The future of money: a possible role for central bank digital currencies and their implications

Introduction

I would like to begin by thanking the Eastern Caribbean Central Bank and Central Banking for inviting me to speak at this conference. It is an honour to be among esteemed colleagues, sharing insights and knowledge on topical issues. Furthermore, I would like to extend my warmest congratulations to the ECCB on their remarkable work of serving the governments and people of the Eastern Caribbean for the past 40 years.

Central bank digital currencies, or CBDCs, could have far-reaching implications for the monetary system. A decade ago, the idea of CBDCs was not yet being discussed. But in the last few years, CBDCs have drawn the attention of policymakers, academics and the general public. Indeed, CBDCs give central banks the unique opportunity to improve the features of central bank money in the digital economy. The way we pay and store value is evolving, and CBDCs hold the promise of addressing several pressing challenges in our payment systems – such as increasing efficiency and fostering financial inclusion. At the same time, their issuance requires substantial efforts, and depending on their design they could challenge the foundations of monetary economics.

Today, I will shed light on the vital role that CBDCs could play in the ever-evolving financial landscape. I will start by elaborating on the benefits that digital payments, in general, can offer to society. Next, I will discuss the role of CBDCs in supporting policy objectives. I will look at the pioneering work of central banks in the Caribbean and across the Americas, and at some related policy initiatives that could hold lessons for CBDCs. To conclude, I will provide an overview of the role played by the BIS in supporting central banks across the globe to leverage digitalisation and to meet their public policy goals.

Digitalisation and benefits for society

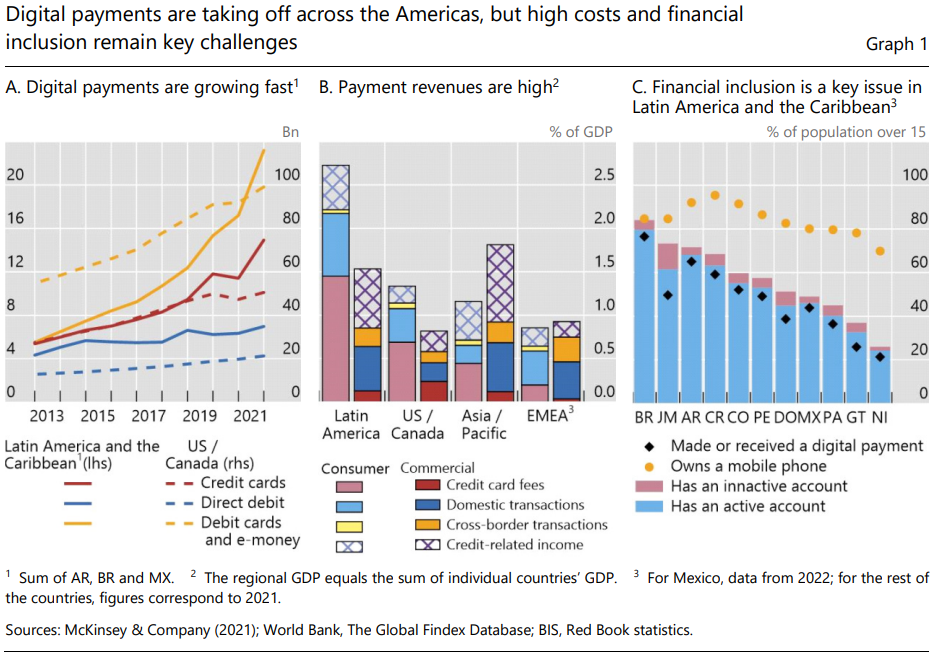

In recent years, we've witnessed a digital revolution in finance. Digital payments are growing fast in the Americas, driven by private sector innovation. Debit cards, credit cards and electronic or mobile money have seen particularly rapid growth (Graph 1.A). The benefits of this wave of digitalisation can be important, given the policy challenges currently in payment systems across the region. While digital payments are taking off, the costs of domestic payments are still high. In Latin America, consumer credit card fees are, in total, over 1% of GDP. Similarly high fees prevail in many Caribbean countries, and in the United States and Canada (Graph 1.B). Additionally, in many countries in the Americas, access to transaction accounts is still limited and use is low (Graph 1.C).

