Hong Kong's Export Outlook 2024: Modest Electronics-Led Recovery Now Anticipated

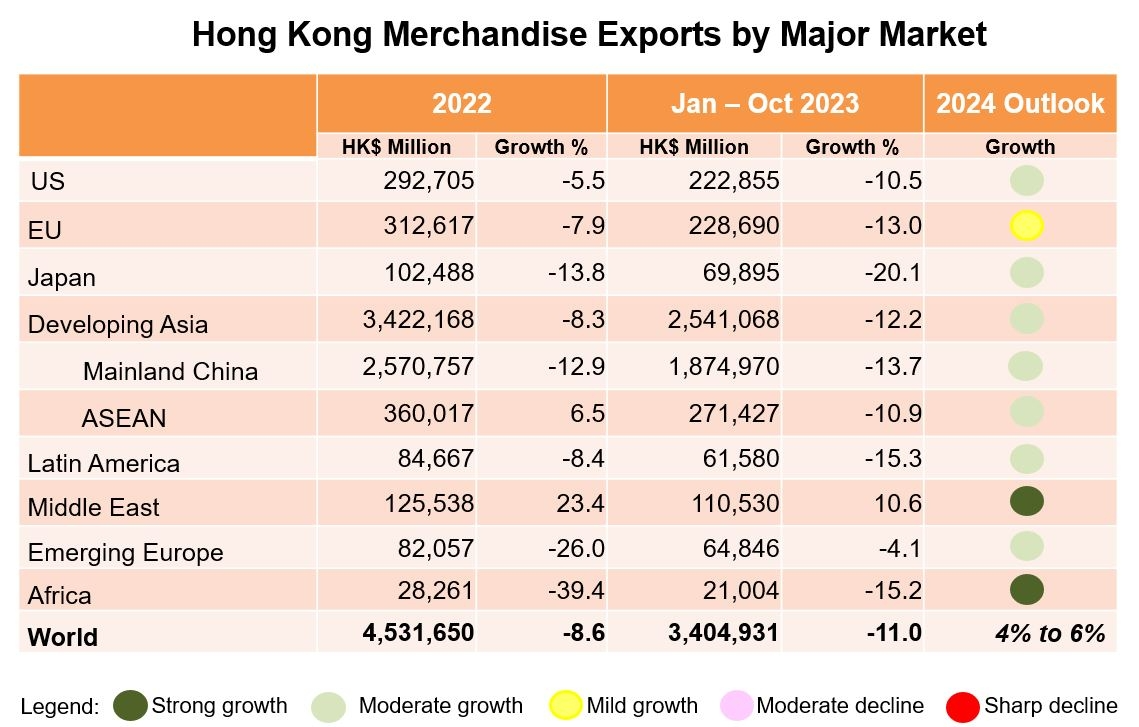

Hong Kong's exports should grow by between 4% and 6% in 2024. The forecast comes as part of HKTDC Research's annual analysis of the state of the Hong Kong external trade and takes into account a wide variety of factors deemed as likely to influence export levels over the coming 12 months.

The moderately optimistic 2024 forecast comes in the wake of a tougher‑than‑expected year for Hong Kong and the global economy. Despite this, as 2023 draws to a close, there have been clear signs that the worst may be over, with the distinct prospect of a rally in the year to come. In the case of Hong Kong, this will largely be driven by the widely anticipated upturn in the electronics market, a sector comprising the single largest proportion of the city's overall export portfolio.

This prospective upturn is all the more remarkable given just how gruelling 2023 turned out to be. In all, Hong Kong’s export levels decreased by 11% from January‑October. This came on top of an 8.6% decline in 2022, as elevated inflation, high interest rates and geopolitical tensions all took a toll on global demand. Among its major trading partners within the wider Asia region, where Hong Kong has largely exported electronics and intermediate goods, the extended downcycle in the semiconductor sector only exacerbated the weakness in intra‑regional trade. In addition, the persisting capacity constraints on Hong Kong‑mainland cross‑border land transportation routes capped the volume of goods transshippable via Hong Kong for much of 2023. On account of this – as well as a number of other factors – it has been estimated that Hong Kong's total exports will have declined by about 7%‑9% for 2023 as a whole, which is more or less in line with global trade performance. UNCTAD, for example, has estimated trade value will decline by 7.5% globally for 2023 overall.

