Hong Kong-Guangdong Collaboration (1): Financial Services Liberalisation

Since the promulgation of the Outline Development Plan for the Guangdong-Hong Kong-Macao Greater Bay Area, the governments of the three places have been devoting great efforts to deepening economic and trade co‑operation and using their different economic strengths to build and develop the Guangdong‑Hong Kong‑Macao Greater Bay Area (GBA). Hong Kong has taken steps to bolster financial co‑operation in the GBA in order to strengthen its competitive advantages as a financial centre. It is also making efforts to enhance collaboration in other sectors, deepen economic and trade co‑operation with the mainland and integrate into the national development plan. Guangdong, meanwhile, has been aiming to increase co‑operation with Hong Kong and Macao through system innovation and reform, opening up and various pilot measures.

Recently, focus has been on the implementation plan launched by Shenzhen in the middle of this year. The aim of the plan is to carry out the financial reform and innovation measures set out in the Opinions on Providing Financial Support for Comprehensively Deepening Reform and Opening Up of the Qianhai Shenzhen-Hong Kong Modern Service Industry Co-operation Zone (or the 30 Financial Measures of Qianhai)1 issued by the Central Government in early 2023. Under the plan, Shenzhen is committed to deepening the reform and development of the Qianhai Shenzhen-Hong Kong Modern Service Industry Co-operation Zone and helping Hong Kong integrate into the country’s new financial reform and opening up framework.

As far as financial innovation at the social level is concerned, apart from making it easier for Hong Kong residents to use mainland financial services, Shenzhen’s financial service sector is also opening up further to Hong Kong as well as attracting more financial institutions and professional service suppliers to participate in the development of the GBA. This not only helps Hong Kong use its advantages as an international financial centre but also allows Hong Kong companies to make use of the services provided in Qianhai to capture opportunities in the mainland market.