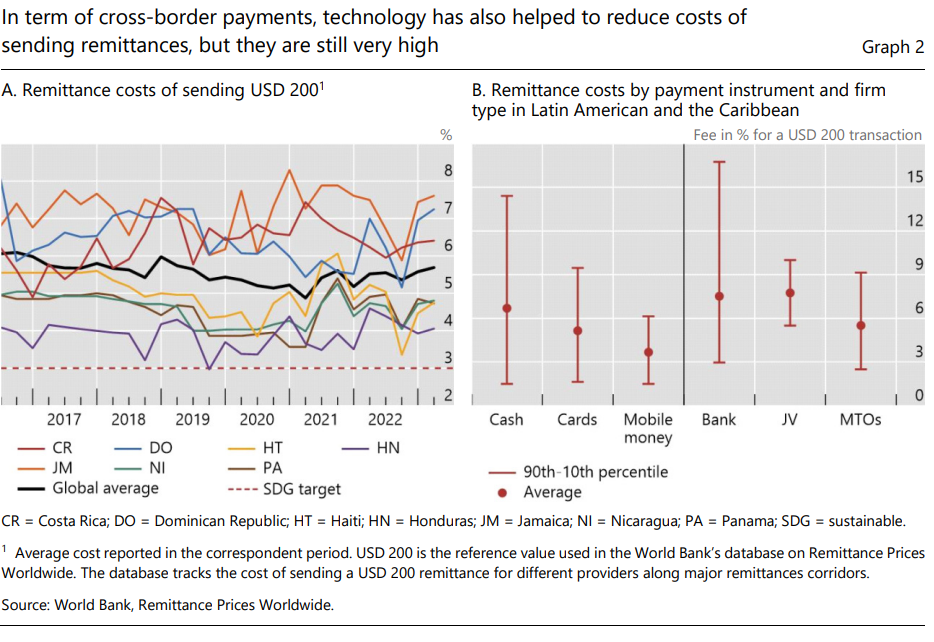

This is the situation at the domestic level, but payments across borders show even greater challenges. To focus on one key area of cross-border payments, the cost of remittances remains stubbornly high – some 4–6% on average, when sending USD 200 (Graph 2.A). Existing digital payment options are cheaper than cash, and new digital providers are cheaper than banks (Graph 2.B). But these costs are still far too high. Moreover, remittance payments can be slow, untransparent and difficult to access for low-income senders and recipients, for whom such payments are particularly important. 2

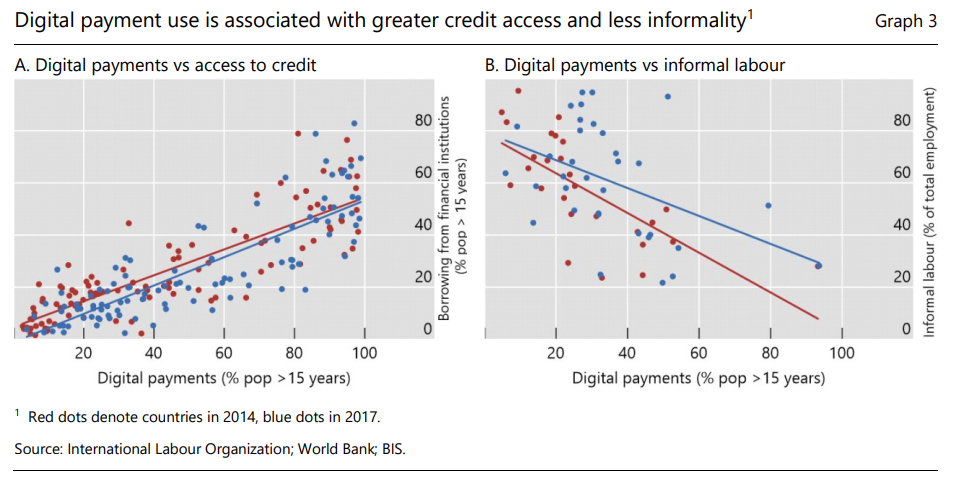

Digitalisation offers a viable solution to the policy challenges in payments, and they can have benefits for the economy as a whole. First, digital payments offer greater efficiency, reducing costs associated with handling cash and making transactions swifter and more secure. Second, they serve as an essential entry point to the formal financial system for the unbanked and underbanked populations. Concretely, digital payments can support economic growth and development by encouraging financial inclusion and improving access to credit. Third, more widespread use of digital payments may encourage unbanked households to open a bank account and enter the formal financial sector. Fourth, greater engagement with the formal financial sector should facilitate borrowing by previously credit-constrained actors. The adoption of digital payments could plausibly affect the informal sector. A widespread use of digital payments may create a “data trail” and help to formalise informal sector firms, thus supporting scale, access to credit and investment. Finally, the use of digital payments for payroll may also help to formalise informal workers, further promoting productivity.

Indeed, in new research by Ana Aguilar, Jon Frost, Rafael Guerra, Steve Kamin and myself, we find that digital payments are associated with greater access to credit (Graph 3.A). Digital payments are also linked to lower informal labour shares (Graph 3.B). A 1 percentage point increase in digital payments use is linked to a 0.06 percentage point fall in the informal labour share, and a 0.10 percentage point increase in GDP growth.3

......

First, please LoginComment After ~