France's Start-up Ecosystem: Prospects and Challenges

The French start-up scene

The Covid-19 pandemic has not slowed down the momentum of the French start up ecosystem. Thanks to the French government’s dedication to developing the nation into a global frontrunner in innovation, France is currently ranked as having the fourth best start up ecosystem in western Europe and the eighth best in the world, according to the Global Startup Ecosystem Index 2023.

On the other side of the world, Hong Kong's start up ecosystem has also demonstrated remarkable resilience. It maintained its growth momentum through 2022, despite the challenges brought about by the pandemic. Hong Kong's start up ecosystem is the most dynamic in Asia, and is ready to work with French start ups, scale ups and even unicorns. Some French unicorns have already successfully established strong footholds in Hong Kong. Examples include Vestiaire Collective, a marketplace for pre owned luxury and fashion items, and Ecovadis, a globally recognised sustainability ratings services agency.

With most, if not all, economies attaching greater importance to the incubation and acceleration of start ups in driving innovation and economic growth, it is crucial to understand how each target market is moving their start up ecosystem forward. To gain a deeper understanding of the French start up ecosystem and explore potential Hong Kong French collaboration, HKTDC Research conducted an in person visit to the French cities of Lille and Nantes in France to gather first hand insights from relevant stakeholders.

Government policies and measures

Government support is crucial in shaping the environment for start ups and entrepreneurial ventures. In France, the national investment and development plan, France 2030, is spearheading the accelerated reindustrialisation of the French economy by focusing on the critical role of industrial and deeptech start ups. Some of the major initiatives and policies offered by the French government to the domestic start up ecosystem are summarised below:

French Tech

The French Tech was established in 2013 with the aim of supporting the development and structuring of the French start up ecosystem. It acts as a platform for the implementation and coordination of public policies. It has three key missions promoting the French start up ecosystem, supporting the growth of technology start ups that align with the nation’s development priorities, and leading the French Tech Capitals and Communities (teams of volunteers who work to energise and encourage the development of the French Tech ecosystem around the world).

The support programmes offered by the French Tech are designed to help companies that align with the French government’s innovation strategy with a comprehensive range of services using available resources from the state. This involves mobilising the French Tech ecosystem of over 22,000 start ups and scale ups and some 4,800 prospective investors, engaging public and private buyers and implementing promotional initiatives. The platform has also launched various programmes in collaboration with other government bodies such as French Tech Next 40/120 and French Tech 2030 to support the growth of the French start up ecosystem.

French Tech Visa

In order to attract global talent, the French government has offered a simplified and accessible visa programme called French Tech Visa. Different types of visas are provided for employees, founders and investors, allowing eligible talent to work and settle in France with residence permits that are renewable for up to four years. The French Tech Visa is designed for individuals coming from countries outside the EU, the EEA and Switzerland. Since its inception in 2017, the programme has helped more than 1,200 companies in France recruit talent from abroad.

Funding and tax incentives

The French government offers financial support to start ups, primarily through Bpifrance, the country’s public investment bank. It offers a wide variety of funding options, including equity investment, loans, guarantees and grants. The bank also provides support measures such as acceleration programmes and international business missions to help start ups and scale ups expand globally.

In 2022 alone, Bpifrance directly invested €726 mn (HK$6.075 bn) in 149 companies through its innovation capital, along with €854 mn in indirect funding into venture funds. It also issued approximately €580 mn in loans to over 1,500 companies through its seed loans schemes.

In addition to the financial support it provides, the French government also boasts one of the most generous tax relief packages in Europe for R&D activities. According to the OECD, France’s implied tax subsidy rate on R&D expenditure for SMEs is 36%, the second highest level in the EU behind only Portugal.

In general, the tax credit rate for qualifying R&D expenditure can be up to 30%, while the rate for innovation expenditure is 20%.

Sectors in focus

Sustainability has emerged as a leading area in innovation, gaining significant attention both locally and overseas. From the France 2030 investment plan budget, aside from decarbonisation, 50% is dedicated to emerging sectors and innovations like foodtech and biopharmaceuticals. The aim is to incubate 100 unicorns (including 25 green unicorns) by 2030. Green tech start ups are increasingly becoming a favourite choice for investors.