Shenzhen-Hong Kong co-operation

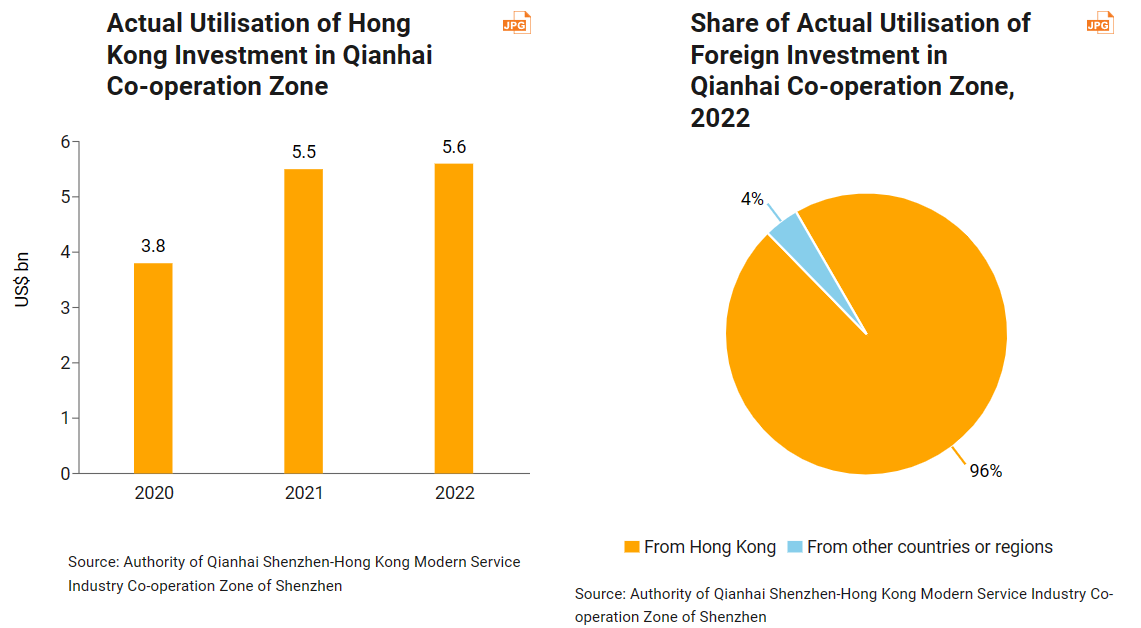

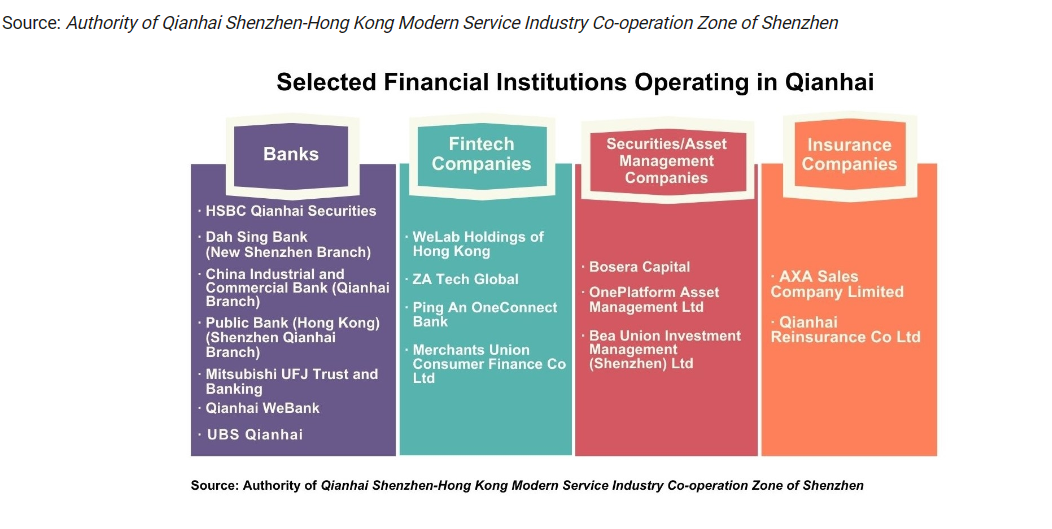

Financial co‑operation has long been a focus of the synergistic development of the GBA. Co‑operation between Hong Kong and Shenzhen’s Qianhai, a frontrunner of financial liberalisation in Guangdong, has been expanding. In 2022, the actual utilisation of foreign investment in the Qianhai Co-operation Zone reached US$5.86 bn (HK$45.77 bn), accounting for more than half of the total amount of foreign investment actually utilised in the Shenzhen municipality. Of this, US$5.61 bn came from Hong Kong, up 3.4% from the year before. Over 11,000 foreign‑invested enterprises (FIEs) have registered in the Zone so far. In particular, 300 financial institutions have established a presence in Qianhai, including the HSBC Qianhai Securities, Hang Seng Bank Qianhai Branch and Dah Sing Bank New Shenzhen Branch, which are actively using Qianhai as a springboard for developing Shenzhen and other markets in Guangdong.2

