Global situation of undertakings for collective investment at the end of October 2023

I. Overall situation

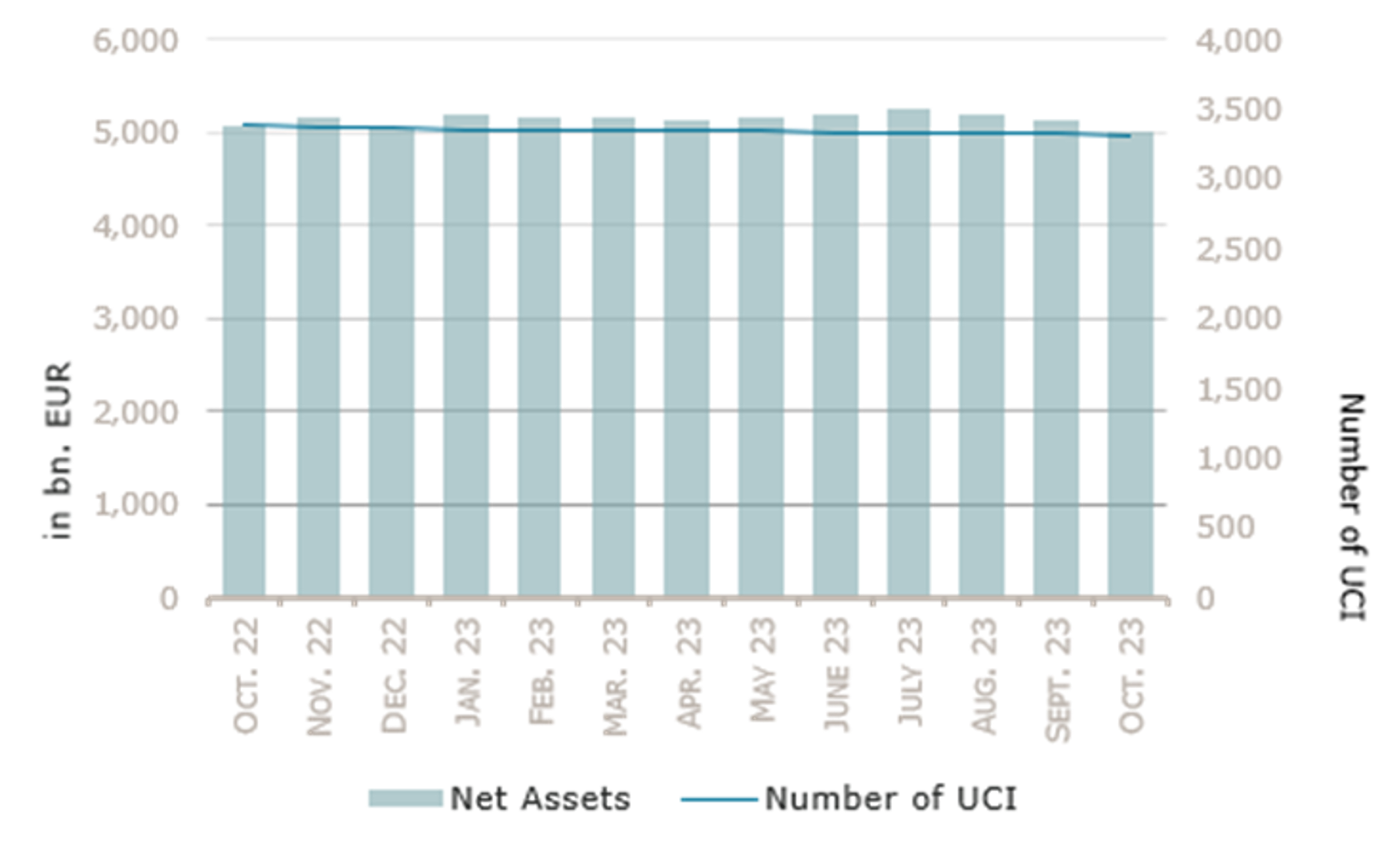

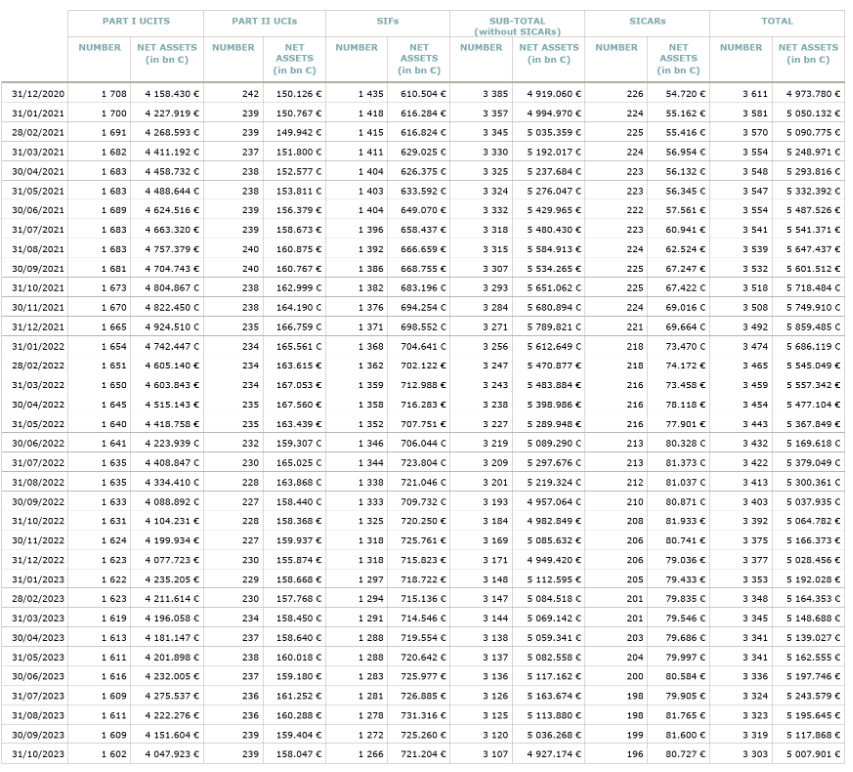

As at 31 October 2023, the total net assets of undertakings for collective investment, comprising UCIs subject to the 2010 Law, specialised investment funds and SICARs, amounted to EUR 5,007.901 billion compared to EUR 5,117.868 billion as at 30 September 2023, i.e. a decrease of 2.15% over one month. Over the last twelve months, the volume of net assets decreased by 1.12%.

The Luxembourg UCI industry thus registered a negative variation amounting to EUR 109.967 billion in October. This decrease represents the sum of negative net capital investments of EUR 10.384 billion (-0.20%) and of the negative development of financial markets amounting to EUR 99.583 billion (-1.95%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,303, against 3,319 the previous month. A total of 2,159 entities adopted an umbrella structure representing 12,914 sub-funds. Adding the 1,144 entities with a traditional UCI structure to that figure, a total of 14,058 fund units were active in the financial centre.

As regards the impact of financial markets on the main categories of undertakings for collective investment and the net capital investment in these UCIs, the following can be said for the month of October.

All the major equity markets posted significantly negative performances in October, mainly caused by indicators showing a resilient US economy, which raised concerns that the Fed might delay its first interest rates cut or increase rates further, whereas economic indicators for Europe are pointing to a possible recession. The outbreak of the Israel-Hamas conflict also negatively impacted investor confidence driving flows into less risky assets amid fears of a revival of the geopolitical tensions in the Middle East.

In October, all the equity UCI categories registered a negative capital investment.

Development of equity UCIs during the month of October 2023*

Market variation in % | Net issues in % | |

| Global market equities | -3,73% | -0,36% |

| European equities | -3,41% | -1,20% |

| US equities | -3,41% | -1,53% |