It would also be remiss not to acknowledge the scale of the economic challenges set to endure well into 2024. With global core inflation still high and likely to decline only slowly, central banks will be minded to maintain rigid oversight for much of the year, a stance that will inevitably rein in economic activity. As a consequence, the International Monetary Fund’s baseline forecast1 is for global growth to slow from 3.5% in 2022 to 3.0% in 2023 and 2.9% in 2024, well below the historical (2000‑19) average of 3.8%.

With the health of the electronic sector key to Hong Kong's export performance, recent indicators suggest the global semiconductor industry may have already reached a turning point. A more meaningful uptick, however, is expected to only become fully apparent in the second half of 2024.

Signs of bottoming out

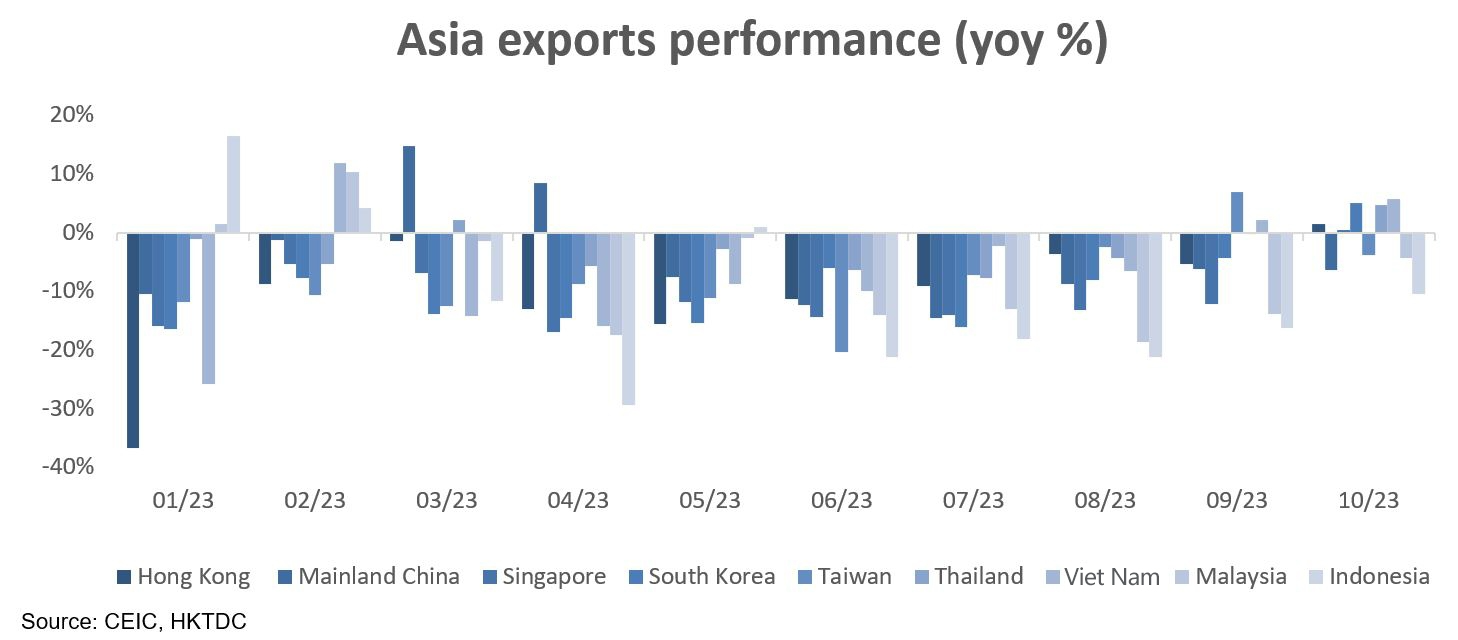

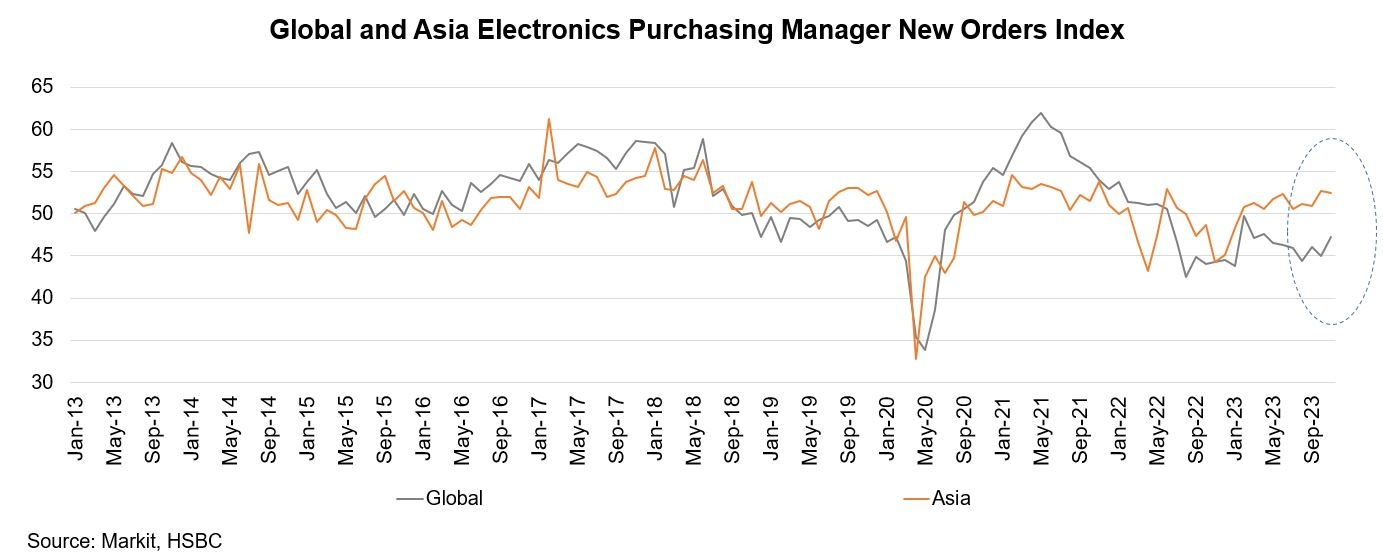

Hong Kong's trade with many of the key Asian markets – including mainland China, the ASEAN bloc, India, South Korea, and Taiwan – largely comprises intermediate goods and other industrial items, which collectively accounted for about 87% of the city's region‑specific exports for January‑October 2023. Such goods largely represent processing production industrial inputs, with demand closely linked to the level of manufacturing activity within the region. The extended downcycle in the semiconductor sector inevitably exacerbated the weakness in intra‑regional trade. This can be seen from the weak export performance reported across Asia (Chart 1).

Chart 1:

Trade with mainland China – Hong Kong'+++s largest market, which accounted for more than 56% of its total exports in 2022 – fell 13.7% in the first 10 months of 2023. It was a similar story elsewhere in Asia, with exports to the ASEAN bloc falling by 10.9% over the same period, including a 3.9% drop for Vietnam and a 23.9% decline for Singapore, Hong Kong's two largest ASEAN markets. At the same time, sales to India fell by 8.6%, to Taiwan by 14% and to Japan by 20.1%. The latter was, in part, down to the yen declining by 11% against the US dollar in the first 11 months of 2023, after having fallen 10% in 2022 (Chart 10).