Financial services

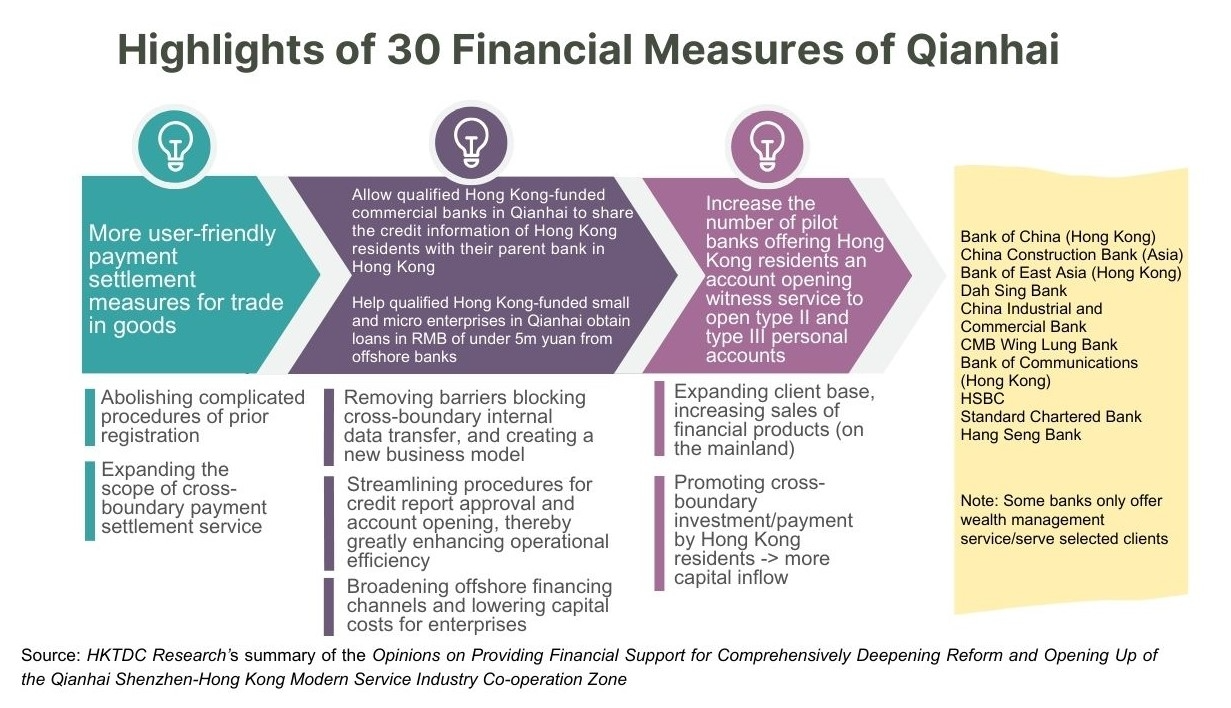

On 10 July 2023, the Shenzhen municipal government issued a notice on the Plan for Implementing the Opinions on Providing Financial Support for Comprehensively Deepening Reform and Opening Up of the Qianhai Shenzhen-Hong Kong Modern Service Industry Co-operation Zone (Shenfuban No. 8 [2023]). The aim was to put in place the 30 Financial Measures of Qianhai, which are designed to facilitate financial services at the social level and cross‑boundary financial services. The implementation plan contains a total of 115 specific measures covering six main areas, which are:

- Deepening financial co-operation between Shenzhen and Hong Kong; giving priority to rolling out financial innovation at the social level; building a higher quality, more diversified and more user-friendly financial service system at the social level in the GBA (22 measures)

- Deepening financial market and infrastructure connectivity between Shenzhen and Hong Kong; introducing pilot measures for cross-boundary finance; enhancing the functions of the innovative experimental zone for cross-boundary RMB transaction (25 measures)

- Further opening up the financial sector to the outside world; introducing pilot measures for foreign exchange administration reform and for internationalisation of the RMB; enhancing the functions of the pilot window for opening up China’s financial sector to the outside world (27 measures)

- Developing special financial services; fostering financial services that cater to the industrial system and medium, small and micro enterprises in the “expanded zone” (23 measures)

- Strengthening co-operation between Shenzhen and Hong Kong in financial supervision; exploring an inclusive and prudential regulatory mode compatible with that of Hong Kong’s financial system; enhancing the mechanisms for prevention and control of cross-boundary financial risks (7 measures)

- Safeguard measures (11 measures)

Financial innovation at the social level

In giving priority to rolling out financial innovation at the social level, the implementation plan set out measures helping Hong Kong residents to live and work in Qianhai. These include making it easier for Hong Kong residents to open accounts with mainland banks; increasing the number of pilot banks in the Qianhai Co-operation Zone where Hong Kong residents can use an account opening witness service to open type II and type III personal accounts through an attestation service; launching a pilot scheme on facial recognition sign on for credit card services; and helping Hong Kong residents open accounts with mainland banks and link up their accounts with their e‑wallets.

