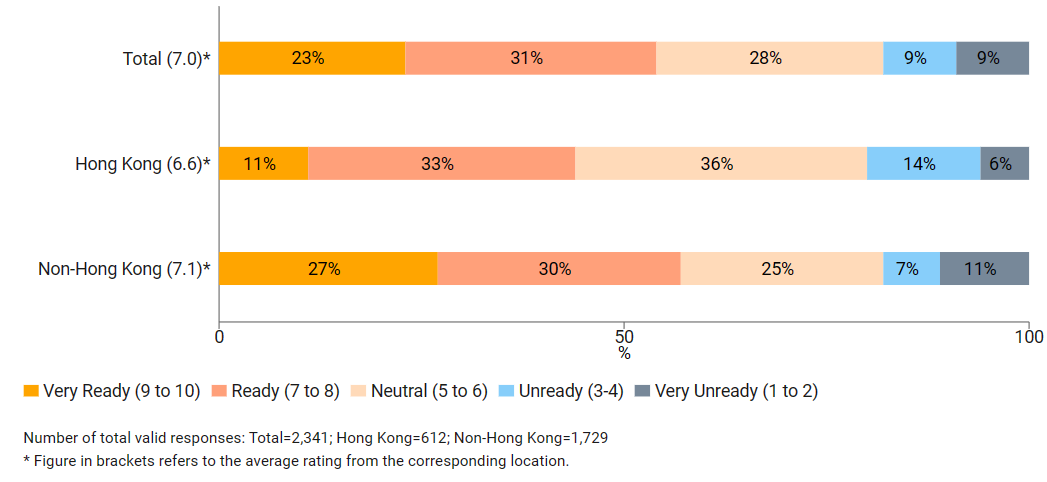

The majority of respondents considered Hong Kong a ready ESG business platform: Survey respondents recognised Hong Kong as a ready platform for ESG businesses, with an average readiness rating of 7.0. Non-local respondents rated higher on the city's ESG readiness than locals.