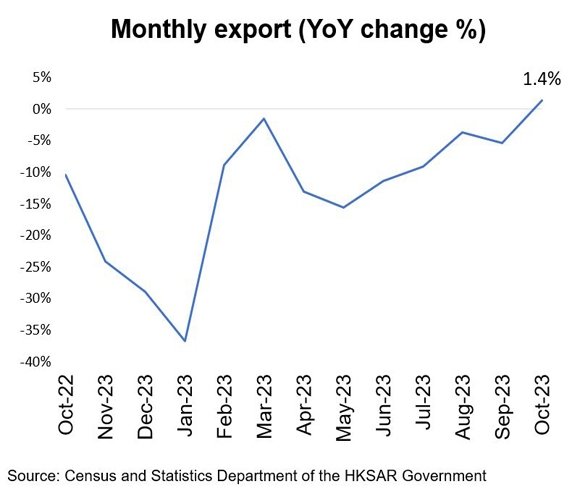

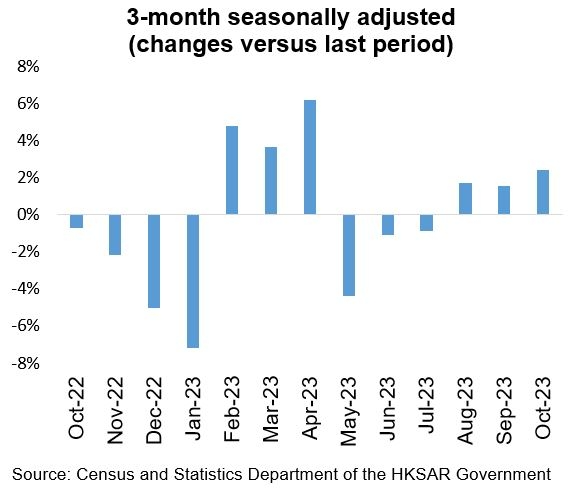

Thankfully, though, Hong Kong's export levels, as well as the external trade performance of several of its key Asian markets, all showed signs of having turned a corner in the past few months. As testimony to this, Hong Kong's exports resumed growth in October, rising by 1.4% year‑on‑year (Chart 2). This improvement is also reflected in the three‑month seasonally adjusted figures for the period (Chart 3).

Chart 2: Hong Kong's total exports

Chart 3: Hong Kong's total exports (seasonally adjusted)

In the case of Hong Kong's US and EU‑destined exports, about half of all such items are consumer goods or items intended for domestic consumption, inevitably making them vulnerable to weakened consumer spending. Just as high inflation has eroded consumer spending power, high interest rates have dampened consumer sentiment. As a result, in the first 10 months of 2023, Hong Kong’s exports to the US fell by 10.5% and to the EU by 13%. Over the same period, however, Hong Kong’s exports to the Middle East rose by 10.6%, a development underpinned by strong demand for a diverse range of consumer goods in the UAE and Saudi Arabia markets.