In addition to green tech, the French government also plans to invest another €500 mn to create 500 deeptech start ups annually through to 2030 under its France 2030 plan. To drive the creation and growth of deeptech businesses, regional technology hubs in France have established joint consortiums with incubators to help provide comprehensive business and financial support. Examples of these regional hubs include Euratechnologies in Lille (which has raised €24 mn to back deeptech start ups and their expansion in eastern Europe) and Atlanpole in the Pays de la Loire region.

Many incubators and start up clusters in France are operating under public private partnership (PPP) models. For instance, the start up acceleration programme designed by Bpifrance is supported by a number of established French businesses in its efforts to help start ups develop business networks and secure funding. Big corporates are also keen to invest in or acquire start ups that have the potential to enhance their existing businesses, reinforcing the commitment of both the government and the private sector to fostering and supporting entrepreneurial ventures.

The success of start up clusters and incubators in France has drawn the attention of private investors across the world. A thriving cluster with a track record of successful ventures and a supportive ecosystem can instil confidence, encouraging private investors to provide more money for start ups. This virtuous cycle of success, where private funds are attracted to successful clusters, has greatly strengthened the French start up ecosystem and created a conducive environment for entrepreneurial innovation.

Lille – an alternative destination

The French start up scene is heavily centralised. The capital Paris hosts more than 8,000 start ups and its start up ecosystem is ranked by one international start up research service as the best in France and the second best in western Europe after London [1]. However, the city’s high cost of living – the highest in France – is posing a challenge to resource poor start ups.

Just an hour away from Paris, the city of Lille is rapidly emerging as a favourable alternative for start ups. Lille is the capital of the Hauts de France region, and is close (within 300 km) to key business centres, including London, Brussels, Amsterdam, Cologne and Luxembourg.

Much of Lille’s famous textile industry departed overseas in the 1980s. Since then, the city’s economy has been transformed by a combination of cluster development policies and the regeneration of derelict industrial sites. Several of its start up campuses have been converted from disused mill facilities. Lille’s five key start up clusters and incubators, along with the specific sector that they focus on, are listed below:

|

Start-up cluster |

Sector of focus |

|

Digital innovation | |

|

Creative industries | |

|

Healthcare | |

|

Food and nutrition | |

|

Textiles and new materials |

EuraTechnologies was established in 2009. It is a leading technological start up incubator, with four campuses providing workspace for over 300 start ups in Lille. Each year, the incubator welcomes around 200 start up projects across seven domains of digital innovation. These domains are: (i) fintech/assurtech, (ii) retailtech/e commerce, (iii) proptech, mobility and smart city, (iv) agritech/greentech, (v) edtech/hrtech, (vi) industry, robotics and spacetech and (vii) cybersecurity.

The incubator organises over 500 networking and educational events every year, which have helped raise over €500 mn since 2009. With the help of generous public funding, EuraTechnologies is able to provide start ups with a year of incubation and six months of acceleration services, all free of charge.

In order to attract global talent, the incubator has a special team to help international start ups looking to expand in France. According to EuraTechnologies, approximately 30% of the founders of its residents (including current ones and those that have graduated from it) come from abroad, the majority from Europe and North Africa. Investors have shown increased interest in green tech start ups, which have in the recent past accounted for the lion’s share of the investment in EuraTechnologies.

One important testimony to the achievements of the incubator is the impressively high survival rate of its start‑ups, with around 80% of them still remaining active after five years of incubation. This is largely due to Euratechnologies’ strong support for start‑ups’ long‑term success.