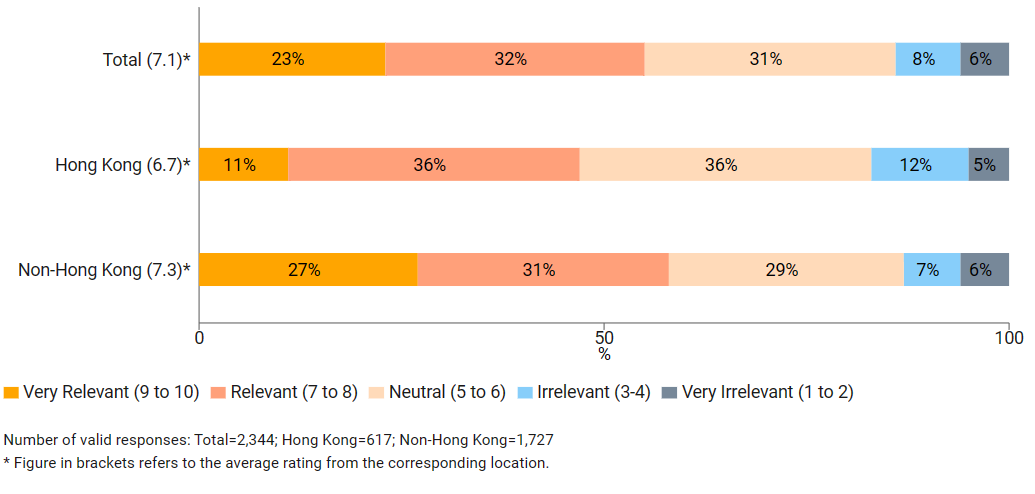

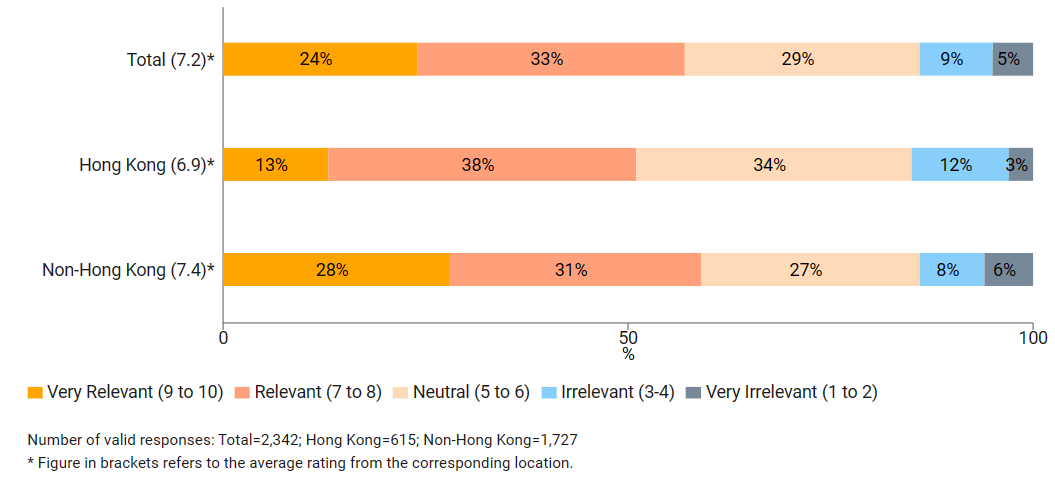

Hong Kong is relevant to current and future ESG strategies: Respondents indicated that Hong Kong is (very) relevant to their current ESG strategies, while anticipating even higher relevance in the future.

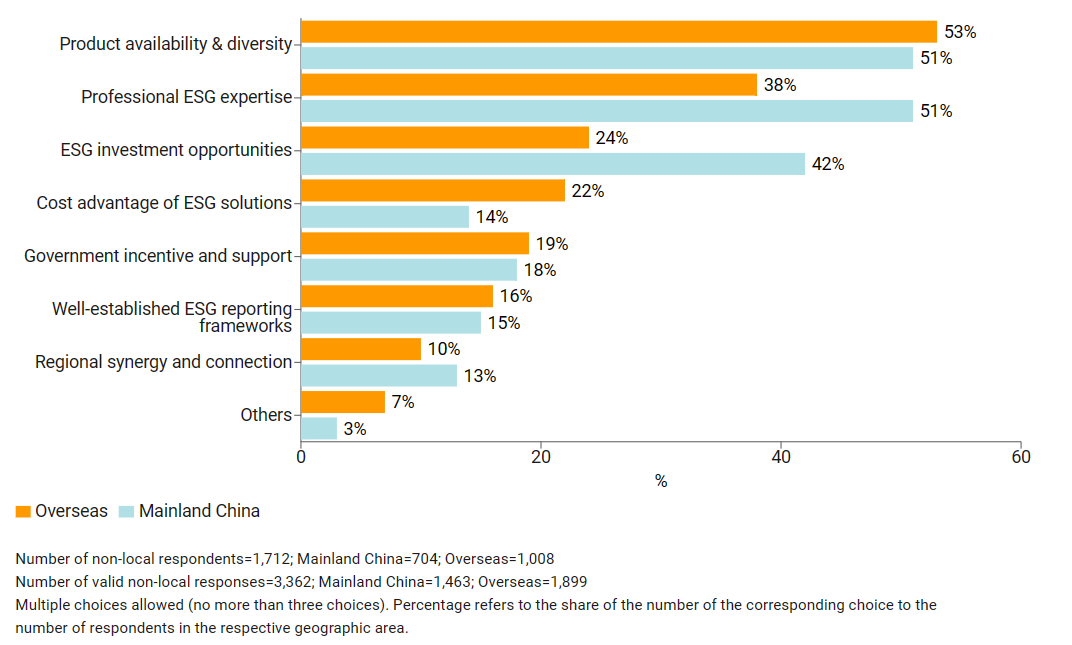

Hong Kong possesses key ESG attributes: Hong Kong's ESG product availability and diversity were seen as the most desirable factors by the majority of non-local respondents, followed by the ready supply of ESG expertise and talent, and ample ESG investment opportunities.

Non-local respondents are more satisfied with Hong Kong's ESG performance: When evaluating the ESG performance of their principal ESG business partners, non-local respondents, in general, gave Hong Kong a higher rating than their other ESG partners.

Introduction

Lessons from extreme weather and climate change have been learned over the years that may help to secure a more sustainable future. Environmental, social and governance (ESG) has increasingly become an indispensable development trend, forcing global businesses into adopting more sustainable practices.

Riding on its position as a well‑established global business and financial hub, Hong Kong has taken the initiative to offer world‑class services and significant opportunities for businesses as they look to meet their ESG needs and goals. This has been supplemented by the city's own ESG strategies, which have been promulgated in a number of different development blueprints, including and Environmental, Social and Governance Reporting Guide, as well as a slew of private‑sector initiatives.