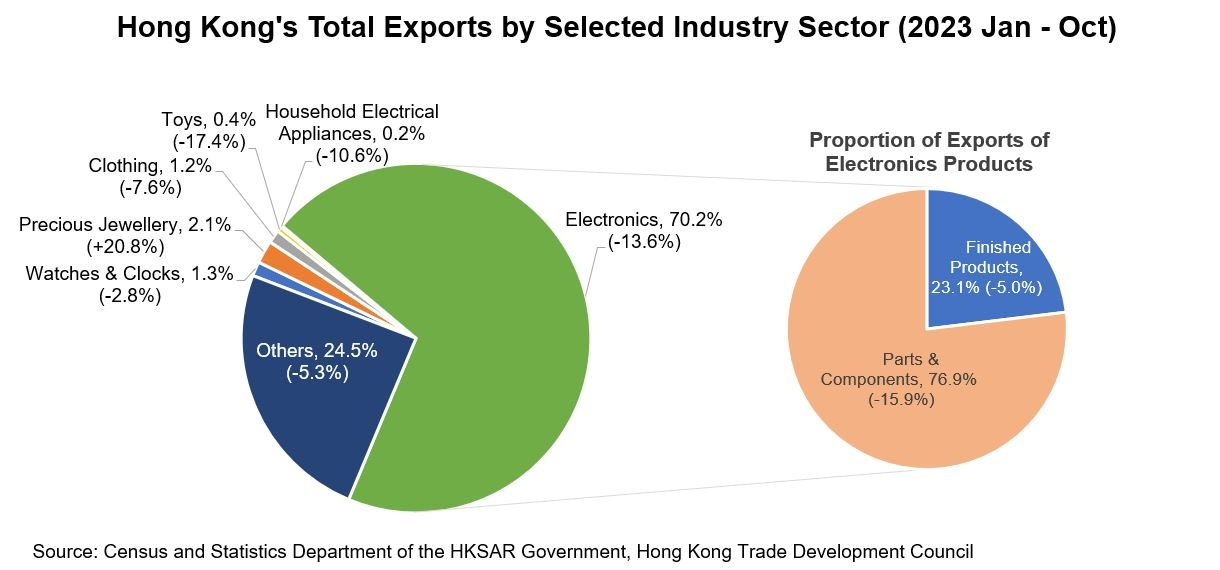

Chart 4:

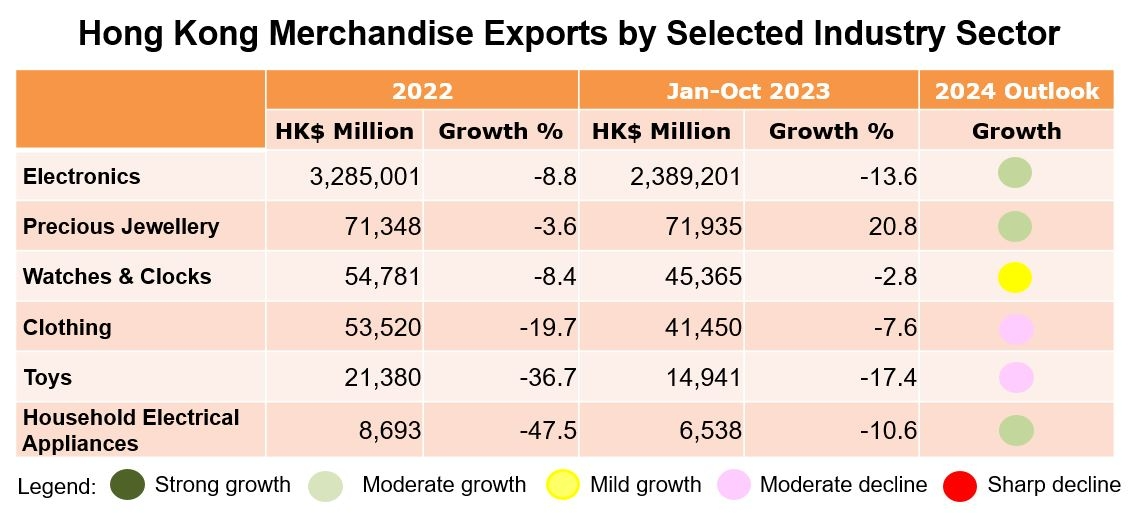

By sector, Hong Kong's electronics exports (more than three quarters of which are parts and components and which account for more than 70% of its total exports) fell 13.6% during the first 10 months of 2023, in line with the extended downcycle hitherto afflicting the global semiconductor sector. This was, in part, due to the shift of consumer spending from electronic hardware to services in the post‑pandemic period. Over the same period, exports of other consumer items – including watches and clocks, clothing, toys, and household electrical appliances – also showed a notable decrease. The only exception here was precious jewellery, exports of which surged by 20.8% in line with the pent‑up post‑pandemic demand stemming from the resumption of weddings and other delayed celebratory events.

