FDI screening mechanism in Belgium

On the 1st of July 2023, the European screening mechanism for foreign direct investments (FDI) came into force in Belgium. This may have an impact on investments into Belgium by Chinese companies or individuals. At the occasion of a webinar hosted by the BCECC on the 26th of October, two speakers from the Ministry of Economy of Belgium introduced the procedures, followed by a presentation by Mr. Jan Bogaert, Partner-Lawyer of the law firm Stibbe and board member of the BCECC.

A European framework

For a long time, foreign direct investments have been an important driver for economic growth in Europe and Belgium. However, geopolitical evolutions have raised concerns regarding the impact that such investments can have on national security, public order and strategic interests.

Therefore, in March 2019, the 2019/452 EU Regulation was issued, establishing a framework for the screening of foreign direct investments by non-EU investors (both companies and individuals) into the EU Member States. The EU encouraged its member states to incorporate FDI screening mechanisms into their national legislation. Countries such as Germany and France already implemented this screening mechanism a few years ago. Smaller member states, such as Belgium and the Netherlands, have adopted the FDI screening mechanism only recently. Today, 21 of a total of 27 EU Member States have implemented a screening mechanism.

In 2021, 1563 transactions were screened by EU member states in total, of which (41%) originated from the USA, followed by the UK (11%) and China (7%) on second and third place respectively. Ultimately, only 1% of transactions was blocked and 3% withdrawn.

Conditions and procedures

In view of the introduction of the screening mechanism in Belgium, a new commission called the ‘Interfederal Screening Commission' (ISC), was set up which consists of members of the Federal State, Flanders, Wallonia, Brussels and the German-speaking community.

The screening will only be performed for investments in specific sectors. Examples are vital infrastructures, essential technologies and raw materials, critical inputs, sensitive information and personal data, private security, media, biotechnology, defense, energy, cybersecurity, electronic communication and digital infrastructure. Furthermore, only investments that lead to the control of a company or the acquisition of, depending on the sector, 10% or 25% of the voting rights in the Belgian entity can be investigated. Only if an investment meets the above-mentioned two conditions, the investment may be screened on the grounds of the risk for national security, public order or strategic interests.

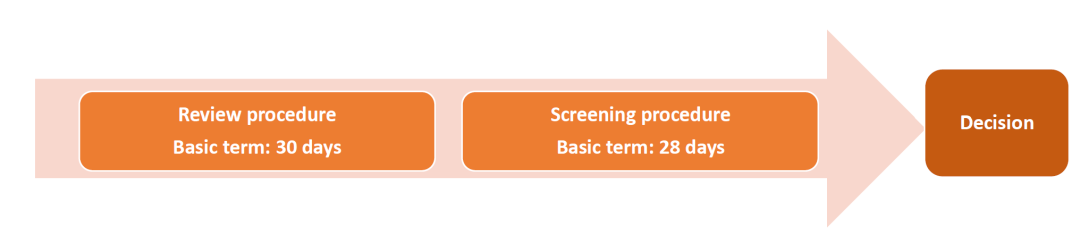

The screening procedure consists of two phases:

1.

The review procedure: After receiving the complete file, members of the ISC have a term of 30 days to determine if a screening procedure needs to be launched.

2.

The screening procedure: The screening procedure should be finished within a period of 28 days (prolongation of 2+1 month is possible depending on the complexity of the file).

What does this mean for Chinese companies?

The FDI screening mechanism is not specifically aimed at China, but it may have an impact on Chinese investments in critical sectors or technologies. Chinese companies now must consider this new screening mechanism in addition to existing regulations on merger control, foreign subsidies and other statutory reporting obligations. This will ultimately lead to higher costs and possible delays, which will have to be considered in M&A negotiations.

Though the impact of this screening regime is not to be underestimated, the Belgian government has stressed that it wants Belgium to remain an attractive destination for foreign investors, including to investors from China. The BCECC expects that the enactment of the screening mechanism in Belgium will have a limited impact on the majority of Chinese investments in Belgium. Nevertheless, at this moment it is still too early to predict the outcome of the system, as many of the guidelines leave room for interpretation and there are no precedents in Belgium yet.

First, please LoginComment After ~