| Japanese equities | -4,23% | -2,65% |

| Eastern European equities | 1,89% | -3,64% |

| Asian equities | -3,90% | -1,70% |

| Latin American equities | -5,22% | -3,14% |

| Other equities | -3,69% | -0,49% |

* Variation in % of Net Assets in EUR as compared to the previous month

The above-mentioned economic indicators combined with the events that occurred in the Middle East drove yields and spreads higher, resulting in losses for most bond UCI categories.

With respect to monetary policy, ECB decided to keep its interest rates unchanged, after 10 consecutive hikes since July 2022, while not excluding the possibility for further rates hikes.

In October, fixed income UCI categories registered an overall positive net capital investment, with significant inflows for all the money market UCI categories and for the USD-denominated bonds UCI category.

Development of fixed income UCIs during the month of October 2023*

| Market variation in % | Net issues in % | |

| EUR money market | 0,09% | 3,68% |

| USD money market | -0,15% | 3,96% |

| Global money market | -0,39% | 3,34% |

| EUR-denominated bonds | 0,38% | -0,25% |

| USD-denominated bonds | -1,24% | 1,99% |

| Global market bonds | -0,77% | -0,43% |

| Emerging market bonds | -1,16% | -1,35% |

| High Yield bonds | -1,27% | -1,44% |

| Others | -0,90% | -0,62% |

* Variation in % of Net Assets in EUR as compared to the previous month

The development of net assets of diversified Luxembourg UCIs and funds of funds is illustrated in the table below:

Development of diversified UCIs and funds of funds during the month of October 2023*

Market variation in % | Net issues in % | |

| Diversified UCIs | -1,94% | -0,72% |

| Funds of funds | -1,60% | -0,07% |

* Variation in % of Net Assets in EUR as compared to the previous month

II. Breakdown of the number and net assets of UCIs

During the month under review, the following two undertakings for collective investment have been registered on the official list:

UCITS Part I 2010 Law:

- COLLECTION, 15, avenue J-F Kennedy, L-1855 Luxembourg

SIFs:

- DIVERSIFIED PRIVATE MARKETS FCP – SIF, 6A, rue Gabriel Lippmann, L-5365 Munsbach

First, please LoginComment After ~