Export outlook: Electronics to drive resumed growth

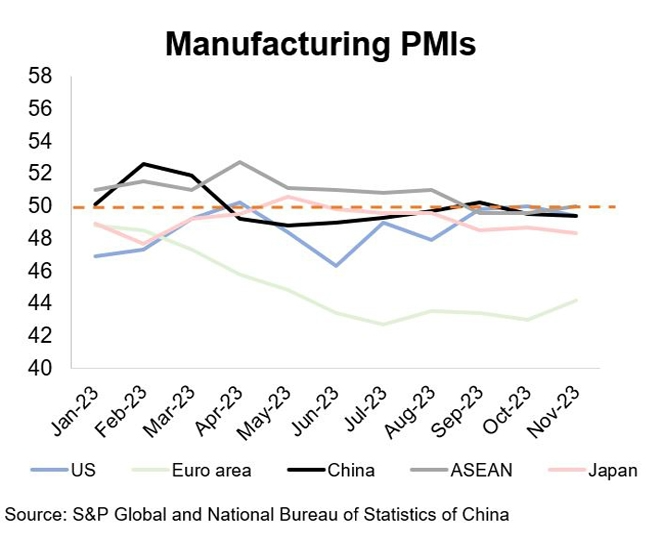

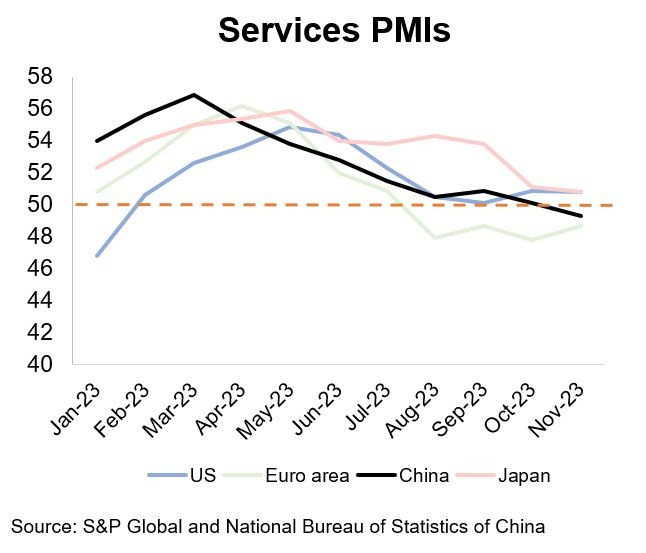

Looking forward to 2024, it is fair to say that Hong Kong's exporters – especially those focusing on consumer goods exports to many of the major markets – will continue to face challenges in the near term. The latest manufacturing Purchasing Managers' Indexes (PMIs) for the US, mainland China and the ASEAN bloc are still lingering around the 50 mark, while the corresponding figures for the Eurozone remain well below 50 and deep within contractionary territory (Chart 5). The services PMI in the US is also easing towards 50 – neutral territory – while those relating to the EU and China remain contractionary, indicating a relatively downbeat global economic scenario over the near term (Chart 6).

For its part, the IMF is also predicting that economic growth in many of the advanced economies will remain sluggish at best in 2024, falling from 2.6% in 2022 to 1.5% in 2023 and 1.4% in 2024 as the full effects of various policy tightening initiatives take hold. It is a sentiment echoed in November's OECD Economic Outlook, which outlined expectations of a decline in global economic growth from 2.9% in 2023 to 2.7% in 2024.2 Overall, while risks to this outlook appear to be more balanced, they remain tilted to the downside. In a further endorsement of the need to moderate expectations, the 2023 Q4 HKTDC Export Index survey saw an overwhelming majority (84.7%) of respondents citing an economic slowdown or a recession in many of the overseas markets as their greatest cause for concern, followed by ongoing geopolitical tensions (62.5%).3

Chart 5:

Chart 6:

Electronic exports set to pick up

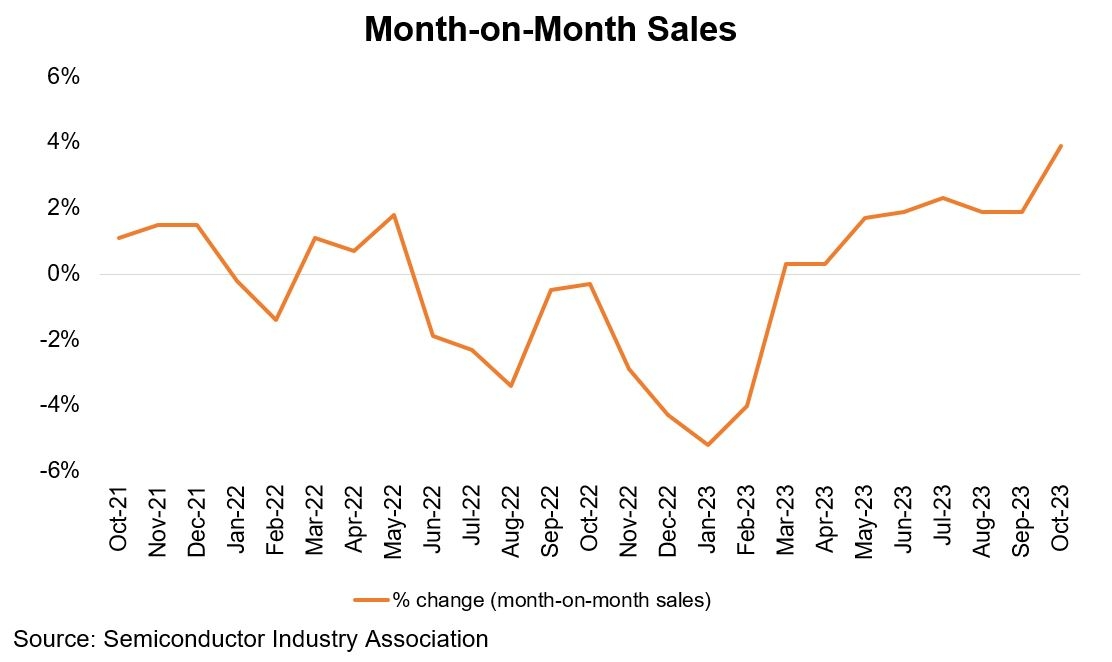

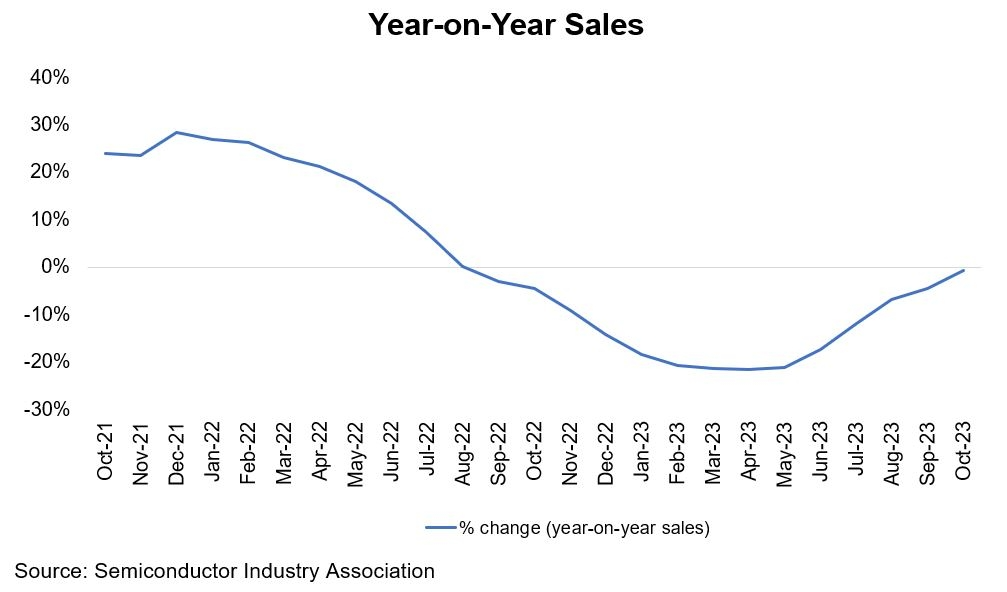

While the overall picture could appear more than a little discomforting, Hong Kong may have greater reasons for optimism than a number of other export‑oriented economies. Particular reassurance comes from the global sale of semiconductors – components widely used in electronic devices and a reliable indicator of the likely demand for finished electronic products – which has registered a sustained month‑on‑month increase over the most recent reporting period. According to data from the Semiconductor Industry Association (SIA), this represents a clear uptick that is likely to be maintained over the near term and beyond (Charts 8 and 9). In more specific terms, the SIA is currently predicting a 13.1% rise in global semiconductor sales over the coming year.4

Global Sale of Semiconductors (Chart 7 & Chart 8)

Chart 7:

Chart 8:

Giving further credence to this, in November 2023, the International Data Corporation (IDC) indicated its expectations that semiconductor sales would enjoy a robust global surge in 2024, a development underpinned by a likely uptick across several related sectors, including PCs, smartphones, automotive and a number of industrial segments.5 Similarly, TrendForce has announced its expectation of a bounce back in 2024 PC shipments, partly as a consequence of demand for AI‑enabled PCs extending beyond premium business needs as such units become a standard feature in many homes.6

In more regional terms, one reassuringly reliable indicator, the Asia Electronics Purchasing Manager New Order Index, has returned to an expansionary +50 level in recent months (Chart 9). More locally still, a survey conducted at the October 2023 Hong Kong Electronics Fair (autumn edition) further underlined the likelihood of a potentially stable or improved export outlook for 2024. This saw some 39% of respondents anticipating that their sales volumes would increase in 2024, while 54% were confident it would at least remain the same.