To better understand Hong Kong's role in facilitating sustainable businesses, HKTDC Research conducted a year‑round survey at its events, online and offline, starting in July 2022, which saw more than 2,361 procurement‑oriented companies participating.

Hong Kong as a Ready Sustainable Business Hub

Hong Kong is relevant to current and future ESG strategies

The majority considered Hong Kong relevant to their current ESG strategies. In line with its perceived readiness as a sustainable business platform. On average, non‑local respondents (7.3) saw Hong Kong as having a higher relevance than local respondents (6.7).

Relevance of Hong Kong to Current ESG Strategies

Looking forward, respondents generally believed Hong Kong would continue to be relevant or very relevant to their future ESG strategies – a reading similar to that relating to current strategies.

Relevance of Hong Kong to Future ESG Strategies

Product availability and diversity matter most

As a ready and relevant ESG platform, Hong Kong was seen as possessing a number of desirable attributes for non‑local respondents. Among the many factors contributing to Hong Kong’s ESG strengths, product availability and diversity (such as eco‑design and net‑zero solutions) ranked highest among all non‑local respondents (52%; n=895), followed by the supply of ESG expertise and talent in fields such as green finance, carbon trading, and ESG investing (43%). As for the latter, the approval rating of mainland China respondents (51%) who were said to have relied more on Hong Kong’s ESG expertise and talents over the years was significantly higher than that of overseas respondents (38%).

As an international financial centre, with one of the world’s most active securities and IPO markets, Hong Kong is far from being short on investment innovations and related products. Close to one‑third of non‑local respondents saw the financial advantages of Hong Kong as a key factor underscoring the city's strengths in terms of ESG investment opportunities. This is particularly true for mainland China respondents (42%) as Hong Kong has the world’s most substantial offshore RMB liquidity pool.

Hong Kong's Strengths as an ESG Business Partner for Non-local Respondents

Hong Kong’s ESG products / services highly rated by non-locals

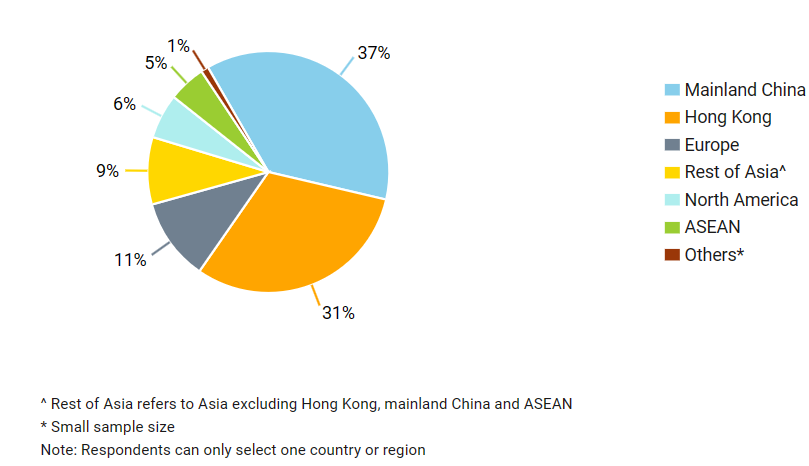

For some 36% of survey respondents, Hong Kong was their principal ESG business partner, followed by mainland China (32%) and Europe (12%). As for non‑local respondents, mainland China was their primary ESG business partner (37%), followed by Hong Kong (31%) and Europe (11%).

Principal ESG Business Partner (All Respondents)

Principal ESG Business Partner (Non-Hong Kong Respondents)