Challenging funding environment

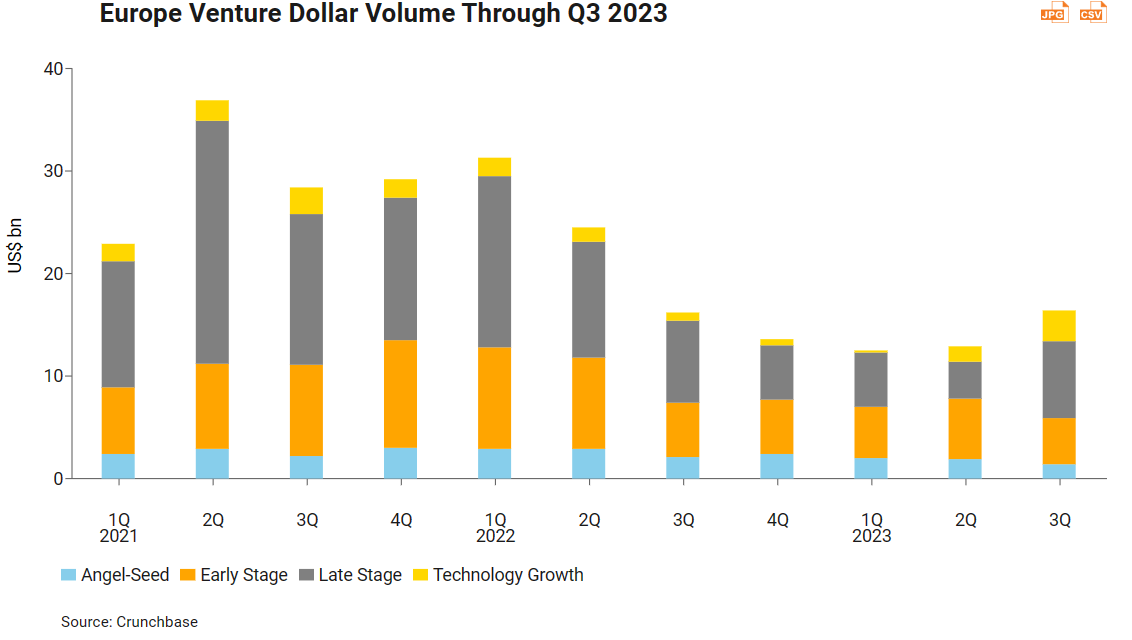

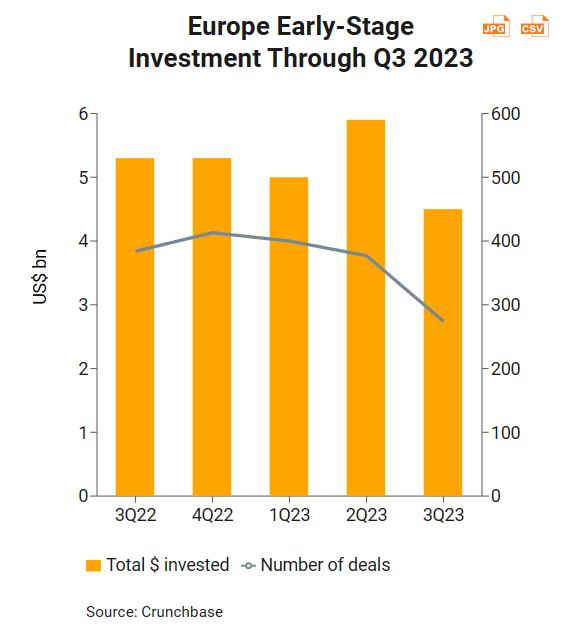

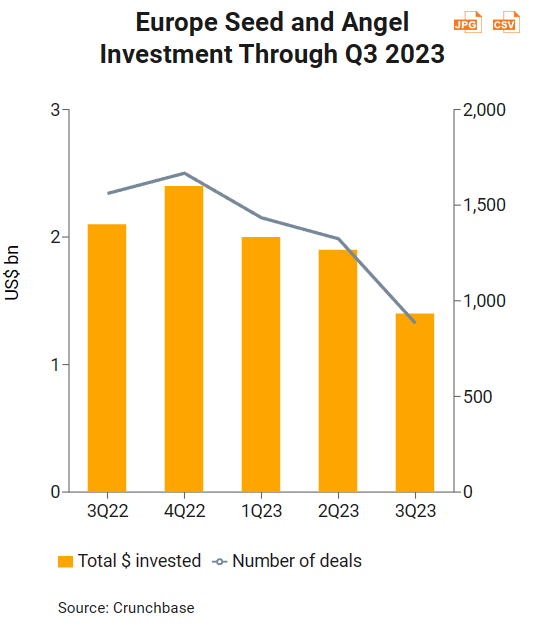

Securing funding has always been a major headache for start‑ups, and this is particularly difficult now with the macroeconomic environment hit by high inflation, tight credit, the global economic slowdown, and a reduced appetite for risk. The collapse of Silicon Valley Bank has also had a major adverse effect on funding. The momentum of European venture investment has been sluggish in recent quarters, despite a slightly better performance since Q3 2023, and France has been no exception to this trend.

Euratechnologies believes that venture capitals (VCs) and investors were previously more attracted to investing in innovative high‑risk business models and placing greater emphasis on larger potential markets. Now, however, their focus has shifted towards projects that can demonstrate quick profit‑generating or revenue‑enhancing potential. In other words, investors have become more selective regarding start‑ups and their business models and innovations. They are becoming less willing to invest in early‑stage start‑ups, which typically involve higher risks, and are instead looking towards start‑ups that have already established a more consistent customer base and a more reliable source of income.

Hong Kong-France crossovers

When it comes to start‑ups, both Hong Kong and France have their own strengths. For instance, in 2023, Hong Kong (together with Shenzhen and Guangzhou) was ranked the world's second‑best science and technology cluster in the Global Innovation Index (GII), and Paris was ranked 12th. France, meanwhile, was ranked the 11th most innovative economy in the same study, whereas Hong Kong was placed 17th. In short, Hong Kong excels in the input pillars, while France performs better in knowledge and technology output. Crossovers such as the French Tech Hong Kong-Shenzhen, which is part of the French Tech network communities, can help French tech start‑ups explore partnership opportunities and investments in Hong Kong, Shenzhen and the rest of the Greater Bay Area (GBA).

HK-CN-FR Innovation Index Ranking

|

2023 Top S&T clusters |