Chart 9:

Export forecast for 2024: A modest recovery ahead

Overall, HKTDC Research is confident that the marked recovery in intra‑regional electronics‑related trade will allow Hong Kong to resume export growth of 4‑6% in 2024, with this rebound being more pronounced in the second half.

While the unique make‑up of Hong Kong’s export portfolio could see it as ahead of the curve, it is also likely to benefit from a general upturn in the global economic climate in the latter half of next year. While the unique make‑up of Hong Kong’s export portfolio could see it as ahead of the curve, it is also likely to benefit from a general upturn in the global economic climate in the latter half of next year. This is in line with the World Trade Organisation (WTO)’s projection that world merchandise trade (volume) is likely to grow by 3.3% in 2024 following estimated growth of 0.8% in 2023.

Chart 10:

Chart 11:

1 “World Economic Outlook: Navigating Global Divergences”, IMF, October 2023

2 “OECD Economic Outlook, November 2023” (https://www.oecd.org/economic-outlook/november-2023/)

3 For further details of the HKTDC Export Index, please refer to: HKTDC Export Index 4Q23: Soft export sentiment amid rising concern of economic risk

4 “Global Semiconductor Sales Increased 3.9% Month‑on‑Month in October; Annual Sales Projected to Increase 13.1% in 2024”, Semiconductor Industry Association, 4 December 2023

5 “Worldwide Semiconductor Market Outlook Upgraded to GROWTH from TROUGH: Semiconductor Market to Grow 20.2% in 2024 to $633 Billion”, International Data Corporation, 14 November 2023

6 “Key Development Period for AI PCs in 2024; Global Notebook Market Set to Rebound to Healthy Supply‑Demand Cycle with an Estimated Growth Rate of 3.2%”, TrendForce, 8 November 2023

First, please LoginComment After ~