Currently, many banks in Hong Kong offer an account opening witness service to local residents who want to open a personal bank account with a bank in the mainland. By using this service, Hong Kong residents can easily open a mainland bank account without having to travel across the border. Some banks simply require the applicant in Hong Kong to use a Hong Kong mobile number instead of a mainland mobile number to open an account. This makes it much easier for Hong Kong residents to use the services of mainland partner banks and other entities. Some players in the financial sector have suggested that this measure can also help financial institutions operating in Qianhai to expand their client base, increase the sales of financial products and effectively promote cross‑boundary investment and payment, thus generating more capital inflow.

Easier credit finance for Hong Kong residents

Some Hong Kong financial institutions which have already set up branches in Qianhai have told HKTDC Research that Qianhai’s geographic advantage (situated in the heart of Shenzhen’s central business district) means that their business network can cover the whole city of Shenzhen. Because of this, Qianhai is their top choice when it comes to expanding business in the GBA. Furthermore, the promulgation of the 30 Financial Measures of Qianhai has provided them with strong support in developing cross‑boundary financial services and has created more new business opportunities for them.

To make it easier for Hong Kong residents to obtain credit finance, the implementation plan has ensured that the relevant laws, rules and regulations are observed and that security controls are in place, and that Chinese‑funded commercial banks and Hong Kong‑funded commercial banks with branches both in the Qianhai Co-operation Zone and the Hong Kong SAR can carry out cross‑boundary internal data transfer on a pilot basis. Also, with the consent of clients, banks in the Qianhai Co-operation Zone and Hong Kong can obtain the corporate credit reports of each other’s clients through corporate credit reporting agencies, and the information in such reports is treated as the internal resources of the bank and can thus be transferred across the boundary. This measure not only helps financial institutions remove the barrier blocking cross‑boundary internal data transfers, but also creates a new business model and streamlines the procedures for credit report approvals and opening accounts.

Hong Kong companies moving deeper into the mainland market

The 30 Financial Measures of Qianhai also contains measures designed to encourage Hong Kong companies to pursue innovation and start up business in Qianhai. Qualified Hong Kong‑funded small and micro enterprises in Qianhai are allowed to obtain loans in RMB of under 5m yuan from offshore banks (including Hong Kong banks). This move aims to broaden offshore financing channels and lower business startup costs. The implementation of these measures makes it possible for Hong Kong companies to use the financing and other financial services provided in Qianhai to support their business in the mainland. At the same time, the implementation plan also introduces trade facilitation measures such as simpler and faster payment settlement for trade in goods. All these can help Hong Kong companies obtain the resources needed in their mainland business so that they can expand more effectively in the mainland market. [For more information, please read Hong Kong‑Guangdong Collaboration (2): Cross‑Boundary Finance]。

1 On 23 February 2023, the People's Bank of China, the China Banking and Insurance Regulatory Commission, the China Securities Regulatory Commission, the State Administration of Foreign Exchange and the People's Government of Guangdong Province jointly promulgated the Opinions on Providing Financial Support for Comprehensively Deepening of Reform and Opening Up of the Qianhai Shenzhen-Hong Kong Modern Service Industry Co-operation Zone (Yinfa No.42 [2023]) (30 Financial Measures of Qianhai). On 10 July 2023, the Shenzhen Municipal Government issued a notice on the Plan for Implementing the Opinions on Providing Financial Support for Comprehensively Deepening Reform and Opening Up of the Qianhai Shenzhen-Hong Kong Modern Service Industry Co-operation Zone (Shenfuban No.8 [2023]) aimed at executing the 30 Financial Measures of Qianhai.

2 Source: Authority of Qianhai Shenzhen-Hong Kong Modern Service Industry Co-operation Zone of Shenzhen

First, please LoginComment After ~