2023 World Innovation Index | |||||

|

Rank |

S&T Cluster |

Rank |

Hong Kong |

Mainland China |

France | |

|

1 |

Tokyo-Yokohama |

Overall |

17 |

12 |

11 | |

|

2 |

Shenzhen-Hong Kong-Guangzhou |

Input | ||||

|

3 |

Seoul |

Institution |

8 |

43 |

27 | |

|

4 |

Beijing |

|

Human capital & research |

15 |

22 |

17 |

|

5 |

Shanghai-Suzhou |

|

Infrastructure |

9 |

27 |

22 |

|

6 |

San Jose–San Francisco, CA |

|

Market sophistication |

2 |

13 |

9 |

|

7 |

Osaka-Kobe-Kyoto |

Business sophistication |

28 |

20 |

17 | |

|

8 |

Boston–Cambridge, MA |

|

Output | |||

|

|

. |

Knowledge & technology outputs |

51 |

6 |

16 | |

|

12 |

Paris |

|

Creative outputs |

3 |

14 |

6 |

France and Hong Kong are both able to act as regional business centres and leading destinations for innovation and investment for start ups looking to expand in each other’s continent.

In general, start up ecosystems in France are open to foreign investment. But tight capital and manpower may hinder their incentive to give it a try. In terms of market demand, particularly in the sustainability related fields, French start ups often enjoy high demand from local and nearby European markets, which again may reduce their appetite to look for markets further afield.

To address this, platforms like InnoEx – a premier platform for smart city innovation and tech commercialisation through forums, exhibitions, product launches, networking events and so on in Hong Kong – could be an excellent first port of call for French start ups looking to showcase their innovative solutions to prospective Asian investors and partners.

While France has a vibrant start up ecosystem and significant market potential for green solutions, some of its green tech start up incubators have recognised that language can sometimes pose a challenge when it comes to Asian collaboration. Having a good command of French would help Hong Kong stakeholders and practitioners trying to navigate the French business and start up landscape, while promoting Hong Kong as the premier gateway for French start ups looking to explore the many opportunities in mainland China and the wider Asia Pacific region.

First, please LoginComment After ~