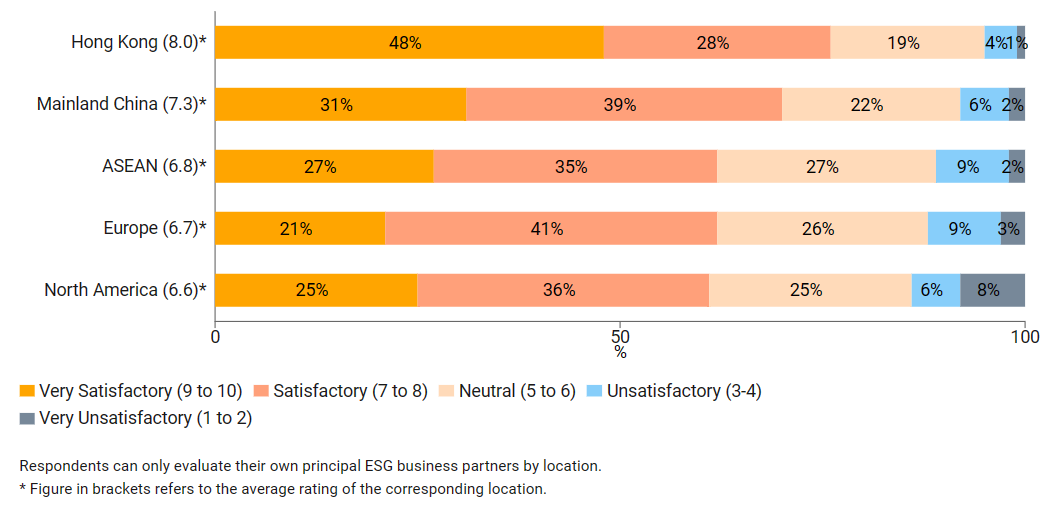

When it came to the ESG performance of their principal ESG business partners, non‑local respondents were more satisfied with their Hong Kong ESG business partners, according them an average rating of 8.0. Mainland China, where of those choosing it as their principal ESG business partner indicated a high level of satisfaction (7 or above), came second with a rating of 7.3.

Performance of Principal ESG Business Partners (by Non-Hong Kong Respondents)

Appendix: Survey respondent profile

The year‑round survey was conducted at some 20 selectedHKTDCevents held between July 2022 and June 2023. To gauge the perception of the development of Hong Kong's ESG competency, only responses from procurement‑oriented respondents were included in the study.

|

Respondents by Event |

Share |

|

International Sourcing Show [1] |

24.1% |

|

Asian Licensing Conference* |

10.6% |

|

HKTDC Hong Kong Watch and Clock Fair / Salon de TE |

10.4% |

|

Toys / Baby Products / Stationery Fairs |

8.5% |

|

HKTDC Hong Kong Electronics Fair (Autumn Edition) / HKTDC Hong Kong International Lighting Fair (Autumn Edition) / electronicAsia |

13% |

|

CENTRESTAGE |

6.7% |

|

Asian Financial Forum |

5.2% |

|

Food Expo / HKTDC Hong Kong International Tea Fair |

3.9% |

|

Belt and Road Summit |

3.9% |

|

HKTDC Hong Kong Electronics Fair (Spring Edition)* / International Lighting Fair (Spring Edition)* / Gifts and Premium Fair* / Home InStyle* / Fashion InStyle 2023* |

3.9% |

|

Business of Intellectual Property (BIP) Asia Forum |

2.5% |

|

ALMAC |

2.0% |

|

International Optical Fair |

1.8% |

|

International Diamond, Gem and Pearl Show* / International Jewellery Show* |

1.7% |

|

Others (Eco Expo / International Wine and Spirits Fair / InnoEx*) |

1.6% |

|

* Events held after the reopening of Hong Kong in February 2023. |

|

|

Respondents by Region / Location |

Share |

|

Mainland China |

29.9% |

|

Hong Kong |

26.7% |

|

ASEAN |

13.6% |

|

Rest of Asia (excluding Hong Kong, Mainland China and ASEAN) |

10.5% |

|

Europe |

9.4% |

|

North America |

3.4% |

|

Middle East and Central Asia |

2.5% |

|

Central and South America |

2.1% |

|

Other |

1.7% |

|

Respondents by Industry |

Share |

|

Electronics and Lighting |

22.7% |

|

Watches and Clocks / Jewellery |

12.2% |

|

Fashion |

9.3% |

|

Toys / Baby Products / Stationery |

8.5% |

|

Gifts and Premium |

7.5% |

|

Houseware |

5.3% |

|

International Trade and Manufacturing |

5.0% |

|

Professional Services |

5.4% |

|

Food and Beverage |

4.5% |

|

Government / Association / Chamber / Institution / Academia / Think Tank |

4.2% |

|

Others (Technology, Optical, Printing and Packaging, etc.) |

7.5% |

|

Unclassified |

8.0% |

[1] The seven exhibitions that comprised theInternational Sourcing Showwere theHong Kong International Lighting Fair (Spring Edition), Hong Kong Electronics Fair (Spring Edition), Hong Kong Gifts and Premium Fair, Hong Kong Houseware Fair, Hong Kong International Home Textiles and Furnishings Fair, Hong Kong International Printing and Packaging FairandHong Kong Fashion Week.

First, please LoginComment After ~